See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

Precious Metals and Central BankersThe dollar exchange rates of the metals fell this week, with that of silver falling more. Friday’s trading action was notable, because at first markets (including the US stock market) interpreted comments by Fed Chair Janet Yellen as “dovish”—i.e. low interest rates will continue. This means a rising money supply, and everyone “knows” that that means rising prices. Especially of assets such as stocks and gold and silver. But then Fed Vice Chair Stanley Fischer reiterated that the Fed may hike rates in September. This means a shrinking money supply, or at least a slowdown in the rate of growth. Therefore… sell. And the markets dutifully did. When these gyrations are happening, it’s easy to get caught up in them. However, at the end of the day (literally, in the case of Friday) the falling silver price trend continued. These media appearances do not usually change the supply and demand fundamentals. |

|

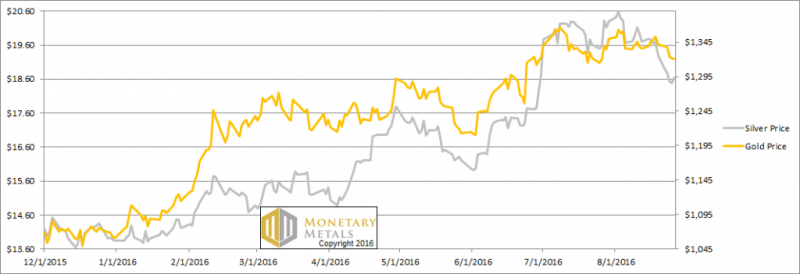

Fundamental DevelopmentsSpeaking of supply and demand fundamentals, read on for the only the only true picture. But first, here’s the graph of the metals’ prices. |

Prices of gold and silver(see more posts on gold price, silver price, ) |

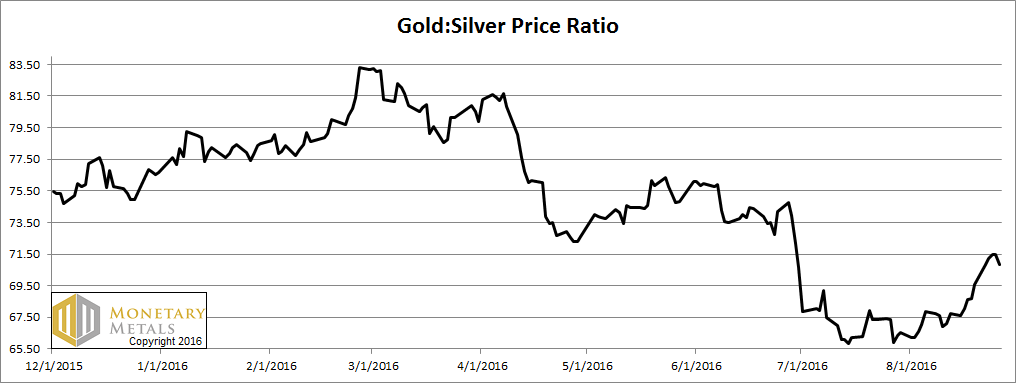

Gold-silver ratioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It rose over a point this week. |

Gold-silver ratio(see more posts on gold silver ratio, ) |

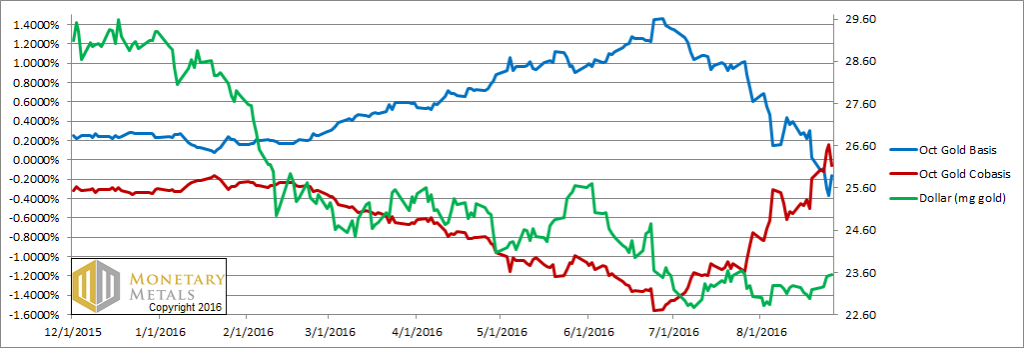

Gold basis and co-basis and the dollar priceHere is the gold graph. We haven’t seen this in a while. The gold basis crossed the co-basis. We actually had backwardation (temporary though it may be, as selling pressure on the October contact has already begun, due to the roll). Unlike the market price, the calculated Monetary Metals fundamental price was up this week. It’s now 45 bucks above the market, the first time that the fundamental price is above the market price since April. |

Gold basis and co-basis and the dollar price(see more posts on gold basis, Gold co-basis, ) |

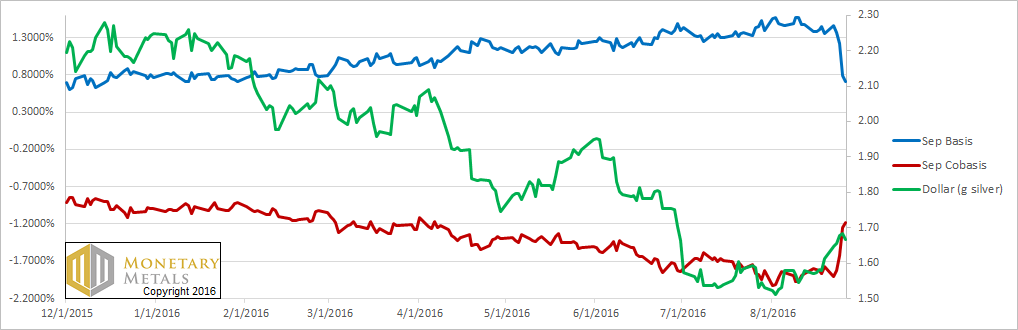

Silver basis and co-basis and the dollar priceIn silver, we now see a big move in the bases, on Wednesday and especially on Thursday. Visually comparing the green line (i.e. price of the dollar, as measured in silver) to the red line (i.e., the co-basis, silver’s scarcity measure) we see both rising. That is, the dollar is up (the price of silver is down) and silver is more scarce to the market. This is generally the correlation we expect. The fundamental price is up to around $17, which at least isn’t as far below the market price as it was last week. |

Silver basis and co-basis and the dollar price(see more posts on silver basis, Silver co-basis, ) |

Charts by: Monetary Metals

Full story here Are you the author? Previous post See more for Next post

Tags: central banks,dollar price,gold basis,Gold co-basis,gold price,gold silver ratio,Janet Yellen,newslettersent,Precious Metals,silver basis,Silver co-basis,silver price,Stanley Fischer