Summary:

US election results accelerated forces that were already present.

Interest rates have appeared to bottom, fiscal stimulus in Canada and Japan already evident, and divergence between US and EMU/Japan monetary policy.

US stimuli may reach when the economy is already near trend.

United States

The results of the US election did not unleash new forces in the capital markets as much as accelerate those forces that we had already identified as being operative. The cyclical low in interest rates has likely already been registered. There also seems to be a somewhat greater willingness in several countries to move toward looser fiscal policy. The divergence between the US monetary policy on the one hand, and the EU and Japan on the other, is poised to widen further.

It is not unusual that, despite the fiercely fought partisanship, the US political cycle does not exactly coincide with the economic cycle. For example, the deregulation and military build-up that is associated with Reagan began under Carter. Following the Soviet invasion of Afghanistan, Carter began boosting military spending, and the deregulation of the airlines began on his watch. Although we dub the dollar’s bull market of that era as the “Reagan dollar rally,” it began before he was elected. Volcker had already begun hiking interest rates, and the dollar had bottomed.

The recognition of the limits of monetary policy had become several commonplace quarters ago. A new Canadian government provided modest fiscal stimulus. Hammond, the UK Chancellor of the Exchequer, is expected to also offer some stimulus in his Autumn Statement later this month.

At the same time, Fed officials have been signaling their growing comfort to raise rates again. Nine of the 12 regional Presidents called for a discount rate increase. Economists argue that headline inflation converges to core inflation, and core inflation regresses to labor costs. Hourly earnings rose 2.8% in the year through October, the most in seven years. More broadly, deflationary pressures outside of Japan have eased in recent months.

There is much uncertainty about the policies of a Trump Administration. Within days of the election, Trump seemed to back away from completely scrapping the Affordable Care Act (Obamacare), firing Fed Chair Yellen, getting rid of the entire Dodd-Frank omnibus financial regulation bill, and pursuing legal charges against Clinton.

However, there has been no sign of wavering about the commitment to a strong fiscal stimulus package. An economic adviser to Trump penned an op-ed piece in the Financial Times before the weekend that sketched out the $1 trillion stimuli in the form of tax cuts and infrastructure spending. With a roughly $18 trillion economy, the stimulus is significant at 5.5% of GDP. In terms of GDP, that is, incidentally, the same size as the February 2009 stimulus package tax cut and spending package).

The stimulus would reach a US economy that is already growing near trend. Trend growth is the sustainable pace consistent with stable prices. The Federal Reserve has surely but slowly cut its assessment of this pace to 1.8%. An unscientific sampling of private sector economists puts at 1.5%-2.0%. Stimulus on top of trend growth is understood to be inflationary. This implies a somewhat stronger monetary response and the derivatives market appears has begun the discounting process. For example, the implied yield of the December 2017 Eurodollar futures contract rose nearly 25 bp since before the election.

While some may think a rising interest rate environment is not good for equity valuations, it is important to recognize the transformation by which corporations as a whole are net providers of capital rather than net takers. There are also some important offsetting policies as well. Among the stimulus measures are deregulation and tax cuts. Trump’s economic adviser underscored two tax cuts.

The first is the rate levied on corporate profits. Trump would like to see it slashed to 15%, but his adviser notes that even at UK’s 20% level, $660 bln would add to the economy. Of course, the assumption here is that businesses currently pay the tax schedule of 35%, which is dubious.

The second is a one-off 10% repatriation fee to entice corporations to bring home the $2.5 trillion of foreign earnings that have been stashed overseas. Every time the government offers such a tax break, it is presented as a one-off, but after getting the “one-off” break, companies retain earnings offshore waiting for another “one-off” break. Trump’s adviser suggests that an overhaul of the corporate tax structure (dramatic cut in taxes, and perhaps taxing foreign earning even if not repatriated) could deter this behavior. The sequence of the changes then will be important.

