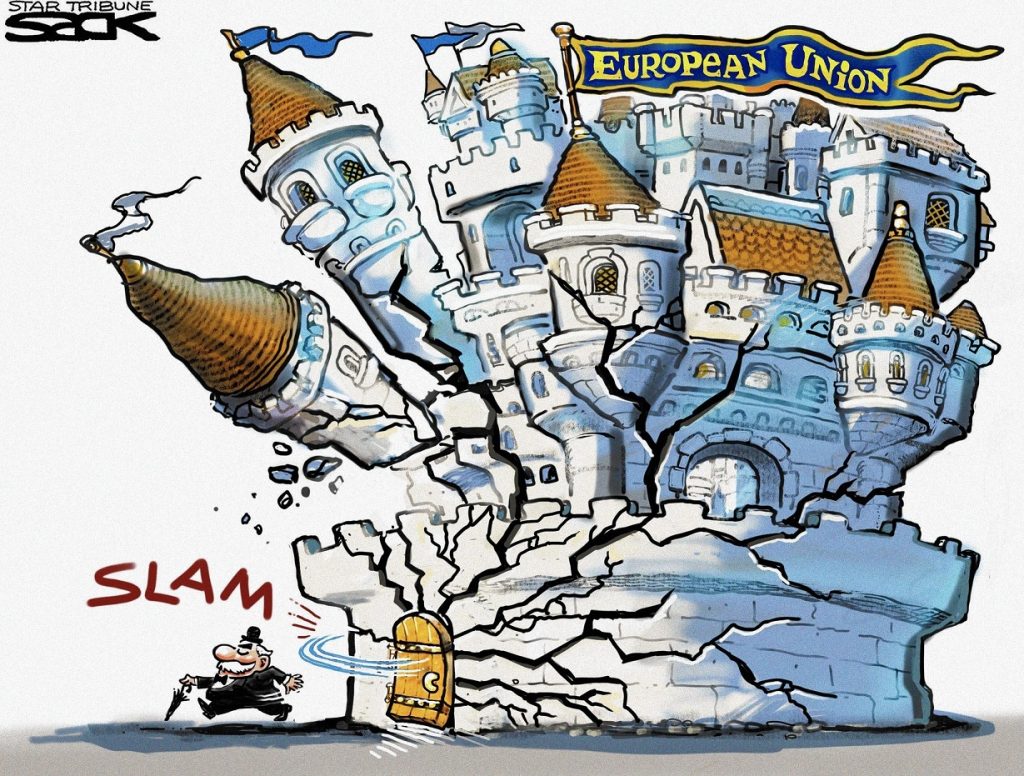

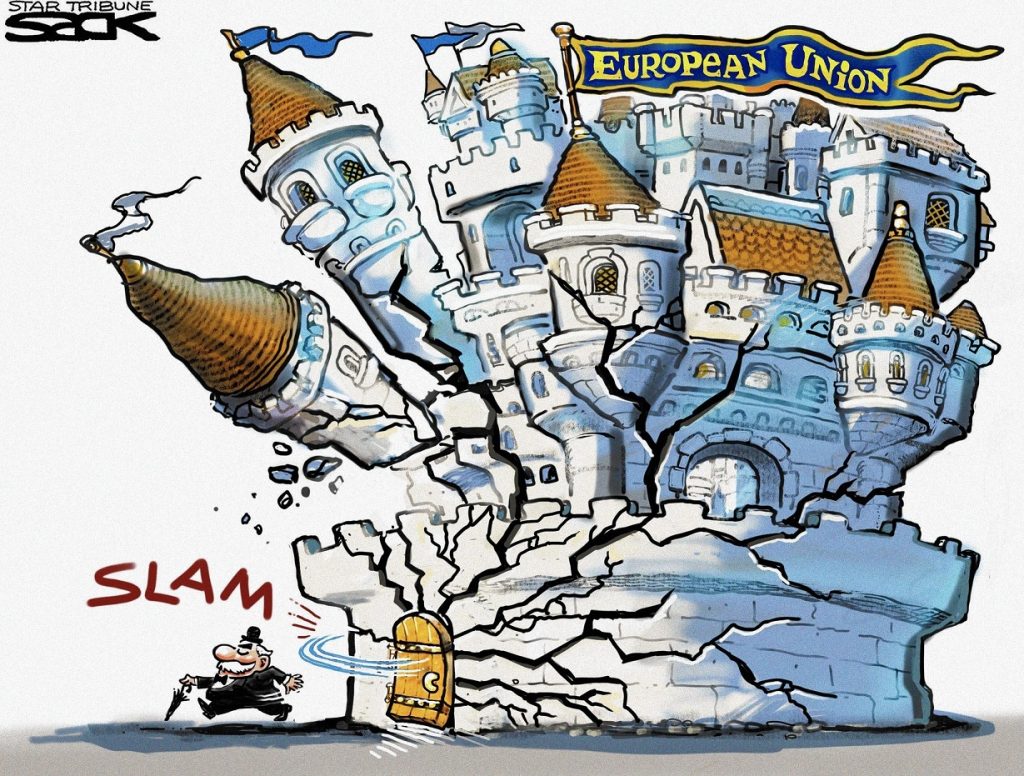

| Investors have realized Brexit isn’t the end of the world. First, because they think it won’t really happen. After all, elites can fix elections, buy politicians, and control public policy… surely, they can fix this!

A letter in the Financial Times reminds us that Swedish voters cast their ballots against nuclear power in 1980. The government just ignored them, doubling nuclear power generation over the next 36 years.

Second, because investors see the panic over Brexit leading to more spirited intervention by central banks! The EZ money floodgates – already wide open – are to be opened wider.

The U.S. has its QE program on hold, but Europe’s scheme is gushing like Niagara. Mario Draghi at the European Central Bank buys $90 billion a month in bonds. And he’s not only buying government bonds; he’s buying corporates, too. |

The feds got out the knife in 1971. They changed the money system itself. They severed the link between gold and the dollar – and between value and price. It was so subtle almost no one objected… and so clever almost no one saw what it really meant. It took us more than 40 years to figure it out. - Click to enlarge |

Yields Less Than Zero

In Japan, always a trendsetter, the Bank of Japan has bought so many bonds it has pushed Japanese government bond yields below zero – out to more than 45 years on the yield curve!

In other words, you can now lend to the bankrupt Japanese government until 2051 with no hope of making a single yen, nominally, on your investment. Now, with bonds stacking up in their vaults, the Japanese feds are diversifying. They’re buying exchange-traded funds (ETFs), too. |

The feds got out the knife in 1971. They changed the money system itself. They severed the link between gold and the dollar – and between value and price. It was so subtle almost no one objected… and so clever almost no one saw what it really meant. It took us more than 40 years to figure it out. - Click to enlarge |

BoJ Purchases of Japanese Stocks

