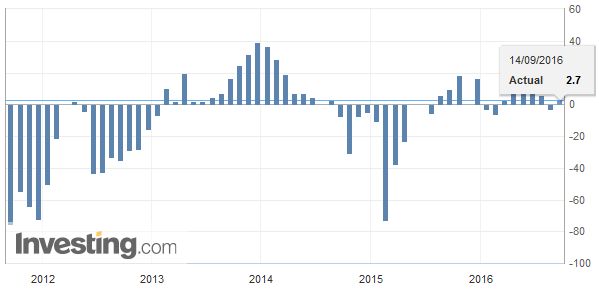

Swiss FrancSwiss ZEW expectations came in better than expected. The value was +2.7 instead of expected negative value. |

Switzerland ZEW Expectations(see more posts on Switzerland ZEW Expectations, ) |

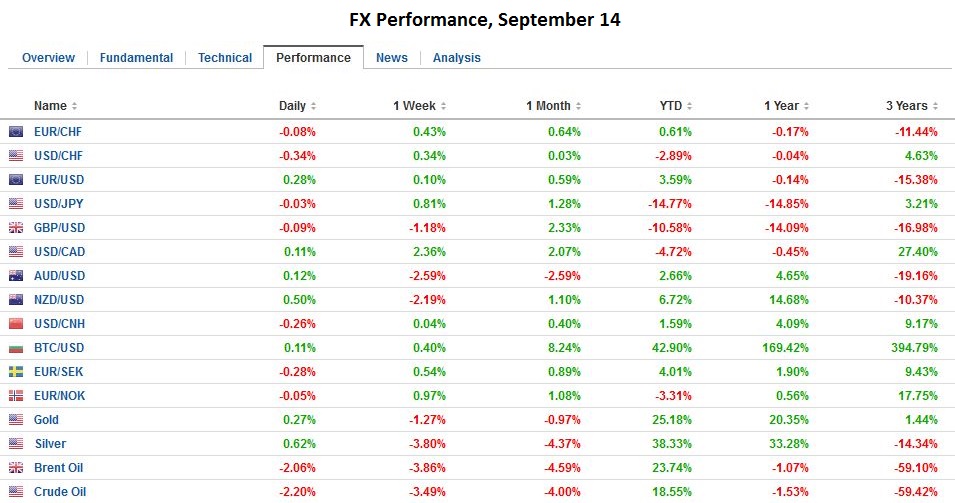

FX RatesThe US dollar advanced yesterday and is in narrow ranges with a mostly softer bias today. The exception is the Japanese yen. Japanese press have reported that more negative rates are under consideration may have contributed to the weakness of the yen. Note that today may be the fourth session of the past five that the greenback advances against the yen. Broadly speaking, it appears the backing up of interest rates offsets the weakness in equities as driving the yen. |

Movers and Shakers, September 14 - Click to enlarge |

| We suspect the kernel of truth behind the reports of negative rates is that officials do not want to rule any action out. Also, recall that the negative rates apply to a small part of deposits at the BOJ. They could widen the coverage of negative rate, which is broaden its applicability rather than deepen the cut.

A Bloomberg poll found a little over half the economists expect the BOJ will expand monetary stimulus next week. Of those that do see a move 53% anticipate a deeper cut in the negative rate and a little more than a third (35%) think the BOJ will buy more government bonds. |

|

JapanThe dollar is rose to a six-day high against the yen near JPY103.35. Above here, resistance is seen in the JPY103.85 area and then August high in the JPY104.00-JPY104.30 area. Intraday technicals and the easing of the upside momentum on yields warns that the dollar may struggle to extend its gains without new news. On the downside, initial support is pegged around JPY102.70. |

