Isn’t it wonderful to have a strong central bank like the SNB sitting behind you when trading Forex?

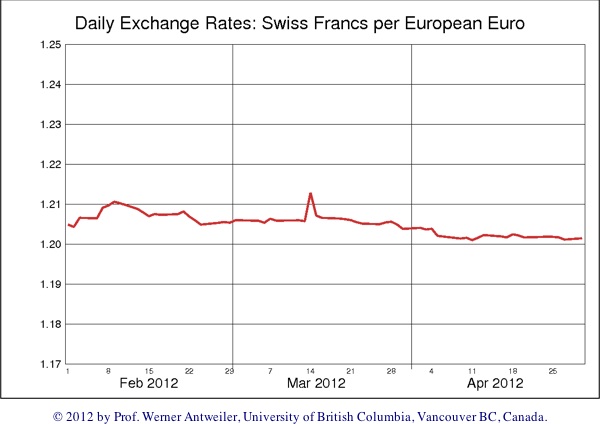

Losses are limited to the floor of 1.20 and in the meantime you can gain forward swaps with the higher euro zone interest rates.

Like in the March meeting, the Forex crowds got excited about the central bank’s commitment and pushed the EUR/CHF higher.

Surprisingly the EUR/CHF did not fall directly after the meeting. Given that the Swiss economy might weaken and that the ECB seems to have solved the euro zone crisis with her “pay-all-with-German-tax-payers-money” Bazooka, Forex traders currently have big faith in both these two central banks. The common euphoria lasted even after the SNB monetary policy assessment meeting.

As we stated already in a previous post, if the SNB does start not big CHF purchases, the EUR/CHF can remain several weeks above the floor level of 1.2010. Between November and April 2012, the SNB bought francs and slowly moved the exchange rate from 1.22 towards 1.20, often only 1-2 pips per day. Once this was similarly based on rumors about a floor hike, namely at the March SNB meeting. Some Forex traders even thought that “there were some big accounts trading against the central bank”, but they finally realized that they were trading against the central bank.

We think that the same thing will happen now. Forex traders are by 95% long EUR/CHF and they will not move out of the pair until it reaches a certain stop loss. For many the stop loss is defined around 1.1995, slightly below the floor of 1.20. Yes, there might a 1% loss between the current levels of 1.2125 and the floor, but the 0.75% yearly swaps difference can nearly make this up, if their Forex platform does not charge too much. And there is still the chance that the SNB raises the peg…

We might have entered a phase during which the SNB is able to sell some of her reserves to these FX traders. We said in a previous post that due to seasonal factors these selling phases often last from September/October to March. Between April and September, the central bank had to increase reserves and/or accepted a defeat. However, due to the relatively high USD/CHF exchange rate and rising QE3 hopes, we are not sure that the SNB will be able to reduce reserves between September 2012 and March 2013.

We also explained that last week the SNB had to buy foreign currencies for the equivalent of five billion newly printed francs despite the EUR/CHF rise. In this sense comments of “pressures have eased somewhat” were valid in August, but not necessarily in September ..

Global Macro funds and investment banks traders

One group of investors does not really care about the forward swaps in the currency markets. Global macro funds and traders of (especially) US investment banks anticipate the movements of long-term investors (more details here). They will come into the office soon and will trade the FOMC meeting today. These funds and traders look on global macro data, like inflation or a potential quantitive easing, which will drive long-term investors out of the USD into gold and the correlated Swissie.

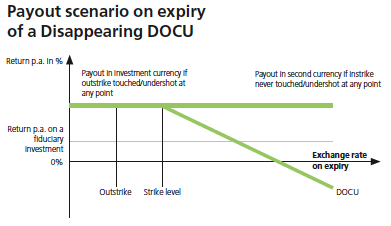

Last but not least, there are certain investment products that make investment banks lose money against their wealthy clients when the EUR/CHF appreciates too much. An example is the DOCU on EUR/CHF with the common strike level of 1.22 (see an equivalent DOCU on EUR/USD):

Investors are paid back in euro from a strike level of around 1.22 upwards (plus a premium) and in francs below this strike. The interest of the investment banks is that the investors are paid back in the alternative currency francs and the exchange rate as far as possible from the 1.22 level, the best for the banks would be slightly above the floor.

