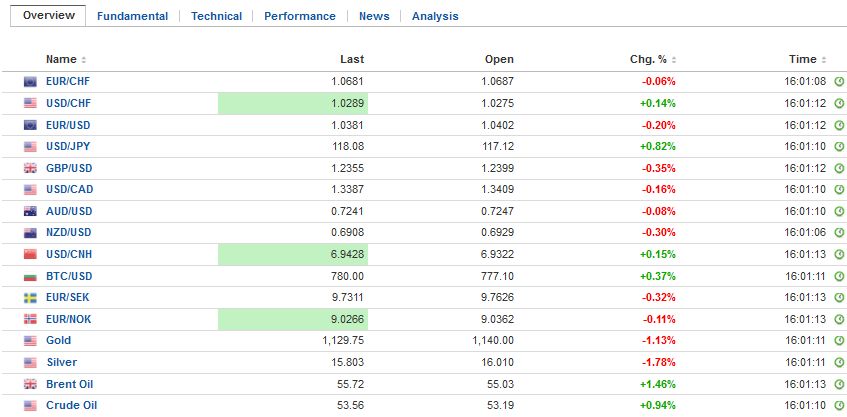

Swiss Franc |

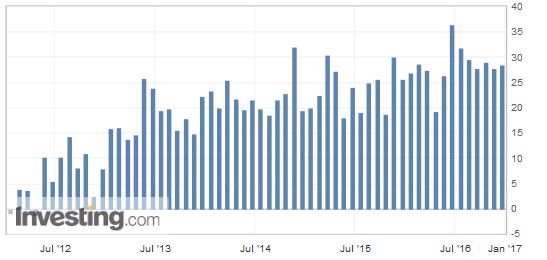

Switzerland Trade Balance, November 2016(see more posts on Switzerland Trade Balance, ) Source: Investing.com - Click to enlarge |

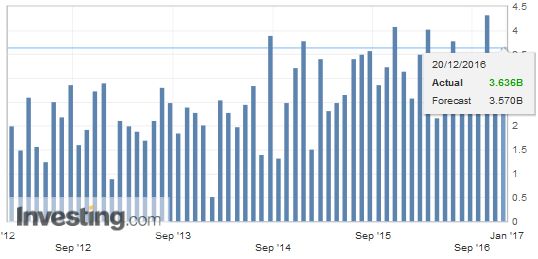

FX RatesThe yen’s incredible ride this year has been recapitulated in recent days. Consider that before last weekend; the US dollar reached a little above JPY118.40. At its extreme yesterday, the dollar fell to JPY116.55. Today it reached traded near JPY118.25 in the European morning, where it was encountering some offers. |

FX Performance, December 20, 2016 Movers and Shakers Source: Dukascopy.com - Click to enlarge |

| Sterling, which traded like a ton of bricks yesterday, is not faring much better today. It briefly poked through $1.25 yesterday and finished the North American session a little below $1.24. Today its losses were extended to $1.2335, its lowest in nearly a month. It appears to be a function of broad-based dollar strength. It is only marginally weaker than the euro in recent days. The intraday technicals for sterling suggest a bounce is likely in early North American activity today, which features no US or Canadian data of note.

