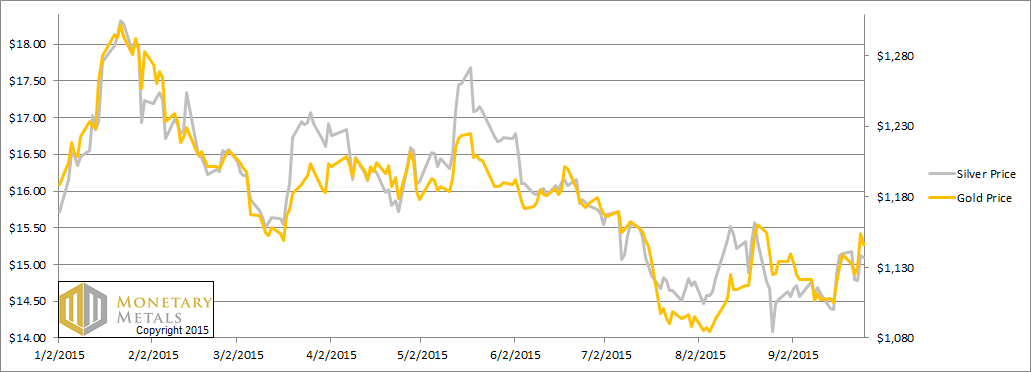

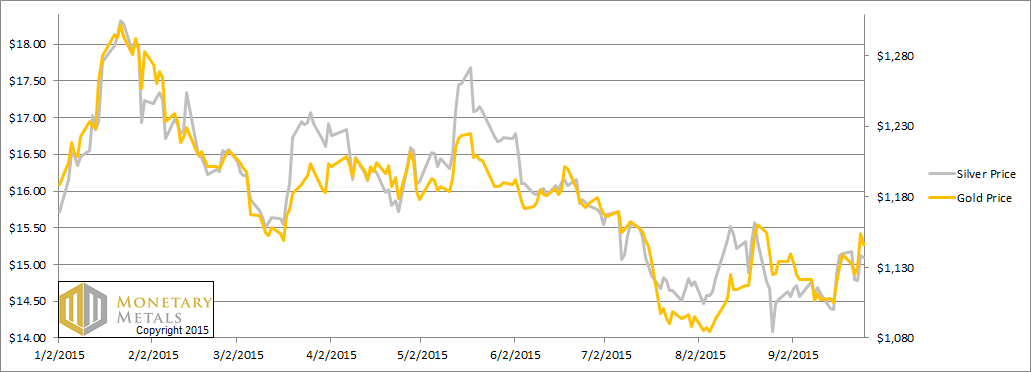

The price of gold moved up moderately, and the price of silver moved down a few cents this week. However, there were some interesting fireworks in the middle of the week. Tuesday, the prices dropped and Thursday the prices of the metals popped $23 and $0.34 respectively.

Everyone can judge the sentiment prevailing in gold and silver articles for themselves, but we think there is a growing feeling of optimism (that is a renewed fall in the dollar, which most think is a rise in gold). This goes along with a sense that the long bull run in the stock market is rolling over.

We are inclined to agree that the stock market may be overdue for its appointment with gravity. This is not a good business climate, and we sure don’t see where earnings growth could come from. At the same time, we see lots of forces that could cause margin compression, not to mention rising default risk in many disparate places (e.g. shale oil bonds). We are not stock market prognosticators, so treat this is nothing more than a feeling.

Gold market participants may be expecting the price of gold to move up if the stock market moves down. This would be a continuation of the pattern of the last several years, with the prices moving opposite to each other. We are inclined to agree with this. That said, to shamelessly borrow a phrase from the London Underground (we’re currently visiting London), please mind the gap between the theory and the data.

