| Back in August 2 we reported of a historic event for China’s economy: for the first time in its modern history, China’s current account balance for the first half of the year had turned into a deficit. And while the full year amount was likely set to revert back to a modest surplus, it was only a matter of time before one of the most unique features of China’s economy – its chronic current account surplus – was gone for good.

Fast forward to this weekend, when as part of its summary of Top Macro Trades for 2019, UBS wrote that the loss of China’s current account cushion, softening domestic activity, and upcoming tariffs mean that “for the first time in 25 years, China would have to make a choice between external stability and growth.” Still, with many policy levers still available, China is likely to avoid uncontrolled depreciation, but with little carry protection, UBS believes that it makes sense to remain defensive on the CNY, especially as many currency strategists expect the trade war between the US and China to get worse, pushing the Yuan below Beijing’s “redline” of 7.00 vs the dollar. |

Current account balance and forecasts 2000-2020 |

| Which brings us to one of UBS’ top recommended themes and trades for 2019, namely “China Stimulus” represented by going long Chinese stocks, and short the Yuan.

As UBS explains, Beijing’s dilemma is that Chinese easing now has to balance conflicting demands between external stability and growth. This according to the Swiss bank, “should lead to a welcome, but more limited, stimulus in this cycle and more emphasis on domestic than foreign spending. In turn, this easing cycle will likely provide more benefit to domestic assets rather than traditional China satellites.” |

China Capital Account vs House Prices 2006-2018(see more posts on China House Prices, ) |

| In equities, the direct expression of this theme is to be long China A-shares versus EM ex-China, with UBS expecting the coming infrastructure spending in China to have a larger impact on domestic equities than on EM in aggregate, and China equities should have more upside.

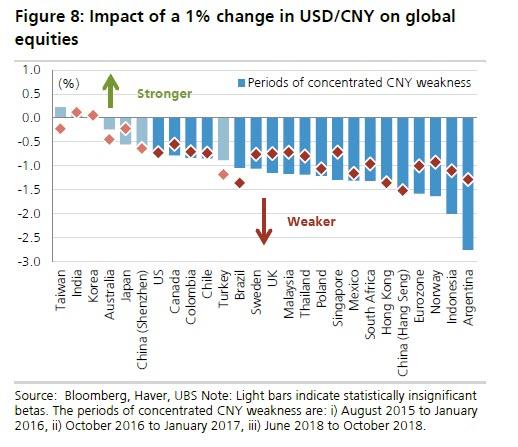

Meanwhile, from a portfolio perspective, long USD/CNY combines well with the equity trade, because in the base case, Chinese equites can perform well as the currency weakens. In a more adverse scenario for Chinese equities, the equity trade would likely perform poorly, but USD/CNY should be a good hedge. To get a sense of the sensitivity between the relative strength of the Yuan and equities, UBS shows the following chart mapping the impact of a 1% change in the USDCNY on global stocks. Finally, to complete its thematic recommendation, UBS adds a fixed income leg in the form of long Asia HY versus short Asia IG position as “slower Chinese growth, a weaker CNY, and a tight onshore credit environment should push Asia credit spreads wider, but HY should fare relatively better given extreme valuations.” Then again, many said the same thing for the US junk bond market until it finally cracked earlier this month… |

CNY Impact on stocks(see more posts on USD/CNY, ) |

Tags: China House Prices,newsletter,USD-CNY