In terms of the impact on investment and employment, studies have suggested that past one-off tax breaks did not have the impact that had been promised. In terms of the dollar, much of the earnings retained overseas are already invested in dollar-denominated instruments. This is standard behavior for corporations that report in dollars. However, the repatriation does show up in the current account, and the improvement may be seen by some investors as dollar positive. In this case, assuming the “one-off” break takes place during the divergence of monetary policy, it could add more fuel to the dollar’s appreciating trend.

Economic Events: United States, Week November 14The market is rife with speculation over Trump’s cabinet. Some announcements are expected toward the end of the week ahead. A key takeaway is the pro-growth bias of many of Trump’s economic advisers. When the Treasury Secretary comes from Wall Street, like Regan and Rubin, the dollar tends to appreciate. When the Treasury Secretary comes from Corporate America, like O’Neill and Snow, the dollar often falls. Another pattern is that under the three Treasury Secretaries from Texas, (Connolly, Baker, and Bentsen) the dollar has depreciated. Many countries want to see faster US growth, but it is not an unalloyed good. We have been swayed by BIS reports documents a large structural short dollar position, especially among emerging markets. In a low US interest rate environment, and a soft dollar, many emerging market sovereigns, and corporates borrowed dollars and swapped for their local currency. The dramatic rise in US yields and a stronger dollar squeeze emerging market credits. As capital left emerging markets last week, several countries intervened to slow the decline in their currencies. China and India were among them. When central banks intervene to support their currencies, the dollar is often sold. Sometimes US Treasuries are liquidated to free up the dollars. This can be seen almost in real time, with the Federal Reserve’s weekly report on its custody account for foreign central banks. The Treasuries held with the Fed have been falling since the middle of last year. The trend accelerated before the election and likely continued. In fact, the pace has more than doubled. Consider from the start of July 2015 through May 2016, the Fed’s holdings of US Treasuries for foreign central banks fell by $131 bln. In the last five months, through November 9, they fell another $125 bln. The foreign official owned-Treasuries at the Federal Reserve stand at their lowest level in four years. Trump’s election shifts the focus away from the high frequency data, though there is a full slate in the week ahead. After the US employment data, the next tier of data that reveal the strength of the economy, retail sales, industrial output, and consumer prices, are all reported next week. Headline retail sales are expected to be lifted by autos and higher gasoline prices and match September’s 0.6% increase. However, the more important measure that strips these away, alongside a few other items, like building materials is expected to rebound to 0.4% from 0.1% in September. Core CPI is expected to be steady at 2.2%. Industrial production and manufacturing production are expected to edge higher. Of note, Yellen testifies before the Joint Economic Committee of Congress on November 17. Her remarks are unlikely to deviate from the substance of the recent FOMC statement. |

