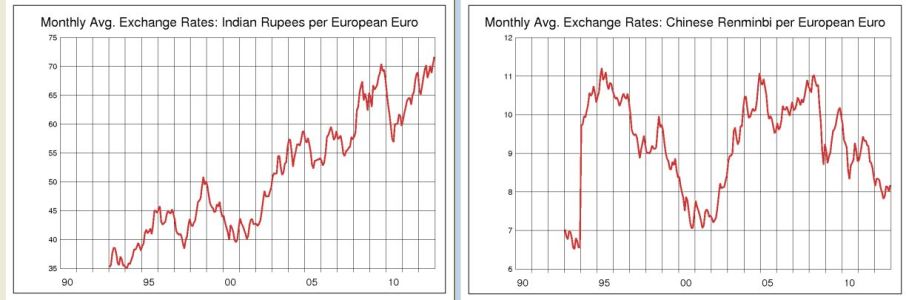

This post is motivated by recent headlines suggesting that the Chinese yuan has depreciated in recent days. Here's an example: China's yuan weakens to 5-1/2 low as c.bank tolerates depreciation. This headline is completely inaccurate - the Chinese yuan has been appreciating in recent days. So that's one problem I'd like to fix.

Read More »

Category Archive: 4.) FX Theory

(5.6.1) Crowther’s Balances and Imbalances of Payments: METI Paper

The former chief editor of "The Economist" Geoffrey Crowther published a great work on the development of balance of payments and current accounts over the long-term. It divides development into six phases, which are analogous to Shakespeare's seven phases of life.

The seven stages are:

Young debtor nation, Mature debtor nation, Debt repayment nation, Young creditor nation, Mature creditor nation, Credit disposition /Asset Liquidation nation and...

Read More »

Read More »

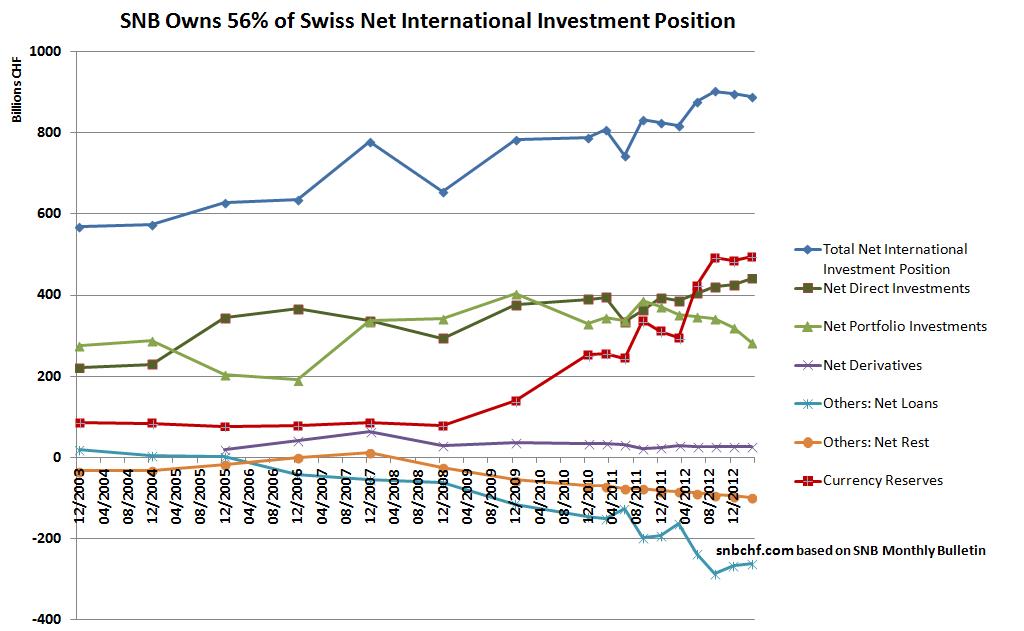

(10.1.2) Net International Investment Position Switzerland and Italy

We compare aspects of the Net International Investment Positions for Italy and Switzerland

