Monthly Archive: March 2016

Labour costs 2014: Labour costs in Switzerland: marked differences according to enterprise size

22.03.2016 09:15 - FSO, Economic Surveys (0353-1601-50) Labour costs 2014 Neuchâtel, 22.03.2016 (FSO) – In 2014, average labour costs in Switzerland amounted to CHF 59.60 per hour worked across the secondary and tertiary sectors. According to the Fe...

Read More »

Read More »

Der weiterentwickelte Hof – ein Drama in vier Reformen

Es war einmal ein Bauer. Willy hiess er. Er hatte einen Hof, 65 Kühe, seine Frau Vreneli, einen anständigen und allseits respektierten Fuhrpark, war glücklich, zufrieden und wohlhabend. Dann kam die Wende auf dem Milchmarkt: Milch kam ausser Mode. Er...

Read More »

Read More »

Silver Gone Wild Report, 20 Mar, 2016

Early on Monday morning (Arizona time), silver began to rise. From its close on Friday of $15.46, it ran up to $15.82. Then it began to slide, eventually dropping to $15.17 by midmorning on Wednesday. Then…

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended the week on a mixed note after posting strong post-FOMC gains. The bounce in risk seems likely to continue this week, with little on the horizon to derail it. Specific country risk remains in play, however, with heightened political concerns in Brazil and South Africa. Taiwan reports February export orders Monday, which are …

Read More »

Read More »

FX Daily: When a Quarter is Two Halves

The year started off poorly, to say the least. Equity markets plunged from the get-go. The Nikkei, DAX and S&P 500 gapped lower on the first trading day of the year. Emerging markets and commodities were smashed. Many economists blamed the Federal Reserve for hiking rates in mid-December. Pundits warned that the seven-year bull … Continue...

Read More »

Read More »

Weekly Speculative Positions: Pile into Sterling and Take Profits on Long Aussie

After a relatively quiet period into the run-up to the ECB, speculative activity markedly increased in the CFTC reporting week ending the day prior to the conclusion of the FOMC meeting. Two speculative gross currency position adjustments stand out. First, speculators appeared to have bought a record amount of sterling contracts. The gross long position more …

Read More »

Read More »

How Venezuela Exported 12.5 Tonnes Of Gold To Switzerland On March 8

Submitted by Ronan Manly of Bullionstar Blogs

Following on from last month in which BullionStar’s Koos Jansen broke the news that Venezuela had sent almost 36 tonnes of its gold reserves to Switzerland at the beginning of the year, “Venezuela Exporte...

Read More »

Read More »

FX Daily, 03/19: Greenback Remains Technically Vulnerable

The US dollar had a difficult week. The price action after the ECB meeting had undermined the technical tone, and the dollar took another leg down after the FOMC moved closer to the market expectation by reducing the number of rate hikes the median official thinks will be appropriate this year from four to two. … Continue...

Read More »

Read More »

Weekly Emerging Markets: What has Changed?

China press is reporting that policymakers are drafting rules for a so-called Tobin tax on yuan transactions. This would seem to go against China’s efforts at making the yuan more accessible and liquid. While it could deter speculative activity, th...

Read More »

Read More »

Thoughts on Conspiracy Theories of the Dollar’s Losses

In our work, we have argued that the dollar is having its third significant rally since the end of Bretton Woods. The first rally was associated with Reagan though it began under Carter and followed 100 bp hike by a new Federal Reserve Chairman...

Read More »

Read More »

FX Daily 03/18: Dollar Trims Losses Ahead of the Weekend

The US dollar is firmer against most major and emerging market currencies to pare this week's decline. There are three notable exceptions, and they are all in Asia. For all practical purposes, the dollar is flat against the Japanese yen near JP...

Read More »

Read More »

FX Daily 03/17: When Doves Cry: Imprudently Cautious

If there was one word Yellen emphasized yesterday it was caution. The dot plot reflected that as well. Can one ask if the Fed is being too cautious? Yellen acknowledged that the Fed's assessment of the US economy had not changed much from December. There is little reason it should. However, it is difficult to … Continue reading...

