Alexander Gloy is founder and president of Lighthouse Investment Management

Alexander Gloy is founder and president of Lighthouse Investment Management

The IMF’s (International Monetary Fund) “World Economic Outlook”, a slim 250-page piece, came out.

Some excerpts:

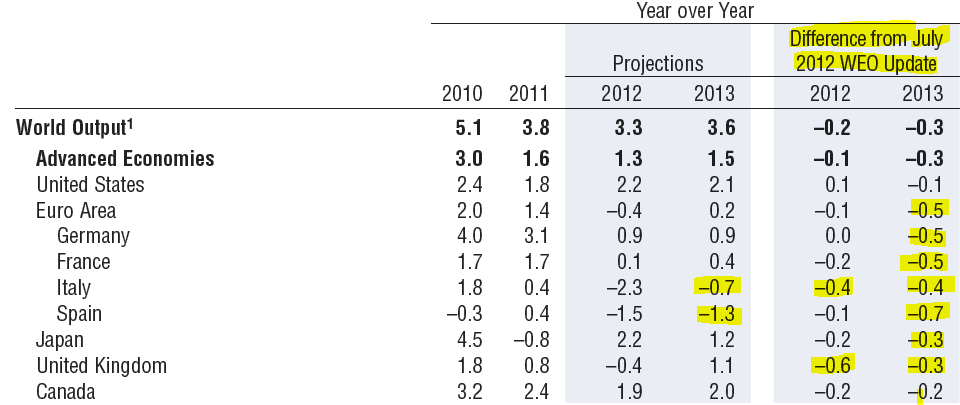

Substantial reductions in estimated output (GDP) growth for 2013 for all major countries:

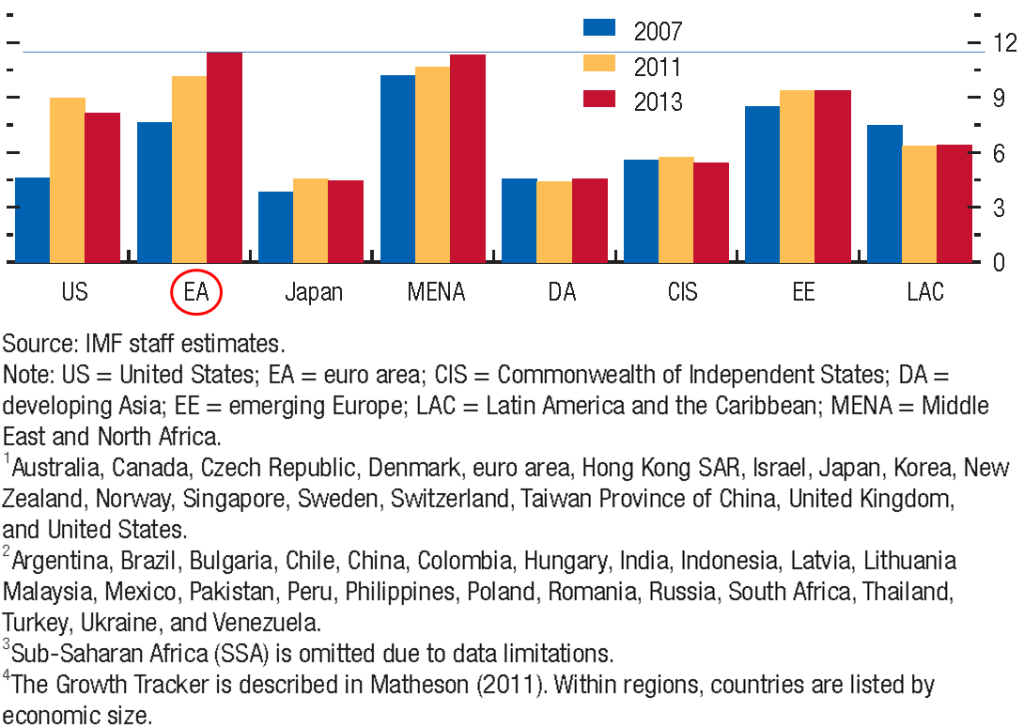

Unemployment in the Euro-Area (“EA”) is now expected to rise above the level in the Middle East and North Africa (“MENA”) in 2013.

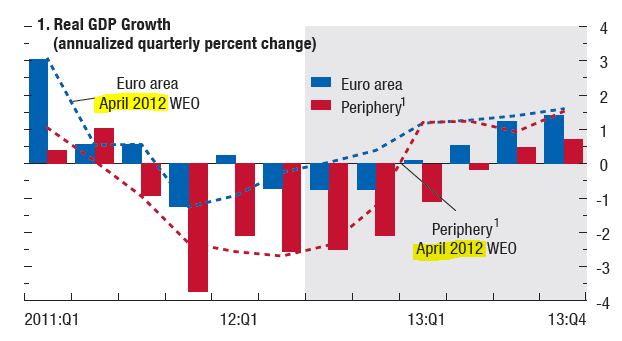

An end to the recession in the Euro-Area has been pushed back from Q4 2012 to Q2 2013.