Read More »

Read More »

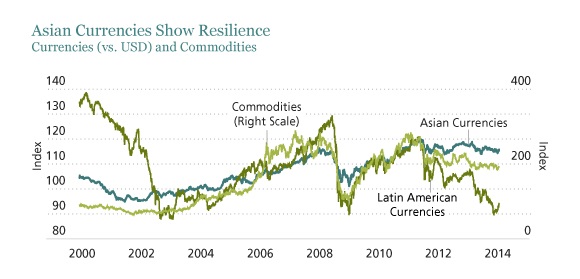

(1) What Determines FX Rates?

The effects of so-called “currency wars” and other central bank actions are small compared to the long-term impact made by these five catalysts, which include credit cycles, trade balance, differences in economic growth, and more.

Read More »

Read More »

(1.2) Explaining price movements in FX rates

We indicate the main factors that influence FX rates in the longer term. We explain the movements of currencies based on these factors.

Read More »

Read More »

(2) FX Theory: Purchasing Power Parity

An economic theory that estimates the amount of adjustment needed on the exchange rate between countries in order for the exchange to be equivalent to each currency's purchasing power.

Read More »

Read More »

(2.2) Purchasing Power Parity: Big Mac and Starbucks Tall Latte

The following table compares the Big Mac and the Starbucks Tall Latte index among different countries. It explains the issues with these measurements.

Read More »

Read More »

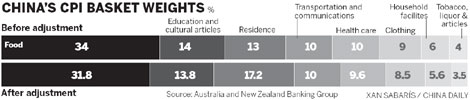

(2.3) Differences in global CPI baskets

Typically poorer countries have a basket with a higher weight for food and other consumption goods, but richer states give them a smaller weight. Here the full details over different countries

Read More »

Read More »

