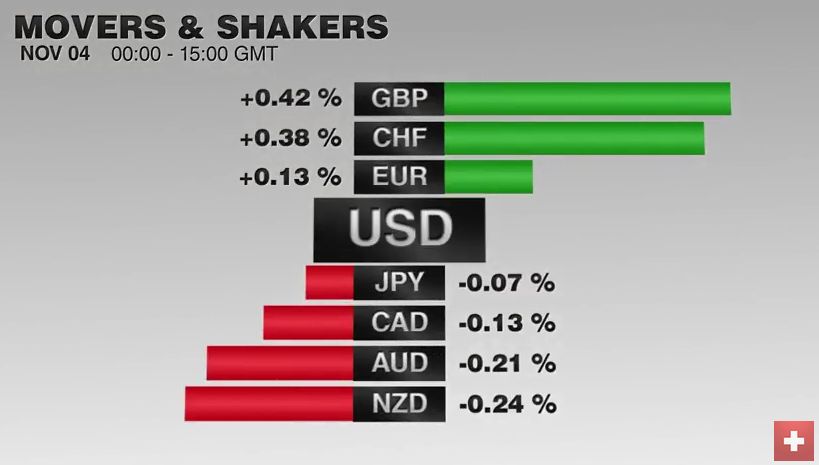

Swiss FrancWith the not convincing U.S. jobs number, both the EUR and, in particular, the Swiss Franc could improve. With continuing political uncertainty in the U.S., more speculators closed their short CHF positions. Moreover, I expect significant inflows into CHF, we write more in the weekly sight deposits on Monday. I should mention that income inequality is far less in Switzerland than in the United States, for example cashiers at Migros or Lidl obtain more than 3000 Francs per month. If Trump wins , then U.S. income inequality should become smaller, This could be achieved with new tariffs against China and in favor of U.S. Manufacturing workers. This, however, will reduce profits of U.S. multi-nationals and raise U.S. inflation. Hence if Trump wins, this would be very bad good news for the Swiss National Bank. Inflation always means that CHF improves. |

EUR/CHF - Euro Swiss Franc, November 04(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge |

