We show that Target2 imbalances and the SNB currency reserves represent the same issues, namely current account surpluses/deficits and capital flight. Therefore it makes sense to compare them, in total and by inhabitant.

In a recent post we explained that currency reserves represent the cumulated balance of payment surpluses over the years, in particularly the cumulated account surpluses and the cumulated capital account surplus.

Similarly, the Target 2 (im-) balances reflect these two aspects, namely:

- Current account surpluses and deficits – vigorously defended by Hans Werner Sinn and many German economists. They claim that the current account imbalances need to be reduced, so that the periphery no longer lives “on the costs of Germany”.

- Change in capital account or the “capital flight” – fiercefully defended by Paul de Grauwe, Willem Buiter and Karl Whelan, et. al. They insist that the weak countries must continue consumption and generate growth. With growth the capital flight and consequently the Target2 imbalances will be reduced.

These two fractions fought big battles in the financial and academic press, and wrote long and complicated articles, in our eyes this was purely academic. Maybe they should have simply said that “we are the Current Accountist” and the second ones “we are the Capital Flightests“. And that they want to start reducing the (im)balances of payments reflected in Target2, either with a reduction of current account imbalances or with a growth and therefore a smaller capital flight.

The current solution to the euro zone crisis is the first, the German solution or the Merkel compromise, namely that the weak countries need to implement austerity and increase competitiveness so that they can reduce their current account deficit. This has been successful so far: Italy even has a current account surplus, Spain and Greece reduced their deficit. And, oh wonder, the capital flight and target2 imbalances were reduced and money came back to the periphery. Still Buiter, De Grauwe and Whelan will claim that austerity will trigger lower growth over many years and weaken the countries’ finances over the long-term.

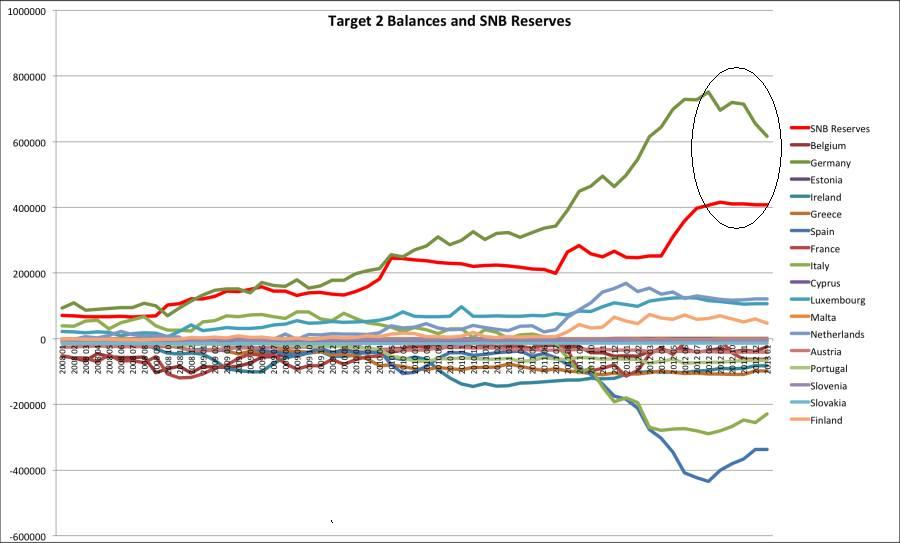

In the following graphs we want to now present the link between the reserves of the Swiss National Bank (SNB) and the Target2 (im)balances, which, as we have learned now, are essentially the same.

The Swiss occupy the second position with 400 billion € reserves, whereas Germany has a Target2 surplus of 616 billion € inside the so-called “euro system”. Greece, Spain or Ireland have deeply negative Target2 balances, which means that their central bank would have deeply negative equity and their country would be probably bankrupt, if there was not the euro system to keep them together.

For the SNB, however, and this is strange, the reduction of Target2 balances did not imply a reduction of currency reserves: the German Target2 balance is smaller by nearly 150 bln. €, especially with recent LTRO repayments, while SNB reserves have fallen just by 3 bln. since their highs. The capital flight from the periphery to Germany was reversed, but the capital flight into Switzerland remained nearly stable. The reduction of the Swiss capital account managed to counter the Swiss current account surplus.

(click to expand), Target2 in Mil. € vs. SNB reserves since 2009 (data sources University Osnabrück and SNB IMF data), Finnish, Swiss, German and Italian numbers as of January 2013, most others as of December 2012.

Apart from the recent LTRO repayments, the gap between the latest Target2 balances and SNB reserves, has to do with a capital movements of “positive animal spirits” that want higher investment yields, e.g. asset prices in Switzerland and Germany are rising, but falling in the periphery, and “negative animal spirits” that just want to preserve their money against a euro zone collapse.

The capital flight in the negative sense was possibly only the top of the Target2 iceberg, maybe 150 bln. €, that recently returned to the periphery and some more upcoming LTRO repayments, given that the tail risks of a euro zone break down has been eliminated for now. … while maybe 400-500 bln. € prefer to be invested in Germany in expectance of higher returns and longer-term safety.

This is the third category beyond “current accountists” and “capital flightiest”, namely capital movement for higher yields connected with some safety considerations. An example is a Spanish portfolio manager that prefers to be invested in Germany and not in Spain to obtain a return on the investment.

