Lance Roberts

My articles My offerMy siteAbout meMy videosMy books

Follow on:TwitterSeeking AlphaFacebookAmazon

| ➢ Listen daily on Apple Podcasts: https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757 ➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel: www.youtube.com/c/TheRealInvestmentShow ➢ Upcoming personal finance free online events: https://riaadvisors.com/events/ ➢ Sign up for the Newsletter: https://realinvestmentadvice.com/newsletter/ ➢ RIA SimpleVisor: Analysis, Research, Portfolio Models, and More. https://www.simplevisor.com/register-new Visit our Site: www.realinvestmentadvice.com Contact Us: 1-855-RIA-PLAN https://twitter.com/RealInvAdvice https://twitter.com/LanceRoberts https://www.facebook.com/RealInvestmentAdvice/ https://www.linkedin.com/in/realinvestmentadvice/ #Markets #Money #Investment_Advice |

You Might Also Like

The Fed’s New Form of QE

The Fed’s New Form of QE

2024-03-19

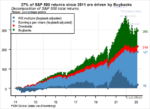

There’s a definite correlation between changes in stock buybacks and changes in market performance. With the closure of the stock buyback window by the blackout period, the effects will be interesting, especially with the prevailing attitudes in an over-extended market. We also notice Bitcoin is having an excellent correction. ance and Michael discuss the Fed’s Dot Plot and plans for Quantitative Easing: Which problem is easier to fix: Creating recession or inflation? Bank of Japan is ending it’s policy of negative rates; what will be the effect on the US? What’s the risk to the currency carry trade? Japan’s demographic problem. Is the Fed formulating a new type of QE? What QE does; is it inflationary? What the Fed can do; the stealth form of QE: Will it provide liquidity to markets?

Blackout Of Buybacks Threatens Bullish Run

Blackout Of Buybacks Threatens Bullish Run

2024-03-19

With the last half of March upon us, the blackout of stock buybacks threatens to reduce one of the liquidity sources supporting the bullish run this year. If you don’t understand the importance of corporate share buybacks and the blackout periods, here is a snippet of a 2023 article I previously wrote.

Valuation Metrics And Volatility Suggest Investor Caution

Valuation Metrics And Volatility Suggest Investor Caution

2024-03-05

Valuation metrics have little to do with what the market will do over the next few days or months. However, they are essential to future outcomes and shouldn’t be dismissed during the surge in bullish sentiment. Just recently, Bank of America noted that the market is expensive based on 20 of the 25 valuation metrics they track.

How to Avoid the Retirement Income Death Spiral (1/12/24)

How to Avoid the Retirement Income Death Spiral (1/12/24)

2024-01-12

(1/12/24) Hosted by RIA Advisors’ Director of Financial Planning, Richard Rosso, CFP, w Senior Financial Advisor, Danny Ratliff, CFP

Produced by Brent Clanton, Executive Producer

——–

Register for our 2024 Economic Summit: Navigating Markets in a Presidential Cycle:

https://www.eventbrite.com/e/ria-advisors-economic-summit-tickets-703288784687?aff=oddtdtcreator

——–

The latest installment of our new feature, Before the Bell, "Markets Prepare for the Q4 Earnings Parade,"is here:

&list=PLwNgo56zE4RAbkqxgdj-8GOvjZTp9_Zlz&index=1

——-

Our previous show is here: "Could You Live Solely on Social Security?"

&list=PLVT8LcWPeAugpcGzM8hHyEP11lE87RYPe&index=1

——–

Articles Mentioned in this Show:

"The Goldilocks Narrative Reigns For Now"

What the Latest Fed Minutes Mean

What the Latest Fed Minutes Mean

2024-01-04

(1/4/24) Santa fails to deliver at Broad & Wall Street; Economic data is coming: Is employment softening? January declines decimate December’s gains: This is the correction we needed, but stocks are still trading above their 50-DMA. Fed Meeting minutes: What about QT or a taper? The Fed seems to be looking for moderation to keep things from getting out of control. The Fed is alluding to seeing something no one else does, but not saying what. Hunting on the border with StarLink ; pressure for market sell-off on large stocks; what about the other 493 stocks in the S&P? Is the shift temporary? Market Champions & Super Bowl Teams: Rarely repeat back-to-back wins. Customer defections from streaming services: Could this be the next leading economic indicator? The flaws in "the data:" looking

The Dash for Trash: FOMO & The Bandwagon Effect

The Dash for Trash: FOMO & The Bandwagon Effect

2023-12-21

(12/21/23) It’s the final live-show of 2023: We look at New Year’s market indicators, the Super Bowl & the Bandwagon Effect; someone will be wrong next year. Economic data is starting to improve, which will be problematic for the Fed. The "worst market sell-off since September(!)" Simmer down; this has been expected. Market gains were "Gone in 120-minutes," less time than the movie. The dash for trash: FOMO & the Bandwagon Effect. What does the Fed know that they’re not telling? Some turbulence ahead: Expect a soft landing to be "bumpy." Headwinds will come from the lag effect of the Fed’s liquidity injections. Watch for volatility, epecially if the Fed has to raise rates to combat rising inflation; what happened to home sales? From Enron to the SPAC’s: Where were the auditors? How the

Has Market Exuberance Gotten Out of Hand? (12/18/23)

Has Market Exuberance Gotten Out of Hand? (12/18/23)

2023-12-18

(12/18/23) It’s the week before Christmas and on Broad & Wall, though Lance’s shopping list is empty, he’s not hitting the mall! Did markets mistake what Jerome Powell really said last week? The current market rally is long in the tooth: 7-weeks running a buying stampede; correction is inevitable. 46% of S&P is at all-time highs. Will markets drift higher through the end of the year? Santa Claus Rally defined (it extends into January). Has market exuberance gotten out of hand? How much more salary would make you happy? What Dave Ramsey IS right about: Getting out of debt. Stock ownership is on the rise: Almost back to where it was pre-1999.

Hosted by RIA Advisors’ Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

2:57 – Correction is Coming

Banking Rules & Blockchain Fears

Banking Rules & Blockchain Fears

2023-12-07

(12/28/23) Newly proposed rules for raising major banks’ reserve requirements are raising the ire of Bank CEO’s like JPMorgan/Chase’s Jamie Dimon. Boo-hoo. either get completely under government control, or exist as independent private business, and be allowed to fail without bailouts. Why the government wants to force banks to hold more reserves: Buy more bonds. Bitcoin: Why is Dimon so opposed? The alternative to banking. The difference between Bitcoin vs Blockchain; Crypto is the ultimate fiat currency, backed by nothing. Why Dimon should fear blockchain.

Hosted by RIA Advisors’ Chief Investment Strategist Lance Roberts, CIO, w Portfolio Manager Michael Lebowitz, CFA

Produced by Brent Clanton, Executive Producer

——–

Watch today’s show on our YouTube channel:

Tags: Featured,newsletter

7 pings

Skip to comment form ↓