First, a few quick words on Brexit. Being the always positive and optimistic person that I am (big grin), I see one very positive outcome of Brexit – it is a revolution without bloodshed. For once, I’m not digressing. Brexit has a lot of parallels with housing affordability in the US.

Read More »

Tag Archive: negative equity

Purchasing Power Parity, REER: Swiss Franc Overvalued?

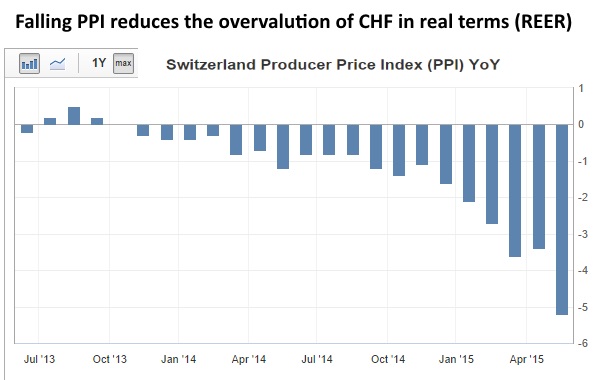

Most economists, like the ones at the Swiss National Bank (SNB), claim that the franc is overvalued. Many use misleading Purchasing Power Parity (PPP) measures like the Big Mac index, the OECD index or the PPP based on consumer prices for computing fair values.

The second big mistake is to compute the Real Effective Exchange Rate (REER) with the wrong "base year"The third error is to ignore massive Swiss current account surpluses, helped by high...

Read More »

Read More »

Jordan’s “Does the SNB need equity?”, an assault on the Swiss constitution?

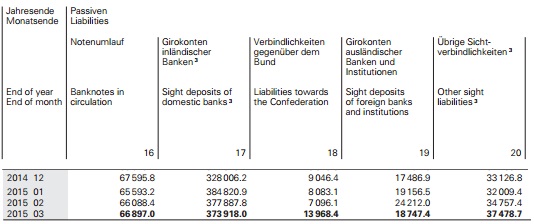

Marc Meyer argues that the Swiss National Bank must build up reserves, but this does not mean "foreign exchange reserves", but "Swiss Franc reserves". According to the constitution these reserves are owners' equity denominated in Swiss Franc and some gold. Thomas Jordan famous paper "Does the SNB need equity?" tries to overturn the constitution suggesting that the constitution accepts FX investments as "reserves".

Russia builds up foreign...

Read More »

Read More »

The Last Free Lunch for Holders of SNB’s High-Risk Share?

Marc Meyer, the maybe strongest opponent of the Swiss National Bank criticizes the misleading vocabulary in monetary policy that confuses central bank liabilities with assets. He identifies the intrinsic and time value of the SNB share. According to Meyer, the recent strong share price performance was caused by the free lunch at the shareholder assembly.

Read More »

Read More »

New Swiss Gold Initiative Getting Attention When Parallel Currencies Might Challenge Swiss Franc

In Switzerland the ordinary people have started several initiatives to protect their savings against the establishment. After the first gold referendum failed in November 2014, a new gold initiative is trying to introduce a gold-backed Swiss currency, as parallel currency or investment vehicle.

With the end of the EUR/CHF peg and the apparent risks caused by the SNB, the importance of the Gold Franc initiative has increased. Different groups want...

Read More »

Read More »

What Caused The Swiss Financial Tsunami? Three Reasons, One Trigger, One Chain Reaction

In this post we give our (Swiss) view for the financial tsunami on January 15.

The SNB has preferred its secondary mandate, namely financial stability, and the elimination of risks on its own balance sheet caused by ECB QE.

It will not obey its primary target, price inflation, for the next three to five years. While in the mid-term (5 -10 years) inflation should move up.

Differing perceptions between Switzerland and the Anglophone world about...

Read More »

Read More »

The liquidity monster and FXCM

As we have already pointed out about Thursday’s unprecedented Swiss franc move following the SNB’s announcement about removing its 1.20 euro level floor and introducing a -0.75 per cent interest rate regime, the real story to pay attention to is what...

Read More »

Read More »

Zillow CEO: If You Can, Sell Your U.S. Home Now

Via CNBC Against the backdrop of increasing home prices and the prospect of much higher mortgage rates, it’s a “great time” to sell, Spencer Rascoff, CEO of online real estate marketplace Zillow, told CNBC on Thursday. That is, if you can find a place to buy, he added. “As mortgage rates inevitably come from …

Read More »

Read More »