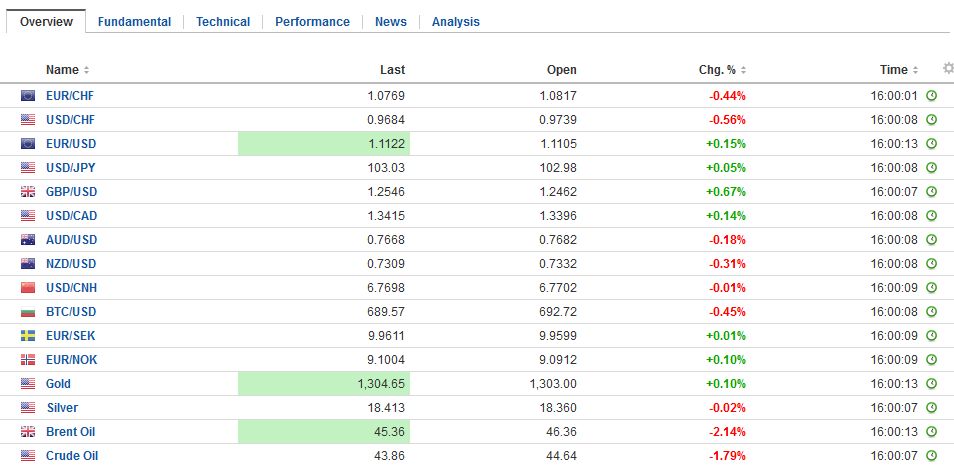

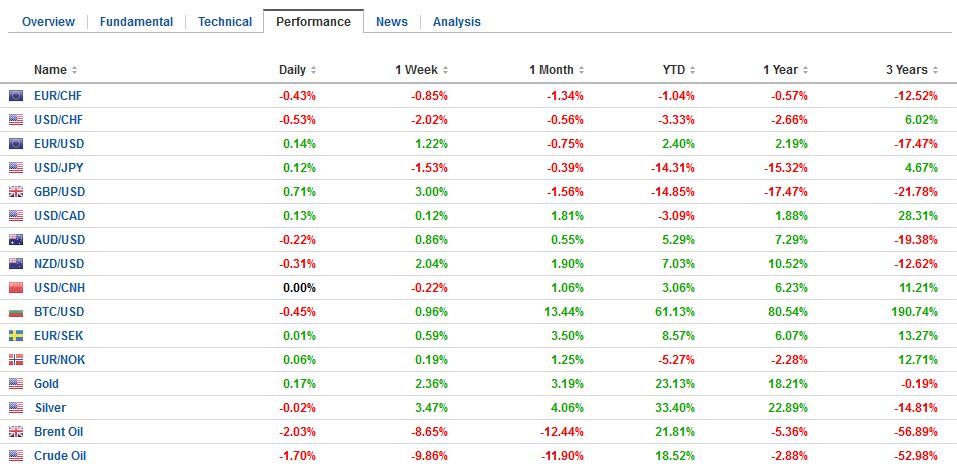

FX RatesThe US dollar is little changed, unable to recover much from this week’s slide. Only the Canadian dollar among the majors has failed to gain on the greenback this week. Core bond markets are quiet, though peripheral European bonds, especially in Italy and Portugal are under a bit of pressure. Equity markets stand out. They are broadly lower as the slide continues. |

FX Performance, November 03 2016 Movers and Shakers Source: Dukascopy.com - Click to enlarge |

| Despite the fact that four major central banks met and there has been the usual start-of-the-month high frequency economic data, the main driver has been the continuing narrowing of US presidential contest. In the past week, Trump’s chances have double according to the acclaimed fivethirtyeight.com to 33.8% today. Clinton’s chances have fallen from 82.2% to 66.2% today. |

FX Daily Rates, November 04 (GMT 16:00) |

| The sell-off in equities continues. The MSCI Asia-Pacific Index is off almost 0.9% today, the third consecutive loss. It is off 1.4% on the week and is at its lowest level since mid-September. It has fared relatively better than other regions. Europe’s Dow Jones Stoxx 600 is off 1% after a flat performance yesterday. It has not posted a gain (to the hundredth of a percentage point) since October 20. It fell 3.6% this week after a 1% decline last week. It is at its lowest level since mid-July and has now retraced more than 50% of its summer rally. The next retracement is another 1% lower.

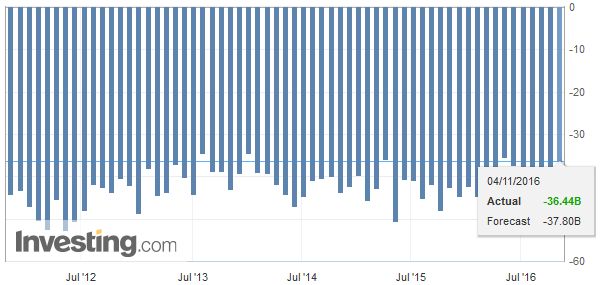

Lastly, we note that oil prices are steadying to conclude a dreadful week. The December light sweet crude contract is off 8.2% this week, which is the worst weekly performance since early this year. It followed a 4.2% decline last week. It has approached the lower end of its two and a half month range near $44. As recently as October 20, it was near $52. Doubts about what OPEC is willing to deliver and a surge in US inventories, coupled with technical selling are the drivers. |

