Tag Archive: yield

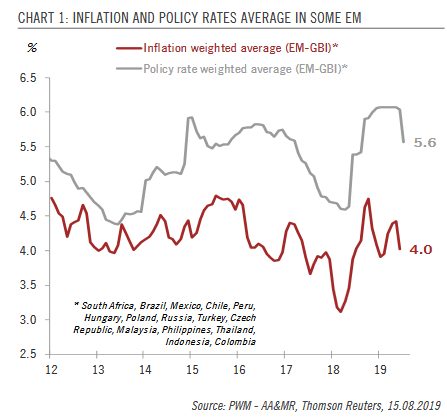

Emerging market sovereign debt update: yields are falling

Yields have fallen significantly in the EM sovereign bond space in local currency; USD movements will be key to watch for going forward.Yields have fallen impressively in the emerging market (EM) sovereign bond space in local currency, reaching 5.3% on 16 August, near their all-time low of 5.2% (in May 2013). This downward movement has been partly driven by the recent policy rate cuts of some EM central banks.

Read More »

Read More »

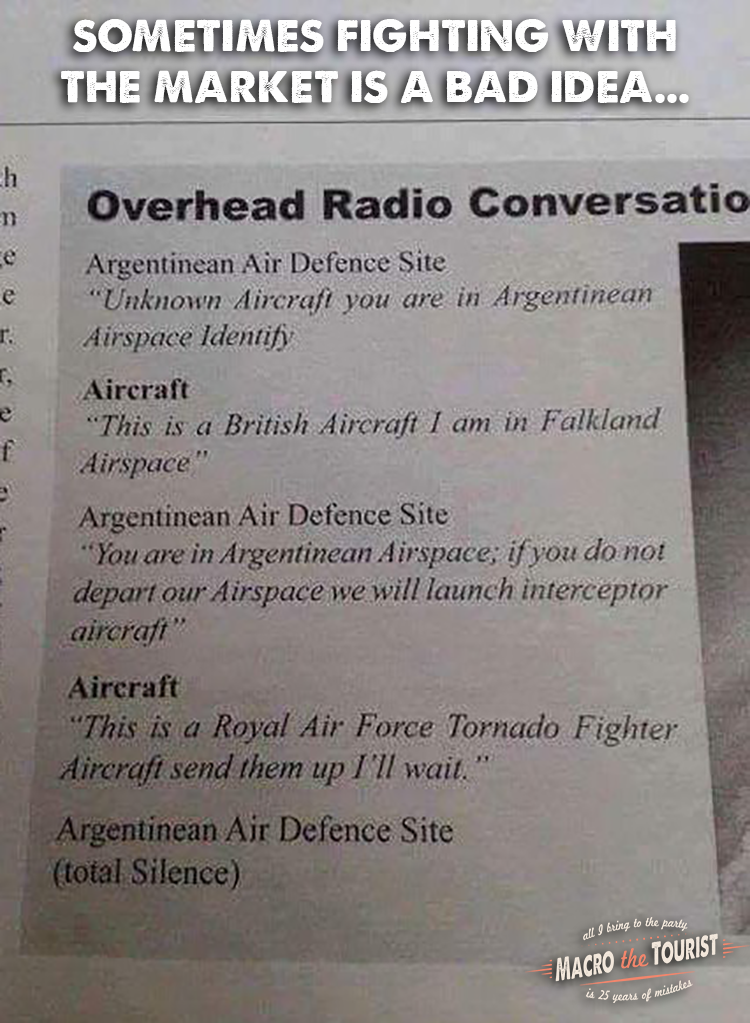

Is This The Best Way To Bet On The Fed Losing Control Of The Bond Market?

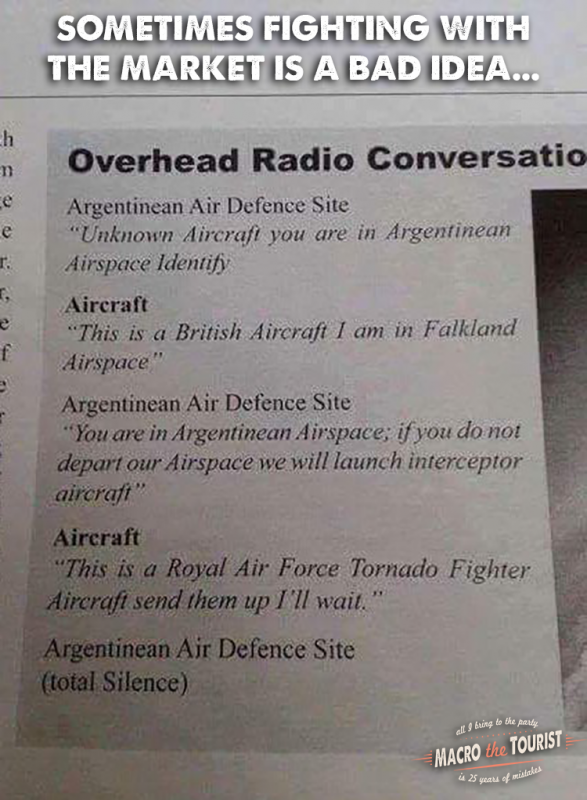

Authored by Kevin Muir via The Macro Tourist blog, Lately, one of my biggest duds of a call has been for the yield curve to steepen. Sure, I have all sorts of fancy reasons why it should steepen, but reality glares back at me in black and white on my P&L run. Sometimes fighting with the market is an exercise in futility.

