Tag Archive: #USD

FX Daily, March 31: March Ends like a Lion, No Lamb in Sight

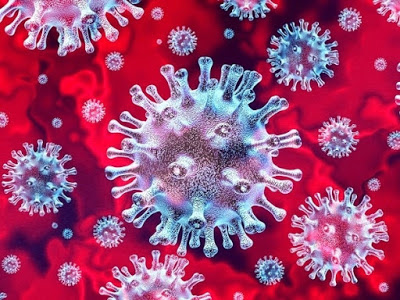

Overview: The coronavirus plague upended the world in March. Equities are finishing the month on a firm note. Strong gains in the US yesterday and an unexpectedly strong Chinese PMI (yes, to be taken with the proverbial grain of salt) helped lift most Asia Pacific and European markets today. Japan and Australia are exceptions to the generalization.

Read More »

Read More »

FX Daily, March 30: Monday Blues

Overview: Risk appetites remain in check as the spread of the coronavirus is leading to more and longer shutdowns. Asia Pacific equities fell with Australia, the notable exception. Its benchmark rallied a record 7%, encouraged by additional stimulus measures.

Read More »

Read More »

FX Daily, March 27: Nervousness Ahead of the Weekend

Overview: Officials appear to have persuaded investors that they have put into place measures that will cushion the economic blow and ensure that the financial system continues to function. After seemingly goading officials into action, investors are choosing not to resist. Moreover, there is a recognition that many programs are scalable.

Read More »

Read More »

FX Daily, March 26: Rumor Bought, Fact Sold

Overview: Speculation that the US Senate would pass the large stimulus bill worth around 10% of US GDP is thought to have fueled a bounce in equities in recent days. The bill was approved and will now go to the House, where a vote is expected tomorrow. If the rumor was bought, the fact has been sold. The first to crack was the Asia Pacific region.

Read More »

Read More »

FX Daily, March 25: Relief, but…

Overview: Global equities are marching higher. While the Dow Jones Industrials posted its biggest advance since 1933, the US is lagging behind other leading benchmarks. The MSCI Asia Pacific advanced, led by Japan's Nikkei's 8% gain. It was third consecutive gain, during which time the Nikkei has rallied 17%. Europe's Dow Jones Stoxx 600 is up about 3.5% after bouncing 8.4% yesterday.

Read More »

Read More »

FX Daily, March 24: Relief Bounce On Tuesday, but Turn Around not Secure

Overview: Bottom-picking, after officials step up efforts and some optimism creeps in, is helping lift spirits today. As one looks at the equity bounces, it is important to remember that among the biggest rallies take place in bear markets. Nearly all the bourses in Asia-Pacific rallied, led by a 7% advance by Japan's Nikkei and an 8%+ surge in South Korea's Kospi. Most other markets were up 2%-5%.

Read More »

Read More »

Conference Call Replay

Here is the link for the replay of the conference call I hosted earlier today. I shared two ways in which this crisis is different from what we have seen in the last generation. Unlike the Great Financial Crisis, the tech bubble, and the S&L Crisis, the current crisis did not begin in the financial sector, but the real economy.

Read More »

Read More »

FX Daily, March 23: Greenback Demand Not Satisfied by Swap Lines

Overview: In HG Wells' "War of the Worlds," the common cold repelled a Martian invasion. Now, a novel coronavirus is disrupting everything and everywhere. Global equities continue to get hammered, though the apparent relative resilience of Japan may have spurred some buying of Japanese equities.

Read More »

Read More »

FX Daily, March 20: Markets Ending the Week on Better Note

Overview: Dramatic price action continues but in the other direction. Stocks and bonds have rallied strongly, and the US dollar is snapping a strong advance with a sharp and broad setback. The immediate trigger is hard to identify. Some accounts linking it to fears that the California shutdown will be repeated throughout the country, deepening the coming downturn.

Read More »

Read More »

FX Daily, March 19: ECB’s Bazooka Support Bonds but not the Euro

Overview: It is not just that the dollar soared while stocks and bonds continued to plunge. The dollar's strength is, in effect, a powerful short-covering rally. It was used to fund a great part of the global circuit of capital. The circuit of capital is in reverse now, and the funding currency is being bought back. The dollar's strength is a function of the sell-off of other assets.

