Connecting DotsBALTIMORE – U.S. stocks bounced on Tuesday, with the Dow up 269 points [and even further on Wednesday, ed.]. Was that all there was? Is the “Brexit” scare over? We don’t know… but we’re going to take a pause today. Instead of trying to connect the new dots, we’re going to take a look at the old dots we’ve already strung together. We’ve been connecting the dots every day (except weekends) for the last 17 years. And today, for the benefit of new readers, old dear readers, and our own benefit too… we step back. What do we see? As for Brexit – British voters’ decision to leave the European Union – it is simply a case of the common man mooning the elite. It doesn’t matter whether he says “schedule” or “skedule,” he’s dropping his pants, fed up, even if he doesn’t exactly understand what he is fed up with. Let us begin in the beginning; maybe we can help him out. Markets do not set prices. They discover prices. The difference is critical. Prices change every minute the markets are open… with buyers and sellers always scrambling to find the right one. Prices are signals. Capitalism is fundamentally a learning system, not a get-rich system. And prices – honest, freely-discovered prices – are vital information. They direct investment, consumption, savings – everything. Fiddle with the prices – as the Fed now does with the most important price of all: the price of credit – and you cause distortions, corruptions, and breakdowns. What is anything really worth when you don’t know what money is worth? |

|

Price vs. ValueAnd prices are different from values. Prices may change from day to day. Values change slowly. “Price is what you pay,” say the old timers, “but value is what you get.” The distinction is important. As courtroom witnesses, prices are easily suborned. They can be bribed, bullied, and bamboozled without much effort. They yield readily to passing fancies, news, PR, mob sentiments, fads, fashions – and Fed manipulation. Prices can be fiddled, in other words. Values cannot. Values are reliable; they do not waiver, they do not crack under pressure. But they are deeper… and harder to discern. The difference is roughly the same difference between quantity and quality. Any fool can produce quantity and any economist can count. But discerning quality – the real value of something – requires judgment, taste, and the discipline of a market. That’s the trouble with modern economics, too: It is all counting. What really matters is quality. And economists wouldn’t know quality if it bit them on the derriere. Here at the Diary, we look for value. In stocks. In everything. And almost everywhere we look today, we don’t see it… |

|

Guaranteed LossesTake a Japanese government bond, for example. You can buy one that matures in 10 years. For your trouble, you’ll get a yield of MINUS 0.24%. That means, in “nominal” terms (not adjusted for inflation or deflation), the Japanese government (which is effectively bankrupt) positively, absolutely guarantees you will get back less money than you paid. Where’s the value? 10 year JGB– you’ll be guaranteed to lose 0.24% annually if you buy it here and hold it to maturity – n.b., in nominal terms, and only if the Japanese government is still solvent in 10 years time. What a deal! – click to enlarge. |

|

| Or take the typical stock on the New York Stock Exchange. According to Yale economist Robert Shiller, it sells for 25 times last year’s reported earnings. If you bought the whole company, you’d have to wait a quarter-century before earnings – if there still were any – repaid your investment. Where’s the value in that?

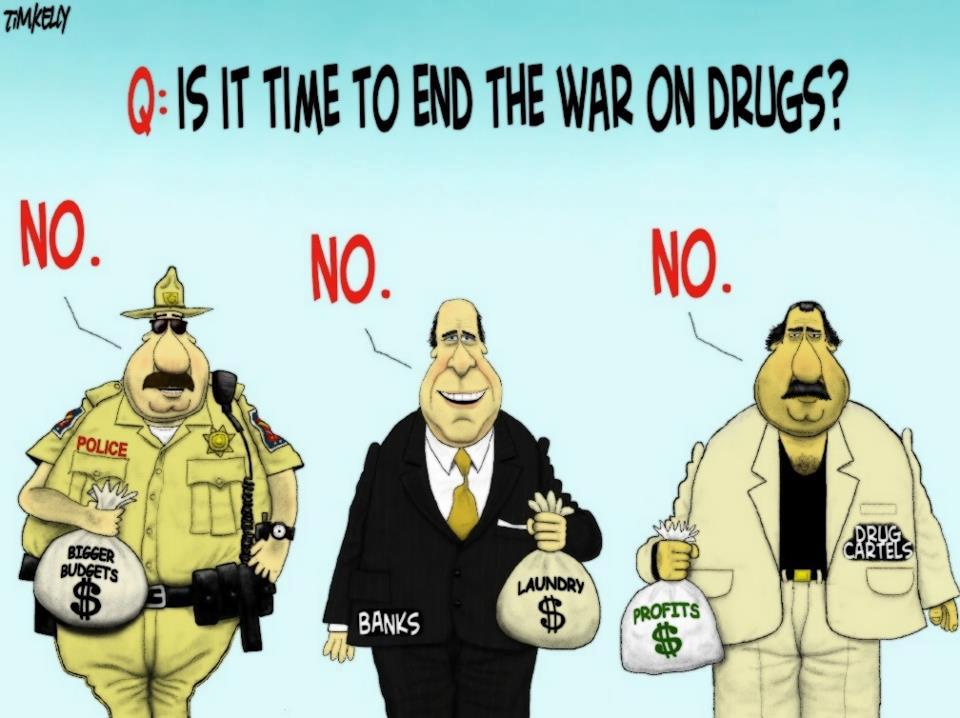

And that’s before taxes. A Maryland or California resident could expect to wait twice as long – a half-century! Or take politics. Do you see real value in Congress? In the candidates for president? In a system that pretends that “the people” call the shots, when they clearly don’t? And then, there are public policies – the War on Poverty, the War on Drugs, the War on Terror, the wars in the Mideast. The government has invested trillions of dollars in these programs. But where’s the return? Where’s the value? |

|

Trillions Down the TubesAnother pause for detail. The U.S. has plenty of oil and gas. It doesn’t need to spend $1 trillion a year (the entire cost of the U.S. “security” industry) to protect energy imports from the Mideast. This year, the U.S. will import about 500 million barrels of oil from the Persian Gulf. At $40 a barrel, that’s only $20 billion worth of oil. But James Burgess at OilPrice.com writes:

Where’s the value? And Stanford political scientist Francis Fukuyama writes:

Isn’t this what the War on Drugs was supposed to prevent? Where’s the value? Trump supporters want to know. How did the elites get so cut off? How did they get so rich while everyone else got so poor? What happened 45 years ago that caused prices to rise… but values to fall? Stay tuned… |

Charts by: BigCharts, Doug Short / Advisorperspectives

Chart and Image captions by PT

The above article originally appeared at the Diary of a Rogue Economist, written for Bonner & Partners.

Tags: newslettersent,On Economy,On Politics