Submitted by Marc Chandler, Global Head of Currency Strategy, Brown Brothers Harriman

The main tension in the foreign exchange market is between positions adjusting pressures, which are US dollar negative, and widely held ideas that the trajectory of growth and interest rate differentials favor the US, which is dollar positive.

The main tension in the foreign exchange market is between positions adjusting pressures, which are US dollar negative, and widely held ideas that the trajectory of growth and interest rate differentials favor the US, which is dollar positive.

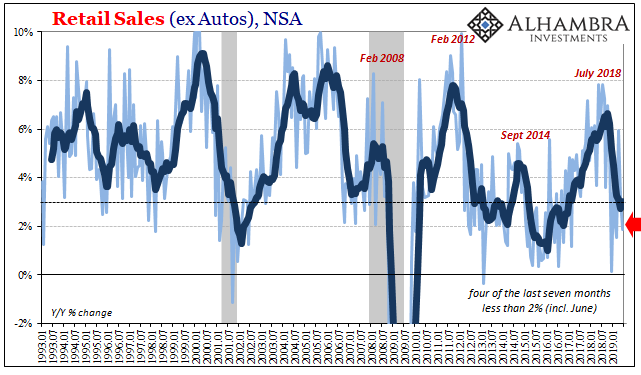

There are some important economic data due out in the coming days, including Japan and euro area Q2 GDP, UK inflation and labor market update, US retail sales, inflation, and industrial output and the first regional surveys for August. However, the data are unlikely to change the base line scenario and, with summer holidays in the US and Europe, corrective forces are likely to continue to dominate the foreign exchange market.

At the same time, we recognize that the marginal change to the general narrative has not been in the US, but the reflation story in Europe and China. There have been several months of improving PMI data in the former and the composite reading is back above the 50 boom/bust level. Rising exports and industrial production in China lend support to the official PMI readings, showing the world’s second largest economy is stabilizing, strengthening confidence in the soft landing scenario.

We also have recognized four channels of capital flows that have worked in favor of Europe. First, there has been a reduction of speculative long dollar positions, as reflected in the futures market, which is understood as a proxy for the momentum and trend follower market segment. Second, US money market funds have reportedly increased their exposure to European bank paper. Third, survey and anecdotal reports suggest international fund managers have shifted some funds to European bonds and stocks from the US and Japan, the outperformers in the first part of the year. Fourth, recent cross border acquisition activity also appears to mean net direct investment inflows into Europe.

The dollar’s technical tone remains fragile. After declining most of July, the Dollar Index began August on a firm note, but the disappointing jobs data helped spur the last leg lower. To stabilize the tone, at the bare minimum, the Dollar Index needs to break the downtrend line draw off the July 9 high (~84.75) and the August 2 high (~82.50). It comes in near 81.75 on Monday and falls toward 81.20 by the end of the week.

The June lows were set near 80.50. We think there is a reasonable chance the Dollar Index bottoms around there. That said, it may not be simply about price, but also time.

September will be a key month, a window for Fed tapering, the German (and Australian and Norwegian ) elections, and Japan’s Abe set to decide about the retail sales tax. The position adjustment this month will create opportunities to position for these macro-developments. Volatility is falling and this often happens before large spot moves (think of a spring coiling). The danger in such a scenario is getting in too early and being chopped up awaiting the events.

The euro bounced a cent in response to the US employment report and another cent last week to stop just shy of the June high near $1.3420. We have suggested that the break out from a possible diamond pattern projects into the $1.3460-$1.35 area. At the same time, a mild correction to the post-jobs report rally can see the euro ease back into the $1.3270-$1.3300 area.

While the euro rallied two cents in the past two weeks, sterling has gained nearly a nickel, helped of course, by a powerful short squeeze, fueled by forward guidance regime that embraced the recent data as evidence that a recovery is underway. While low rates will be maintained (until the economy improves to an extent that it does not forecast likely for three more years), additional action is unlikely. Moreover, the conditions for maintaining low interest rates were such as to seem to diminish its commitment.

Sterling stalled in front of $1.56. It flirted with the downtrend line draw off the early January high and the mid-June high, but has not closed above it. It comes in near $1.5550 (coinciding with the 200-day moving average is $1.5535) on Monday and drops about 5 ticks a day. Given the magnitude of the advance, sterling can slip a little below $1.5400 without signaling an important top is in place.

The dollar has ground lower against the yen and traded below JPY96.0 for the first time since mid-June. While there is not compelling evidence that a low is in place, we think there is a reasonable chance that the greenback will begin stabilizing after falling about 4% last pre-jobs data high. A move above JPY97.00 lends credence to this somewhat more constructive view.