Read More »

Read More »

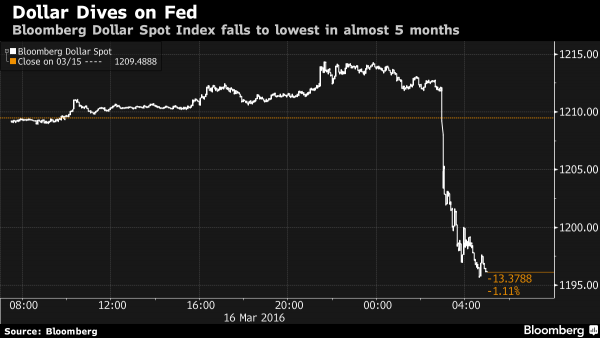

Great Graphic: Dollar Index Retracement, Too Soon To Say Top is In

The cry that the dollar has peaked is gaining ground. We are not convinced. The macro-fundamental case remains intact. Divergence between the US and other high income countries continues, even if at a more gradual pace than the Federal Reserve expected a few months ago. This Great Graphic of the Dollar Index, created on Bloomberg, …

Read More »

Read More »

FX Daily 03/17: Dollar Drop Extends Post-Fed, Stocks, Bonds and Commodities Rally

The Federal Reserve's cautiousness has sent the dollar reeling. The Fed's backtracking to two hikes this year from four is still met with skepticism by the market. It previously had a June hike nearly discounted but has not pushed that out unti...

Read More »

Read More »

Another Fed “Policy Error”? Dollar And Yields Tumble, Stocks Slide, Gold Jumps

Yesterday when summarizing the Fed's action we said that in its latest dovish announcement which has sent the USD to a five month low, the Fed clearly sided with China which desperately wants a weaker dollar to which it is pegged (reflected promptly ...

Read More »

Read More »

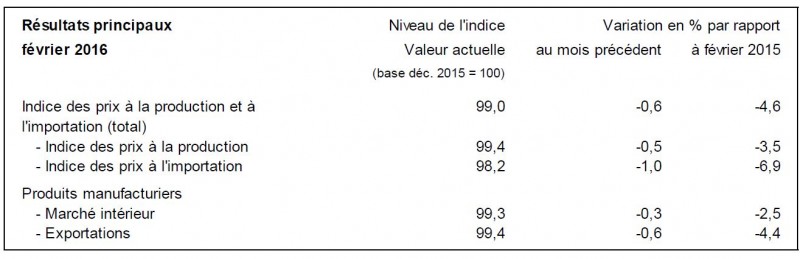

Swiss Producer and Import Prices Index February 2016: 0.6 percent MoM, 4.6 percent YoY

17.03.2016 09:15 - FSO, Prices (0353-1602-50) Producer and Import Price Index in February 2016 Neuchâtel, 17.03.2016 (FSO) – The Producer and Import Price Index fell in February 2016 by 0.6% compared with the previous month, reaching 99.0 points (ba...

Read More »

Read More »

FX Daily 03/16: Fed Pulls Back to Two Hikes, Dollar Drops and Stocks Rally

The Federal Reserve halved the number of rate hikes it anticipates this year from four to two. The market has been moving toward this as well after having thought the would be no hikes this year. The dollar sold off. The dollar-bloc currencies and emerging market currencies are have rallied sharply. Risk assets in general …

Read More »

Read More »

Brexit, Cyprus and the EU Summit

The EU leaders summit on refugees begins tomorrow. A conclusive agreement will likely be elusive. There are three main obstacles. First, the effort to reinforce the external borders to allow free internal movement requires Turkey's cooperation, but it won't be represented. Second, that is important because Cyprus is demanding more concessions by Turkey. Third, others …

Read More »

Read More »

Dollar Firm Ahead of the FOMC, UK Budget Looms

Since the Federal Reserve hiked rates in December, both the European Central Bank and the Bank of Japan have eased policy further. The idea that because they cut rates means that the Fed cannot raise rates is a not a particularly helpful way to ...

Read More »

Read More »

Anticipation of Osborne’s Budget Weighs on Sterling

If UK Chancellor of the Exchequer Osborne wants to position himself to be the next Prime Minister, the budget to be unveiled tomorrow may not be particularly helpful. There is little room to relax fiscal policy, given the self-imposed constraints. The deficit for the current fiscal year was projected to be GBP73.5 bln, but through …

Read More »

Read More »