For an updated picture of the only true supply and demand data read on…

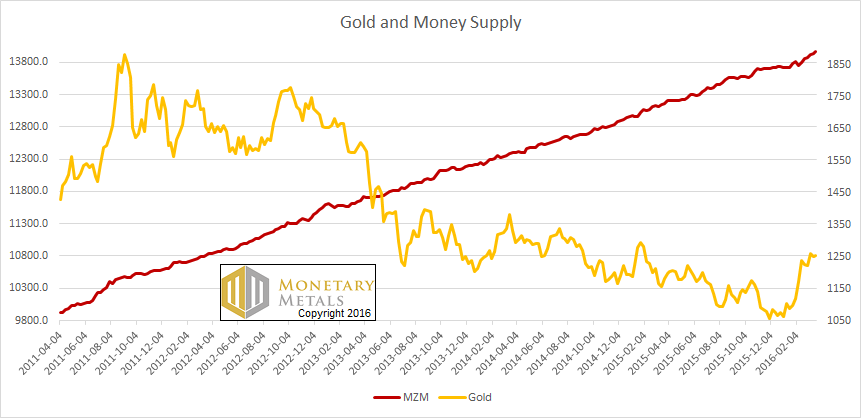

First, here is the graph of the metals’ prices.

The Prices of Gold and Silver

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production (stocks to flows) can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price, and under the right conditions. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

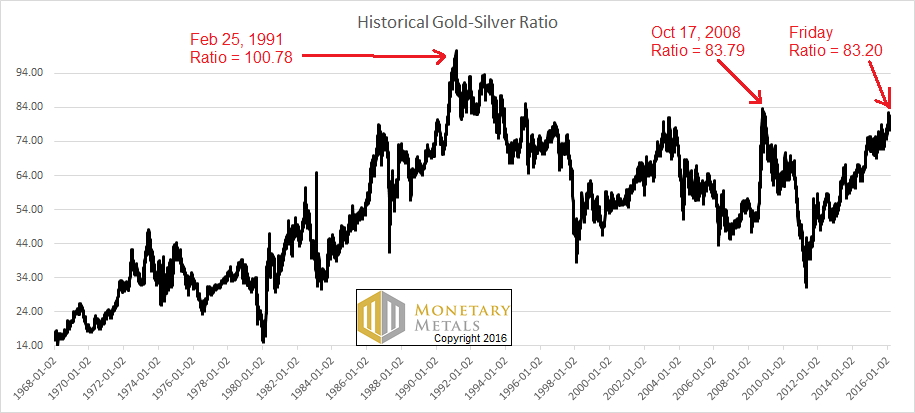

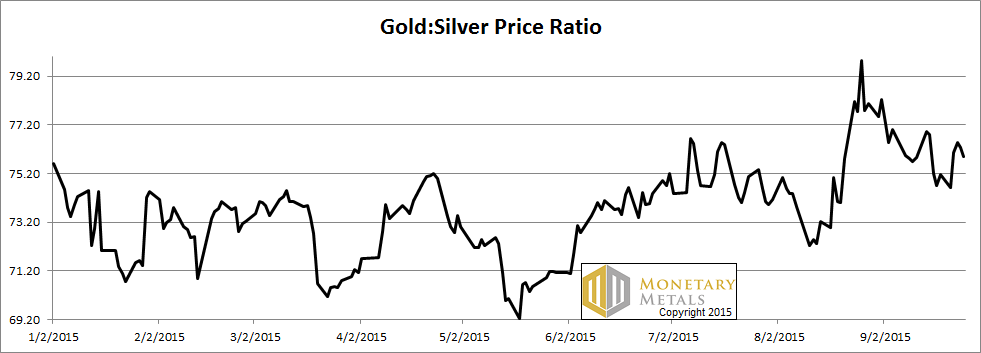

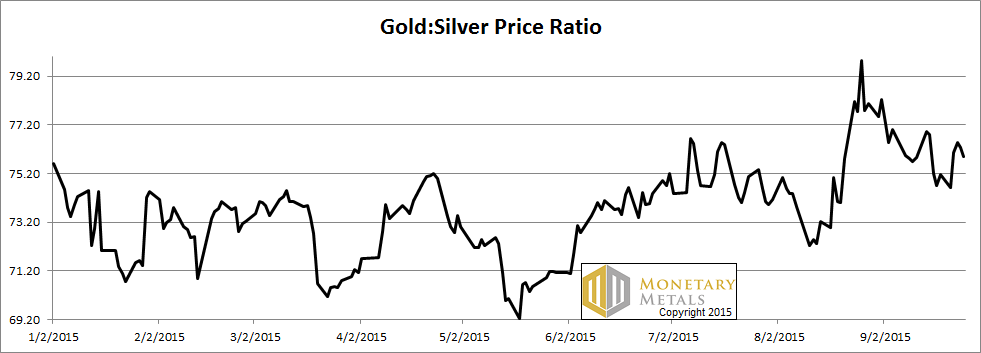

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio moved up a little this week.

