4 future scenarios for the Swiss franc and the Japanese yen

For many people it is astonishing that the Swiss franc continuously rises against the euro, especially when markets are up. Is the CHF no safe-haven any more ?

This year the Japanese yen has strongly fallen against the major currencies. Together with the upturn in the US economy and an asset-purchase program by the Bank of Japan the Euro increased from levels from 97 to 110, giving up some gains to levels of 107 most recently.

The EUR/CHF reached a top on November 8th, 2011 of 1.2456, when a global recession was looming and markets were expecting a hike in the floor from the SNB. Since then an improving global economy has pushed the EUR/CHF down again and also the thread from the SNB.

The main currencies that fall in rising markets are the US dollar and the Japanese yen, the CHF however rises.

What are the differences between the CHF and the JPY ?

1) As opposed to Japan the net migration to Switzerland is positive. Swiss population increased by 1% in 2011, but the Japanese population remained steady. Especially well-educated and rich people migrate to Switzerland and increase the labour productivity whereas the working population in Japan decreases due to aging effects.

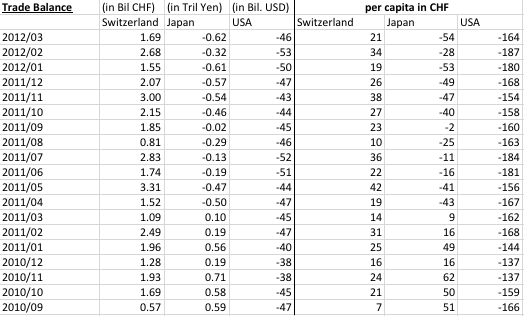

2) The Swiss trade balance is still positive and more or less on the levels of 2011, whereas Japan is seeing now a negative trade balance mainly due to increased energy imports: only 5 out of 54 atomic reactors are still in operation.

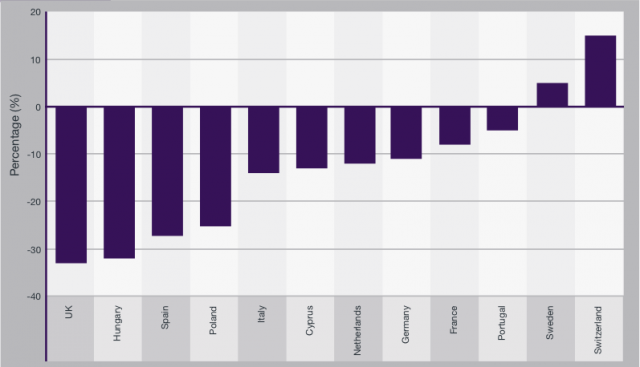

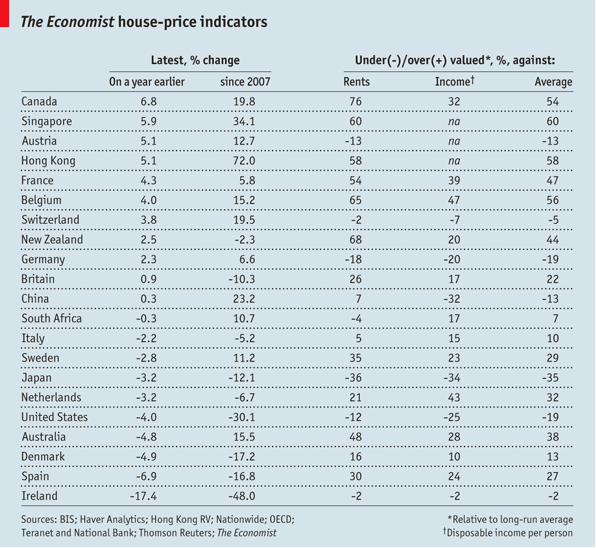

3) Swiss house prices are on the rise, whereas prices of most European countries and Japanese prices and rents are falling. The home price data from RICS shows that since 2007 Swiss house prices are increasing whereas European ones are falling.

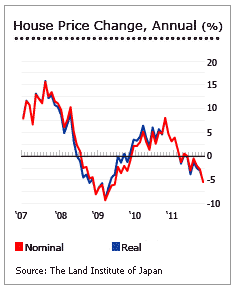

Thanks to cheap price levels and the repatriating of funds after the financial crisis Japanese land prices have risen between 2009 and 2011. The EUR/JPY fell from 170 in summer 2008 to 110 in 2010. Despite the strong yen, Japan grew by 4.5% in 2010. After Fukushima and with the global downturn in 2011 house price started to fall again.

We expect Japanese real estate prices to bottom out earlier than the ones in the US for several reasons:

– The time of the peak was a lot earlier than the peak in the US. In the meantime the housing supply overhang has reduced substantially and vendors have also reduced their price expectations. The supply overhang in the US will continue despite recent better news and rising rents in centers when young people move to their first home.

