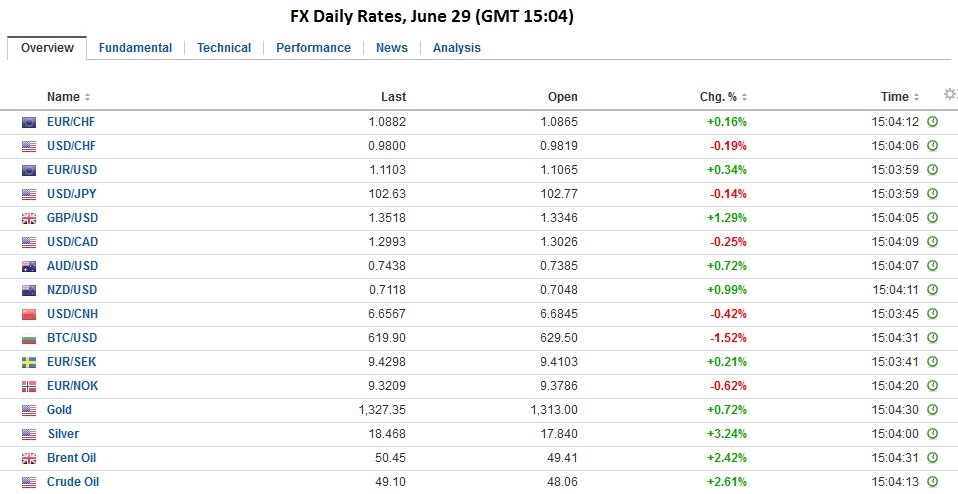

FX RatesNo fundamental development can compare with the UK decision to leave the EU. It has set off a chain reaction whose outcome is still far from clear. Sterling is firm, alongside most of the major and emerging market currencies today. Sterling narrowly edged above yesterday’s highs to reach almost $1.3425 before encountering selling pressure. |

|

| Equity fund managers may find themselves over hedged into quarter-end, may have to buy sterling today or tomorrow. This may provide an opportunity for those who want to re-establish short sterling hedges, reduce sterling exposure, or go outright short. The $1.3480-$1.3550 area may seem a bit far, but it is an interesting technical area. |

UK Prime Minister Cameron attended what will likely be his last EU Summit dinner. Reports made it sound like he blamed the other officials for not making more concessions to the UK especially on free movement. There seemed to be little recognition on Cameron’s part that 1) calling a referendum was a mistake in the first place; 2) that such an important change maybe should not have been decided on a simple majority basis; and 3) that the Remain ran a poor campaign, based on fear, rather than a positive, constructive agenda.

The Tory Party leadership challenge formally opens today as candidates’ names are submitted. The Labour Party is hardly in better shape. Corbyn overwhelmingly lost a vote of confidence among the Labour MPs; This was a foregone conclusion. The poor showing in the local elections that were held in early-May, coupled with the feckless campaign to remain and the alienation of many of Labour’s traditional donors all are strikes against Corbyn.

Corbyn’s support is derived not from the part of Labour that was elected, but the rank and file members who are to the left of the MPs. Corbyn has refused to submit to the demand of the MPs. The next step is for the MPs to formally trigger a leadership contest. It is not clear if there is a rival who can capture a majority of the rank and file.

