After a relatively quiet period into the run-up to the ECB, speculative activity markedly increased in the CFTC reporting week ending the day prior to the conclusion of the FOMC meeting.

After a relatively quiet period into the run-up to the ECB, speculative activity markedly increased in the CFTC reporting week ending the day prior to the conclusion of the FOMC meeting.Two speculative gross currency position adjustments stand out. First, speculators appeared to have bought a record amount of sterling contracts. The gross long position more than doubled; increasing 33.5k contracts to 62.9k. Despite the continued recovery of sterling in the spot market, the bears hardly moved. The gross short position slipped 1.9k contracts, leaving 76.5k contracts in speculator hands still short. The net short position of 13.6k contracts is the smallest since last November.

The second notable speculative position adjustment was the profit-taking on long Australian dollar positions. The gross long position was culled by 24.6k contracts, leaving 61.5k. The gross short position was trimmed by 8.2k contracts to 48.8k.

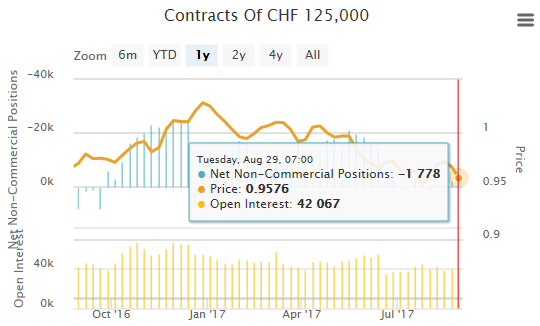

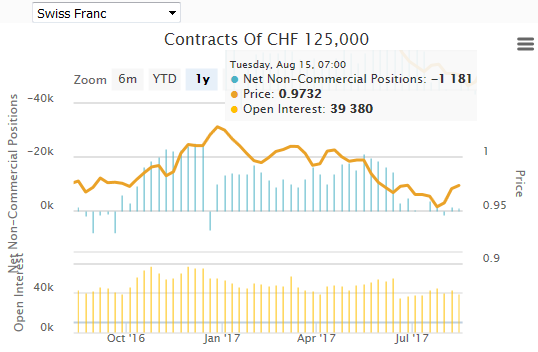

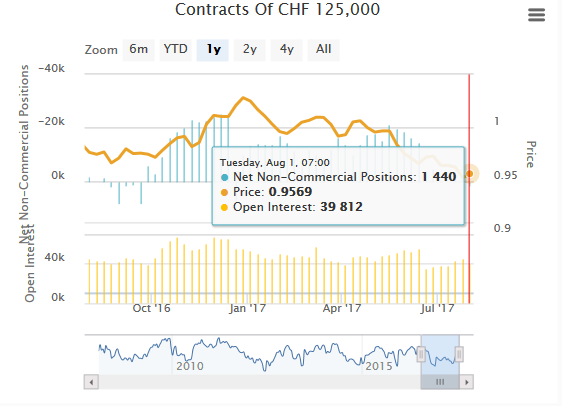

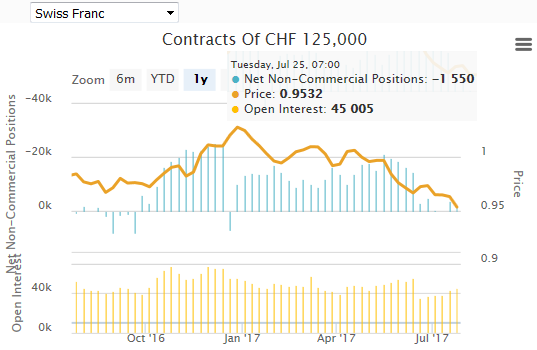

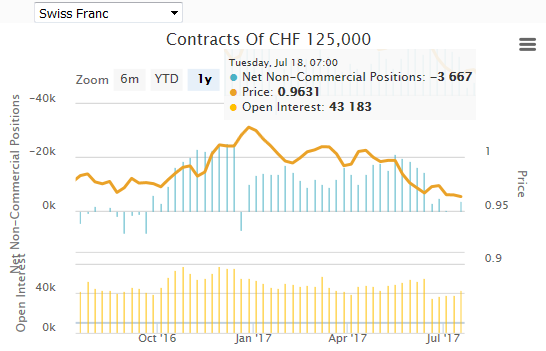

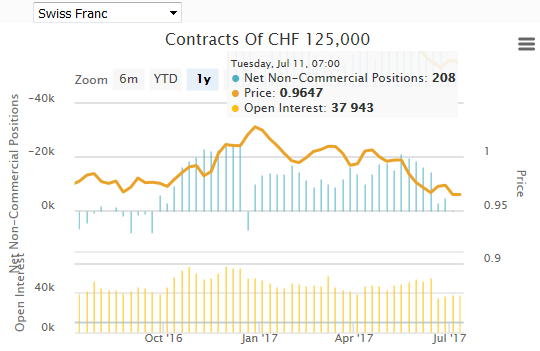

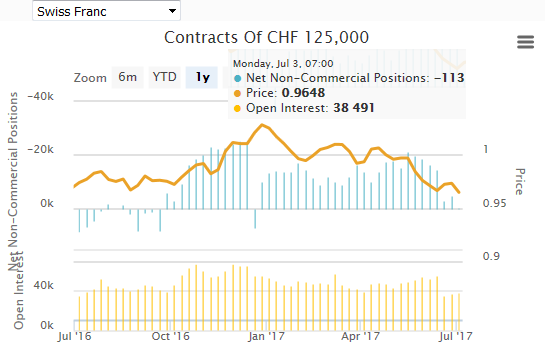