Via its ETF purchases, the BoJ buys about $30 billion of Japanese stocks a year. This has made it a top 10 shareholder in about 90% of the companies listed on the country’s Nikkei 225 Index.

Apparently, the BoJ announced it would buy a particular kind of politically correct ETF, even before such an investment existed. This led to a rush to meet the demand (no matter how looney) to create exactly the ETF the Japanese feds were looking for.

So now, the phony money created by the BoJ buys phony ETFs created by the sushi equivalent of Wall Street – solely for the purpose of letting the Samurai feds put more phony money into the financial sector. The ETF then must buy politically fashionable companies, many of which probably wouldn’t exist were the fix not in so deeply.

Private investors did not want these stocks

Result? The Bank of Japan – not private investors – is the proud owner of stocks and bonds that private investors didn’t want, bought at prices they wouldn’t pay. The whole show is too goofy for words. But words are all we’ve got! |

The feds got out the knife in 1971. They changed the money system itself. They severed the link between gold and the dollar – and between value and price. It was so subtle almost no one objected… and so clever almost no one saw what it really meant. It took us more than 40 years to figure it out. - Click to enlarge |

Capitalism Without Capital

“It is just a matter of time,” says a friend writing from Switzerland, “before the feds own all our assets. They’re determined to keep prices high and they have unlimited resources.”

Yes, stocks, bonds, old copies of Mad Magazine… everything will be owned by the government. Then our liberty will be complete. We will have nothing… and nothing to lose.

We will have become what leading German post-war economist Wilhelm Röpke had anticipated: the “stable fed” animals that depend on their masters to keep them going.

At last, we will have the kind of capitalism another economist – Karl Marx – dreamed of: capitalism without private capital. The Deep State will control all our wealth.