– House prices against income are undervalued by 34% in Japan and by 25% in the US, whereas they are overvalued in many European states with the exception of Germany and Switzerland.

– In the current low-interest environment risk-averse funds will not leave Japan.

For us the breakdown of the European housing market has only started with the recent price decrease in Ireland and Spain. Highly overvalued house prices in Italy, France and Belgium must adjust, when austerity measures, higher taxes and the big part of income paid for mortgages and rents will hit consumer spending. Prices in the stronger economies Germany and Switzerland, on the other side, will continue to rise from its undervalued levels.

4) Thanks to several years of deflation the yen is the preferred funding currency for investments into higher-yielding currencies. For the Swissie it is different: still in June 2011 the SNB thought about hiking rates.

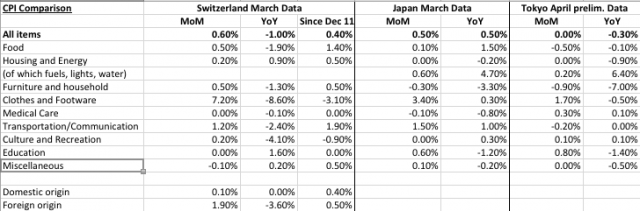

Switzerland shows a rising MoM inflation, whereas Japan recently managed to reach positive 0.5% inflation in March thanks higher import costs due to the weaker yen and rising oil prices. A stronger yen in April (see Tokyo area), however, saw prices fall again.

Especially the rise of products of domestic origin since December 2011 shows that inflation is still a danger for the SNB, if they really decide to maintain the floor over the long-term.

We expect Swiss YoY inflation to top at 1% in August/September 2012, when the effects of the EUR/CHF floor introduction one year earlier get incorporated in the statistics and to slow down again to 0.5%. It will be very interesting, if the SNB will be able to hold the floor during these months.

The positive Japanese inflation in March is for us a one-time effect at least this year. Based on the assumption that Japanese house prices and the global economy will slowly recover, the 1% inflation target of the Bank of Japan might become real. The point in time, however, is unclear yet, rents are falling again. Rents make up 19% of the CPI, but are implicitly contained in the pricing of many other goods.

In the meantime the yen continues to be the funding currency of any carry trade.

5) Rising commodity prices let the Swissie rise against the euro and the yen fall.

Japan’s reliance on foreign oil let the yen fall when oil goes up, whereas Switzerland is sufficiently immune thanks to local energy production and effective energy saving. Moreover Swiss multi-international companies take profits in the emerging markets and move parts of the profits taking benefit of the Swiss tax privileges, especially when sales departments are situated in Switzerland. Higher growth in the emerging markets correlate with higher commodity prices.

Conclusion:

The Swiss franc is effectively only partially a safe-haven. We consider four scenarios:

Scenario 1) Strong rebound of the global economy, return to usual bond yields in the US and Europe.

We give this case a low probability and do not expect it before 2016: In this case JPY and partially the CHF will devalue against the Euro again.

Scenario 2) Rising global economy and commodity prices based on the growth of China, the other BRICS and Germany (like in 2011), continued slow growth in the US:

We expect the EUR/CHF floor to break very quickly, because Swiss inflation will be increasing. The swiss economy will outperform again. We give this case a lower probability at least in 2012: The reason is that high interest rates prevent a further strong increase of local investments in the BRICS. However a hard landing seem to be prevented. We think that a similar strong growth in the BRICS as in 2010/2011 will return not before 2014.

Scenario 3) Continuing problems in the euro zone, but somewhat stronger growth in the United States:

Since the Swiss exporters are very globally oriented and Swiss products are not very price-sensitive, Switzerland will be dragged into the euro crisis only partially. European safe-haven demands will drive the EUR/USD and partially the EUR/CHF exchange rate down, the SNB will continue to defend the floor. Less safe-havens demands from the US will help the SNB. A strong increase of the USD will make Swiss exporters more competitive. The EUR/CHF floor will break, but it will take two to three years. We think that this scenario is the most probable one for 2012.

Scenario 4) Global depression, when the downward pressure of euro crisis is stronger than upwards beat in the US.

Switzerland will be dragged into the depression, deflation will reign. Thanks to cheap oil price the Yen will appreciate, the EUR/CHF might rise thanks to continued fear of the SNB. We give this scenario the second highest probability after scenario 3.

Tags: Bank of Japan,Carry Trade,China,Deflation,Euro crisis,franc,Japan,Japanese yen,Real Estate,Safe-haven,Swiss National Bank,Switzerland,Switzerland inflation,Switzerland Trade Balance,Tax