There are currently rumors going on on CNBC that the SNB is planning something this night. As we explained here, the SNB had to strongly restart the printing press and printed tremendous 13 bln francs in one week. Moreover, they probably sold some of their in Q4 2011 and Q1 2012 acquired GBP, JYP and USD. Furthermore, Jordan ruled out a hike of the floor. The EUR/CHF is completely flat at peg level of 1.2010.

The USD/CHF has risen to 0.97 from 0.71 in August 2011. Swiss exporters (40% to USD-correlated areas) are happy with this situation, but imported inflation is increasing due to the stronger dollar. Swiss GDP is to rise strongly in Q1, 2012, the announcement will be tomorrow 7.45 Swiss time, a big evidence for an action or a lot of work for the SNB traders! The pressure on the SNB to print will surely increase.

There are six possibilities for us, it is just pure speculation for now:

- They are planning capital controls, negative interest or similar. We have ruled this out, here. This would not be a night action like the rumor implies.

- The SNB removes the floor completely and let the franc freely float. Already the OECD suggested the floor is appropriate as long as the Swiss economy has problems, but otherwise it would be simple protectionism.

- They take the pressure out of the printing press and lower the EUR/CHF to 1.10. This was already implicitly coming via currency reserves as explained here.

- They take the pressure out of the printing press and to stipulate a floor against a currency basket. For sake of easiness the central bank would prefer a EUR/USD combined floor, e.g. at 1.10/0.90. For us the second biggest possibility.

- They announce a crawling peg, e.g. 5% devaluation per year (according inflation difference or state of euro zone problems) on EUR/CHF allowed. An example for crawling peg in Serbia (see to the right)

- Nothing happens. Just rumors. They just get prepared to print early tomorrow when Swiss GDP comes out. Due to current public opinion and the latest SNB statements, that they defend the 1.20 floor, still the most probable option.

In these statements, Jordan, however, indicated in several questions that money printing was dangerous because the SNB fears a real estate bubble. To make the franc more expensive at least for foreigners would be a solution, a SNB job.

Actually he spoke in more details about stronger controls on banks than about the floor, after the 10 years CHF fixed-term mortgages had fallen to 1.5%. All these measures, however, need to be taken by the Swiss government. For the German speaking followers, one political option would be a stronger Lex Koller so that foreigners cannot buy Swiss houses any more, even when using some tricks.

What will happen to the SNB balance sheet, when the floor is lowered to 1.10 ?

We do not speculate on the effect on massive stops under 1.20 and the consequences. Our blog aims to understand the thinking inside the SNB. Therefore we calculate how much the SNB will loose when it lowers the floor. The calculations are not intended to be 100% correct !

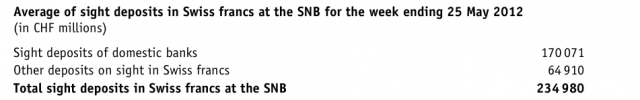

We base our calculations on the most recent money supply data. Since bank notes of around 50 bln. are missing in this data, the FX reserves are actually 10-20% higher.

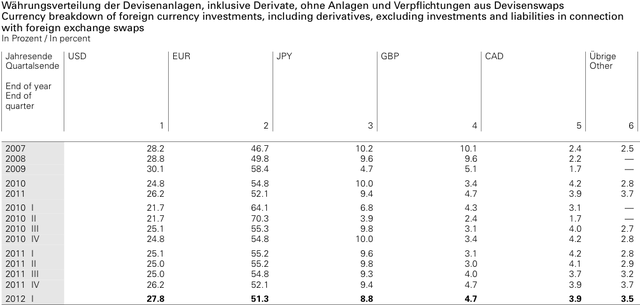

and the distribution of the currency reserves on the Q1 balance sheet:

The maximum losses are:

EUR positions (51% of FX reserves, new exchange rate EUR/CHF 1.10 from Q1 1.20): Losses of 23 bln. CHF go into the books

USD positions (28%, new exchange rate USD/CHF 0.88 from 0.97, but end Q1 0.90): slight losses

JPY positions (9% new exchange rate CHF/JPY 90 from 81, but end Q1 90): no change

GBP positions (5% new exchange rate GBP/CHF 1.39 from 1.50, but end Q1 1.44): slight losses

Gold positions (additional 20% of the currency reserves, 50 bln. CHF, now 1559, end Q1: 1669)

Losses in gold positions (prices are in USD) accumulated: 6 bln CHF. If the floor is changed then these losses cannot be compensated any more via the rise in USD/CHF.

Overall maximum losses: 33 bln. CHF, it is a vague estimate

(to our opinion better than printing 13 bln. per week)

What will happen to a combined EUR/USD floor at 1.10/0.90

Idea: The way is to stipulate that none of the two floors, EUR 1.10 and USD/CHF 0.90 can be breached.

The maximum losses:

A bit lower, since USD/CHF will be above 0.90 and not fall to 0.88 in the worst case.

Tags: Capital Controls,floor,franc,Gold,imported inflation,Jordan,money printing,negative interest,peg,Swiss National Bank,Switzerland,Switzerland Money Supply

1 comments

Adam Oldridge

2012-06-10 at 18:28 (UTC 2) Link to this comment

Hi,

Very interesting point of view. I am reading all your posts.

In my opinion the easiest way is to print CHF without a limit, till holdings become a problem. Than make a move like negative interest rates or any other short term move, to get rid of positions (use the situation to buy back the CHF with profits on ballance). After this step SNB can start again. Market doesn’t like a vacuum, speculators can wait but not years.

It’s rather speculative attitude, but all in all that is all about.

Regards,

Adam