We will go to college on federal loans… we will drive cars, leased of course, at federally subsidized low rates… we will live in houses mortgaged by federal mortgage lender Fannie Mae… with the mortgage rates pushed down by its fellow manipulator, Freddie Mac… we will work for companies that depend on the Fed’s EZ money financing…and, of course, our medical care will be in the hands of the feds… and our retirement finances too.

Cradle to grave – Chapter 1 to Chapter 11 – all on central bank credit.

Each dollar in the private sector is either earned or borrowed. The feds and their crony friends get their money for free. Gradually, they own more and more assets, while the rest of the people owe more and more debt. |

The feds got out the knife in 1971. They changed the money system itself. They severed the link between gold and the dollar – and between value and price. It was so subtle almost no one objected… and so clever almost no one saw what it really meant. It took us more than 40 years to figure it out. - Click to enlarge |

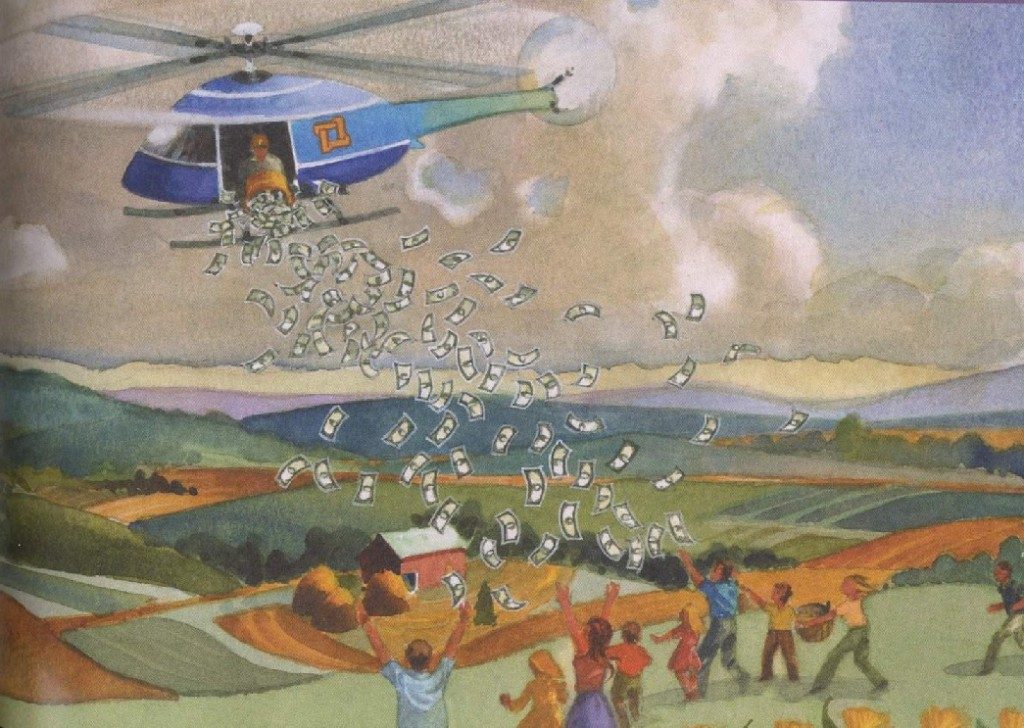

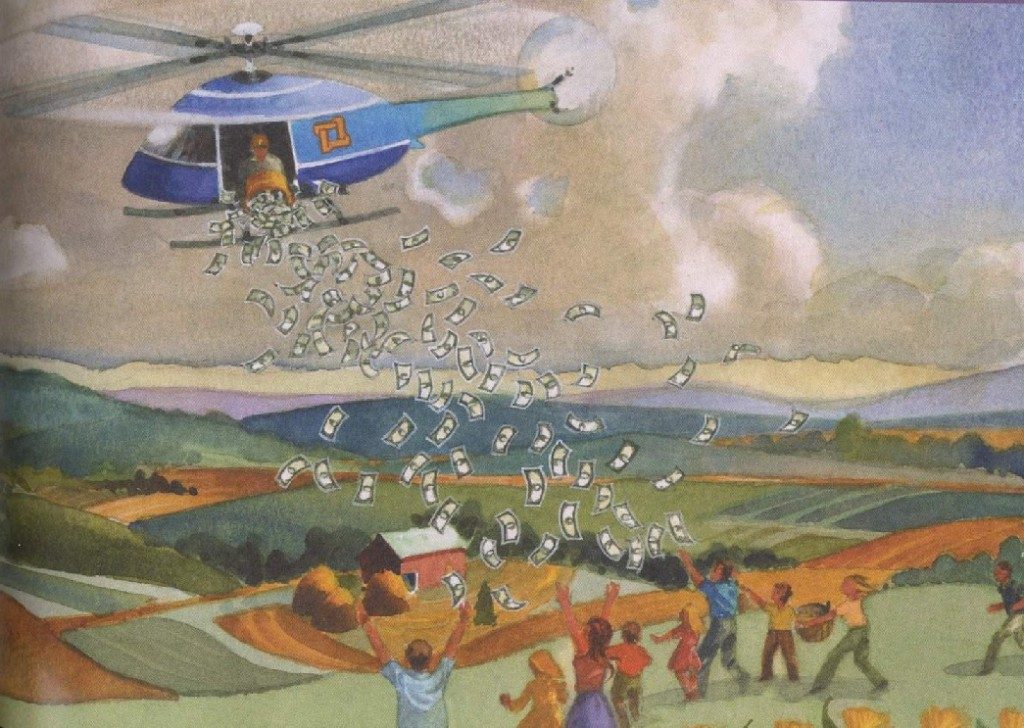

Sacred Tether: Money from Helicopters

But wait – let us look again at the maze of dots. How did this happen? Yesterday, we saw that price is not the same as value. If you want to increase prices, all you have to do is spread around some cash. Drop money from helicopters, especially in bad neighborhoods, and prices will soar. But value?

Here is where it gets interesting. Because when you drop money from helicopters, values tend to drop, too. What shoemaker will still take pride in a making a good pair of walking boots, when his money floats down from Heaven with no effort at all? |

The feds got out the knife in 1971. They changed the money system itself. They severed the link between gold and the dollar – and between value and price. It was so subtle almost no one objected… and so clever almost no one saw what it really meant. It took us more than 40 years to figure it out. - Click to enlarge |

| What company will still sweat and strain to produce the best possible products, when its revenues no longer come from demanding customers? What analyst sharpens his pencil to find the best companies to invest in, when there is no longer any connection between money and quality performance.

In rich neighborhoods or in poor ones, giving away money causes trouble. Quality declines, as fewer and fewer people are willing to put in the time and trouble to produce it. And why should they? The ancient and sacred tether, connecting quality to wealth, effort to reward, has been severed.