The Ratio of the Gold Price to the Silver Price

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production (stocks to flows) can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price, and under the right conditions. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio moved up a little this week.

The Ratio of the Gold Price to the Silver Price

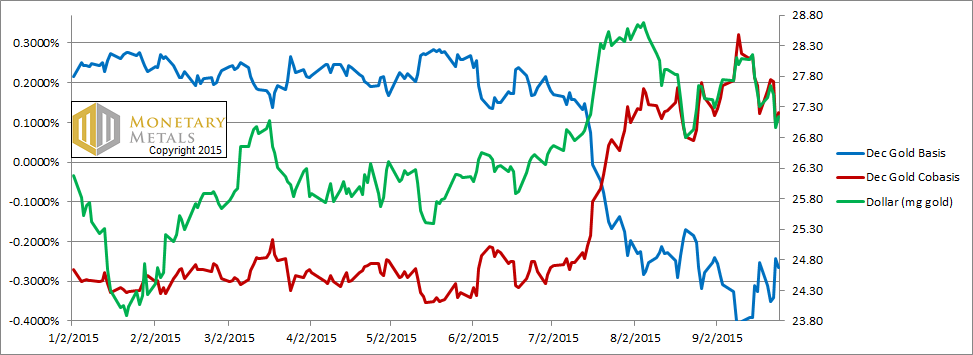

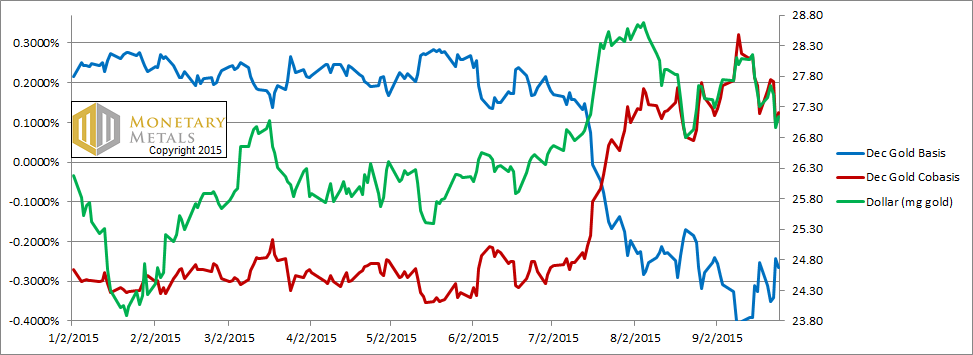

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

We switched to the December contract, as the October contract is nearing the end of its life.

Look at that incredible correlation between the price of the dollar (inverse of the commonly accepted price of gold) and the gold cobasis (i.e. scarcity indicator)! Since mid to late august, they have been tracking almost perfectly.

What does this mean? It means as the dollar drops (i.e. the gold price rises) gold becomes less scarce. As the dollar rises, gold becomes scarcer. For now—we emphasize this is not a permanent feature of the gold market!—the gold market is moving like any commodity market. A lower price encourages buying and discourages selling. A higher price is the opposite.

During this period, our calculated fundamental price has inched its way up an additional $45. It’s now more than $130 above the market price. The market price increased only about $10.

This does fit the narrative expecting stocks to move down, and the price of gold up. However, let’s look at silver.

