Tag Archive: USD-CNY

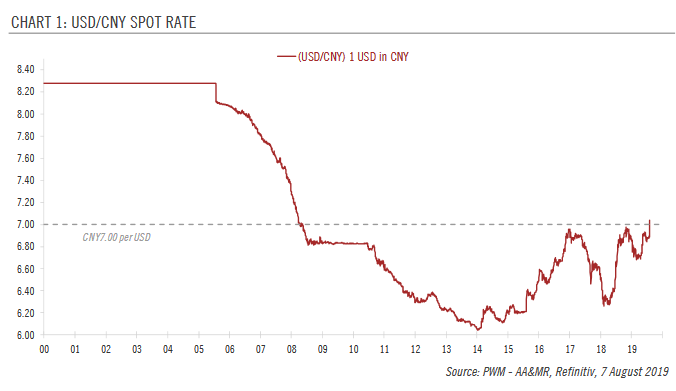

The US labels China a currency manipulator

The near-term impact will likely be limited but this is a clear negative for trade negotiations.Shortly after the renminbi’s sharp depreciation on Monday, the US Treasury Department labelled China a currency manipulator. This is the first time in 25 years that the US government has designated a country as a currency manipulator.According to the US Treasury Department, the decision was triggered by the perceived lack of action by the PBoC to resist...

Read More »

Read More »

For The First Time In 25 Years, China Has To Make A Choice Between External Stability And Growth

Back in August 2 we reported of a historic event for China's economy: for the first time in its modern history, China's current account balance for the first half of the year had turned into a deficit. And while the full year amount was likely set to revert back to a modest surplus, it was only a matter of time before one of the most unique features of China's economy - its chronic current account surplus - was gone for good.

Read More »

Read More »

China’s Pooh Lesson

It’s one of those “nothing to see here” moments for Economists trying not to appreciate what’s really going on in China therefore the global economy. The slump in China’s automotive sector dragged on through October, with year-over-year sales down for the fourth straight month.

Read More »

Read More »

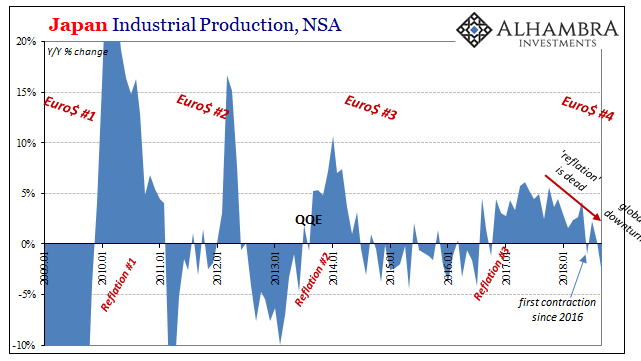

China Now Japan; China and Japan

Trade war stuff didn’t really hit the tape until several months into 2018. There were some noises about it back in January, but there was also a prominent liquidation in global markets in the same month. If the world’s economy hit a wall in that particular month, which is the more likely candidate for blame? We see it register in so many places. Canada, Europe, Brazil, etc.

Read More »

Read More »