Read More »

Read More »

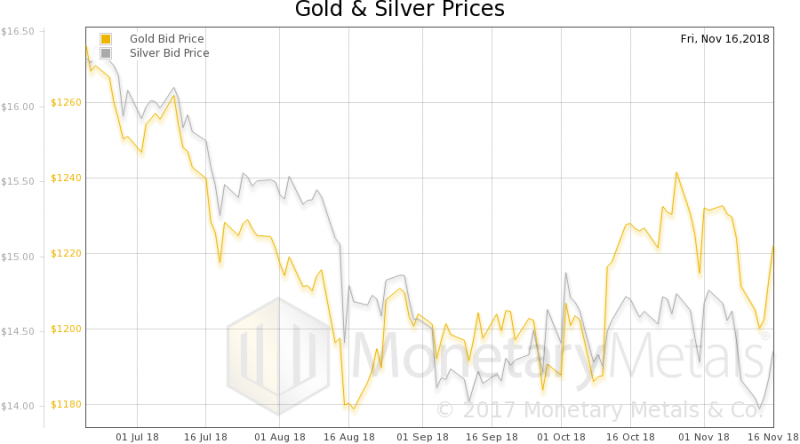

Swiss 10 year bond yields still negative, but approaching zero.

The global bond rout returned with a bang, sending 10Y US Treasury yields as much as six basis points higher to 2.53%, the highest level in over two years. The selloff happened as oil prices surged by more than 5% following Saturday's agreement by NOPEC nations agreed to slash production, leading to rising inflation pressures. At last check, the 10Y was trading at 2.505%, up from 2.462% at Friday and on track for its highest close since September...

Read More »

Read More »

666: The Number Of Rate Cuts Since Lehman

BofA's Michael Hartnett points out something amusing, not to mention diabolical: following the rate cuts by the BoE & RBA this week, "global central banks have now cut rates 666 times since Lehman."

Read More »

Read More »

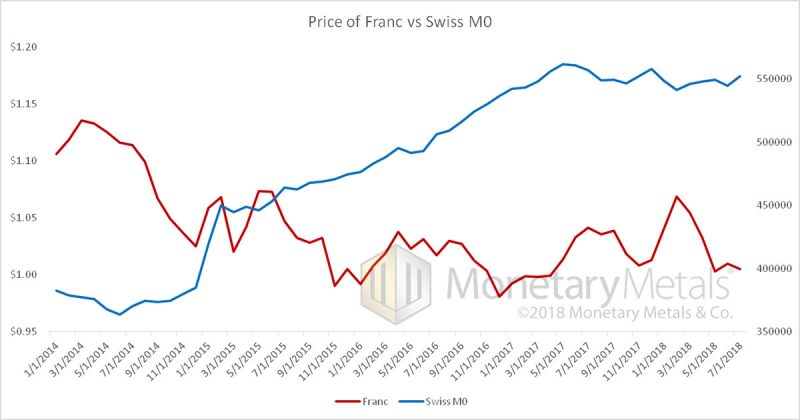

With Daily Record Lows: Chart of German Bund Yields Since 1977

The German Bund chart is very important for us, because the Swiss franc is negatively correlated to German government bond yields. The lower Bund yields, the stronger the Swiss Franc. When European governments and the ECB are ready to pay higher interest rates, then CHF depreciates.

Read More »

Read More »

What Drives Government Bond Yields?

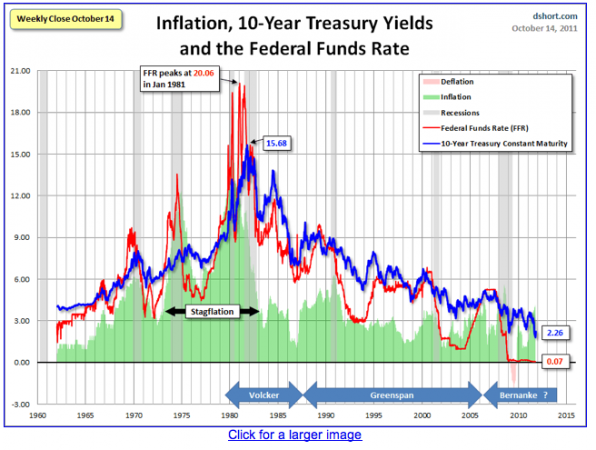

For us the five major drivers of government bond yields are:

Inflation expectations and inflation: The by far most important criterion. High inflation expectations must be compensated via higher bond yields. The main driver behind inflation expectations is the wage development, this is the form of inflation that typically persists. Price inflation follows inflation expectations with a certain lag.