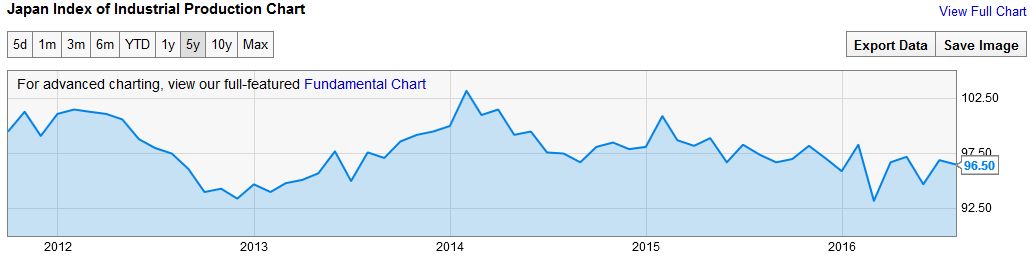

Japan Index of Industrial Production(see more posts on Japan Industrial Production, )Japanese industrial production was weaker than expected and fell by 0.4%. |

|

Sterling initially ticked up on the news but stalled in the $1.3230 area.The intraday technicals allow for additional upticks in sterling. Only a move above $1.3330 would signal anything important. The dollar-bloc currencies, which saw steep losses yesterday, are trading quietly, holding on to small gains in the European morning.The tone is one of consolidation more than a correction. Initial support for the greenback is seen near CAD1.3120. The Australian dollar fell to $0.7440 yesterday, its lowest level since late-July. Previous support around $0.7500-$0.7520 may now act as resistance. For the third consecutive session, the euro remains within last Friday’s range of roughly $1.1200 to about $1.1285. Intraday technicals give little hope that the range is broken today. |

|

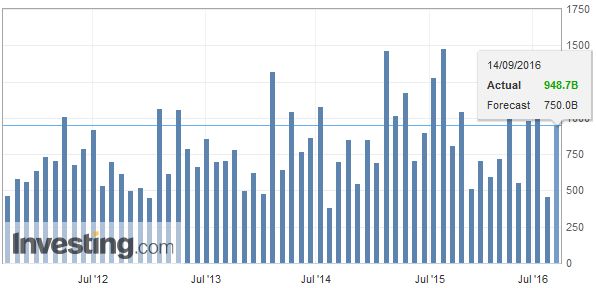

ChinaChinese equities finished near one-month lows ahead of a holiday that will shut the local markets until Monday. There are two talking points today about China. The first is the continued squeeze in HIBOR, which is seen as induced by the PBOC ostensibly to ward off speculative pressure. Some link the PBOC action to the inclusion of the yuan into the SDR. However, since the decision has already been made, it is not clear that the level or yuan stability is important. Instead, an alternative hypothesis links the PBOC action to the backing up of rates and the prospect of the Fed lifting rates. The idea being that officials want to slow its yuan’s descent. The CNY6.7 level has taken on psychological significance. The second talking point is the Chinese data. Aggregate financing jumped by nearly a trillion yuan. In July it was CNY488 bln and in August it was CNY1.47 trillion. The increase was roughly evenly divided between the banking system (yuan loans) and shadow banking. Money supply growth (M0 and M2) accelerated. China appears to be purchasing a semblance of economic stability at the cost of continued debt accumulation. |

China New Loans(see more posts on China New Loans, ) Click to enlarge. Source Investing.com |

EurozoneEuropean news is largely limited to the UK employment data ahead of the summit in Bratislava, where the European project will be the focus. The details of Brexit is not the issue. It is widely recognized that the battle for the hearts and minds needs to be reinvigorated. This also speaks to realization that the democratic deficit may be undermining the project. Reports suggest officials are keen to take up issues that are more important and relevant to the people of Europe, like terrorism, migration, and the challenges of globalization. |

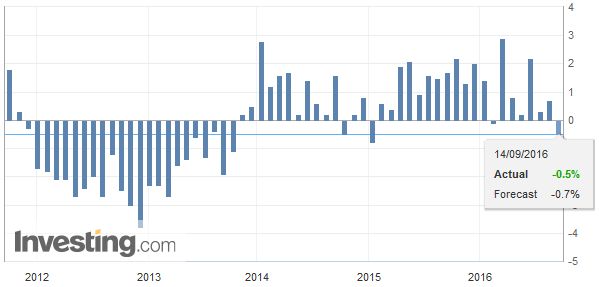

Eurozone Industrial Production YoY(see more posts on Eurozone Industrial Production, ) Click to enlarge. Source Investing.com |

