Tag Archive: U.S. Housing Starts

Housing starts measures the change in the annualized number of new residential buildings that began construction during the reported month. It is a leading indicator of strength in the housing sector.

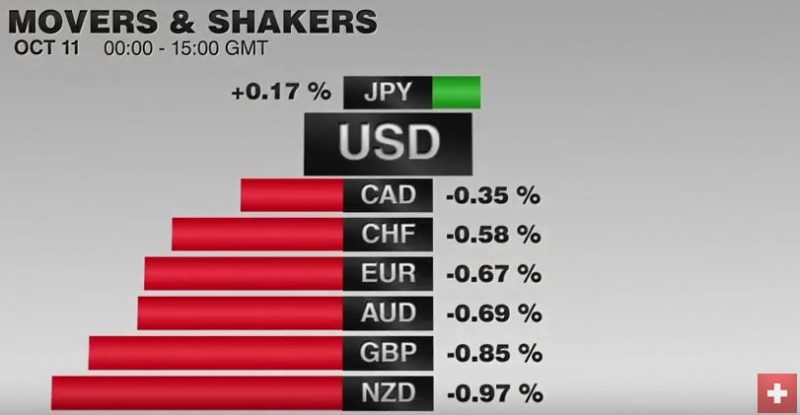

FX Daily, October 11: The Dollar Remains Bid

The US dollar is bid against all the major and most emerging market curerncies. An important driver is the backing up of US rates. The two-year yield, which is particularly sensitive to Fed policy is at it highest levbel since early June (~86 bp). The US 10-year yield is five basis points hihger today at 1.77%, which is the highest in four months.

Read More »

Read More »

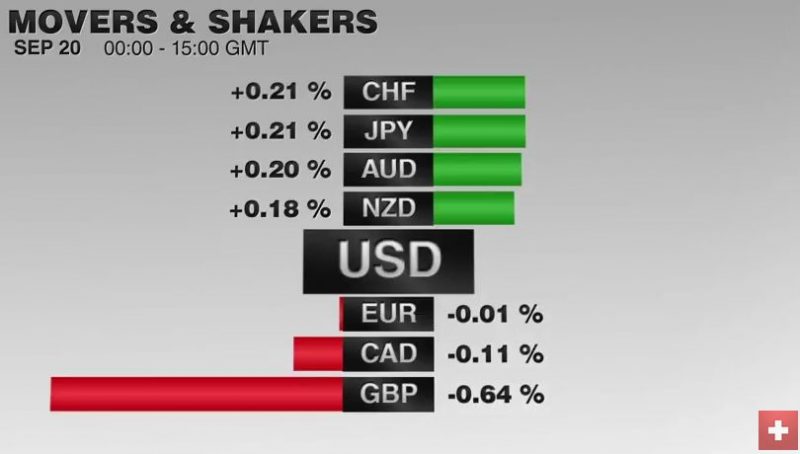

FX Daily, September 20: The Swiss Franc Continues To Rise.

The trade balance express if a currency is overvalued or not. The Swiss trade surplus is constant or rather rising, hence the Swiss Franc is correctly valued or rather undervalued. And the franc continues to appreciate.

Read More »

Read More »

FX Daily, June 17: Martyrdom of Cox Acts as Catharsis

The assassination of Jo Cox, a member of the UK parliament is a personal

and political tragedy. Her needless death provided an inflection

point. The suspension of the referendum campaigns and a steady stream of reports and speech...