Read More »

Read More »

FX Daily, March 18: Bonds Join Equities in the Carnage

Overview: A new phase of the market turmoil is at hand. Bonds are no longer proving to be the safe haven for investors fleeing stocks. The tremendous fiscal and monetary efforts, with more likely to come, have sparked a dramatic rise in yields. Meanwhile, equities are getting crushed again.

Read More »

Read More »

FX Daily, March 17: Even Turn Around Tuesday is Flat

Overview: While the markets are not as disorderly as they have been, the tone is fragile, and the animal spirits have been crushed. Australian stocks fell more than 10% last week and dropped another 9.7% yesterday before rebounding by almost 6% today to be one of the few Asia Pacific equity markets to rise. The Nikkei eked out a small gain, but the broader Topix rose 2.6%.

Read More »

Read More »

FX Daily, March 16: Monday Blues: Fed Moves Bigly and Stocks Slump

Overview: The Federal Reserve and central banks in the Asia Pacific region acted forcefully, but were unable to ease the consternation of investors. The Reserve Bank of New Zealand cut key rates by 75 bp. The Bank of Japan appears to have doubled its ETF purchase target to JPY12 trillion, and the Reserve Bank of Australia is preparing for new measures that will be announced Thursday.

Read More »

Read More »

FX Daily, March 12: Trump Dump as Market Turns to ECB

Overview: After the Bank of England and the UK Treasury announced both monetary and fiscal support, the focus turns to the ECB, but the proximity of the US Congressional recess (next week) without strong fiscal measures being in place sucked the oxygen away from other issues. President Trump's national address in the Asian session failed to reassure investors.

Read More »

Read More »

FX Daily, March 11: US Over-Promises and Under-Delivers, while BOE Steps Up with 50 bp Rate Cut

Overview: The S&P 500 and Dow Jones Industrials sold off after the higher open and briefly traded below yesterday's lows. Investors seemed disappointed that the Trump Administration was not ready with specific policies after Monday's tease that had initially helped lift Asia Pacific and European markets earlier on Tuesday. This sparked a sharp decline in Europe into the close.

Read More »

Read More »

FX Daily, March 10: Markets Stabilize after Body Blow

Overview: It appears after a few days of miscues, US officials struck the right chord, and the global capital markets seemed to stabilize shortly after the US session ended. President Trump's press conference today is expected to spell out in greater detail relief for households and businesses. Asia Pacific equities rallied, led by a 3% surge in Australia.

Read More »

Read More »

FX Daily, March 9: Monday Meltdown

Overview: Equities plunged, and yields sank as the coronavirus threatens a global recession. The oil price war signaled by Saudi Arabia and Russia aggravates the desperate situation. Equities markets in the Asia Pacific region slumped 3-7%. The Shanghai Composite was fell 3%. The Nikkei was off by 5%, and Australia was hit among the hardest with a 7.3% loss.

Read More »

Read More »

FX Daily, March 06: Panic Deepens, US Employment Data Means Little

The sharp sell-off in US equities and yields yesterday is spurring a mini-meltdown globally today. Many of the Asia Pacific markets, including Japan, Australia, Taiwan, and India, saw more than 2% drops, while most others fell more than 1%. The MSCI Asia Pacific Index snapped the four-day advance had lifted it about 2.8% coming into today.

Read More »

Read More »

FX Daily, March 5: The Capital Markets YoYo Continues

Overview: The 4.2% rally in the S&P 500 yesterday helped lift Asia Pacific markets earlier today, and the five basis point backing up of the US 10-year yield pushed regional yields higher. However, the coattails proved short, and Europe's Dow Jones Stoxx 600 is snapping a three-day advance and is off about 1.3% in late morning turnover to give back yesterday's gains.

Read More »

Read More »

FX Daily, March 4: Equities Trade Higher, While Yields Continue to Fall

Overview: The G7 delivered up a nothing burger than was shortly followed by a 50 bp Fed cut. The equity market seemed to enjoy it briefly and extended Monday's dramatic gains, before falling out of bed. The S&P 500 lost about 2.2%, while the Dow Industrial slumped 3%, but shortly after the markets closed, equities began recovering, and the recovery carried over to the Asia Pacific region and Europe.

Read More »

Read More »