FX Performance, November 04 |

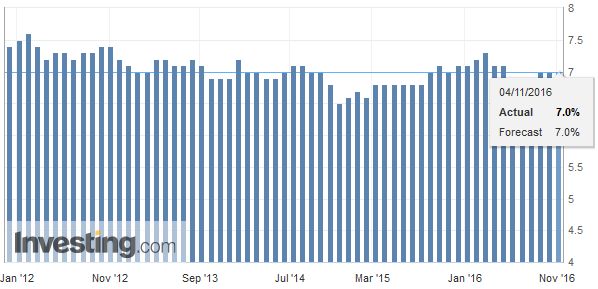

EurozoneThe euro has been confined to about 10 pips on either side of $1.1100. The PMI reports take some of the shine off the preliminary surge but show that as a whole the region is off to a good start in Q4. The composite reading was revised to 53.3 from the flash 53.7, but it still the highest since January. However, the divergence grows. The French data was revised down, and in fact shows some worrying signs. Its service PMI was revised to 51.4 from 52.1 in a flash, which was down from 53.3 in September. The composite fell to 51.6 from 52.7 in September. |

Eurozone Services PMI, October 2016(see more posts on Eurozone Services PMI, ) Source: Investing.com - Click to enlarge |

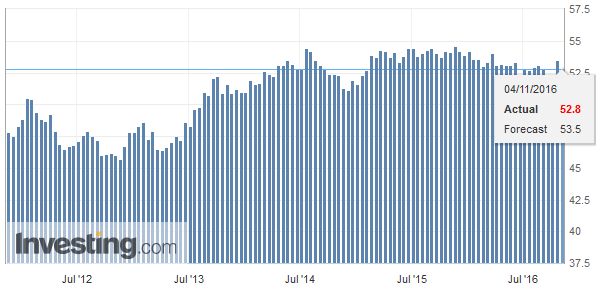

GermanyIn contrast, after a soft August and September, Germany snapped back strongly. The service PMI jumped from 50.9 to 54.2 (54.1 flash). |

Germany Services PMI, October 2016(see more posts on Germany Services PMI, ) . Source: Investing.com - Click to enlarge |

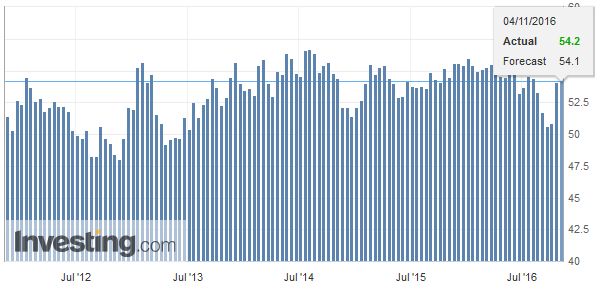

Germany Composite PMIThe composite rose to 55.4 from 52.8 in September. |

Germany Composite PMI, October 2016(see more posts on Germany Composite PMI, ) . Source: Investing.com - Click to enlarge |

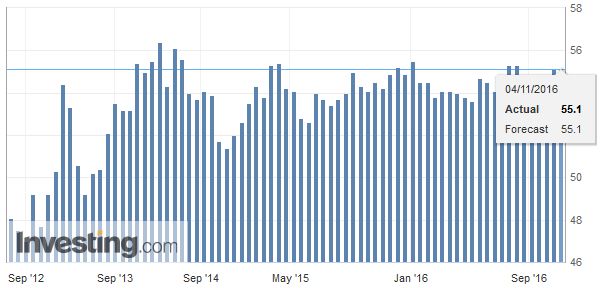

Spain Services and Composite PMISpain also reported a better composite. It increased to 54.4 from 54.1 in September. |

Spain Services PMI, October 2016(see more posts on Spain Services PMI, ) . Source: Investing.com - Click to enlarge |

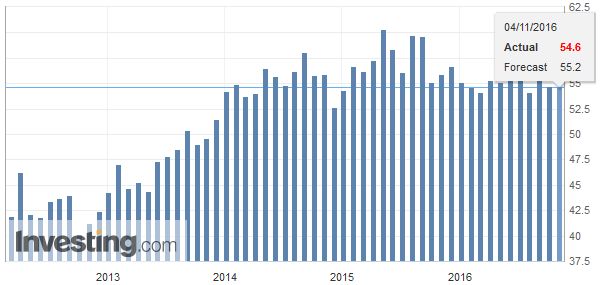

Italy Services and Composite PMIItaly was a little disappointing, but its composite was unchanged at 51.1. |