Read More »

Read More »

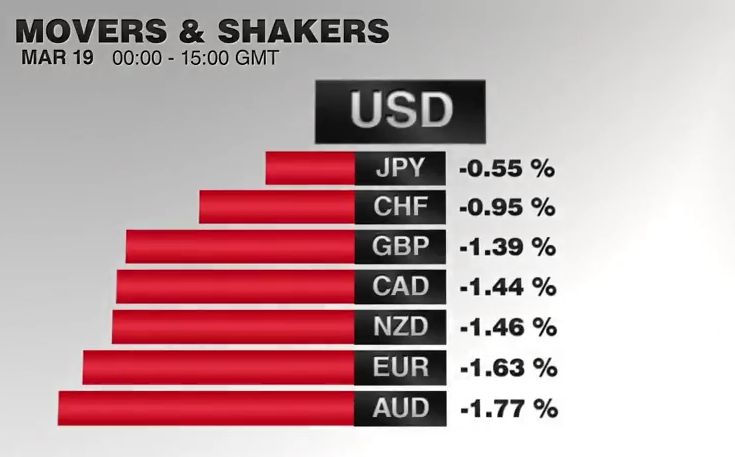

FX Daily, May 17: The Meaning of Sterling and Aussie’s Advance Today

The US dollar is mostly weaker today. It appears to be consolidating the gains scored since the reversal on May 3. Sterling and the Australian dollar are leading the way early in Europe. The Australian dollar’s gains appear more intuitively clear. The minutes from the recent RBA meeting indicated that it was a closer decision. This …

Read More »

Read More »

Are Dollar Fundamentals Lagging the Technical Improvement?

The US dollar extended its recovery that began on May 3. Its technical condition remains constructive, even though up until now, the gains are still consistent with a modest correction rather than a trend reversal. The details of the employment report, if not the headline, coupled with the 1.3% increase in retail sales, have boosted …

Read More »

Read More »

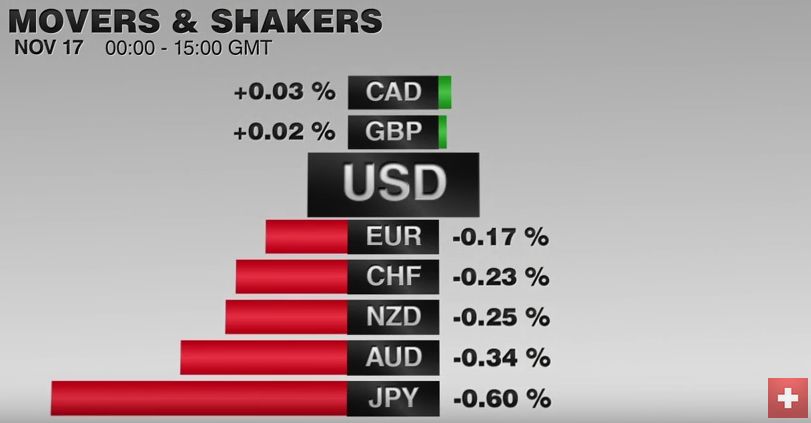

FX Daily, April 22: Capital Markets Mostly Consolidate, Yen Drops

Equity markets are seeing this week's gains trimmed after the S&P 500 fell 0.5% yesterday, recording its biggest loss in two weeks. Disappointing earnings in some tech leaders spurred profit-taking, The US 10-year Treasuries are consolidati...

Read More »

Read More »

FX Daily April 20: Markets Build on Yesterday’s Dramatic Recovery

Global capital markets staged an impressive recovery after the initial reaction to the failure to freeze oil output sent reverberations through the oil markets, commodities, and Asian equities. The sharp reversal begun in Europe and extended in N...

Read More »

Read More »

FX Daily: Yen Pares Gains, Dollar-Bloc Firms

The surging yen has been the main feature in the foreign exchange market in recent days, but its advancing streak has been stopped with today's setback. The greenback traded briefly dipped below JPY107.70 in North America yesterday but has not ...