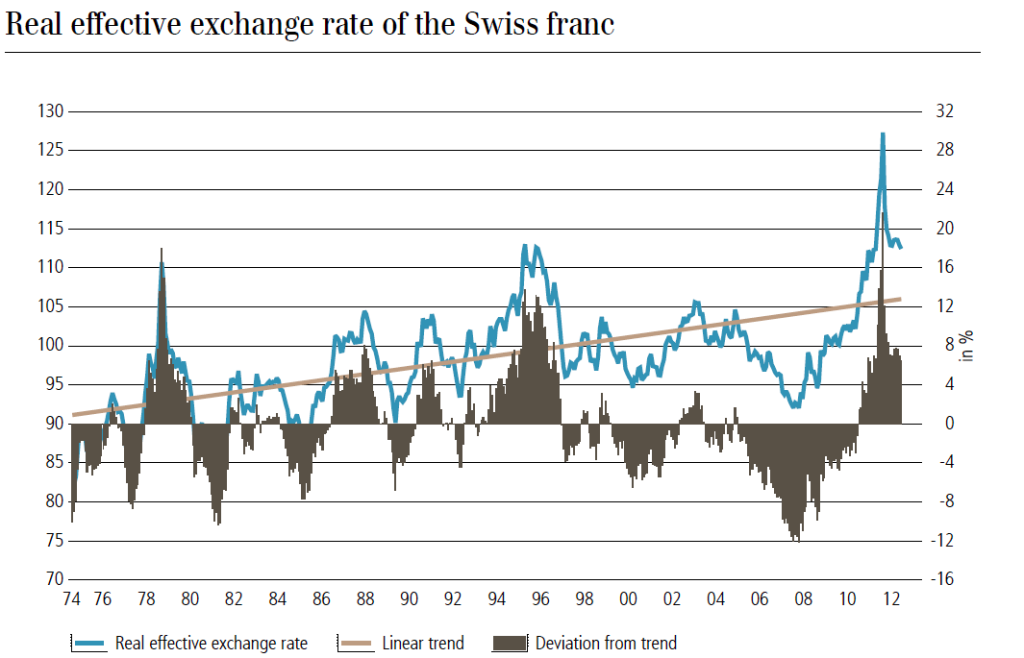

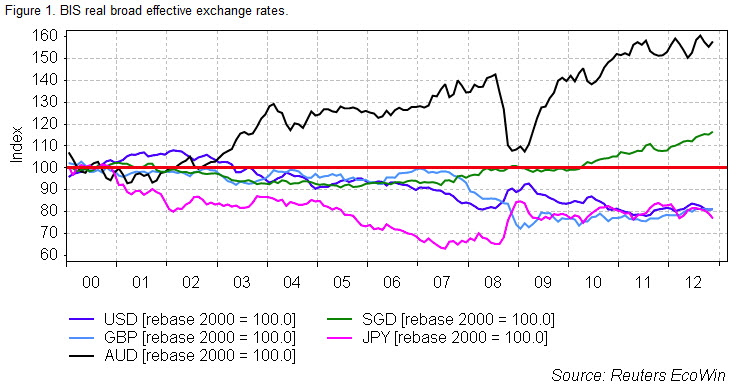

(2.5) Real Effective Exchange Rate, Swiss Franc, Yen and Renminbi

The weighted average of country's currency relative to index or basket of other major currencies adjusted for inflation. We explain the Real Effective Exchange Rate for the Franc, the Yen and Renmimbi

Read More »

Read More »

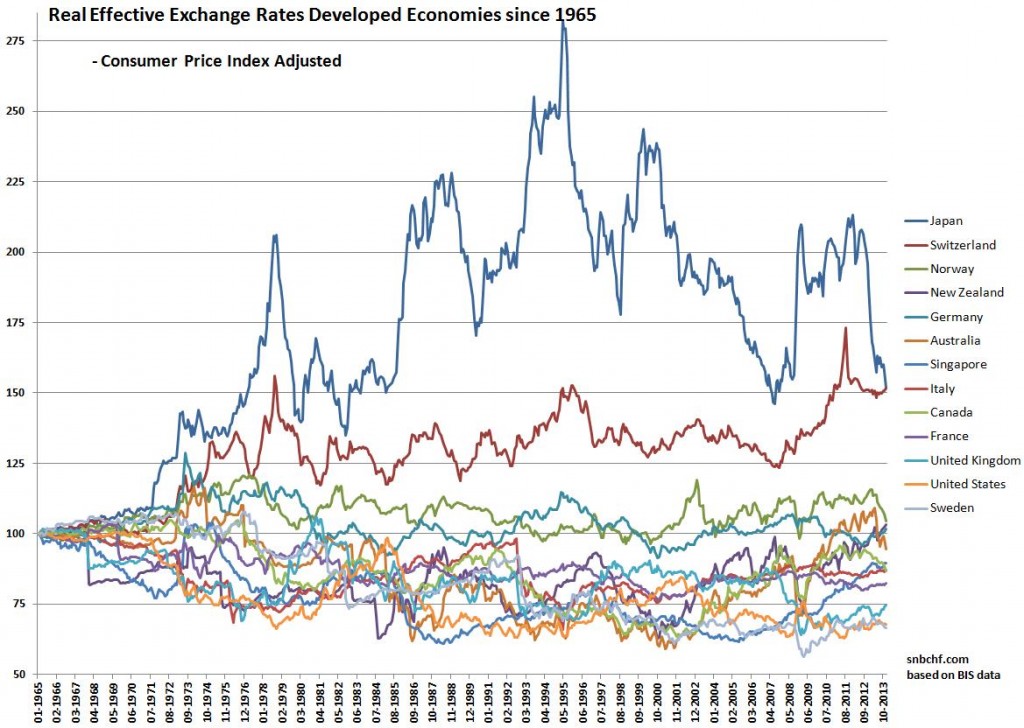

(2.6) CPI-based Real Effective Exchange Rate Since 1965: Yen Still Most Overvalued Currency

If we calculate Real Effective Exchange rates on the base year 1965, the Japanese yen remains the most overvalued currency.

