Swiss Franc |

EUR/CHF - Euro Swiss Franc, November 21(see more posts on EUR/CHF, ) |

FX RatesThe euro is trying to snap a ten-day losing streak. Its bounce today has stopped a little shy of the five-day moving average that is found near $1.0650. It has not traded above this short-term moving average since the November 9. |

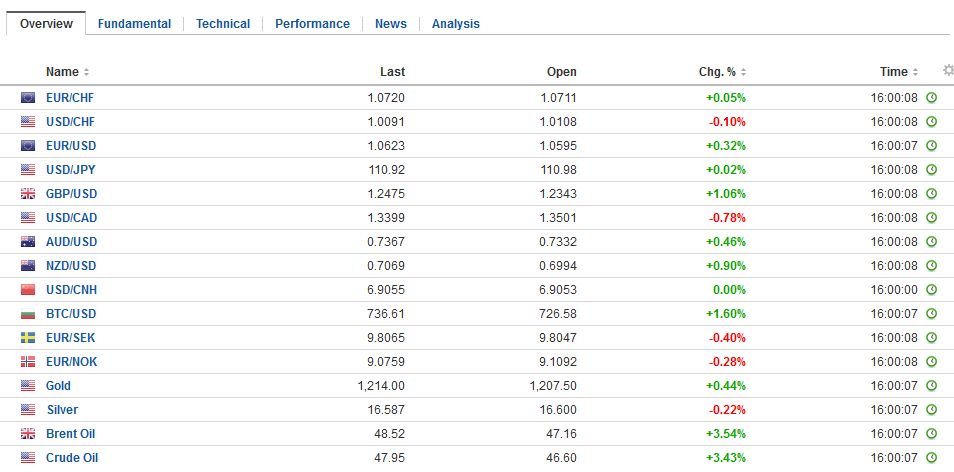

FX Performance, November 21 2016 Movers and Shakers . Source: Dukascopy - Click to enlarge |

| The news over the weekend is primarily political in nature. Sarkozy is going to retire (again) after taking a drubbing in the Republican Party primary in France. Fillon, the self-styled French Thatcher unexpected beat Juppe, but without 50% and therefore the results set up the run-off this coming weekend. It is as if, knowing their candidate will likely face Le Pen in the final round next spring, the Republican Party might as well chose the most extreme laissez-faire candidate. |

FX Daily Rates, November 21 (GMT 16:00) |

| The dollar extended its recent gains against the yen, marching to JPY111.20 before sellers emerging in Asia. Early Europe saw the greenback slip to almost JPY110.50 where new bids were found. In late May, the dollar was turned back from JPY111.45.

Japan’s Topix rose 1.0% to extend its winning streak into the eighth consecutive session. It was led by the telecoms, energy, and financials. Utilities and materials were laggards. It is at its best level since February. More broadly, the MSCI Asia-Pacific Index rose 0.35%. European bourses recouped early losses, and the Dow Jones Stoxx 600 turned positive in late morning turnover. Energy and information technology are the strongest performers today |

FX Performance, November 21 |

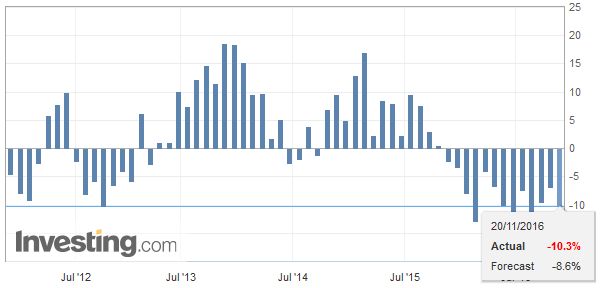

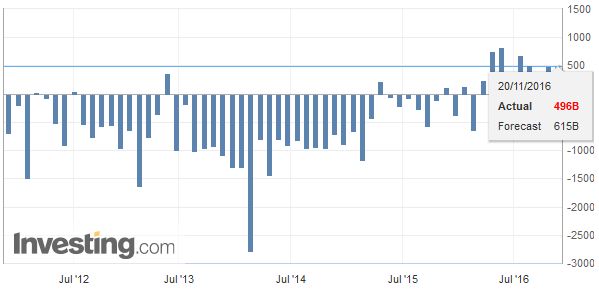

JapanIn a session light on economic news, Japan stands out. It reported its second consecutive trade surplus in October. The JPY496.2 bln surplus was slightly smaller than the September surplus of JPY498.3 bln. However, the surplus came despite the continued fall in imports and exports. Japanese exports have not risen on a year-over-year basis since September 2015. Its exports fell 10.3% in October after a 6..9% drop in September. Exports of autos, steel, and telecom equipment haven been weak. Exports to the US are off 11.2%, 9.5% lower to Europe and a 9.2% falling in exports to China. |

