Tag Archive: U.S. Initial Jobless Claims

Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. This is the earliest U.S. economic data, but the market impact varies from week to week.

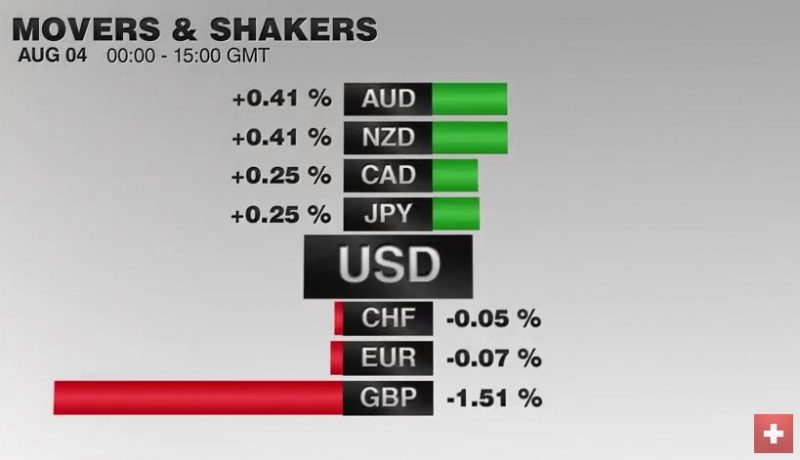

FX Daily, August 04: The BOE Owns Today, but Tomorrow is a Different Story

The Swiss Franc appreciated today against the euro. Given that the Bank of England started monetary easing, this slight appreciation is unexpectedly weak - reason was probably intervention. The SNB intervention level should be around 1 billion francs. Numbers revealed in next week's sight deposits.

Read More »

Read More »

FX Daily, July 28: Dollar Pulls Back Further Post-FOMC

After reversing lower yesterday after the FOMC statement, the US dollar has continued to move lower against the major currencies, save sterling. While the market is not fully confident of a rate cut by the Reserve Bank of Australia, indicative pricing in the derivative markets suggest a UK rate cut has been fully discounted (and a new asset purchase plan may also be announced).

Read More »

Read More »

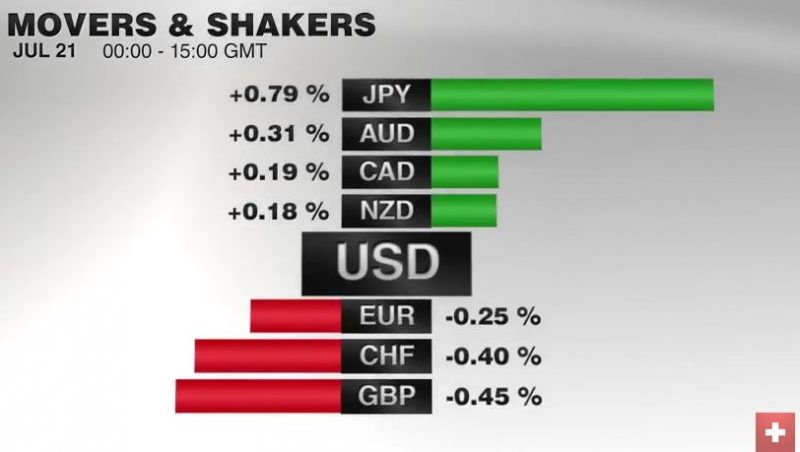

FX Daily, July 21: Monetary Policy Expectations are Driving Foreign Exchange

Monetary policy is said to have lost its impact on the foreign exchange market, as investors scratch their heads at the resilience of currencies with negative interest rates. Yet the price action in the action cannot be understood without recognizing the ongoing importance of monetary policy expectations.

Read More »

Read More »

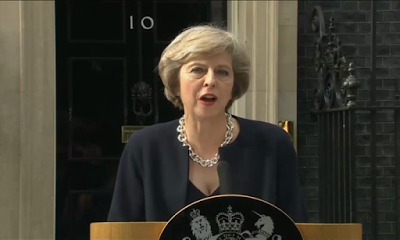

FX Daily, July 14: Will BOE Ease on May Day?