This analysis is based on the real effective exchange rate (REER) provided by the Bank of International Settlement (BIS) and a consumer price-index adjusted exchange rate.

The real value of the yen is around 50% higher than 1965, the same applies to the Swiss franc.

Read More »

Read More »

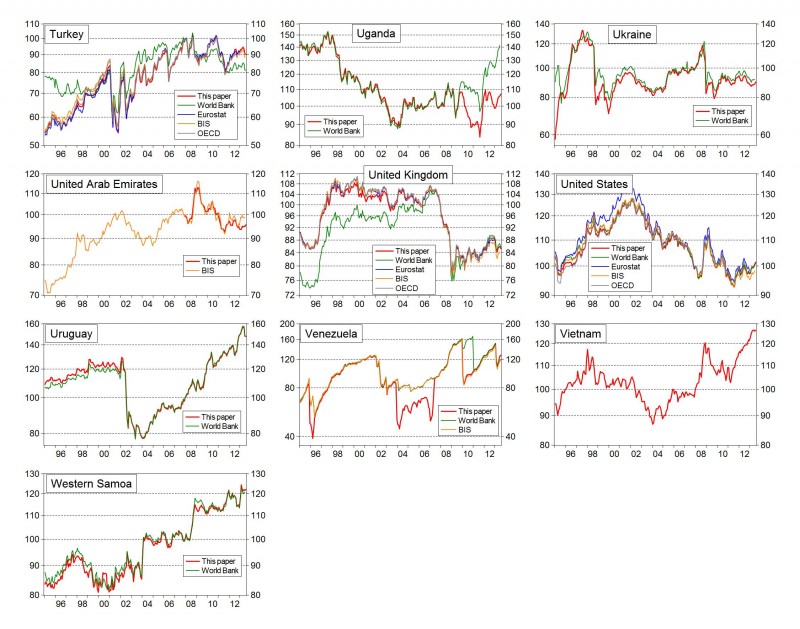

(2.7) The Most Complete Real Effective FX Rate Comparison

In August 2013 the Bruegel blog offered one of the best comparison of long-term real effective exchange rates (REER). The data is CPI based and therefore not as good as the producer price index (PPI) that reflects tradable goods better.

However the data is huge with three different sources - BIS, World Bank, Eurostat, OECD and Bruegel. The data indicates how the real value of the currencies of China and many other Emerging Markets (EM) have...

Read More »

Read More »

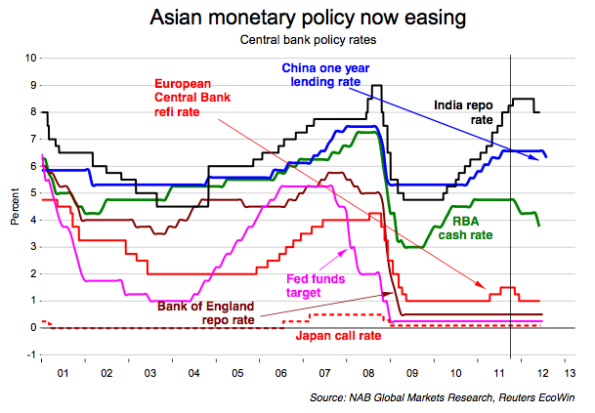

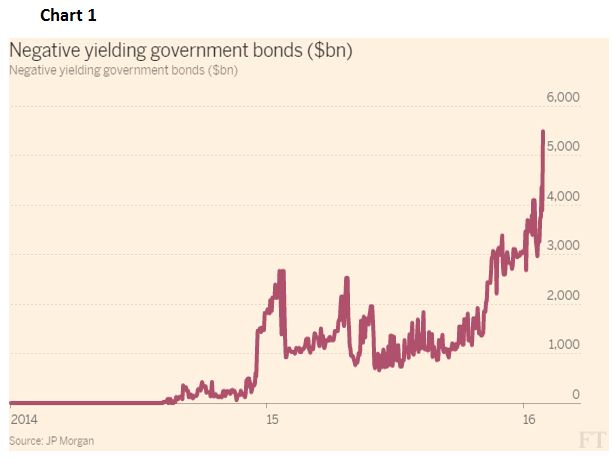

(3) Inflation, Central Banks and Interest Rates

In this chapter we connect three related concepts: inflation, central banks and interest rates.