Italy Services PMI, October 2016(see more posts on Italy Services PMI, ) Source: Investing.com - Click to enlarge |

United StatesThe S&P 500 has fallen for the past eight sessions coming into today. It has been up a single session since October 19. It is also at nearly four-month lows. It closed below the 50% retracement of its summer rally (~2093) yesterday. The next retracement target is a little below 2069. |

.

|

| Barring a significant surprise, investors will most likely look through today’s US employment report. The FOMC just met, and the bar to a December hike is low. The FOMC will have another, more current read on the US labor market before its next meeting. With very fluid polls, traders may be reluctant to extend their risk. |

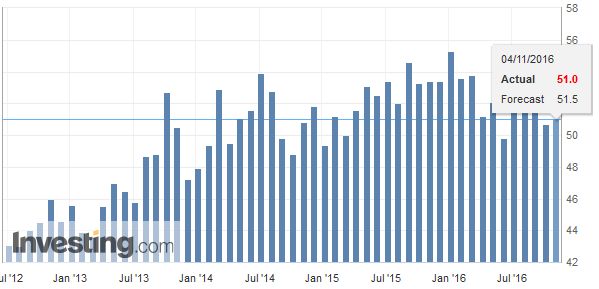

U.S. Nonfarm Payrolls, October 2016(see more posts on U.S. Nonfarm Payrolls, ) . Source: Investing.com - Click to enlarge |

| Most look for US jobs growth to return toward this year’s average pace (~178k) from overshooting it the past three months (average 192k). However, what this means is that the market is looking for a little improvement over September’s 156k. Internals are important. There is some chance, largely due to rounding, some are looking for the unemployment rate to slip back to 4.9% from 5.0%. | .

|

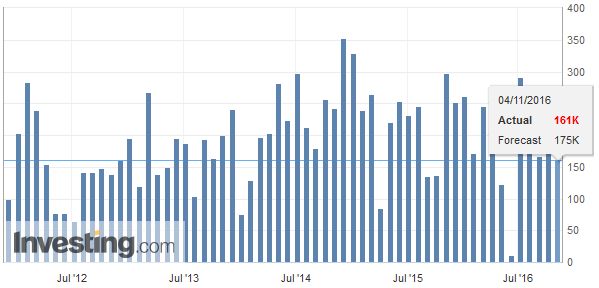

| Average hourly earnings are expected to rise by 0.3%. If so, that would keep the year-over-year pace at 2.6%, slight ahead of the CPI. The average work week is stable at 34.4 hours. |

. U.S. Participation Rate, October 2016(see more posts on U.S. Participation Rate, ) . Source: Investing.com - Click to enlarge |

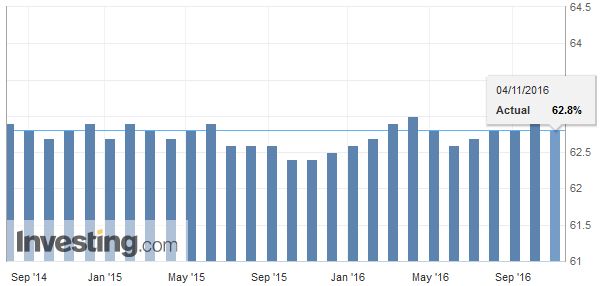

| Canada also will publish its October jobs report. Here the market expected a loss of 15k jobs after the outsized 67.2k jump in September. Two-thirds of those jobs (44.1k) were part-time positions. The unemployment rate is forecast to remain steady at 7.0% on a flat participation rate of 65.7%. |

Canada Unemployment Rate, October 2016(see more posts on Canada Unemployment Rate, ) . Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$CAD,Canada Unemployment Rate,EUR/CHF,Eurozone Services PMI,FX Daily,Germany Composite PMI,Germany Services PMI,Italy Services PMI,newslettersent,Spain Services PMI,SPY,U.S. Nonfarm Payrolls,U.S. Participation Rate,U.S. Trade Balance,U.S. Unemployment Rate