See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

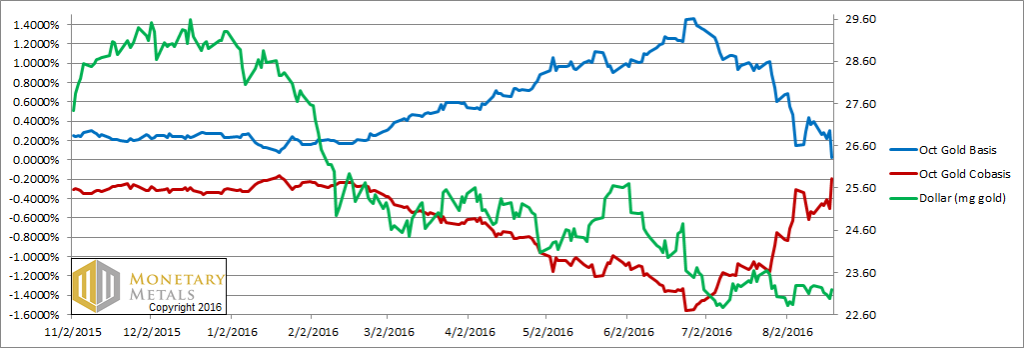

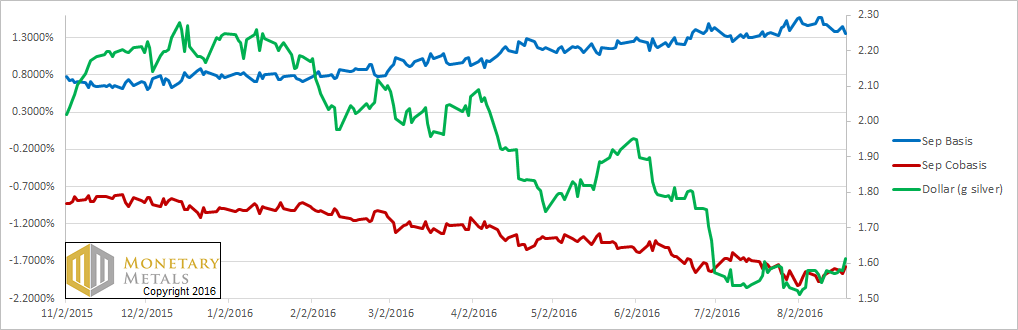

The Lighthouse ProblemMeasured in gold, the price of the dollar hardly budged this week. It fell less than one tenth of a milligram, from 23.29 to 23.20mg. However, in silver terms, it’s a different story. The dollar became more valuable, rising from 1.58 to 1.61 grams. Most people would say that gold went up $6 and silver went down 43 cents. We wonder, if they were on a sinking boat, tossing about in stormy seas, if they would say “that lighthouse went up 5 meters.” To our point last week, what would be the utility of a lighthouse that you measured from your boat which is going down and up, but mostly down? Would you wonder if lighthouses had another purpose, any other use? If you could make money betting against other sailors, on the lighthouse’s next position, would you care?

Of course, what Buffet doesn’t mention is that we’re forced to use paper certificates of government debt as if it were money. This debt is losing value as the government racks up ever more implausible amounts of it ($19.5T at the moment). Meanwhile, lenders are offered lower and lower interest rates to finance this growing monument to economic insanity. Surely anyone from Mars would be scratching his head at this, too. Unfortunately, Nixon’s gold default almost exactly 45 years ago to the day removed the extinguisher of debt. When you pay off a debt using gold, the debt goes out of existence. When you pay a debt using dollar, the debt is merely shifted. So the debt grows—must necessarily grow—at an exponential rate. Also unfortunately, Nixon’s gold default also unhinged the rate of interest. It began to shoot to the moon. It eventually peaked at an insane high (and historically unprecedented) level in 1981. Since then, it has been falling and now it keeps hitting insane low (and unprecedented) levels. You can get yourself out of the loop by buying gold, but you cannot affect the debt, interest rates, or the banking system. You are disenfranchised. Instead, we have monetary policy administered the way the Soviet Union had food prices set by bureaucratic diktat. The problem is not that gold cannot have any utility. It had it, once. The problem is that the government has locked up gold’s utility. What’s left of gold is just betting on the price action in the casino. Sooner or later, that price action is going to come to an ignominious end. Contra the Quantity Theory of Money, the value of the dollar will go to zero. This will not be because its quantity rises to infinity. It will be because gold owners no longer wish to risk holding dollars, for fear of counterparty default. About the best we can say is that today is not that day. |