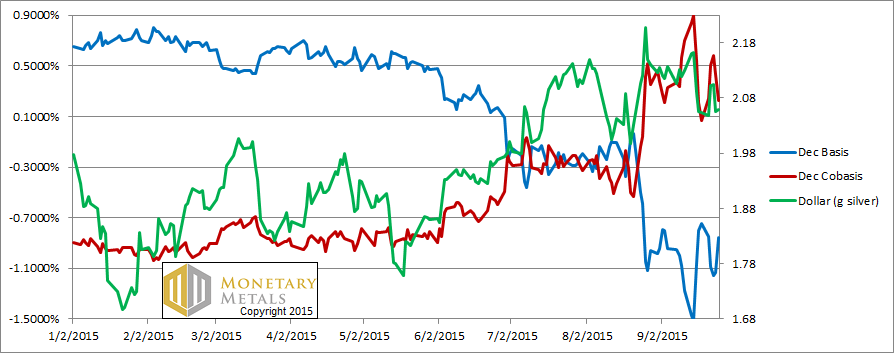

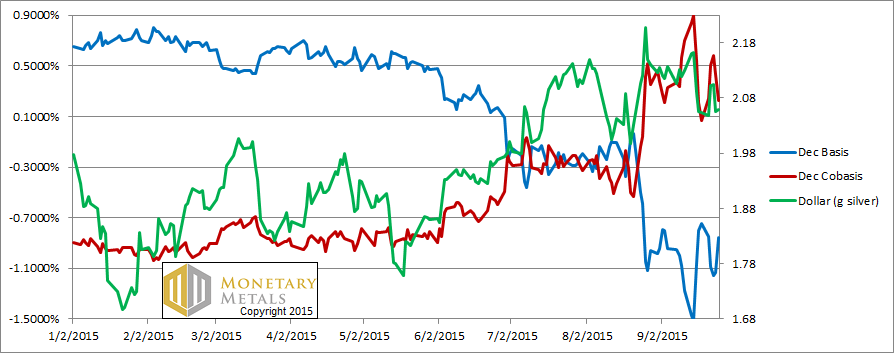

The Silver Basis and Cobasis and the Dollar Price

We switched to the December contract, as the October contract is nearing the end of its life.

Look at that incredible correlation between the price of the dollar (inverse of the commonly accepted price of gold) and the gold cobasis (i.e. scarcity indicator)! Since mid to late august, they have been tracking almost perfectly.

What does this mean? It means as the dollar drops (i.e. the gold price rises) gold becomes less scarce. As the dollar rises, gold becomes scarcer. For now—we emphasize this is not a permanent feature of the gold market!—the gold market is moving like any commodity market. A lower price encourages buying and discourages selling. A higher price is the opposite.

During this period, our calculated fundamental price has inched its way up an additional $45. It’s now more than $130 above the market price. The market price increased only about $10.

This does fit the narrative expecting stocks to move down, and the price of gold up. However, let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

Silver also shows the same basic pattern. The price of the dollar (measured in silver this time) moves with the scarcity of silver, thought the correlation isn’t quite as neat. The cobasis had moved way up and now has reverted.

In the same period since August, both the market and fundamental prices of silver have moved sideways. The market price is down about twenty cents, and the fundamental is up about a dime.

The market price and the fundamental price are now basically the same. Unlike gold, which is offered on sale at a big discount, silver is fairly valued.

This does not mean that the demand for silver metal couldn’t rise and its fundamentals couldn’t get stronger. Of course, we will keep monitoring for any such change.

However, it does contradict part of the stocks down and metals up theme. When the price of gold moves up, traders expect the price of silver to move up even more. As we continue to warn, that may not be the case this time. The ratio of gold to silver is currently about 76. We calculate a fundamental ratio of about 84.5.

Monetary Metals is sponsoring a seminar in central London this Friday (October 2), to discuss economics and markets, with a focus on how to approach saving, investing, and speculating. Please register here.

© 2015 Monetary Metals

Silver also shows the same basic pattern. The price of the dollar (measured in silver this time) moves with the scarcity of silver, thought the correlation isn’t quite as neat. The cobasis had moved way up and now has reverted.

In the same period since August, both the market and fundamental prices of silver have moved sideways. The market price is down about twenty cents, and the fundamental is up about a dime.

The market price and the fundamental price are now basically the same. Unlike gold, which is offered on sale at a big discount, silver is fairly valued.

This does not mean that the demand for silver metal couldn’t rise and its fundamentals couldn’t get stronger. Of course, we will keep monitoring for any such change.

However, it does contradict part of the stocks down and metals up theme. When the price of gold moves up, traders expect the price of silver to move up even more. As we continue to warn, that may not be the case this time. The ratio of gold to silver is currently about 76. We calculate a fundamental ratio of about 84.5.

