Euro Crisis Has Affected Germany, Switzerland Still Immune

Most Recent Events

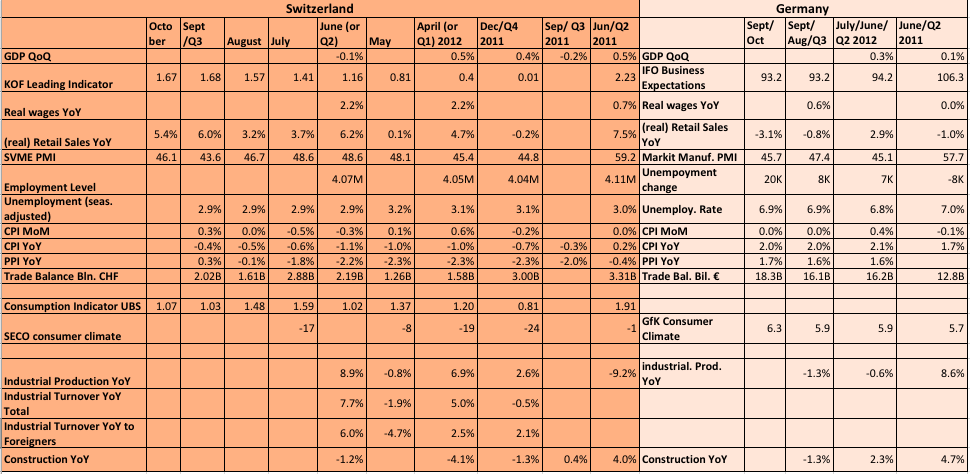

The Swiss SVME PMI has risen from 43.9 to 46.1. This PMI is dominated by machinery, metallurgical and electric equipment exporters organized in the Swissmem organization. As opposed to the chemical industry, they were not innovative enough to adapt to the stronger franc; but the euro peg and the soon already undervalued franc heals all wounds with the time.

Swiss retail sales continued its strong performance with a 5.4% increase, but Germany had a retail sales contraction on a yearly basis.

10000 UBS jobs were slashed mostly in London and New York, but only 2500 in Switzerland. To our minds this will only enforce the Swiss economy. Reducing the risky, very expensive and (therefore over the long-term) unproductive overhead that investment bankers simply are, frees capital and strengthens the bank.

Both Swiss and German economic indicators show continued signs of stability, but the German situation has become a worse and might affect the Swiss. Especially low unemployment; rising real wages and strong trade balances are signs of robustness.

Despite that, Germany’s industrial production is weaker than last year, the strong growth of 2011 has finished. Switzerland sees higher increases in real wages. Thanks to higher incomes and lower prices, Swiss retail sales rose by 5.4% on a yearly basis, but fell by 0.8% in Germany. Construction is now slowing in both Switzerland and Germany.

The Swiss “KOF leading indicators” have risen from 0.01 in Q4/2011 to 1.67 now, but are situated still under the value of 2.23 from June last year. The leading German indicator, the “IFO business expectations” stands at 93.2 and is clearly behind last year’s June value of 106.3 and smaller than the October 2011 value of 97.0.

Possibly thanks to lower inflation and higher wages, the German GfK consumer climate is ticking higher than last year; maybe finally time for retail sales to edge up.

Purchasing manager indices (PM) for the manufacturing industry in both Germany and Switzerland are far lower than in 2011, as the Southern European and Chinese demand for cars, machines and equipment has fallen. The latest Swiss industrial production (month of June) was up 8.9% against the previous year and contradicted the negative sentiment of the PMIs – as said above the SVME PMI is biased. Germany’s industrial production, however, contracted by -1.3% YoY.

Some other divergences exist: The KOF leading indicators and the UBS consumption index are expanding, but the official SECO consumer climate is contracting.

After the franc had strongly revalued, the Swiss National Bank (SNB) stopped a deflationary environment in September 2011. This month the Producer Price Index (PPI) has broken into inflationary territory with a rise of 0.3% on a yearly basis.

Higher prices were probably one reason for Swiss exporters to hike prices. We explained why the franc is now fairly valued on the basis of purchasing power parity. Higher export prices fit into this picture.

The strong franc and higher prices do not represent an issue for their customers, because the Swiss trade balance is still strongly positive.

The Swiss consumer price index (CPI) is lagging, because transfer prices for imported goods only adjust gradually and multi-national firms try to keep higher profits in Switzerland in order to pay lower taxes. Especially imported clothes and shoes were still expensive in 2011 despite the stronger franc. The importers were taking profit via the strong purchasing power of the Swiss consumer. Finally clothes prices fell by nearly 6% this year; this was the main component that prevented higher CPI inflation.

(Click to expand table)

Sources: Most data on ForexPros, individual data on KOF, Swiss Statistics, SECO

New data source for industrial production,Switzerland, Germany. We replaced Forexpros data (German Forexpros data contained both industrial production and construction, is therefore misleading).

New data source for construction, replaced Forexpros data: Switzerland, Germany

Wages: Economist, Swiss Statistics, real wages computed via CPI

Germany: ForexPros, Retail sales: Destatis, Labor costs: Destatis

Crawling peg on EUR/CHF from spring 2013?

Provided that no global depression takes place in 2013, it is quite probable that the SNB will move to a crawling peg in spring 2013. The month of May is the typical moment when strong inflows into the franc happen (see seasonal effects in detail). By then the PPI might have risen over 1%: quite a big figure for Switzerland. With the crawling peg, the central bank might lower the minimum rate for the EUR/CHF to 1.15 for 2013, and promise another decrease to 1.10 in 2014. A stronger franc will help the central bank to tame prices of imported goods, which make up 27% of the Swiss CPI.

Many like Jim Rogers or Marc Faber are expecting a global depression. In this case the SNB will continue to enforce the peg with the risk that the central bank’s later losses are even bigger.

Jim Rogers: Switzerland becoming Bulgaria?

We are sure that sooner or later the SNB will allow the franc to appreciate. As Jim Rogers said, they will not play “Bulgaria”. As Thomas Jordan already explained in 1999, the central bank will not allow Switzerland to become a country with high inflation and a currency pegged to the euro (like the Bulgarian Lev). The central bank will not kill the Swiss financial sector with inflation, but give up the peg.

And then it will be time for UBS to hire private bankers, but no investment bankers.

Are you the author? Previous post See more for Next post

Tags: Construction,Consumption indicator,Euro crisis,GDP,Germany GfK Consumer Climate,Germany IFO Business Climate Index,IFO,industrial production,PMI,PPI,Producer Price,Purchasing Manager,real wages,Retail sales,SECO,SVME,Swiss economy,Swissmem,Switzerland,Switzerland Consumer Price Index,Switzerland KOF Economic Barometer,Switzerland SECO Consumer Climate,Switzerland Trade Balance,Trade Balance,Unemployment