Read More »

Read More »

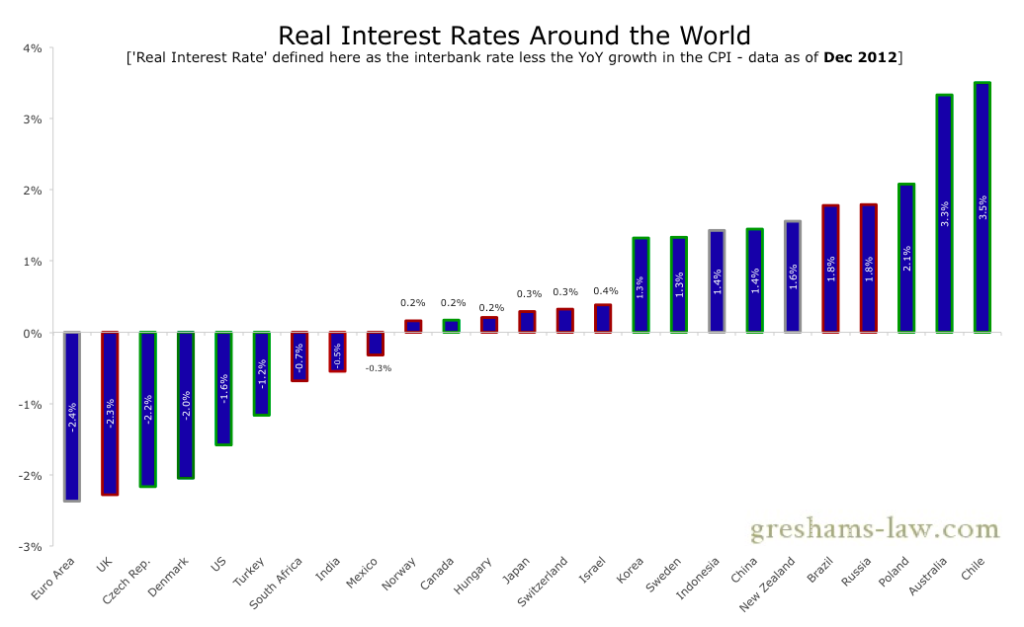

(3.1) FX Theory: Interest Rate Parity

The interest rate parity gives a mathematical explanation for the purchasing power parity and real effective interest rates

Read More »

Read More »

(4) The Main FX Trading Strategies

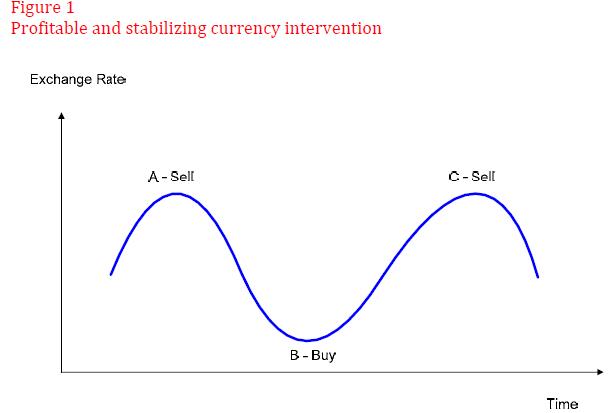

Carry Trades, Central Bank Interventions, Fundamental Data, mean reversion, Momentum Trades, Overshooting, trend following

Read More »

Read More »