Economic Events: United States, Week November 14 |

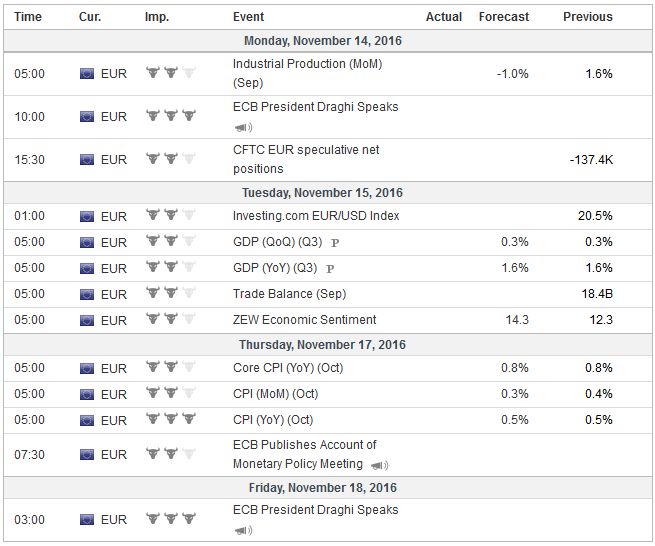

EurozoneThe focus in the eurozone is not so much on the Q3 GDP print (0.3% on the quarter and 1.6% year-over-year, same as Q2) or the final CPI (0.5% headline and 0.8% core). Politics instead will command attention. The first primary for the Republican Party of France is important because the winner will most likely take on the anti-EMU National Front’s Le Pen in the final round of the presidential contest next spring. Next is the Italian constitutional referendum in early December (the same day as the Austrian Presidential do-over election). Even before the US election, Renzi looked to be fighting an increasingly uphill battle, and now many are more confident that it will be defeated. Although it seems unreasonable to expect Renzi to resign (which he had previously indicated), but he will likely be weaker, and the early political reform measures will need to be adjusted. Last week, the sharp rise in Italian yields, with the 10-year yield moving above 2.0% for the first time in nearly 18 months, did not derail the continued recovery in Italian bank shares. This may become more of an issue going forward. |

Economic Events: Eurozone, Week November 14 |

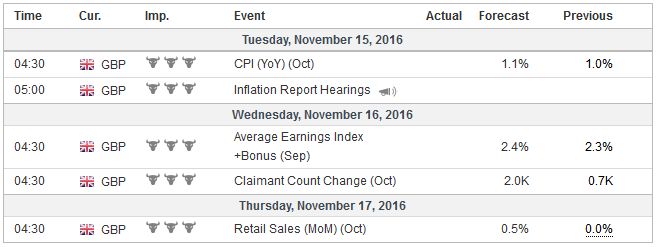

United KingdomOne of the only economic impacts from the UK referendum has been the decline in sterling and the rise consumer prices. Headline inflation is expected to rise above 1% in October when the data is reported in the week ahead. It has not been that high since late-2014. Average weekly earnings are expected to have risen by 2.4% (up from 2.3%) in the three-month period through September from the year ago period, with and without bonus payments. British shoppers took the month of September off, but are believed to have returned in October. Retail sales are expected to have increased 0.5% in October after a flat September. The year-over-year pace of 5.3% is the envy of most high income countries. US retail sales were 2.7% higher year-over-year in September but likely edged higher in October. German retail sales in September were 0.4% above a year ago levels. Japanese retail sales were 1.9% lower than a year ago in September. |

Economic Events: United Kingdom, Week November 14 |

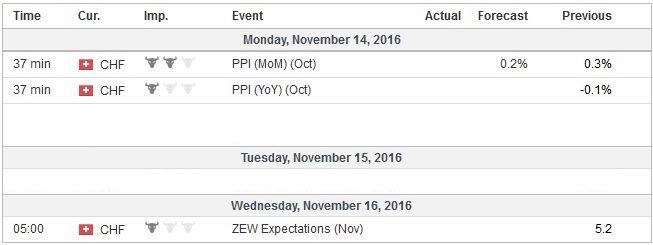

Switzerland |

Economic Events: Switzerland, Week November 14 |

Lastly, we note the central bank of Mexico is set to hike rates on November 17. The market expects a 50 bp hike that would lift the overnight rate to 5.25%. The three earlier hikes this year were also in 50 bp steps. The first hike in the cycle was delivered at the end of last year, and was for 25 bp move.

The reason rates will be hiked may not be so much about targeting the currency as containing the inflation feed through. The peso fell by 8.75% last week and is off 12.5% over the past three months. The changing political climate in the US is the primary driver, but the underlying macro fundamentals are not particularly attractive. Also, rising US interest rates, a broadly stronger dollar, pressure as a proxy hedge vehicle for emerging market exposure generally, and falling oil prices would be negatives in any event.

While by any reasonable measure, the peso’s losses are exaggerated, given the volatility a 50 bp rate hike is unlikely to make much of a difference to short-term speculators. There are other measures central bank can take, including tweaking its intervention rules. There does not seem to be an appetite to introduce dramatic measures, like capital controls.

Full story here Are you the author? Previous post See more for Next post

Tags: #USD,EUR/GBP,MXN,newslettersent