We have been tracking the deterioration in the technical condition of the major foreign currencies in this weekly note for the past three weeks. The euro’s recovery, off the support we identified here last week near $1.2800, should not overshadow the fact that the dollar’s technical tone remains, on balance, still constructive.

Euro volatility continues to trend lower and before the weekend, (3-month implied) dipped below 8.4% for the first time since December 2007. Similarly, yen (3-month implied) fell to its lowest level since July 2007 before the weekend.

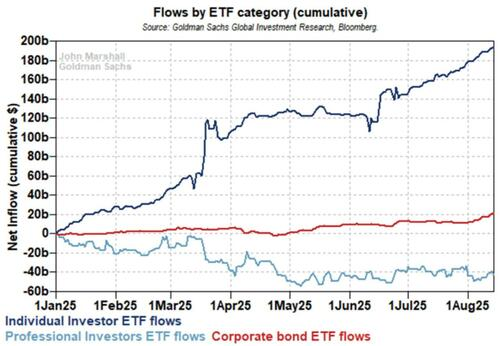

Volatility has trended lower in the euro as it recovered from the move toward $1.20 in late July. An increase in volatility is more likely to happen if the euro begins falling. Likewise, an increase in yen volatility seems more likely if the dollar declines in the current environment. The VIX dipped below 14% on Friday, which it rarely does, as the S&P 500 approached the best level since December 2007. The volatility of the S&P 500 (VIX) is likely to rise as the stock market sells-off.

Our concern then is that Q4 is going to be more volatile than is currently implied and that has directional implications for the dollar. Many longer-term investors believe the US fiscal cliff and debt ceiling issues are the biggest risks facing the world economy. Others are more concerned about the unresolved European debt crisis an the signs of prolonged economic weakness.

At the same time, the policy response to the slowdown in China, the world’s second largest economy, has been less than many would have expected. Japan, the world’s third largest economy, appears headed for a new contraction. The opposition continues to block bond sales in order to force an election. A new election would likely strengthen more nationalistic voices. Meanwhile, the territorial dispute with China has prompted some analysts to revise down earnings growth estimates for some Japanese industries and companies. Another territorial dispute for Japan that is simmering below the surface is with South Korea.

While Israeli Prime Minister Netanyahu presentation to the UN may have signaled less likely a chance of an Israeli attack on Iran nuclear facilities here in Q4, the collapse of the Iranian economy, signaled by the precipitous decline of its currency, injects a different element of instability, albeit a preferable one, but still an unstable situation. The internal struggle in Syria has spilled over and prompted the Turkish military response. There are broad demonstrations in Jordan, seeking political reform. South Africa’s labor strife has dragged the rand to three year lows.

Simply put, the world seems to be sitting on a powder keg. There are so many potential flash points. Volatility is relatively low–at multi-year lows. This contradiction, we expect to be resolved with higher volatility. Higher volatility would be consistent with a weaker euro and a stronger yen (and weaker stock market).

Implied volatility can also be thought of as the price of insurance. Medium-term investors should know that such insurance is on sale now at 2007 prices.

Euro:

The technical tone of the euro improved last week following the successful test on the $1.2800 support area. The weekly close above $1.3030 appears to bode well for additional near-term gains and perhaps a move toward the mid-September high near $1.32. We are a bit skeptical, as the euro’s advance was not confirmed by the other major currencies or the dollar index (DXY). Yet, if it does materialize, we would expect it to be the last leg up in the rally that began in late July. Support is now seen in the $1.2900-50 band and lend credence to out skepticism.

Yen:

The dollar has approached trend line resistance near JPY79. This trend line is important as it is on the weekly and monthly charts as well; connecting the late July and August highs with the mid-September high. Support is seen in the JPY78.00-15 area. The euro is also firm against the yen and appears poised to move in the to JPY104.00-50 area. The yen’s softness should ensure that it stays off the G7 agenda later in the week ahead.

Sterling:

The technical tone is considerably weaker than the euro. Sterling’s push through $1.62 before the weekend was rebuffed and it subsequently was sold to new session lows. Momentum indicators and 5/20 day moving averages also point lower. Support initially is seen near $1.6070. Sterling looks set to under perform against the euro, which has scope to move toward GBP0.8120 before likely encountering stronger resistance.

Swiss franc:

The dollar’s advance at the start of the week was turned back from trend line resistance near CHF0.9450. This exposed the dollar’s downside and sets up the test on CHF0.9245 area. A convincing break of this range may point to the direction of the next 2-big figure move.

Canadian dollar:

Despite better than expected employment data before the weekend, the Canadian dollar was unable to hold on to the lion’s share of its gains. The fact that the US dollar held support near the CAD0.9730 retracement objective and then recovered almost all of its intra-session losses, appears to be reflective of a market without much conviction. Gains now through CAD0.9900 would reinforce the sense that a significant low is in place.

Australian dollar:

The technical tone deteriorated significant in recent days and many stale longs look trapped at higher levels. The Australian dollar made lower lows every day last week. The pace of the decline saw it finish the week just below its Bollinger Band (two standard deviations below its 20-day moving average). Even though the returns (changes) in the currency markets are not normally distributed, closing below the lower Bollinger Band is a rare occurrence. It warns the bears who are moving into ascendancy not to be too aggressive at the start of the new week

Mexican peso:

The dollar fell to new six month lows against the peso before the weekend, but managed to rally smartly to new session highs. The dollar’s recovery was stopped shy of resistance seen in the MXN12.83-5 area. It needs to be overcome to signal a new assault on the MXN13.00 area. Momentum indicators suggest that it is the most likely scenario.