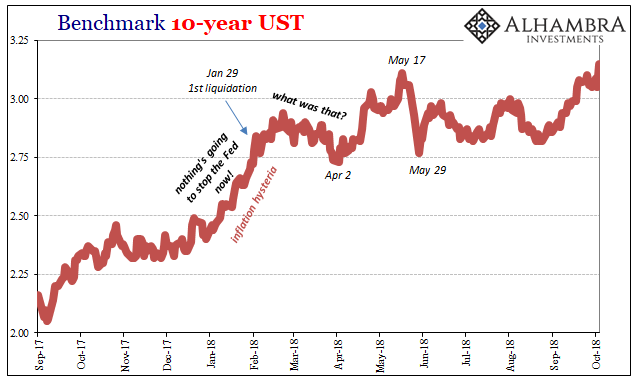

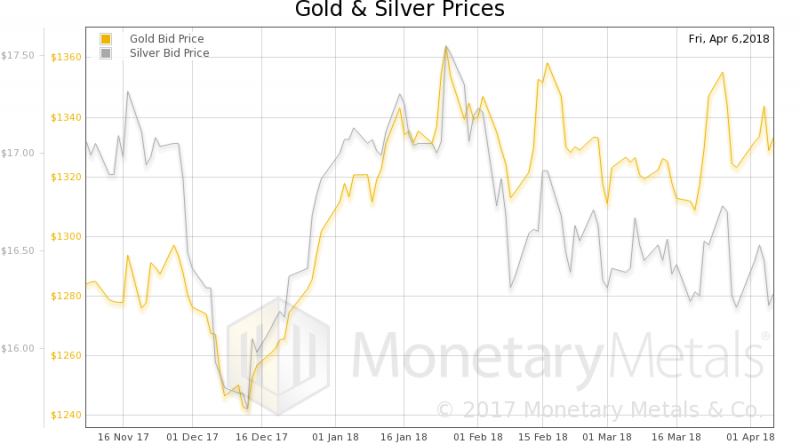

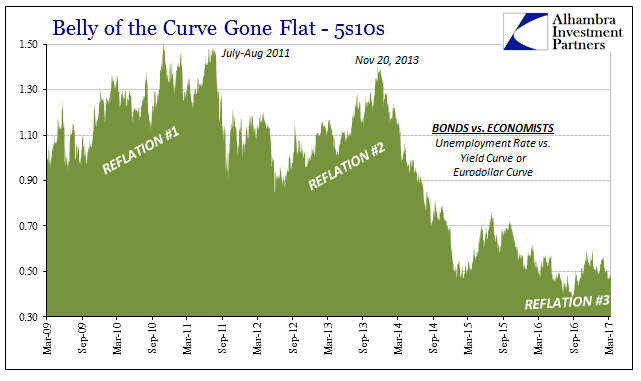

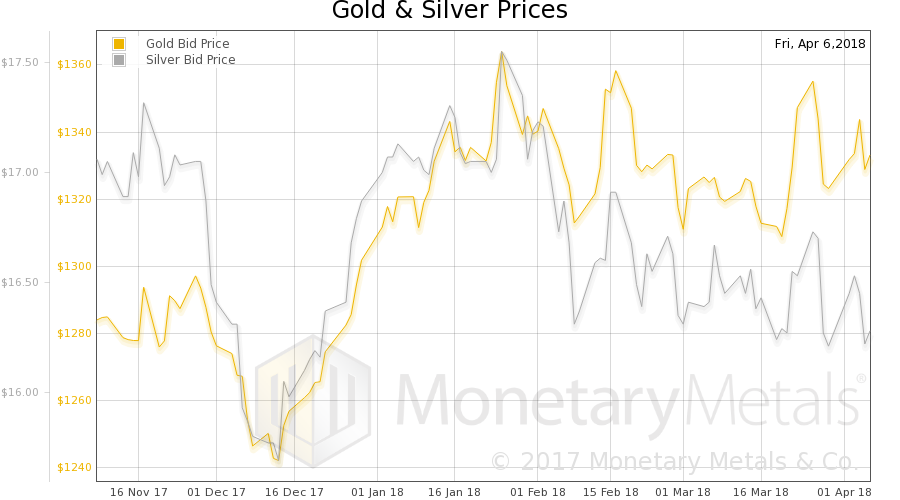

A Few Questions From Today’s BOND ROUT!!!!

On April 2, the benchmark 10-year US Treasury yield traded below 2.75%. It had been as high as 2.94% in later February at the tail end of last year’s inflation hysteria. But after the shock of global liquidations in late January and early February, liquidity concerns would override again at least for a short while. After April 2, the BOND ROUT!!!! was re-energized and away went interest rates.

Read More »

Read More »

Three Things that may Disappoint Investors

There are three areas that we suspect that many investors are vulnerable to disappointment. NAFTA, trade talks with China, and Powell speech at Jackson Hole on Friday. With problems elsewhere, the Trump Administration has been playing up the likelihood of an agreement as early as today with Mexico, which would be used, apparently to deliver a fait accompli to Canada.

Read More »

Read More »

China’s Seven Years Disinflation

In early 2011, Chinese consumer prices were soaring. Despite an official government mandate for 3% CPI growth, the country’s main price measure started out the year close to 5% and by June was moving toward 7%. It seemed fitting for the time, no matter how uncomfortable it made PBOC officials. China was going to be growing rapidly even if the rest of the world couldn’t.

