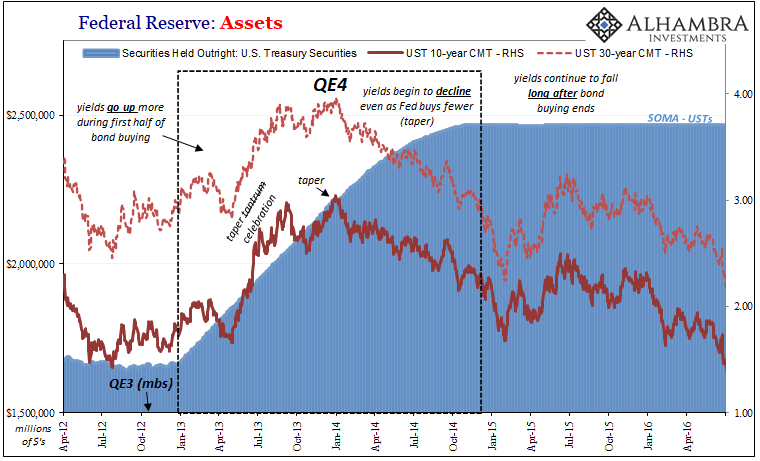

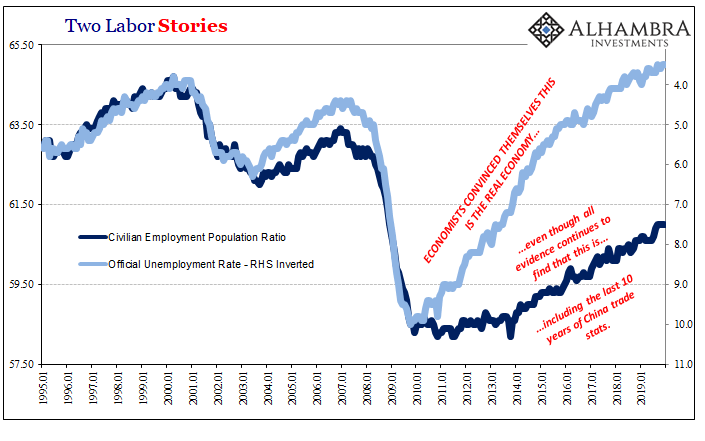

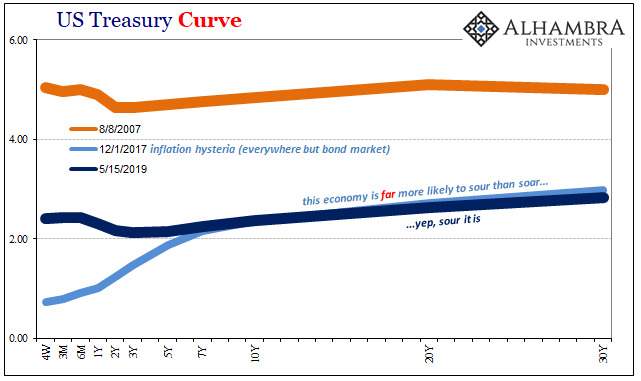

An Abrupt DropLet’s turn back to our regular beat: the U.S. economy and its capital markets. We’ve been warning that the Fed would never make any substantial increase to interest rates. Not willingly, at least. Each time Fed chief Janet Yellen opens her mouth, out comes a hint that more rate hikes might be coming. But each time, it turns out that the economy is not as robust as she had believed… and that a rate hike isn’t such a good idea after all. Mainstream economists regularly dismiss worries about falling employment and output in the manufacturing sector. “Don’t fret about it,” they say. “We have a robust service economy.” |

|

Well, on Tuesday, the news came out that the service economy is not as robust as we thought. Bloomberg:

Besides, the promise of a “service” economy has always been a fraud. We can’t all get rich by mowing each other’s lawns and parking each other’s cars! You can make money by offering services, but only if there is someone who can pay for them. And you can only pay for services if you are doing something that generates real wealth. |

|

Wealth DrainJust look at India. It has over half a billion people willing to do just about anything for peanuts. Services? You can get all you want. But that doesn’t make India a wealthy country. Services are better thought of as a drain on wealth, not a way of building it. Let’s say you want to go out to the movies. Instead of watching your children yourself, you hire a teenager from the neighborhood. You pay, say, $20 for the evening. This results in an increase to the nation’s service industry income of $20. And you had the benefit of the service. You had $20. Now, someone else has the 20 bucks. Where’s the additional wealth? Manufacturing, on the other hand, creates wealth. You take $20,000 worth of labor and materials. You put together an automobile and sell it for $25,000. The automobile is worth $5,000 more than what it cost to build it. You are $5,000 richer. But wait… You will say that someone must be out $5,000. But that isn’t true. He had $25,000 worth of cash. Now, he has $25,000 worth of automobile. He’s even; the world is $5,000 richer. |

|

Crack and SnapchatReaders will be quick to point out how Silicon Valley has added to the real wealth of the nation with its many services and innovations. Social media companies alone are said to be worth $500 billion – evidence of how much wealth they are bringing to the world. And it’s true – some are useful for improving productivity. They speed the output of real wealth. But even profitable innovations can destroy wealth as well as create it. Crack cocaine and television, for example, have probably cost the nation a trillion dollars of real output. Are Facebook and Snapchat much different? As in any other service industry, money passes from one person to another. But is wealth created? Or destroyed? Check your children’s smart phones, tablets, and laptops. Let us know what you find. Foolish, idle, insipid – most of what we see in social media is a waste of time. And what about the internet? Was that just a summer delusion, too? Maybe. Since the internet took off, economic growth rates have been roughly cut in half. And the median American household income has fallen 20% when you account for real inflation, not the government’s phony inflation figures. What kind of service is that? |

Chart by: TradingEconomics

Chart and image captions by PT

The above article originally appeared as “How Can We Save the Ranch?“at the Diary of a Rogue Economist, written for Bonner & Partners.

Full story here Are you the author? Previous post See more for Next post

Tags: Janet Yellen,newslettersent,On Economy