After a nearly three weeks of turmoil following the UK referendum, there is now a sense of order returning to UK politics. Two elements of the new government are particularly relevant. First, May demonstrates strategic prowess by putting those like Johnson and Davis, who campaigned for Brexit, to lead the negotiations with the EU, while putting Tories who favored remaining in the EU in the internal ministries.

Read More »

Read More »

FX Daily, June 30: Calm Continues, but Rot Below the Surface

During the week the Swiss Franc lost momentum. It could regain speed only on June 30, after BoJ Carney's speech.

Read More »

Read More »

FX Daily, June 23: R-Day is Here, but Can it Prove Anti-Climactic?

The UK's referendum is underway. The capital markets are

continuing the move that began last week with the murder of UK MP Cox.

The tragedy seemed to mark a shift in investor sentiment. Sterling

bottomed on June 17 just ahead...

Read More »

Read More »

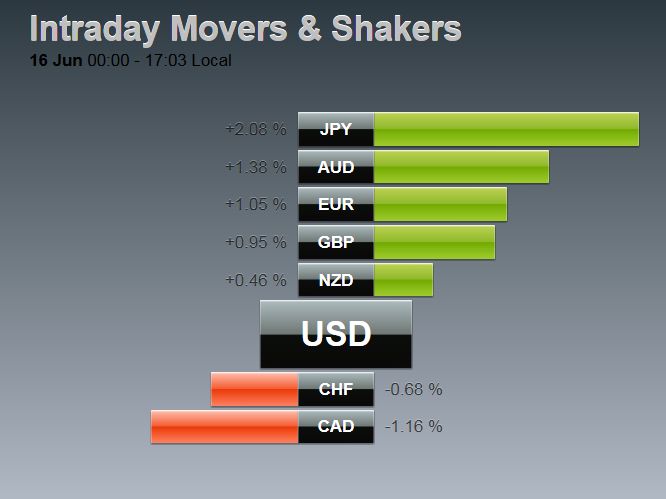

FX Daily, June 16: Markets are Anxious, Yen Soars

The US dollar is higher against the major currencies but the Japanese yen and the New Zealand dollar. The dollar fell to new two-year lows against the yen to JPY103.55 before bouncing in the European morning back to JPY104.40. The...

Read More »

Read More »

FX Weekly Review: June 06 – June 10: EUR/CHF Down 2 percent

Two main events that will drive the foreign exchange market. The first is the FOMC meeting.

The shockingly weak job growth dashed whatever lingering odds of a move next week. The EUR/CHF has fallen by 2%.

Read More »

Read More »

FX Daily, May 5: Dollar Performance Turns More Nuanced

The US dollar is firm, near the best levels of the week against the euro, yen, and sterling. However, against the dollar-bloc and several actively traded emerging market currencies, including the Turkish lira and South African rand, the greenbac...

Read More »

Read More »

Central Banks Roil Markets

The Bank of Japan defied expectations and its economic assessment to leave policy unchanged. The inaction spurred a 3% rally in the yen and an even larger slump in stocks. The financial sector took its the hardest and dropped almost 6%. The...

Read More »

Read More »

Hillary Will be the Least of Your Worries – America has Economic Diarrhea

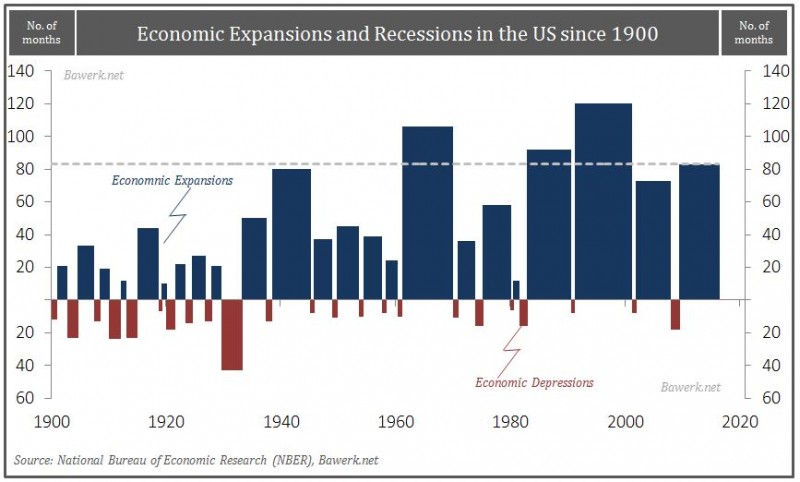

According to the National Bureau of Economic Research (NBER), the official recession arbiter, the US economy is currently at its fourth longest expansion in history. By the sheer nature of a capitalistic society with its inherent cyclicality it is a ...