Read More »

Read More »

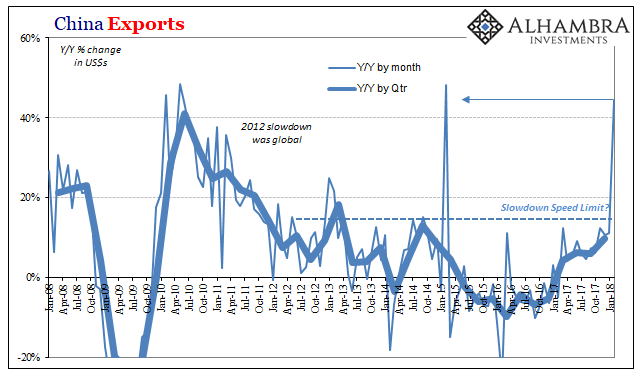

China Exports: Trump Tariffs, Booming Growth, or Tainted Trade?

China’s General Administration of Customs reported that Chinese exports to all other countries were in February 2018 an incredible 44.5% more than they were in February 2017. Such a massive growth rate coming now has served to intensify the economic boom narrative.

Read More »

Read More »

Petro-Yuan? Really?

The launch of futures on Bitcoins was rushed so quickly through the regulatory channels that the anticipation was short-lived. And as the recent price action amply demonstrates, the existence of a derivative market has not tamed the digital token's volatility. It is still the early days, but Bitcoin futures do not look likely to change the world.

Read More »

Read More »

Three Developments in Europe You may have Missed

The focus in Europe has been Catalonia's push for independence and the attempt by Madrid to prevent it. Tomorrow's ECB meeting, where more details about next year's asset purchases, is also awaited. There are three developments that we suspect have been overshadowed but are still instructive. First, the ECB reported that its balance sheet shrank last week. With the ECB set to take another baby step toward the exit, many are seeing convergence,...

Read More »

Read More »

Four Numbers to Watch in FX

The dollar's downside momentum faded today, but it has not shown that it has legs. Watch 96.45 in the DXY and $1.3055 in sterling. The US 2-year note yield is low, given expectations for overnight money. The US premium needs to widen.

Read More »

Read More »

Yen is the Weakest Currency in the World over the Past Month

Yen was the strongest currency in the world from mid-March to mid-April. Yen has been the weakest currency over the past month. US rates have risen relative to Japan. Japan has shifted away from QE and toward targeting interest rate.

Read More »

Read More »

More Thinking about Trade as Pence and Ross Head to Tokyo

Pence and Ross may "feel out" Abe for interest in a bilateral trade agreement. The US enjoys a small trade surplus with countries it has free-trade agreements. Ownership-based framework of the current account and value-added trade suggest the US trade imbalance is not a significant problem.

Read More »

Read More »

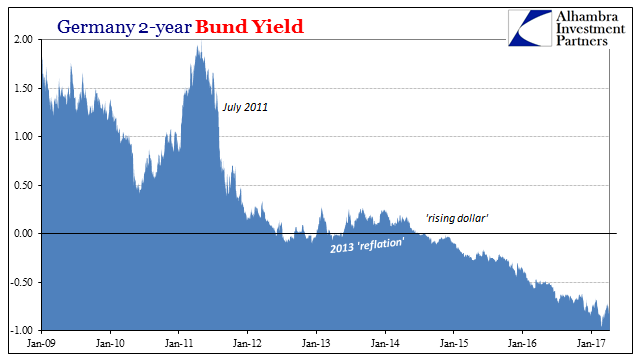

The Global Burden

Bundesrepublik Deutscheland Finanzagentur GmbH (German Finance Agency) was created on September 19, 2000, in order to manage the German government’s short run liquidity needs. GFA took over the task after three separate agencies (Federal Ministry of Finance, Federal Securities Administration, and Deutsche Bundesbank) had previously shared responsibility for it.

Read More »

Read More »

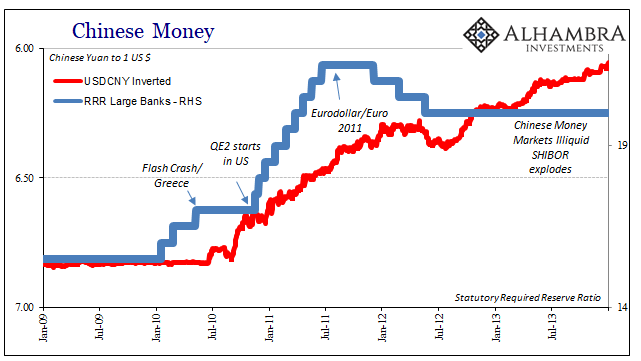

Non-Randomly Surveying RMB

China’s central bank, unlike other central banks, is constantly active almost never resting. Because it is always in motion, the PBOC can seem to be “adding” liquidity at the very same time it might be “draining” it. Its specific actions should never be interpreted as standalone procedures related solely to some unknown policy stance. That is particularly true given that we know what their stance is and has been – neutral.