|

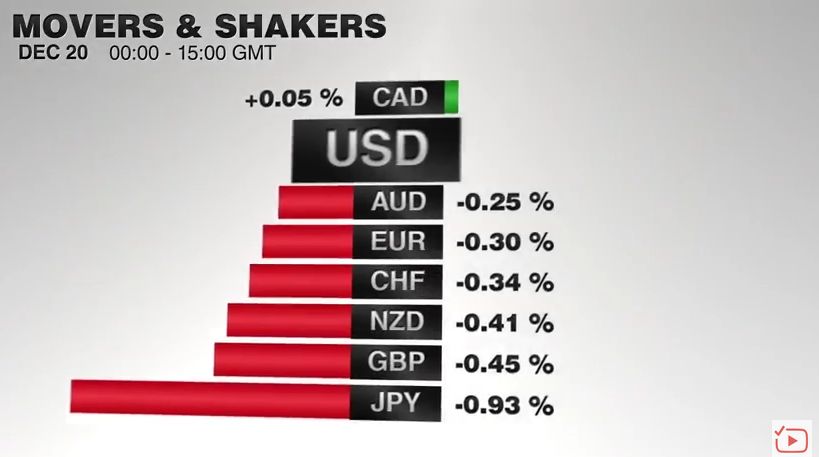

FX Daily Rates, December 20, 2016 |

| The euro recorded an outside down day yesterday. It stalled in front of $1.05, with a high near $1.0480. In late turnover, it slipped through $1.04. Today it has not been above $1.0420, and approached $1.0375 in late European morning dealings, holding just above last week’s low near $1.0365. The intraday technicals warn of a risk back to the $1.0420-$1.0440 area. |

FX Performance, December 20, 2016 |

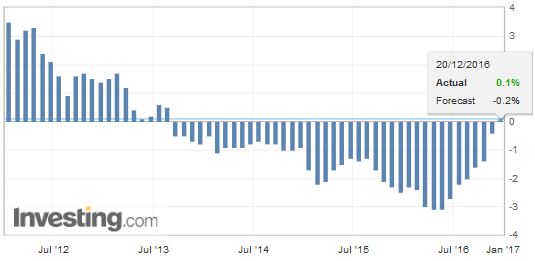

Germany |

Germany Producer Price Index (PPI) YoY, November 2016(see more posts on Germany Producer Price Index, ) Source: Investing.com - Click to enlarge |

EurozoneTurkey, Germany, and Switzerland were hit by terrorist strikes yesterday. The political implications are seen strengthening the populist-nationalist and anti-immigration forces. European markets are resilient. The Dow Jones Stoxx 600 is up about 0.25% in late London morning turnover, thinned by the holiday. It has recorded a marginal new high since the very start of the year today, led by health care, financials, and energy. The Italian bank drama continues. Bank shares are higher amid reports that the Cabinet has agreed to request as much as 20 bln euros authorization from parliament to provide precautionary public guarantees to Monte Paschi (and a couple of smaller banks). Monte Paschi’s share offer expires tomorrow for retail investors and Thursday for institutional investors. It is seeking to raise five bln euros, though its market cap is around one tenth of that. Unicredit, Italy’s largest bank has indicated it will seek to raise around 15 bln euros early next year, which is roughly the size of its market cap. Earlier, Fortress, which has bought bad loan portfolios from Italian banks since 2000 (~22 bln euros) has expressed interest in part of UniCredit’s non-performing loan portfolio. There are two challenges for the new technocrat government led by Gentiloni, the fourth unelected prime minister. First, has to do with the size of assistance that Italian banks need. This is slightly easier than the second challenge, which is the form of the aid. Unlike earlier in the crisis, there are now rules in place to protect taxpayers (conditions on state aid). The various Italian governments have acted too slowly, and when they finally did act, it was too small: Too little too late. Italian bonds are underperforming Spain and Portugal today, though 0.55% rise in equities today is among the strongest equity markets today. |

Eurozone Current Account, October 2016(see more posts on Eurozone Current Account, ) Source: Investing.com - Click to enlarge |

Japan

The BOJ met and as widely expected it left policy on hold. Since September it is targeting the 10-year yield at zero, which in practical terms may mean +/- 10 bp. This appears to have reduced the number of bonds it is buying, and some see in this a tapering. In addition, Bloomberg estimates that about JPY40.5 trillion of bonds on its balance sheet will mature next year.

The BOJ will provide new forecasts next month, but the Cabinet did so today. It is projecting 1.5% GDP in 2017, up from 1.2% Nominal growth is put at 2.5% compared with 2.2% forecast in September. The budget will be JPY97.5 trillion, a small (0.8%) increase from the previous estimate. More spending is customarily provided in one or more supplemental budgets.

Japanese shares have begun weaker but reversed as the yen weakened. The Nikkei snapped a nine-day advance yesterday but closed 0.5% higher. At stake is a six-week advance. Financials and energy were the only sectors to close lower. In addition to Japan, Korean, Taiwanese, and Australian markets advanced, but it was not enough, and the MSCI Asia Pacific Index fell 0.5%.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,EUR/CHF,Eurozone Current Account,FX Daily,Germany Producer Price Index,Italy,newslettersent,Switzerland Trade Balance