Read More »

Read More »

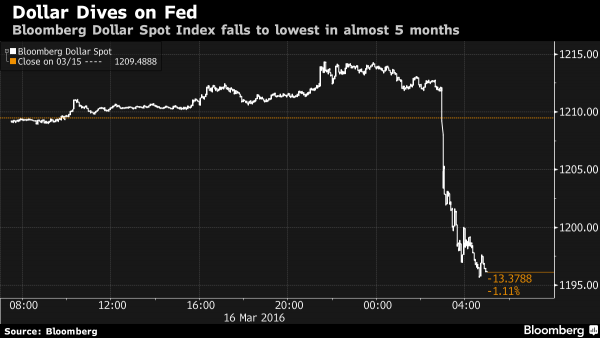

Another Fed “Policy Error”? Dollar And Yields Tumble, Stocks Slide, Gold Jumps

Yesterday when summarizing the Fed's action we said that in its latest dovish announcement which has sent the USD to a five month low, the Fed clearly sided with China which desperately wants a weaker dollar to which it is pegged (reflected promptly ...

Read More »

Read More »

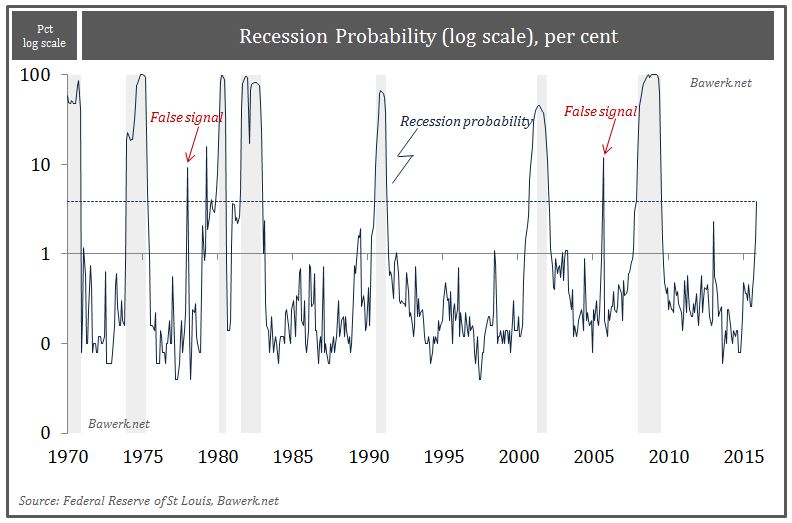

Increasing Price Inflation is Not a Sign of Healthy Recovery, but the Last Stage Before Recession

In a recent article by Kessler Companies (hat tip Zerohedge) they correctly point out that inflation, as measured by the consumer price index, have a tendency to accelerate as the US economy moves into a recession. Contrary to popular belief, the beg...

Read More »

Read More »

The World is not Ending (Yet), Panic To Subside

Investors have become unhinged. The increased volatility and dramatic market moves challenge even the most robust investment strategies. This sets off a chain reaction of money and risk management that further amplifies the price action, like an...

Read More »

Read More »

Week Ahead: What Will It Take to Stabilize the Capital Markets?

Two weeks into the year and most investors are nursing sizable drawdowns. The recovery in the US equities on January 14 looked like a potential turning point. However, the coattails proved non-existent, and the bull trap was sprung with new downside momentum established before the weekend. The obvious takeaway is that the current driver is not …

Read More »

Read More »

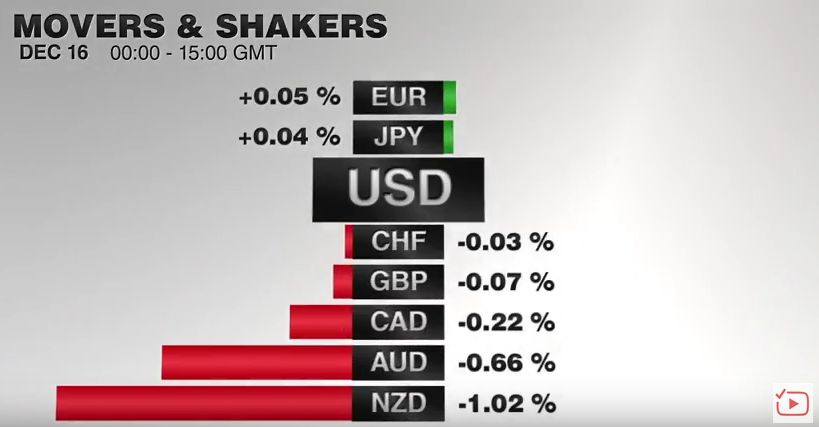

Awaiting Fresh Cues, the Greenback Consolidates Gains

Amid light news, the US dollar’s recent gains have pared slightly. Attention turns to the US, were several Fed officials speak, October housing starts/permits will be released, and then later in the session, traders will peruse the minutes ...

