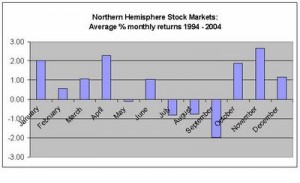

The "Sell in May, come back in October" effect

It is the same seasonal anomaly nearly every year: The statistically flawed (see here and here) Non-Farm Payrolls (NFP) report delivers some good winter readings with 200K new jobs, this time additionally fuelled by a weather effect; biased data that let hard-core Keynesian policy makers doubt Okun's law. Consequently the stock markets rally strongly, the S&P 500 reaches 1400 and more. Decision makers especially of firms in the US and in english-speaking countries get influenced by the NFP coincident indicator and the corresponding PMIs, usually the leading indicators, increase. [caption id="attachment_2663" align="alignright" width="300"] Sell in May, Come back in October[/caption]

Even given these statistical flaws, markets regularly forget that 200K is only a bit above the average 150K new jobs needed to compensate for the population increase and that these 200 K need to be repeated every month over 14 years in order to come back to full employment and to cover the 8.8 million jobs lost in the financial crisis plus the population increase. Only with a significant reduction of the number of unemployed people and of the "not in the labor force", US wages are able to rise more quickly, and only then US consumers will spend as they did before.

Some months later stock markets sell off in their typical "Sell in May" mode, because the 200K NFP reports are not sustainable, especially this year due to the enfolding euro crisis and to the weather adjustment into the opposite direction - the worse is still to come in the June report.

Sell in May, Come back in October[/caption]

Even given these statistical flaws, markets regularly forget that 200K is only a bit above the average 150K new jobs needed to compensate for the population increase and that these 200 K need to be repeated every month over 14 years in order to come back to full employment and to cover the 8.8 million jobs lost in the financial crisis plus the population increase. Only with a significant reduction of the number of unemployed people and of the "not in the labor force", US wages are able to rise more quickly, and only then US consumers will spend as they did before.

Some months later stock markets sell off in their typical "Sell in May" mode, because the 200K NFP reports are not sustainable, especially this year due to the enfolding euro crisis and to the weather adjustment into the opposite direction - the worse is still to come in the June report.

The "May to September" effect on the other side of the atlantic

On the other side of the atlantic a similar procedure repeats every year: Thanks to the good mood in the US economy, US orders to Swiss exporters (+22%) and German ones rise and Swiss consumers keep on spending. Despite Goldmans' negative expectations, the Swiss economy keeps on running close to full employment and the closely related German unemployment beats record lows. Notwithstanding the complaints of the Swiss exporters and tourism industry about the strong franc, the Swiss trade balance is still strongly positive and foreign tourists to Switzerland increased their spending in 2011 but costs for Swiss firms decreased sharply thanks to cheap imports from the euro zone. Consequently the Swiss Q1 GDP rises strongly, beating with a +0.7% QoQ, +2.0 YoY even the US +1.9 YoY, despite the fact that US GDP must grow more strongly than the Swiss one when the strong US birth/death effect is taken into account. As soon as American investors see the bad US data, they look into different directions and realize that there are some other safe-havens, not only the US dollar, especially when the Fed is threatening their currency with Quantitative Easing again.The history of the "May to September" effect on the swiss franc

And this is the way history repeats during the weak US months May to September on the other side of the Atlantic: Between March and June 2009, the SNB managed to maintain the 1.50 EUR/CHF "line in sand" only thanks to intensive FX intervention. Same picture in May 2010: Strong demand for the Swiss Franc, even multiplied by the first Greek crisis. The EUR/CHF fell to 1.40. When the SNB had abandoned the FX interventions the Swiss Franc even reached parity with the dollar and EUR/CHF 1.30 in September 2010. After the typical US rebound in Q4/2010, the Swissie soared again. Like regularly it reached a first peak in the May 2011 up to a EUR/CHF 1.22 and a USD/CHF of 0.83. Then the increase of the Swiss currency even accelerated to reach EUR/CHF of 1.0076 and USD/CHF 0.71 in August 2011. The SNB knows this "May to September" effect and timed the epic introduction the EUR/CHF floor of 1.20 slightly before the yearly rebound of the US economy and not in the months of July and August 2011, when the franc was hovering between 1.00 and 1.15. Similarly, the central bank used the positive US months between October 2011 and April 2012 to cut its heavily overloaded balance sheet by around 17% of the currency reserves and sold Euros deceiving many forex traders that were hoping on a hike of the floor. Full story here Are you the author? Previous post See more for Next postTags: Ben Bernanke,Euro crisis,floor,franc,Germany Unemployment Rate,Gold,Keynes,Keynesian,Labor costs,line in sand,Non-Farm,Okun's Law,PMI,QE3,Quantitative Easing,Safe-haven,seasonal,Swiss National Bank,Switzerland,U.S. Nonfarm Payrolls

2 pings

Swiss vs. German Economic Indicators, August 2012 - SNBCHF.COM

2012-10-26 at 13:27 (UTC 2) Link to this comment

[…] in spring 2013. The month of May is the typical moment when strong inflows into the franc happen (see seasonal effects in detail). Till then the PPI might have risen over 1%, for Switzerland a quite big figure. With the crawling […]

Why euro has recovered or Markit PMI really reliable ? - SNBCHF.COM

2016-02-26 at 13:56 (UTC 2) Link to this comment

[…] The big coincident indicators industrial production, retail sales, employment change (Non-Farm Payrolls) and income change often follow later. Non-Farm Payrolls have a strong influence on sentiment (point 6) and on markets, but are often quite biased. See more here […]