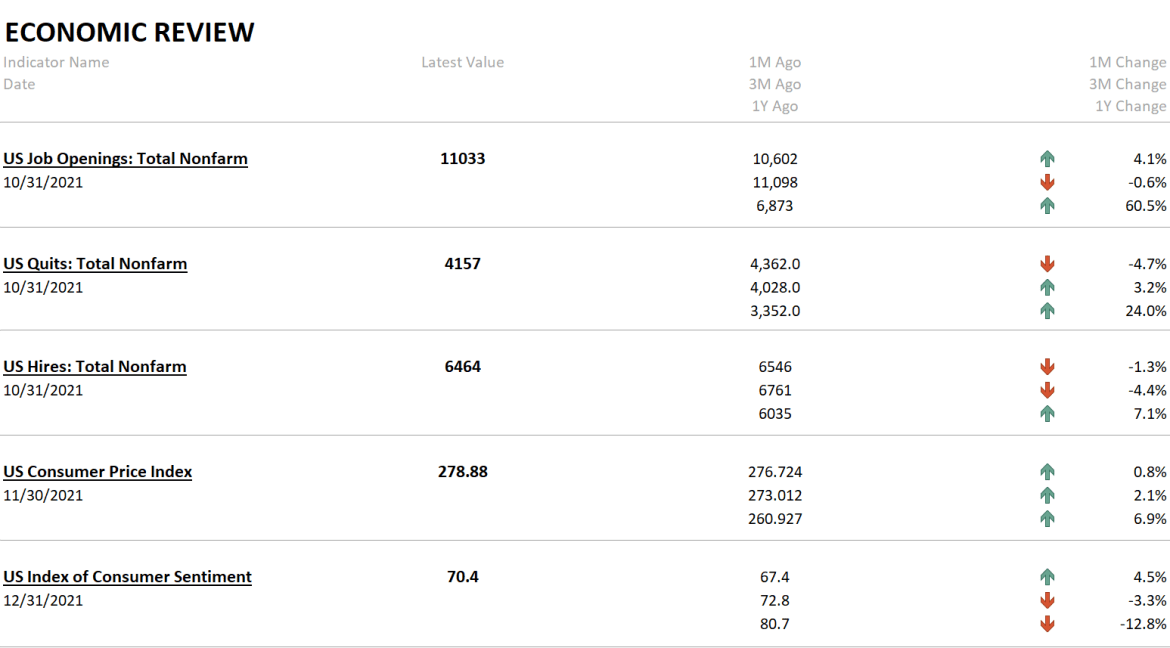

There have been three pieces of macroeconomic news that are not being overshadowed by the price action.