For the Periphery (the PIIGS), it has been pushed back from Q1 2013 to Q3 2013:

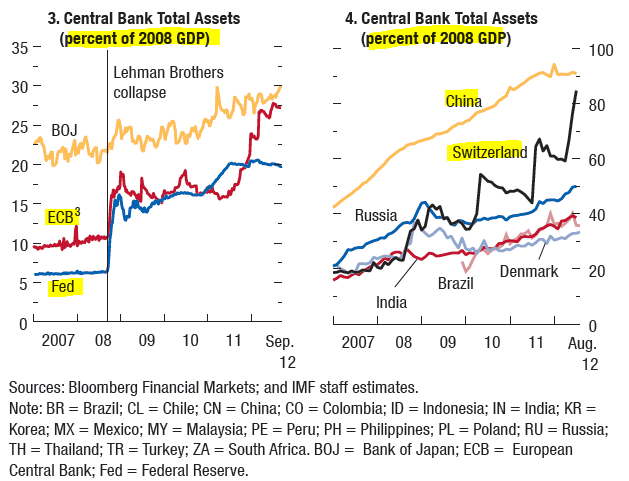

Desperate central banks are depicted in these two charts, showing total central bank assets in percent of GDP. Interestingly, the two “winners”, China and Switzerland, saw their balance sheets expand not because of buying local assets but because of buying foreign exchange in an attempt to prevent their own currency from appreciating:

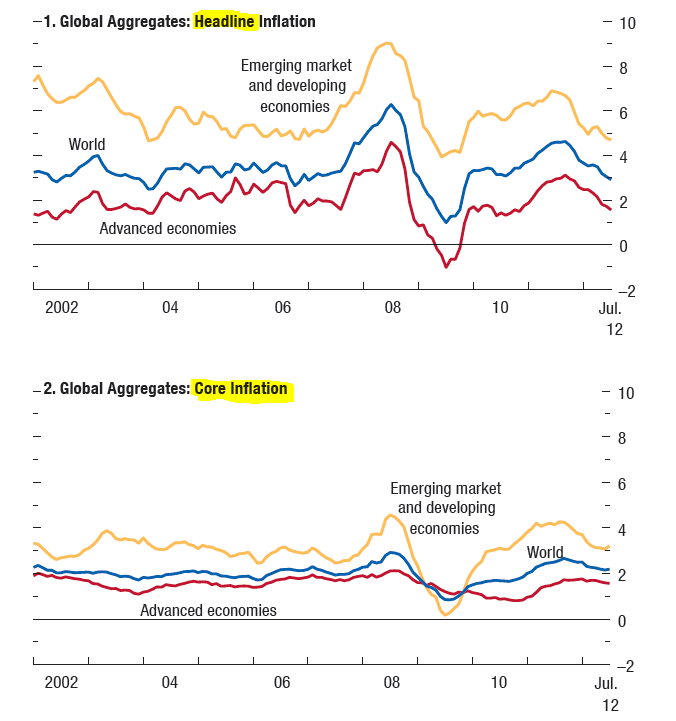

Despite the manic printing of money, global headline and core inflation rates (excluding volatile or seasonal food and energy price changes) remain low

On the Euro-Area: “The euro area crisis could re-intensify again. The OMT [Outright Market Transactions, the replacement of SMP, = further buying of PIIGS government bonds by the ECB] program will reduce risks from self-fulfilling market doubts related to the viability of the Economic and Monetary Union (EMU) most effectively if it is implemented decisively. However, serious risks remain outside this safety net – posed, for example, by rising social tensions and adjustment fatigue that raise doubts about adjustment in the periphery or by doubts about the commitment of others to more integration.”

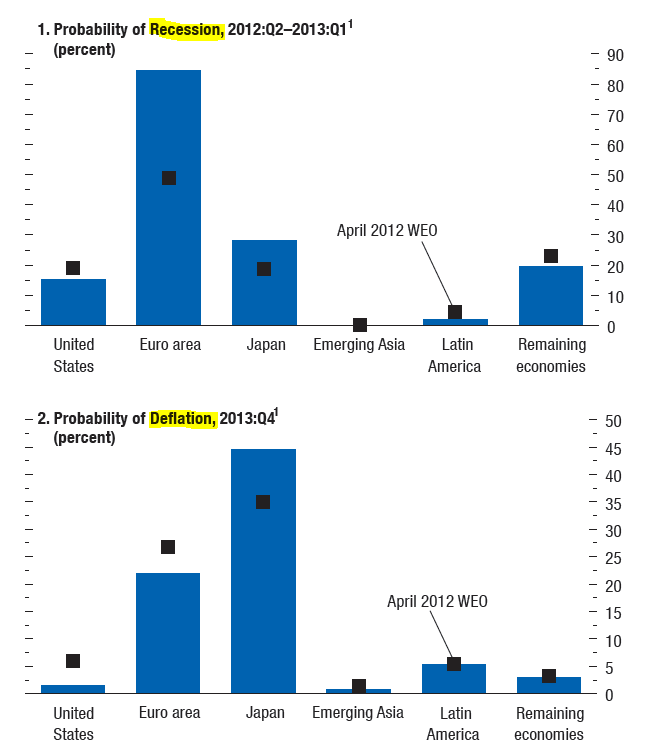

The probability of recession for the Euro area has been increased from 50% (April forecast) to 85%.

“Public debt has reached very high levels, and if past experience is any guide, it will take many years to appreciably reduce it.”

“Despite policy progress, the euro area crisis has deepened. Unless recent ECB actions are followed up with more proactive policies by others, the WEO (World Economic Outlook) forecast may once again prove overly optimistic and the euro area could slide into the weak policies scenario, with deleterious consequences for the rest of the world.

Yes, the IMF’s forecasts once again (as over the last five years) proved overly optimistic.

Alexander Gloy is founder and president of Lighthouse Investment Management

Alexander Gloy is founder and president of Lighthouse Investment Management

Tags: Alexander Gloy,Central Bank,Core Inflation,debt,Deflation,GDP,IMF,International Monetary Fund,Lighthouse Investment,Other Periphery,PIIGS,Unemployment

1 comments

George Dorgan

2012-10-10 at 21:06 (UTC 2) Link to this comment

The IMF data is of Q2/2012, so they lag a bit.

As I pointed out already in August, stocks are overvalued, at least against Gordon’s growth model.