Read More »

Read More »

FX Daily April 25: Global Tensions Lessened, but Bound to Increase Ahead of June FOMC Meeting

We expect the FOMC statement this week to recognize the improvement in the global conditions that have been an increasing worry for officials over Q1. At the same, time the soft patch of the US economy is undeniable. We suspect the Fed will look past the weakness of the US economy. The strength of the … Continue reading...

Read More »

Read More »

The Week Ahead: FOMC, BOJ and More

The last week of April is eventful. The Reserve Bank of New Zealand, the Federal Reserve and the Bank of Japan hold policy meetings. The UK, eurozone, and the US provide the first estimates of Q1 GDP. Japan, the eurozone, and Australia report consumer prices, while the US updates the Fed’s preferred (targeted) inflation measure, the …

Read More »

Read More »

FX Daily, April 22: Capital Markets Mostly Consolidate, Yen Drops

Equity markets are seeing this week's gains trimmed after the S&P 500 fell 0.5% yesterday, recording its biggest loss in two weeks. Disappointing earnings in some tech leaders spurred profit-taking, The US 10-year Treasuries are consolidati...

Read More »

Read More »

FX Daily, April 21: ECB Takes Center Stage

The ECB meeting is the session's highlight. In recognition of the risk that ECB President Draghi expresses displeasure with the premature tightening of financial conditions through the exchange rate channel is encouraged a modest bout of euro s...

Read More »

Read More »

Beware of Particularly Challenging Week Ahead

It is never easy, but the week ahead may be particularly difficult for market participants. It will first have to respond to weekend developments. First, the front page of the NY Times on Saturday was a report that the Saudi Arabia warned the US if a bill making its way through Congress that would allow it (Saudi … Continue reading...

Read More »

Read More »

Another Fed “Policy Error”? Dollar And Yields Tumble, Stocks Slide, Gold Jumps

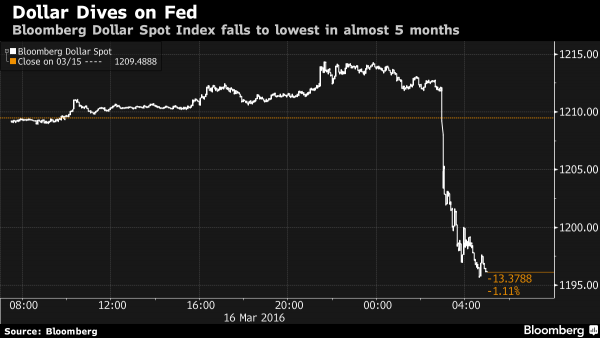

Yesterday when summarizing the Fed's action we said that in its latest dovish announcement which has sent the USD to a five month low, the Fed clearly sided with China which desperately wants a weaker dollar to which it is pegged (reflected promptly ...

Read More »

Read More »

Dollar Retreat Extends

The US dollar remains under broad pressure after yesterday's sharp decline. Neither dovish comments by ECB President Draghi, nor the Reserve Bank of New Zealand have managed to reverse the gains of their respective currencies. Similar, the rise in US yields and firm equities have failed to push the yen lower. Investors and policymakers are …

Read More »

Read More »

Week Ahead: Picking Up the Pieces

Whatever force had gripped the global capital markets since the start of the year has been broken. This simple characterization is rich. It is not clear if or what macroeconomic considerations were driving the markets. The markets had taken the unsurprising Fed rate hike in mid-December in stride. The dramatic moves in the market did not …

Read More »

Read More »

Fragile Calm Ahead of ECB Meeting

The Asian equity markets failed to retain the early gains that had at least partially been fueled by the US equities recouping half of their losses. The MSCI Asia-Pacific Index lost about 1.7% and finished at new 3.5 year lows. European markets are posting minor gains, with the Dow Jones Stoxx 600 up about 0.25% … Continue reading »

Read More »

Read More »