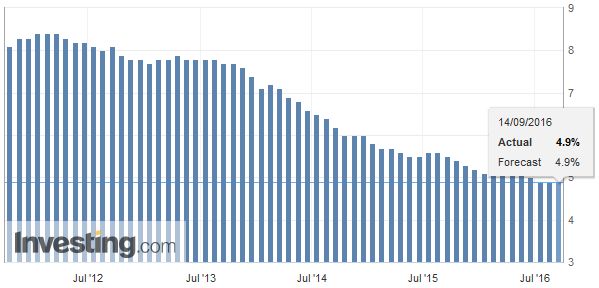

United KingdomUK employment data was largely in line with expectations. The unemployment rate (ILO) was unchanged at 4.9%. |

U.K. Unemployment Rate(see more posts on U.K. Unemployment Rate, ) Click to enlarge. Source Investing.com |

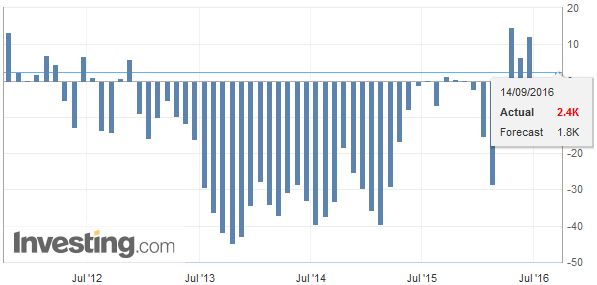

U.K. Claimant CountThe claimant count increased by 2.4k, a few hundred more than expected, while the July series was revised to show a 3.6k decline rather than an 8.6k fall. |

U.K. Claimant Count Change Click to enlarge. Source Investing.com |

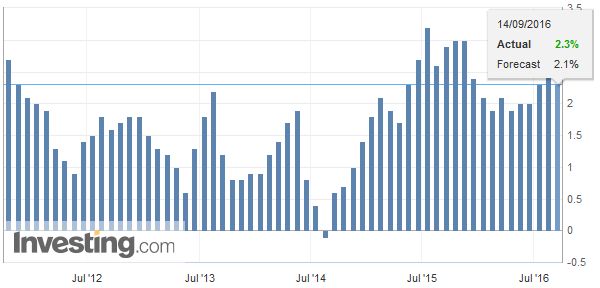

U.K. Average Earnings Index + BonusAverage earnings continued their softening trend, though not as much as the median forecast. Average weekly earnings in the three months through July was 2.3% higher than a year ago, compared with 2.5% in June and expectations of a decline to 2.1%. Excluding bonus, earnings growth was 2.1% down from 2.3%. |

U.K. Average Earnings Index + Bonus(see more posts on U.K. Average Earnings, ) Click to enlarge. Source Investing.com |

United States

The North American session features US import prices, which could offer insight into the PPI data on Thursday. However, the August retail sales data released at the same time tomorrow is more important for the market.

The markets are trying to catch their collective breath after yesterday’s dramatic moves. The sharp slide in US equities may have weighed on Asian markets, but losses are mild. Still, the MSCI Asia-Pacific Index was off 0.8%, the fifth consecutive losing session. European bourses slightly firmer, but appear to be awaiting the US open for stronger directional cues.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,$AUD,$CAD,$EUR,China New Loans,employment,EUR/CHF,Eurozone Industrial Production,France Consumer Price Index (harmonized),FX Daily,Italy Consumer Price Index,Japan Industrial Production,Japanese yen,newslettersent,Switzerland ZEW Expectations,U.K. Average Earnings,U.K. Unemployment Rate