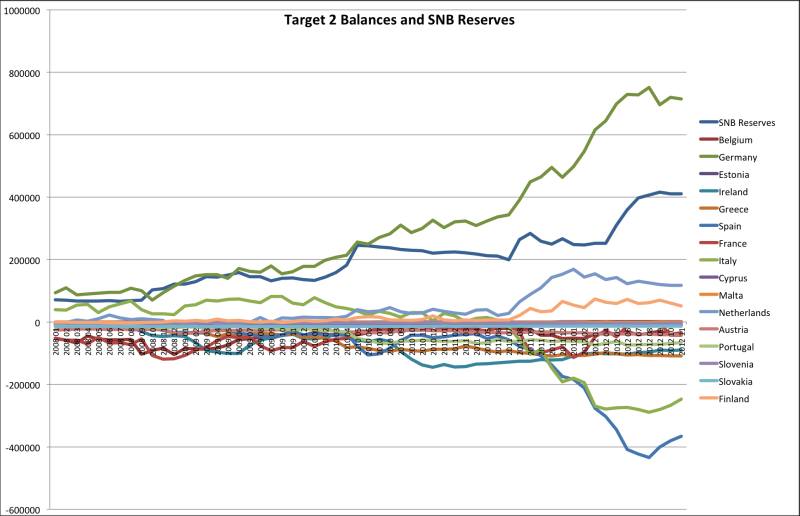

Target2 Balances and SNB Currency Reserves: Same Concept, Update February 2013

We show that Target2 imbalances and the SNB currency reserves represent the same issues, namely current account surpluses/deficits and capital flight. Therefore it makes sense to compare them, in total and by inhabitant.

Read More »

Read More »

Target2 Balances and SNB Currency Reserves. They are Both the Same Concept

We show that Target2 imbalances and the SNB currency reserves represent the same issues, namely current account surpluses/deficits and capital flight. Therefore it makes sense to compare them, in total and by inhabitant.

Read More »

Read More »

How Switzerland Implicitly Joins the Eurozone: SNB Obliges each Swiss to Invest 73% of 2012 income in Euros

The SNB forces each Swiss to invest 73% of each one's yearly income into Euros. Reason enough to join the Euro zone ?

Read More »

Read More »

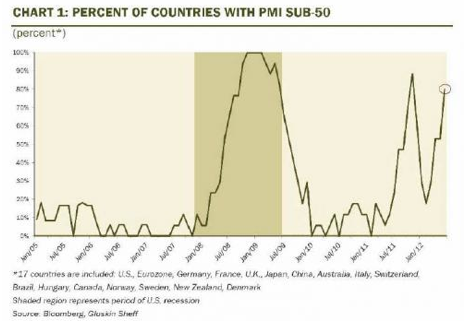

Global Macro with all Global PMIs July 4th

updated July 4,2012 This page inside our macro data menu contains global PMIs compared with the main risk indicators S&P500, Copper, Brent and AUD/USD as of the day after most PMIs came out. JP Morgan’s Global PMI: Click for details inside the table, History of composite PMI

Read More »

Read More »

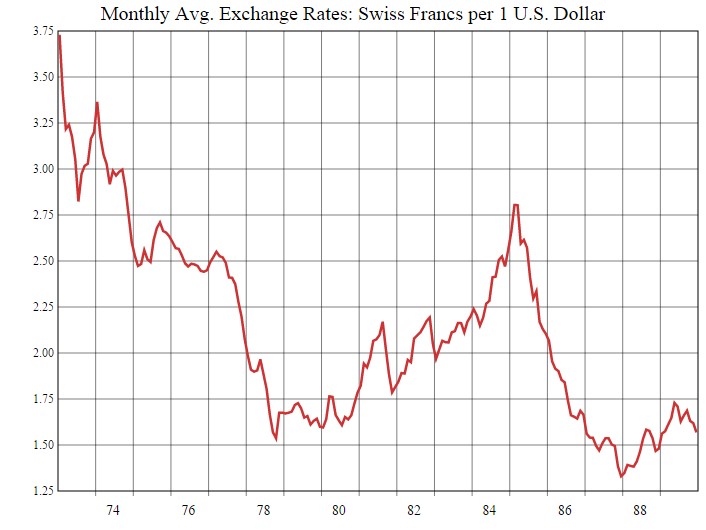

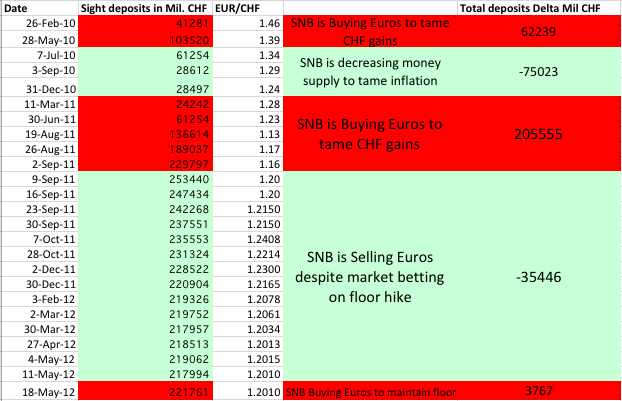

Will the SNB double or triple the forex reserves before they give in ?

Some economists have claimed that the Swiss National Bank (SNB) will be always able to maintain the floor. As opposed to George Soros’ defeat of the Bank of England, the SNB is able to print money ad infinitum, whereas the BoE had limited currency reserves to support sterling. The question, however, is where this “infinitum” …

Read More »

Read More »

Written in February 2012: Will the EUR/CHF never rise over 1.22 or 1.23 again?

Our analysis from February 2012 shows astonishing accurateness: It predicted that the euro would not rise against CHF and that the commodity currencies were overvalued and subject to correction.

Basic foreign exchange theory, the SNB price stability mandate and strong fundamentals for Switzerland and bad ones for the peripheral countries of the euro zone speak for the thesis that the EUR/CHF exchange rate might never go over the level of around...

Read More »

Read More »