This concept is actually closely related to the ideas of Hans-Werner Sinn, namely that countries with strong current account surpluses and good productivity may attract capital that seeks higher yields. Behind this idea is that with higher surpluses more investments are possible and productivity and consumer spending increases. This concept was completely perverted between the year 2003 and 2007, when German and Swiss current account surpluses financed the real-estate bubbles in Southern and Eastern Europe.

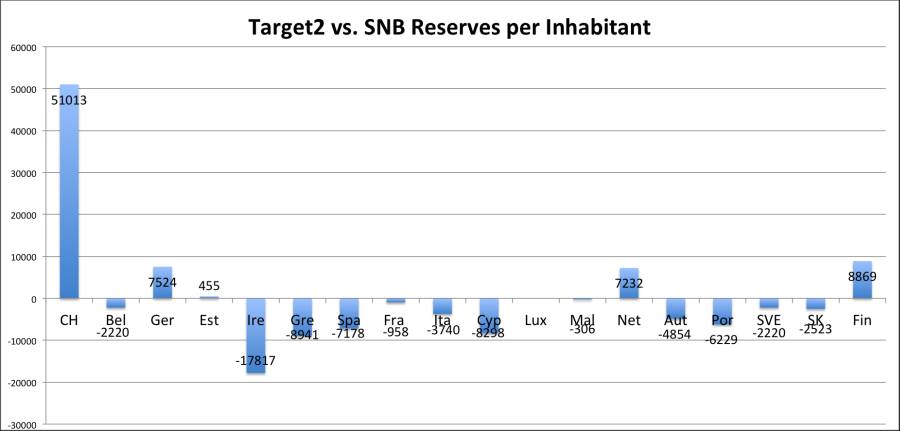

Representing our data on a per person level, we obtain the following graph:

Apart from Luxembourg (see below), the Swiss possess the biggest “imbalances” with 51’013 € (two months ago: 51’400) per person, while Germany has a surplus of 7’524 € (previously 8’721) and Finland 8’869 € (previously 9’595).

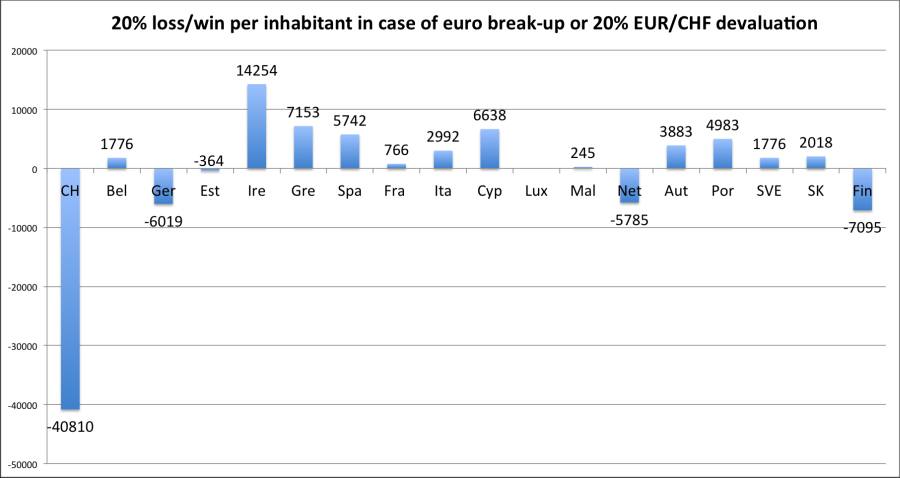

We imagine now that one day the euro zone breaks up – maybe not because the periphery goes bankrupt as some might have suspected between 2011 and 2012, but thanks to rising salaries, real estate and consumption. German, Finnish and also Swiss inflation moves far higher than inflation in the periphery, but Mr Draghi does not want to hike rates. Or because Mr Berlusconi wants Draghi to lower rates and if not, then he threatens that Italy will leave the euro zone.

In case of a break-up, we suggest an exchange rate difference of 20% between the North and the South: the Bundesbank and other Northern central banks will lose 20% of the value of its assets, covered with tax payers money. At the same time, we simulate that the EUR/CHF exchange rate drops by 20%.

While for the German tax payer, the euro break-up would be relatively cheap with 6’019 € (down from 6’977) per inhabitant, it would be very expensive for the Swiss: they would need to pay 40’810€ (down from 41’120) each.

Thanks to the huge SNB holdings of German bonds and a potential revaluation of these bonds, when re-denominated into a future Northern European currency (or a new German Mark), there is a chance that the Swiss get away with the EUR/CHF floor. We do want to discuss this here because of the multitude of legal questions that will arise (e.g. exchange rate used during re-denomination of foreign, domestic vs. central bank holders of bonds into the new currency).

The Luxembourg case

It is well known that (former) euro group chief Jean-Claude Juncker, the former Luxembourg prime minister, is maybe the biggest euro guardian claiming regularly that Germany must bail out the European periphery. We know why: Luxembourg has a Target2 balance of 212’572 € (this value is even up from 210’802 €) per inhabitant and would suffer a loss per person of 170’058 € (up from 168’642 €) in the case of a euro zone breakup. The numbers of Luxembourg, that possesses a big private banking centre, were that big that they did not fit into our graph.

Are you the author? Previous post See more for Next postTags: Animal Spirits,balance of payments,capital account,currency reserves,current account,negative equity,Swiss National Bank,Switzerland,Target2