Japan Exports YoY, October 2016(see more posts on Japan Exports, ) . Source: Investing.com - Click to enlarge |

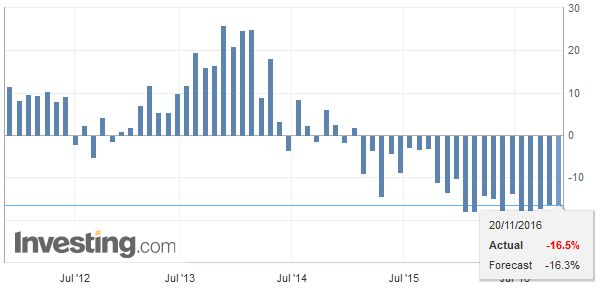

| Imports fall 16.5% from a year ago, after a 16.3% plunge in September. |

Japan Imports YoY, October 2016(see more posts on Japan Imports, ) . Source: Investing.com - Click to enlarge |

| Recall that net exports contributed about 0.5% to Japan’s Q3 GDP. |

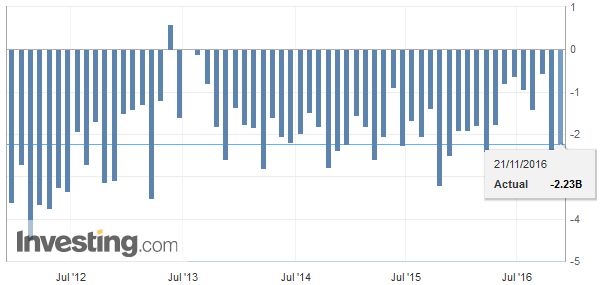

Japan Trade Balance, October 2016(see more posts on Japan Trade Balance, ) . Source: Investing.com - Click to enlarge |

Spain |

Spain Trade Balance, October 2016(see more posts on Spain Trade Balance, ) . Source: Investing.com - Click to enlarge |

Germany

In Germany, Merkel officially announced her candidacy for a fourth term as German Chancellor. This was widely expected. Merkel has moved to protect her flanks after her immigration policy caused a fissure in her alliance with Bavaria’s CSU. The national election is planned for next fall. The anti-immigration and anti-EU AfD party have come on strong to win representation in all but a few German states. The most likely outcome is for a continuation of a grand coalition between the CDU and SPD. It is possible that another party is needed to form a coalition government. If so, the FDP are more likely than the Greens.

United Kingdom

In the UK, Chancellor of the Exchequer Hammond played down need to provide strong fiscal stimulus in this week’s Autumn Statement. Separately, Prime Minister May’s op-ed piece in the Financial Times marks out a pro-business stance, including a corporate tax cut that will lower the UK rate to the lowest in the G20.

Sterling is only of the major currencies to be losing ground against the dollar today, but it is really range-bound between $1.2300 and $1.2370. The technical tone is soft. Sterling fell every day last week against the dollar and is extended that streak into a sixth session today. Part of the heavy tone may be coming from the crosses. Today is the second session in which sterling is trading heavily against the euro. The euro reversed higher before the weekend after nearing GBP0.8525. It needs to push through GBP0.8640 to signal further upside potential.

United States

Oil is building on its pre-weekend gains amid speculation that next week’s OPEC meeting will announce a reduction of supply. Base metals are rebounding after last week’s bout of profit-taking. Nickel, copper, and zinc were up around 2%.

The US 10-year Treasury yield is a couple of basis point lower, while yields are most higher in Europe. The 2-year yield is also fractionally lower. To the extent that the dollar’s gains have been bolstered by the rise in yields, today has the makings for a consolidative session.

(Light publication schedule this week, as I finish up my next book, Political Economy of Tomorrow.)

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,EUR/CHF,FX Daily,Japan Exports,Japan Imports,Japan Trade Balance,newslettersent,Spain Trade Balance