Wealth: The higher the wealth of a country, the...

Read More »

Read More »

Is the Safe-Haven Government Bond Bubble Finally Bursting?

The Safe-haven government bond bubble did not pop, but Italy or Spain have become low yielders as well

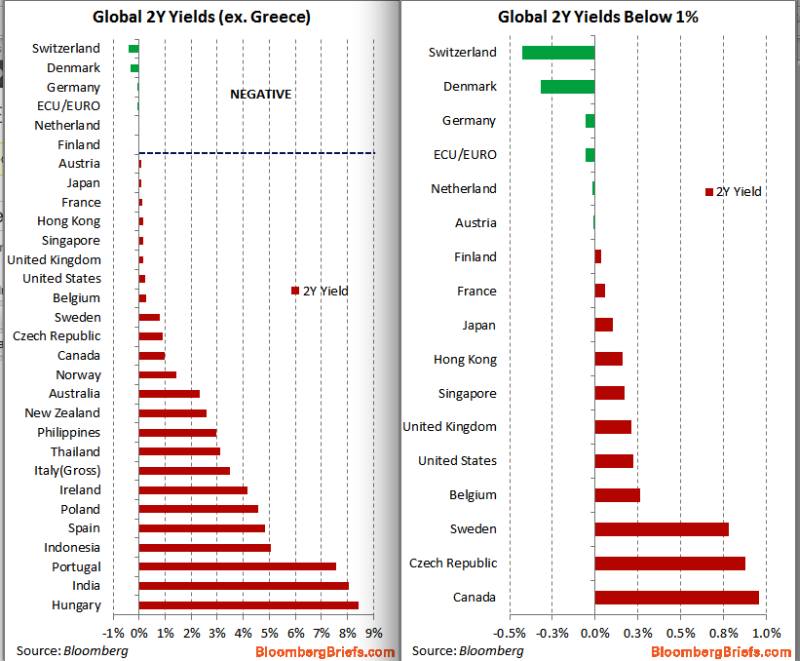

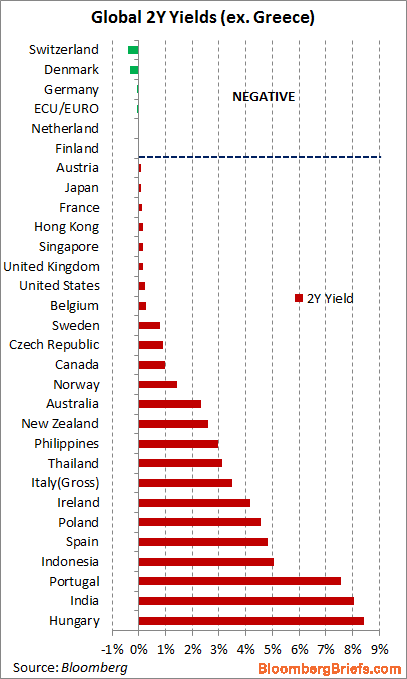

Government bond yields under 10 years for safe-havens are close to zero. In April 2013, even 20 year bond yields are less than 3%, What can explain this bubble of the century?

Read More »

Read More »

Negative and Close to Zero Yields of Government Bonds and the Reasons

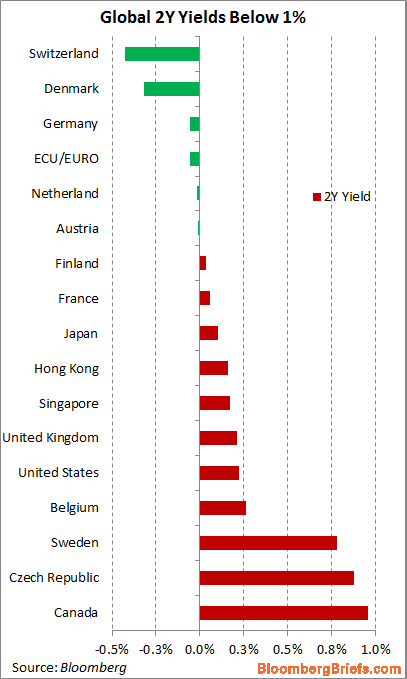

We judge that negative or close to zero yielding government bonds reflect three points: Risk off environment, long-run currency gains on currency with low inflation, insufficient supply of government bonds for bank refinancing purposes.

Read More »

Read More »

The Biggest Bubble of the Century is Ending: Government Bond Yields

Government bond yields under 10 years for safe-havens are close to zero. In April 2013, even 20 year bond yields are less than 3%, What can explain this bubble of the century? Update August 16, 2013: So, 10-year Treasury yields have ended the day closer to 3 per cent. But not as close as they … Continue reading »

Read More »

Read More »

German Schatz turns negative again

After the first time End May, the German Schatz turns negative:

German June 2014 Schatz Average Yield -0.06% vs 0.10% on June 20

Swiss Eidgenossen 2yrs still at -0.4%

Read More »

Read More »