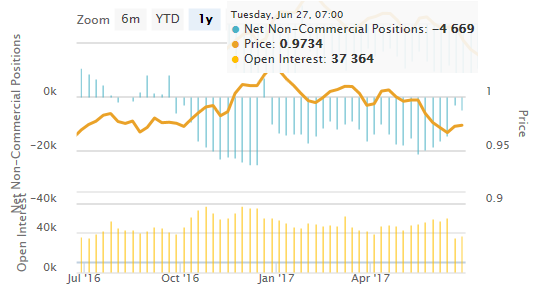

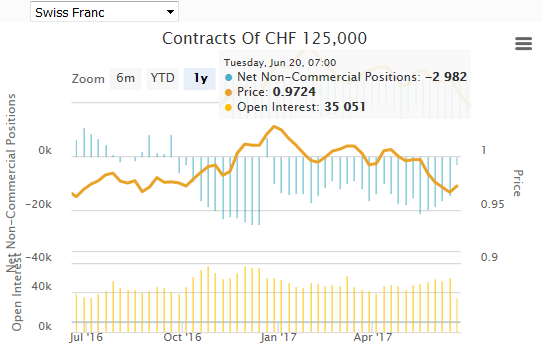

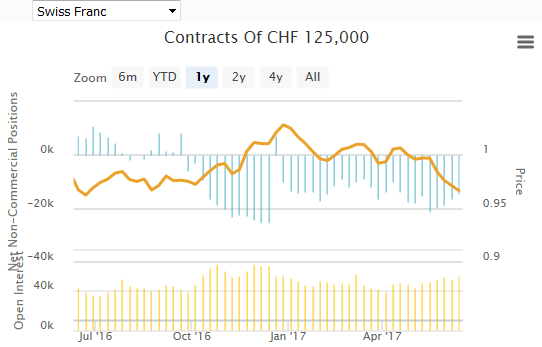

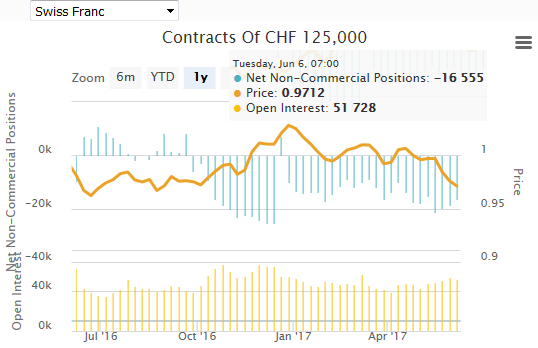

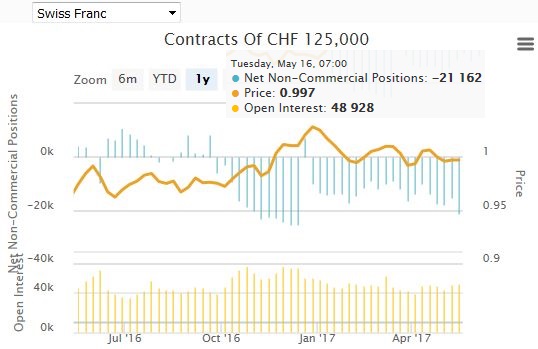

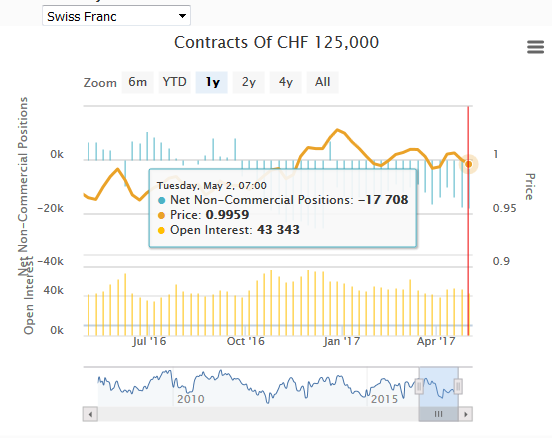

The net speculative Aussie position remained long (12.8k contracts). Relatively minor gross position adjustments in the Swiss franc and New Zealand dollar proved sufficient to shift the net speculative position from short to long. Speculators are now long four of the eight currency futures we track (yen, Swiss franc, Australian and New Zealand dollars).

There were two other gross currency adjustments that we regard as significant, which we define as a change of more than 10k contracts. The gross long euro position fell by about 13.8k contracts to 90.4k. Gross shorts were also reduced. Speculators covered 8.2k contracts, leaving a gross short position of 167.9k contracts.

Speculators cut their gross long yen position by 14.4k contracts to 79.4k. The shorts were not emboldened. They added 4.4k contracts, raising the gross short position to 33.9k contracts.

The doubts about the dollar's outlook was reflected more by speculators reducing short foreign currency exposure. Speculators covered the short position in all the currency futures we track save the Japanese yen. Speculators mostly (five of eight) added to long positions. However, the three that experience long liquidation saw it in size. The three currencies that the speculators reduced long exposure, we have already identified: euro, yen, and the Australian dollar.