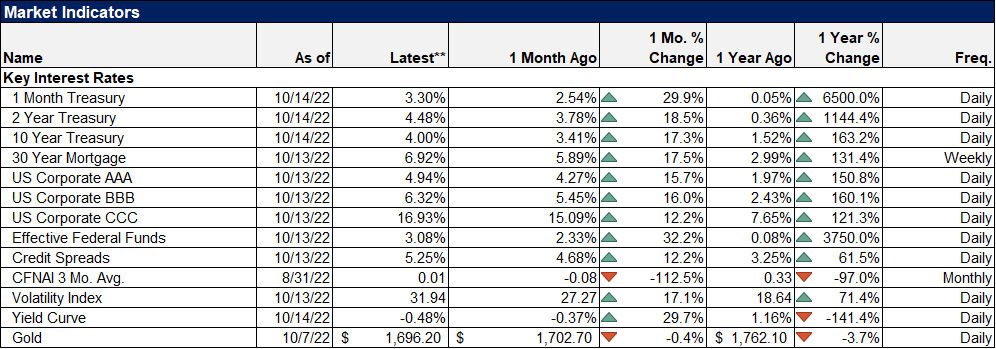

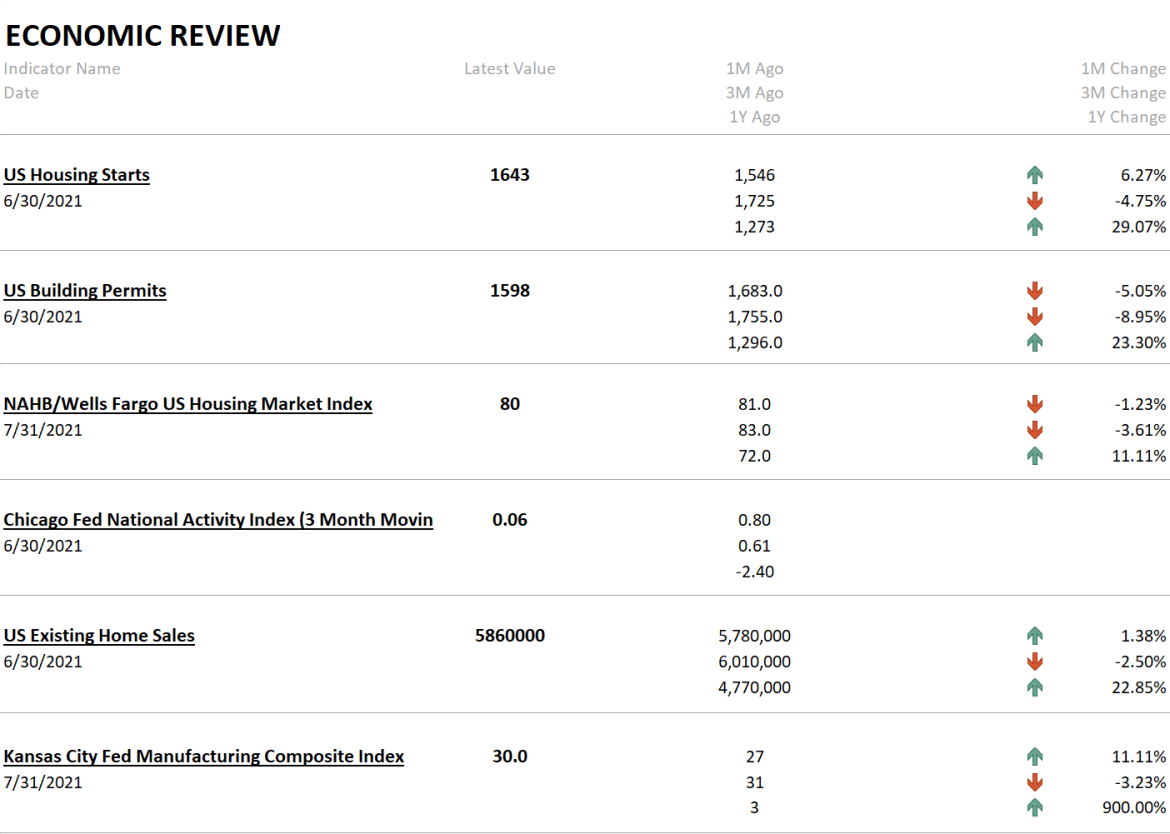

JapanFirst, Japan reported a larger than expected decline in May retail sales. The 1.9% year-over-year decline was more than twice the April decline. The more important gauge of consumption, overall household spending, will be reported later this week. It is expected to have contracted by 1.1% (year-over-year). Overall spending fell every month in 2015 on year-over-year basis but two (May and August). This year it has risen once, in February. Poor economic data, coupled with persistent deflationary pressures, which also are expected to be reported later this week, and the yen’s strength, may push the BOJ into new measures by the end of next month. |

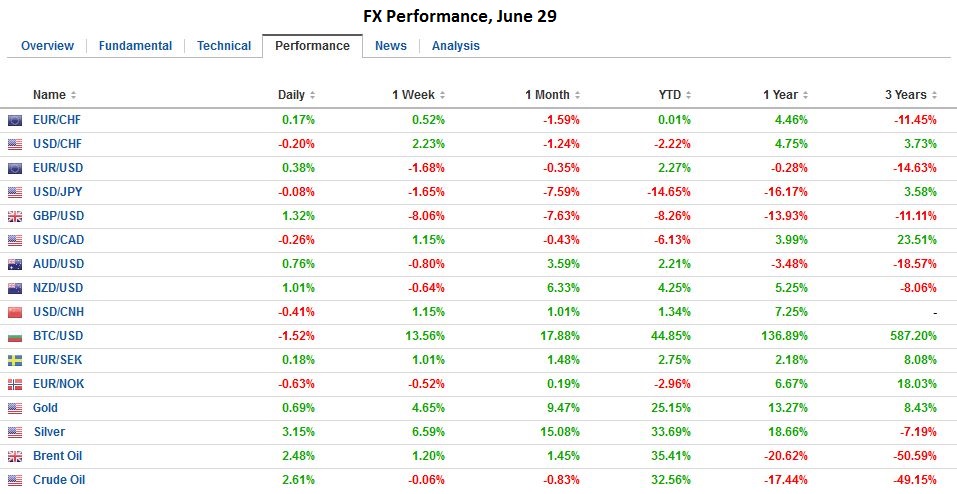

Click to enlarge. Source investing.com |

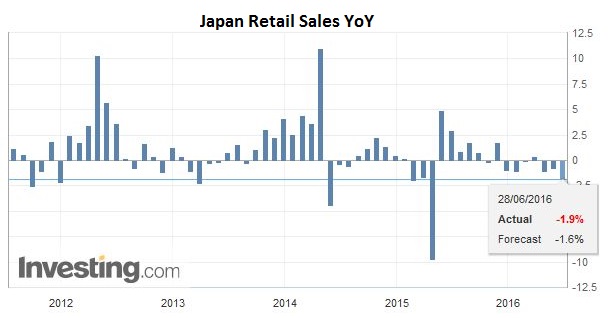

GermanSecond, German states are reporting June CPI figures. The takeaway thus far is that price pressures have ticked up, and the national rate may rise to 0.3% from 0.1%. The main impetus may have come from energy. |