SNB soon a seller of euros and buyer of USD ?

Given the small difference between ECB and Fed rates, we reckon that the EUR/USD will not move far over 1.30, even with QE3. EUR/USD of 1.30 or more would be justified only with an ECB key rate of 1% but not with 0.75%.

Therefore we judge that the SNB will soon switch from selling euros and buying USD and GBP. In the second quarter they increased the euro share to 60% and invested 77% of new reserves into euros buying euros at levels of EUR/USD of 1.22. This step coincided with our proposal to our clients to go long the euro in the beginning of August, here in Seeking Alpha.

Kit Juckes at SocGen is also of our opinion:

If I were the SNB, I would heave an absolutely huge sigh of relief and set about the task of diversifying my reserves away from the euro (euro share at 60% or so is 10% higher than they want). I would not mess with the level of the peg. Though I might be tempted to slip a few thoughts about eventual adjustment out, because if the market talks about it and weakens my currency for me, that makes my life easier and the CHF value of my reserve portfolio goes up….

How to trade it ?

Trade with the SNB traders, investment banks and rich investors, buy francs and sell the euro. It is perfectly possible that the SNB Forex reserves rise this week, but the common euphoria of FX traders pushes the EUR/CHF upwards. Over the mid-term the SNB will try to sell her huge euro reserves and the EUR/CHF will move downwards again. The question is just to find the right entry point to be short EUR/CHF. An entry point could be last week Friday’s high of 1.2154 or the DOCU strike of 1.22. Anything below these entry points is not worth trading, gains are not sufficiently high.

Are you the author? Previous post See more for Next post

Tags: Deposits,ECB,Federal Reserve,Gold,monetary data,Monetary Policy,QE3,SNB sight deposits,Swiss National Bank,Switzerland Money Supply

4 comments

Skip to comment form ↓

Stamen

2012-09-13 at 12:37 (UTC 2) Link to this comment

Hi,

What does DOCU stand for?

George Dorgan

2012-09-13 at 17:28 (UTC 2) Link to this comment

It is Double Currency Unit (DOCU), you may be paid back in 2 different currencies. full details here

Stamen

2012-09-13 at 21:36 (UTC 2) Link to this comment

Hi George,

Thanks for this and all your wonderful content on the site.

How do you explain the sustained strength of the EUR even after the SNB left the floor unchanged?

Which of the 5 groups you mention keep the rate rising? Obviously the retail traders are long but they alone cannot bring the rate to 1.2160, can they? Who is it then – can it be the SNB trying to establish a stable rate of 1.21-1.22 and thus take the pressure off its balance sheet?

Or are their some bigger money changing their mind and switching to Euro?

Thanks a lot.

George Dorgan

2012-09-13 at 21:55 (UTC 2) Link to this comment

Forex trader have a huge leverage, they can outweight big investors on certain days. Usually CHF must move with gold and partially with JPY. Forex traders will not double their bet when big investors or macro funds come in in the coming weeks and months. The SNB will trade very cautiously again, 1-2 pips per day down from the top . Maybe she helped reaching a higher top in EUR/CHF today. The 1.2154 of Friday has been beaten by 1.2157, maybe the top building could continue some days. The crucial numbers to watch is monetary data next monday and monday in a week. There we will see if long-time investors still pile into CHF (e.g. out of USD). Given the inflation risks that both QE in Europe and the US have, I suppose they will. See also the strong fall of USD/JPY and the rise of gold and oil.

And inflation might become an issue in Switzerland too with higher oil prices.

G.