Monetary Metals is sponsoring a seminar in central London this Friday (October 2), to discuss economics and markets, with a focus on how to approach saving, investing, and speculating. Please register here.

© 2015 Monetary Metals

Full story here

Are you the author?

Previous post

See more for

Next post

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production (stocks to flows) can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price, and under the right conditions. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio moved up a little this week.

The Ratio of the Gold Price to the Silver Price

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production (stocks to flows) can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price, and under the right conditions. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio moved up a little this week.

The Ratio of the Gold Price to the Silver Price

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

We switched to the December contract, as the October contract is nearing the end of its life.

Look at that incredible correlation between the price of the dollar (inverse of the commonly accepted price of gold) and the gold cobasis (i.e. scarcity indicator)! Since mid to late august, they have been tracking almost perfectly.

What does this mean? It means as the dollar drops (i.e. the gold price rises) gold becomes less scarce. As the dollar rises, gold becomes scarcer. For now—we emphasize this is not a permanent feature of the gold market!—the gold market is moving like any commodity market. A lower price encourages buying and discourages selling. A higher price is the opposite.

During this period, our calculated fundamental price has inched its way up an additional $45. It’s now more than $130 above the market price. The market price increased only about $10.

This does fit the narrative expecting stocks to move down, and the price of gold up. However, let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

We switched to the December contract, as the October contract is nearing the end of its life.

Look at that incredible correlation between the price of the dollar (inverse of the commonly accepted price of gold) and the gold cobasis (i.e. scarcity indicator)! Since mid to late august, they have been tracking almost perfectly.

What does this mean? It means as the dollar drops (i.e. the gold price rises) gold becomes less scarce. As the dollar rises, gold becomes scarcer. For now—we emphasize this is not a permanent feature of the gold market!—the gold market is moving like any commodity market. A lower price encourages buying and discourages selling. A higher price is the opposite.

During this period, our calculated fundamental price has inched its way up an additional $45. It’s now more than $130 above the market price. The market price increased only about $10.

This does fit the narrative expecting stocks to move down, and the price of gold up. However, let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

Silver also shows the same basic pattern. The price of the dollar (measured in silver this time) moves with the scarcity of silver, thought the correlation isn’t quite as neat. The cobasis had moved way up and now has reverted.

In the same period since August, both the market and fundamental prices of silver have moved sideways. The market price is down about twenty cents, and the fundamental is up about a dime.

The market price and the fundamental price are now basically the same. Unlike gold, which is offered on sale at a big discount, silver is fairly valued.

This does not mean that the demand for silver metal couldn’t rise and its fundamentals couldn’t get stronger. Of course, we will keep monitoring for any such change.

However, it does contradict part of the stocks down and metals up theme. When the price of gold moves up, traders expect the price of silver to move up even more. As we continue to warn, that may not be the case this time. The ratio of gold to silver is currently about 76. We calculate a fundamental ratio of about 84.5.

Monetary Metals is sponsoring a seminar in central London this Friday (October 2), to discuss economics and markets, with a focus on how to approach saving, investing, and speculating. Please register here.

© 2015 Monetary Metals

Silver also shows the same basic pattern. The price of the dollar (measured in silver this time) moves with the scarcity of silver, thought the correlation isn’t quite as neat. The cobasis had moved way up and now has reverted.

In the same period since August, both the market and fundamental prices of silver have moved sideways. The market price is down about twenty cents, and the fundamental is up about a dime.

The market price and the fundamental price are now basically the same. Unlike gold, which is offered on sale at a big discount, silver is fairly valued.

This does not mean that the demand for silver metal couldn’t rise and its fundamentals couldn’t get stronger. Of course, we will keep monitoring for any such change.

However, it does contradict part of the stocks down and metals up theme. When the price of gold moves up, traders expect the price of silver to move up even more. As we continue to warn, that may not be the case this time. The ratio of gold to silver is currently about 76. We calculate a fundamental ratio of about 84.5.

Monetary Metals is sponsoring a seminar in central London this Friday (October 2), to discuss economics and markets, with a focus on how to approach saving, investing, and speculating. Please register here.

© 2015 Monetary Metals

Tags: Gold-Cobasis