Read More »

Read More »

Pressure, Sure, But From Where?

It may just be that in life you have to get used to disappointment. Though not for lack of trying, I have spent a great deal of time over the years intending to piece together exactly what happened on days like October 15, 2014. The official explanation is an obvious whitewash, one so haphazard that I doubt it will ever be referred to again outside of ridicule.

Read More »

Read More »

The Exiling of Risk

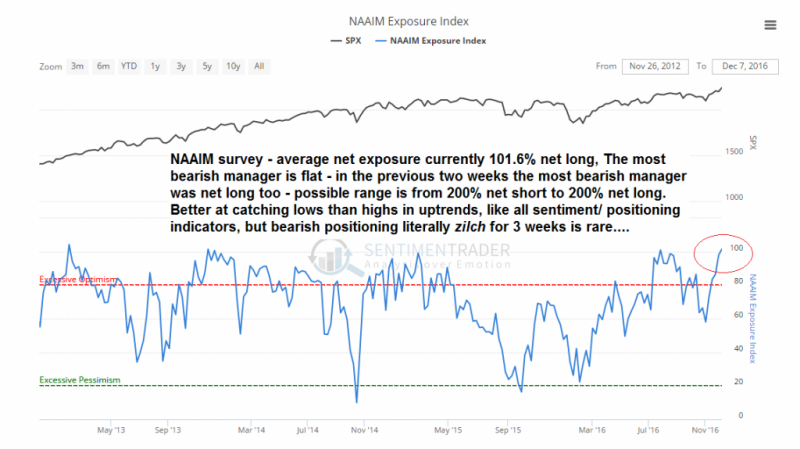

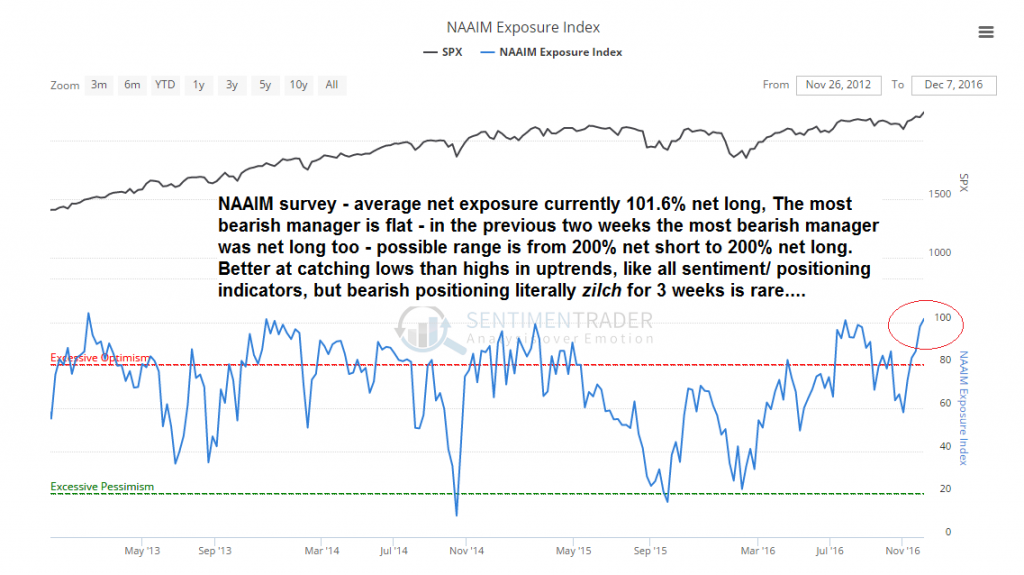

A Quick Chart Overview Below is an overview of charts we picked to illustrate the current market situation. The selection is a bit random, but not entirely so. The first set of charts concerns positioning and sentiment. As one would expect, these look fairly stretched at the moment, but there are always ways in which they could become even more stretched. First a look at the NAAIM exposure index.