Read More »

Read More »

What Drives the Economy: Consumer Spending or Saving/Investment?

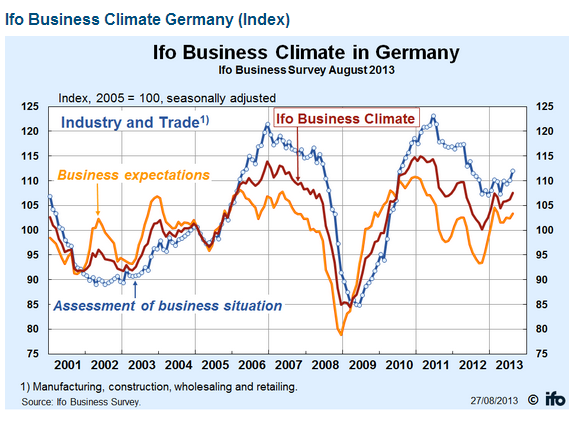

The concerted actions in September 2012 between the two big central banks reflected two fundamental economic principles: The Fed opted for Keynes' law, the ECB for Say's Law with conditionality. And apparently the ECB was successful.

Read More »

Read More »

Is U.S. Housing Really Recovering? A Discussion

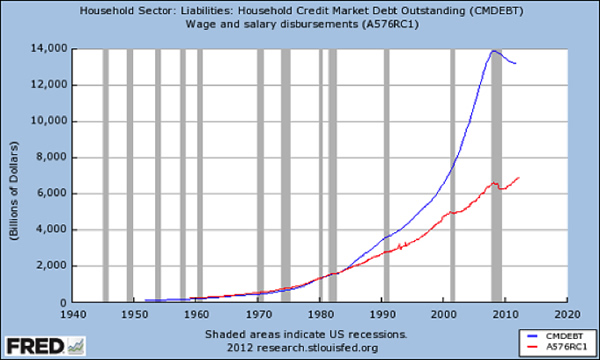

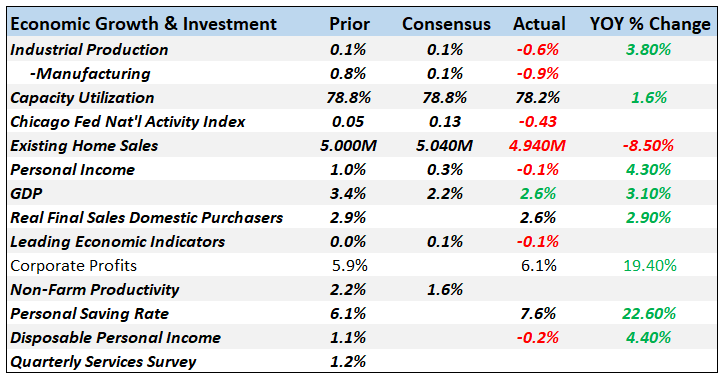

Collection of 6 sources showing: Housing Market Index,Home Inventory, S&P/C-Shiller, New Home Sales&Prices and Ratio to Population, MBS Purchases by the Fed, Household Liabilities and Dependency Ratio.

Read More »

Read More »

Net Speculative Positions, FX Outlook, Global Stock Markets, Week September 17

Submitted by Mark Chandler, from marctomarkets.com Nearly every development in recent days has been embraced by the foreign exchange market as a reason to continue to do what it has been doing since late July, and that is to sell the dollar. The German Constitutional Court ruling, allowing the European Stability Mechanism to …

Read More »

Read More »