Want to know why the average American man earns less today than he did 40 years ago? Want to know how the rich got so filthy rich? Want to know why, as the Financial Times put it yesterday, Hillary is afraid of a “populist contagion”? |

The feds got out the knife in 1971. They changed the money system itself. They severed the link between gold and the dollar – and between value and price. It was so subtle almost no one objected… and so clever almost no one saw what it really meant. It took us more than 40 years to figure it out. - Click to enlarge |

In 1971 the Fed removed the link between value and price

The feds got out the knife in 1971. They changed the money system itself. They severed the link between gold and the dollar – and between value and price. It was so subtle almost no one objected… and so clever almost no one saw what it really meant.

It took us more than 40 years to figure it out. And even now, the dots reveal a pattern, but it is indistinct… hard to see… and easy to misinterpret. Most people see only the symptoms, the boils. the fever, the night sweats – and the daytime delusions:

The masses voting for Brexit or Donald. Interest rates falling to 5,000-year lows. The gap between rich and poor opening wider and wider. What is the cause?

Stay tuned…

Chart by: BarChart

Chart and image captions by PT

The above article originally appeared at the Diary of a Rogue Economist, written for Bonner & Partners. Bill Bonner founded Agora, Inc in 1978. It has since grown into one of the largest independent newsletter publishing companies in the world. He has also written three New York Times bestselling books, Financial Reckoning Day, Empire of Debt and Mobs, Messiahs and Markets.

Full story here

Are you the author?

Bill Bonner founded Agora, Inc in 1978. It has since grown into one of the largest independent newsletter publishing companies in the world. He has also written three New York Times bestselling books, Financial Reckoning Day, Empire of Debt and Mobs, Messiahs and Markets. A man of many talents, his entrepreneurial savvy, unique writings, philanthropic undertakings, and preservationist activities have all been recognized and awarded by some of America's most respected authorities.

Previous post

See more for 8e.) Helicopter Money

Next post

Tags:

central banks,

Deep State,

Helicopter Money,

newslettersent,

On Economy,

On Politics