If UK Chancellor of the Exchequer Osborne wants to position himself to be the next Prime Minister, the budget to be unveiled tomorrow may not be particularly helpful. There is little room to relax fiscal policy, given the self-imposed constraints.

The deficit for the current fiscal year was projected to be GBP73.5 bln, but through January, the deficit has been GBP66.5 bln. This suggests the deficit will be closer to GBP80 bln. The budget deficit was 4.4% of GDP last year, down from 5.5% in 2014 and 10.4% in 2009.

To reach the self-declared goal of a balanced budget in 2019-2020 more revenue will have to be raised. Look for fuel duty and six taxes to be lifted. There is some thought that the insurance premium tax may be raised again, but it would be very controversial and not raise much revenue.

Expenditures will likely be trimmed. Some economists project the need to cut spending by around GBP4 bln. National Health Services will likely be exempt, but ultimately, the spending cuts will likely translate to cuts in public-sector employment.

The budget presentation will be Osborne's last major statement to Parliament ahead of the June referendum. In the Autumn Statement in November, Osborne was upbeat. The stronger growth and lower interest rates generated a GBP27 bln windfall that he quickly used to cancel unpopular welfare cuts. Yields are lower now, but growth is slowing, and a funding gap has emerged.

This is the first fully year budget since the Tories secured a parliamentary majority. Last year's post-election budget was for a partial year. Typically, it may make political sense to take the pain of unpopular measures early in the tenure of a government so that by the time it has to go back to the polls, it can be more voter-friendly. The referendum that the Tory government sponsored makes political calculations more difficult.

If the government loses the referendum and the majority of voter favor leaving the EU, there would have to be elections. Such a result is tantamount to a public vote of no-confidence. Under such a scenario, the current London Mayor Johnson is expected to challenge Osborne in a leadership challenge.

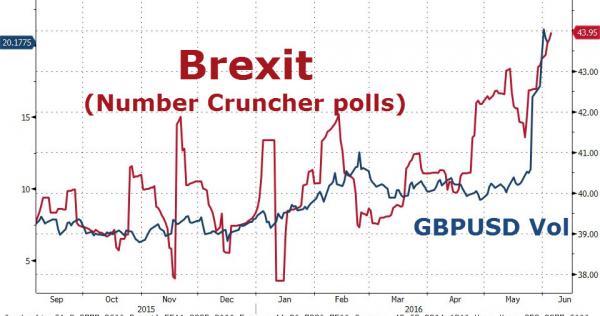

Sterling peaked in July 2014 near $1.72. By March 2015, it had fallen to near $1.45. It recovered in Q2 15 to almost $1.60. It has been trending lower since, first as the market pushed out expectations for the BOE's first rate hike and then on Brexit fears. The risk that the UK would leave the EU saw sterling tumble to near $1.3825 at the end of February. A short-covering bounce saw it peak above $1.4430 at the end of last week. This counter-trend advance was about the same magnitude as the move from mid-January through early February.

In the past two sessions, sterling has retraced 50% of its corrective upticks (at ~$1.4140), which also corresponds to the 20-day moving average (~$1.4155). A break of $1.4120, last week's lows, signal a move toward the $1.4000-$1.4050 area.

Tags: United Kingdom