Submitted by Mark Chandler, from marctomarkets.com

The week ahead kicks off what we expect to be a period of intense event risk. The combination of positioning, judging from the futures market and anecdotal reports, and the low implied volatility in currencies and equity markets warn of heightened risk in the period ahead.

The week begins off slowly with a long holiday weekend in the US. It is here where continued position adjusting may dominate. Of the central bank meetings, the Reserve Bank of Australia is first (Sept 4) and is the least likely to surprise the market. While most participants expect that the easing cycle is not over, most look for a resumption of it later in Q4. That said, a rate cut would likely push some of the Aussie bulls to the sidelines, even though Australia will continue to offer among the highest interest rates among the major industrialized countries.The Bank of England meets Sept 6. An extension of its gilt buying program was discussed last month and evidence points to continued deterioration of the economy. Extending the current gilt purchases, which run through early November, would likely have little market impact. A rate cut would likely be seen as somewhat more negative for sterling.

Fourth, there may be some discussion of the ECB’s seniority as a creditor. It is ironic, in some respects, that this is being discussed now, two weeks after Greece had to jump through fresh hoops to ensure the repayment in full of a Greek debt the ECB had purchased; apparently redeemed at face value and a coupon, suggesting the ECB just booked profits on some of its Greek bonds. In any event, participating in the very short-end of the market, bills for example, might be a way to square the circle for the ECB. The problem with this of course is would force countries to issue more short-term debt.

Fifth, there is also some talk that the ECB may buy Portuguese bonds to demonstrate its new approach (modalities). While we advocated this a few weeks ago, there are some short comings that the new advocates may not fully appreciate. Portugal is getting international assistance now. It is not tapping the capital markets to fund its deficit. If the ECB were to drive down yields in Portugal, this would not help the Portuguese government as much the current holders of short-term Portuguese bonds, like local banks. Whether it would trickle down to lower consumer and business rates is a completely different story. As we have seen elsewhere, lower interest rates in a weakening economy with rising unemployment and is not sufficient to rekindle the animal spirits or the demand for capital.

Last, but not least the US jobs data, on which the outcome of the following week’s FOMC meeting appears to rest. We understand the recent string of US economic data to show that the economy is improving modestly in Q3. The bar of “significant and sustainable” that the Fed has cited is a question of judgment.

The Fed places emphasis on the full employment as the other two (yes, two) price stability and long-term interest rate stability have been largely achieved. The monthly non-farm payroll report is among the most difficult of the high frequency data to forecast. It is a net figure, as the world’s largest economy creates and destroys hundreds of thousands of jobs a month. It is impacted by seasonal adjustment and complicated adjustments for the creation and destruction of small businesses.

On balance, we expect that on a net basis, the private sector generated around the same number of jobs in August as it did in July (~172k) and that this, or something reasonably close to this, will keep the Fed adjusting its future guidance rather than a new asset purchase program. Such an outcome, we suspect, will be understood as dollar bullish.

Euro:

Short covering in the week through August 28, saw the net short cover position fall 22k contracts to 102k, which is the smallest in about four months. The gross shorts fell 22.4k, but at 147.5k are almost as large as the other gross short futures positions combined. The gross longs fell less than 60 contracts to dip below 46k.

Yen:

Sterling:

Swiss franc:

Canadian dollar:

Australian dollar:

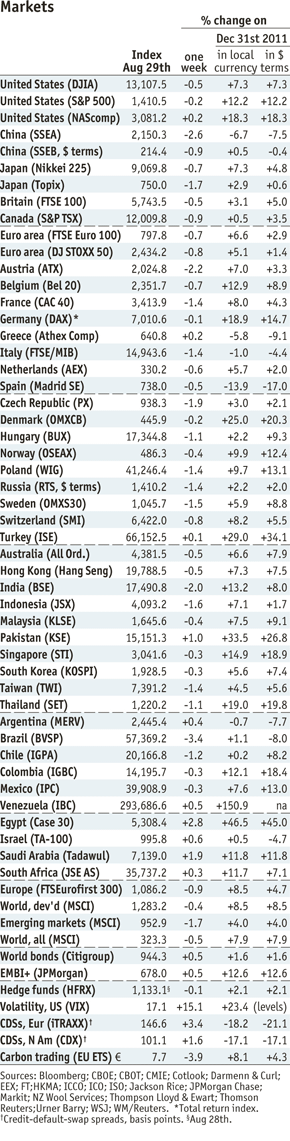

Markets by August 29 (source The Economist ) - Click to enlarge

Mexican peso:

Global Stock Markets (by George Dorgan)

Thanks to a strong euro in the last week, the DAX managed to come closer to the NASDAQ in $ return terms this year. Denmark’s OMXB has even a stronger $ return than the DAX.

Chinese, Japanese and Canadian stocks lost quite strong strongly last week together with currency losses against the euro. In total these countries see a small $ return compared to the US. British stocks saw some losses last week, but thanks to a rising pound against the dollar, the changes in $ terms were positive.

In the euro area Greek, Italian and Spanish stocks saw only small losses, together with a rising euro they had a positive $ performance for this week.

Most countries of Northern and Eastern Europe continue to see strong gains this year, last week’s stock markets were almost unchanged in local currencies. Thanks to the rising euro and the correlated local currencies, gave place for some gains in $ terms.

Switzerland’s SMI continues to see only small gains this year in $ terms and losses in local currency. For us, a strange diversion from the strong performance of the DAX, maybe because the SMI is a more conservative index and contains a higher share of banking (UBS and Credit Suisse). Remember that German and Swiss exporters showed near record trade balances and Swiss GDP growth outperformed German GDP growth !

The weak PMIs in China pushed both Australian stocks and the currencies downwards. In the Emerging Markets Argentine, Brazilian, Chinese and Israeli markets continue to underperform; these countries still suffer of outflows. For Mexico and Colombia the story is different. With a smaller local markets and/or a closer distance to the United States their economies and stock markets are expanding better.

More related posts directly from Marc’s website:

- Summary of Big Picture Views

- Draghi: Call Me Maybe

- Dollar Heavy While Waiting for Bernanke

- Great Graphic: Euro and Sterling Testing Key Levels

- Is this the Price Signal We have been Waiting For ?

- Initial Reaction to Bernanke: USD and US Assets Firm

- Great Graphic: Chinese PMI

- Short Note on Significance of the Price Action

Tags: Animal Spirits,Ben Bernanke,Canadian Dollar,Commitments of Traders,COT,Credit Suisse,Currency Positioning,FOMC,franc,FX Positioning,Japanese yen,Marc Chandler,MXP,Net Position,Peso,PMI,Purchasing Manager,Speculative Positions,Swiss National Bank,Switzerland,Switzerland Gross Domestic Product,Technical Analysis,UBS