Speculators hardly changed their position in the US 10-year Treasury note futures. The longs trimmed their gross long position by 9.4k contracts (to 501.2k). The short covered 6.4k contracts (to 436.1k). These adjustment pushed the net position to 65.1k contracts from 68.1k.

Speculators were emboldened by developments in the oil market. The net long position rose by a little more than 10% to nearly 270k contracts. This was a function of 8.8k more long contracts (to 5444.k) and a 16.8k reduction of short contracts (to 274.6k).

| 15-Mar | Commitment of Traders | |||||

| Net | Prior | Gross Long | Change | Gross Short | Change | |

| Euro | -77.6 | -71.9 | 90.4 | -13.8 | 167.9 | -8.2 |

| Yen | 45.5 | 64.3 | 79.4 | -14.4 | 33.9 | 4.4 |

| Sterling | -13.6 | -49.0 | 62.9 | 33.5 | 76.5 | -1.9 |

| Swiss Franc | 5.3 | -0.1 | 22.6 | 2.9 | 17.4 | -2.5 |

| C$ | -16.8 | -25.8 | 31.6 | 1.0 | 48.4 | -7.9 |

| A$ | 12.8 | 29.2 | 61.5 | -24.6 | 48.8 | -8.2 |

| NZ$ | 1.3 | -2.0 | 20.5 | 0.1 | 19.2 | -3.2 |

| Mexican Peso | -45.0 | -57.6 | 23.0 | 2.6 | 68.1 | -9.9 |

| (CFTC, Bloomberg) Speculative positions in 000's of contracts | ||||||

Tags: Commitments of Traders,Speculative Positions