The Australian dollar was the best performing currency against the dollar last week, gaining about 3.25%, despite the central bank delivering a 25 bp rate cut and another poor employment report. The better Chinese data, especially metal imports and industrial production, provided additional fuel for the short squeeze. The strong close before the weekend, above the recent downtrend line, suggests additional gains in the coming days. We initially see scope for a test on the Q3 highs in the $09300-20 area.

A long Australian dollar-short yen tactical position expresses our views. The charts initial potential toward JPY90.00-50 and possibly as high as JPY92.00 during over the next several weeks.

The Canadian dollar, like the Australian dollar, shrugged off poor news and finished the at the highs for the week. The speculative short Canadian dollar positions were not nearly as extended as the Aussie and may help explain the more muted bounce. Initial support is seen near last month’s lows in the CAD1.0250 area. A convincing break could spur another half to full cent decline to test the base built in the first half of June.

Although some observers will try to link the Canadian dollar’s advance to the rally in oil prices, we remain skeptical. The 60-day rolling correlation is near six month lows. The 30-day correlation is negative for the first time since last December, which itself was the first time since March 2011.

The Mexican peso’s correlation with oil prices is also weak. On a 60-day basis, the correlation is near 2-year lows (below 0.1) and the 30-day correlation is inverse. The dollar made new 2-week lows against the peso before the weekend, but unlike the Aussie and Canadian dollars did not finish with strong momentum. Soft Mexican inflation and industrial output data may encourage those who see the chances of a rate cut in Q4, and with the risk of tapering in the US, the trajectory of monetary policy may diverge. The MXN12.50-MXN12.70 looks likely to contain most of the price action in the coming sessions.

Observations on the speculative positioning in the CME currency futures:

1. The overall changes in positioning were minor in the latest Commitment of Traders report for week ending August 6. There were no gross adjustments larger than 10k contracts and only 3 above 5k contracts (euro longs and shorts and peso shorts).

2. Even with the small moves, a clear pattern emerged: adding to gross currency longs (with the exception of the Australian dollar) and mostly covering shorts (with the exception of the Canadian and Australian dollar). This translates into an overall reduction of long dollar exposure.

3. For the first time since late June, the net euro position swung to the long side. It is interesting to see what has happened in recent weeks. Counter-intuitively, new longs have come in more than short have been covered and by more than a 2:1 ratio at that. Since the July low, the gross longs have grown 33k contracts, while the shorts have been reduced by 14k contracts.

4. Significant spot moves have taken place that are not captured in this data. We suspect the market is not quite as short the Australian dollar as this report suggests, and new longs were probably enticed. A 1.6% rise in the yen likely reflected some short covering Sterling too launched an impressive rally after first falling to $1.51 in response to the BOE’s quarterly inflation report.

| week ending Aug 6 |

Commitment of Traders |

|

|

(spec position in 000’s of contracts) |

|

|

Net |

Prior |

Gross Long |

Change |

Gross Short |

Change |

| Euro |

6.1 |

-8.5 |

85.2 |

7.0 |

79.2 |

-7.5 |

| Yen |

-80.2 |

-82.1 |

19.4 |

1.2 |

99.6 |

-0.7 |

| Sterling |

-46.0 |

-49.5 |

22.1 |

1.9 |

68.1 |

-1.5 |

| Swiss Franc |

-0.3 |

-1.3 |

8.8 |

-0.8 |

9.1 |

-1.7 |

| C$ |

-10.4 |

-11.4 |

-22.6 |

1.9 |

33.1 |

0.9 |

| A$ |

-76.8 |

-72.6 |

16.6 |

-3.0 |

93.3 |

1.2 |

| Mexican Peso |

32.1 |

24.9 |

62.2 |

1.2 |

30.1 |

-6.1 |

Are you the author?

George Dorgan (penname) predicted the end of the EUR/CHF peg at the CFA Society and at many occasions on SeekingAlpha.com and on this blog. Several Swiss and international financial advisors support the site. These firms aim to deliver independent advice from the often misleading mainstream of banks and asset managers.

George is FinTech entrepreneur, financial author and alternative economist. He speak seven languages fluently.

Previous post

See more for 4) FX Trends

Next post

Tags:

Canadian Dollar,

Commitments of Traders,

COT,

Currency Positioning,

FX Positioning,

Japanese yen,

Marc Chandler,

money-market funds,

MXP,

Net Position,

Peso,

Speculative Positions,

U.S. Retail Sales

The main tension in the foreign exchange market is between positions adjusting pressures, which are US dollar negative, and widely held ideas that the trajectory of growth and interest rate differentials favor the US, which is dollar positive.

The main tension in the foreign exchange market is between positions adjusting pressures, which are US dollar negative, and widely held ideas that the trajectory of growth and interest rate differentials favor the US, which is dollar positive.