Click to enlarge. Source investing.com |

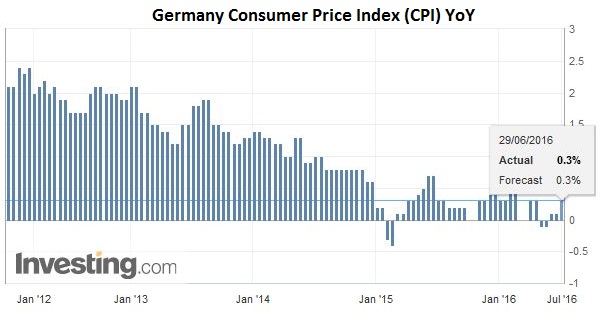

SpainThird, Spain also reported June CPI figures. On the EU harmonized measure, deflationary forces eased slightly. The June CPI stood at minus 0.9% from minus 1.1%. It is the second month that deflationary pressures have eased. Despite the deflation, Spain is among the fastest growing economies in EMU and EU. In particular, contrary to textbook concerns that deflation will encourage households to defer consumption, Spain’s retail sales are buoyant. They rose 2.3% year-over-year in May. The central bank estimates growth in Q2 at 0.7%, a hair below the 0.8% pace seen in the last few quarters. |

Click to enlarge. Source investing.com |

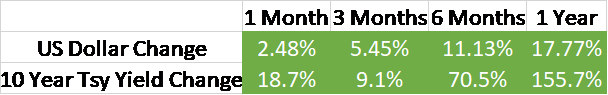

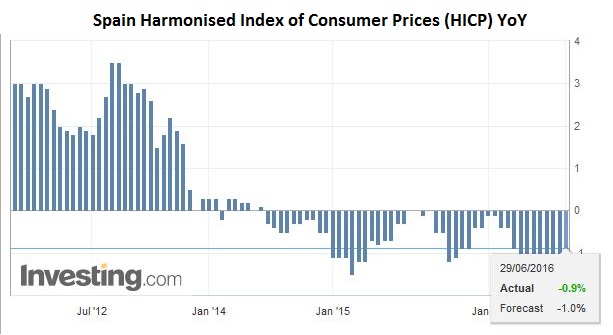

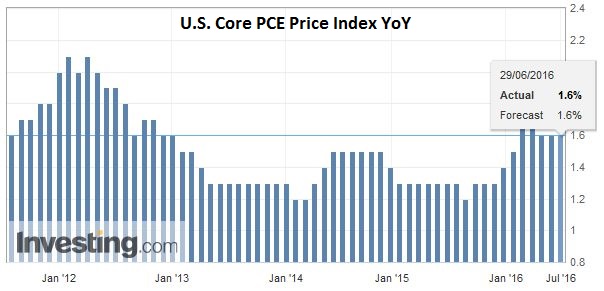

United StatesThe US reports personal income and consumption figures. The importance is that it will help economists fine tune expectations for Q2 GDP. The Atlanta Fed will update its tracker later today but as of the end of last week, it stood at 2.6%. The New York Fed has it at a little above 2%. It will update its model before the weekend. The core PCE deflator is expected to be unchanged at 1.6%. |

Click to enlarge. Source investing.com |

In terms of the price action, the US dollar is softer across the board, global equities are higher, and oil is firmer following the API estimate that there was a 3.86 mln barrel drawdown of US crude stock. Bond yields are lower in Europe and the US. Draghi warned yesterday that Brexit will likely lower eurozone growth by around 0.5% for each of the next three years, and the Fed’s Powell recognized the headwinds from Brexit too.

The euro has approached the $1.1100 area. A move above $1.1110 can give $1.1170. The dollar is nearing JPY102.80. It needs to get above JPY103.20 to give potential toward JPY103.80. The dollar-bloc is firm. The New Zealand dollar and the Australian dollar are leading the majors, with gains of nearly 1% and 0.65% respectively. The Aussie, which we had thought could be a relative outperformer this week, faces immediate resistance near $0.7440, but if this can be surmounted, there is potential toward $0.7475-$0.7520.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: FX Daily,Germany Consumer Price Index,Japan Retail Sales,Japanese yen,Jerome Powell,newslettersent,Spain Consumer Price Index,U.S. Core PCE Price Index (PCE Deflator)