Read More »

Read More »

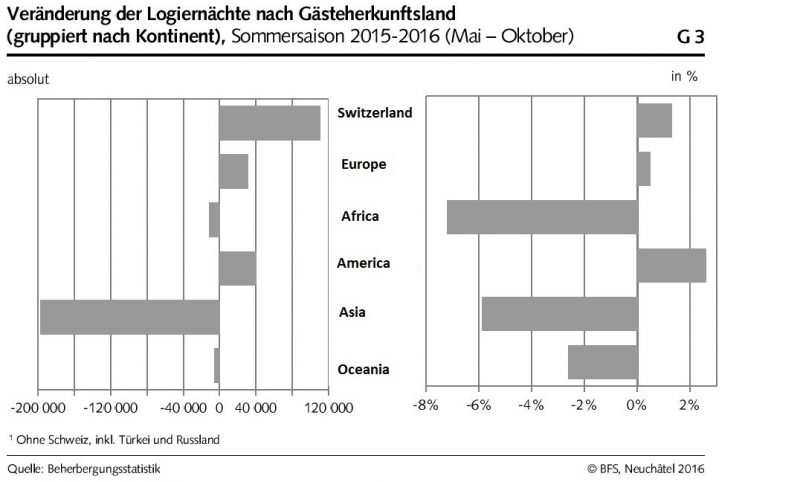

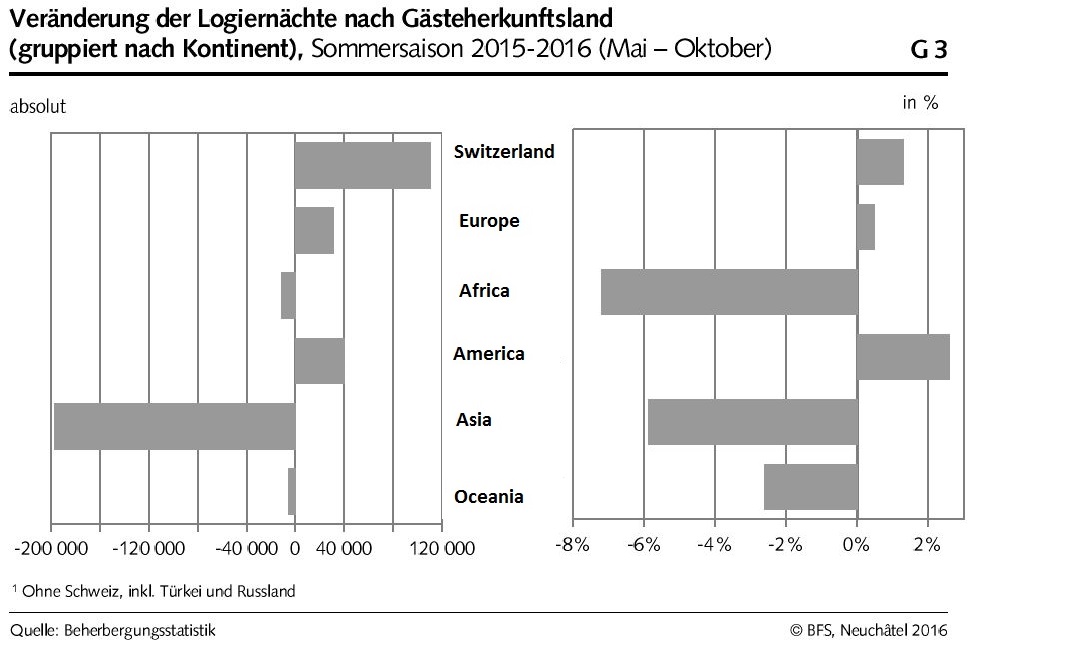

Swiss Tourism this Summer: More Swiss Guests, Less Asian Guests

In the summer months, the Swiss hotels registered more guests from Switzerland. from the United States and from Europe. But there was a sharp decline of guest from Asia.

100'000 more overnight stays from Switzerland could not recover the decrease of 200'000. One important reason for decline is the weakening Chinese currency, that reduced their purchasing power, in dollar but also in CHF.

Read More »

Read More »

On the Road to Panicville

An Alert for the Global Posse of Liquidity Junkies In the summer of 2015 and again in December-February this year, global stock markets were rattled by weakness in the yuan’s exchange rate vs. the US dollar. Yuan weakness is widely held to exacerba...

Read More »

Read More »