|

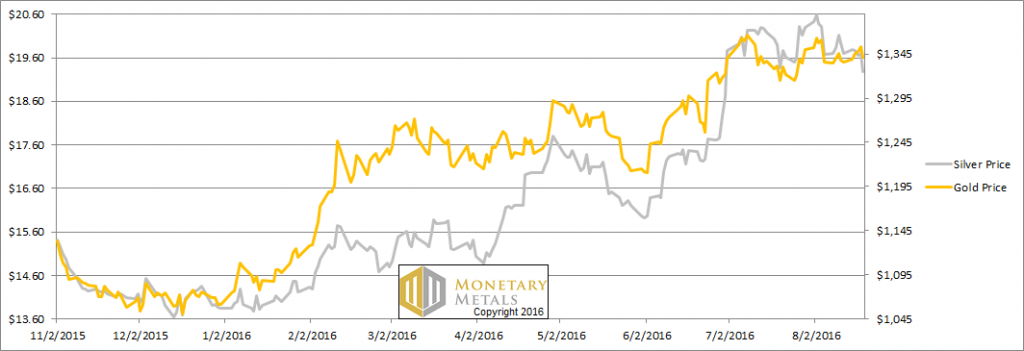

Gold Fundamentals Catch UpRead on for the only the only true picture of the supply and demand fundamentals that ultimately drive the price action. But first, here’s the graph of the metals’ prices. |

|

| Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It rose significantly this week. | |

Gold basis and co-basis and the dollar priceHere is the gold graph. Well, well, well. Look at that. The abundance of gold (i.e. the basis, the blue line) falling all week, and the scarcity rising. Indeed, we see now this pattern has been going since the end of June. The same pattern holds true for farther-out contracts. This means that someone, or millions of someones—do not get too caught up in the fallacy of famous market players—is buying physical gold metal. In that time, speculators have not been eager to buy more. So the net result is that the fundamentals have nearly caught up to the price. |

|

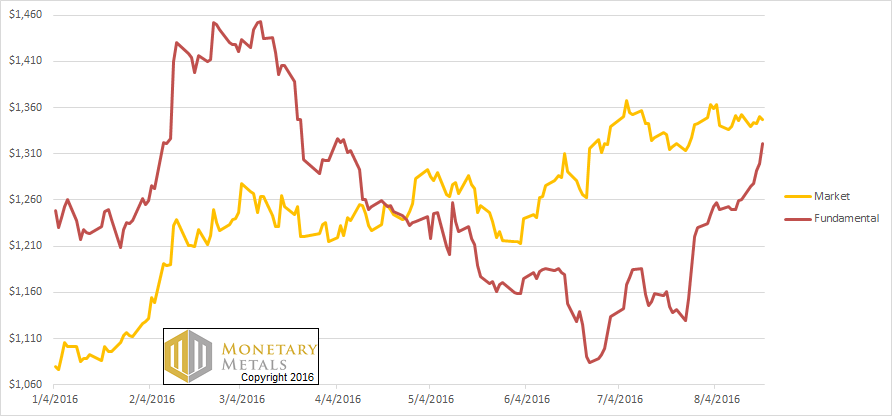

Gold – market price vs. fundamental priceThe gold market may not be screaming “buy” yet—today is not that day—but it’s no longer screaming “danger”. It is interesting to see that the speculators—who are really betting against the dollar, even if they don’t always know it—sometimes go their own way. Perhaps they see a central banker in the news, or the jobs report disappoints. Buy, buy! No animal species can survive by cannibalism—by members eating other members. And speculators cannot drive the market by continually buying from one another, giving them both profits (as they reckon it, in dollars) and ever-rising price. Eventually either the fundamentals change and the speculators are proven right. Or the speculators give up, or get flushed out. This time, the speculators are proven right. They put their dollars in harm’s way, particularly since the end of April when the softening fundamental price fell below the market price. It continued to fall all the way through late June. But the market price did not follow this trajectory. |

|

Silver in a Different WorldSilver is in a different world. We do see a falling basis and rising co-basis this week. However, it’s just tracking price. That is rising dollar price (i.e. falling silver price) corresponds with rising co-basis. As speculators reduce their positions, the price falls a bit. It has a long way farther to fall, before it catches down to the fundamentals. |

Charts by: Monetary Metals

Full story here Are you the author? Previous post See more for Next post

Tags: dollar price,gold basis,Gold co-basis,gold price,gold ratio,newslettersent,Precious Metals,silver basis,Silver co-basis,silver price,silver ratio