Tag Archive: U.S. Gross Domestic Product

Gross Domestic Product (GDP) measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health. A stronger than expected number should be taken as positive for the EUR and a lower than expected number as negative to the EUR.

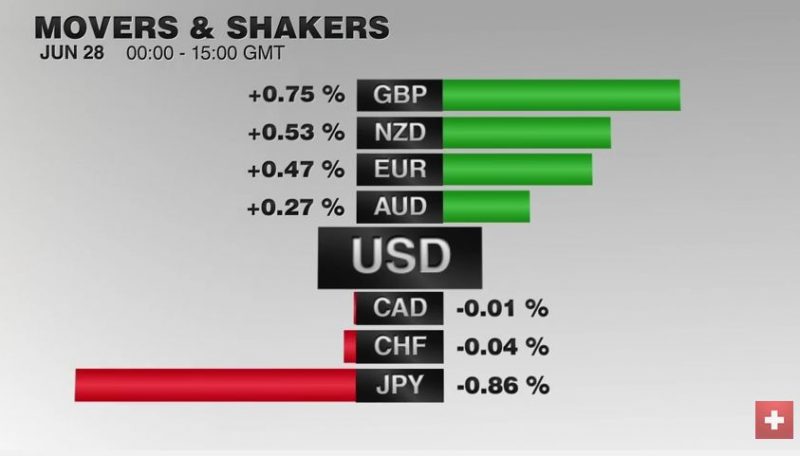

FX Daily, October 28: Dollar Sidelined, Krona Stabilizes, Rates Firm

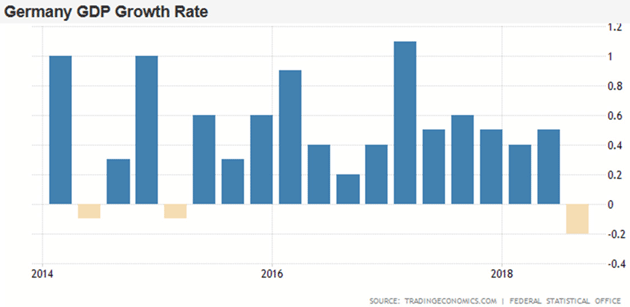

The main development here in the last full week of October is the sharp rise in bond yields. US 10-year yields rose nine bp this week coming into today's session, which features the first look at Q3 GDP. The two-year yield is up four bp. European 10-year benchmark yields mostly rose 11-17 bp. UK Gilts were are the upper end of that range. Two-year yields are 3-5 bp higher.

Read More »

Read More »

End Of The Bond Bull – Better Hope Not

It’s been really busy as of late to cover all of the topics I have wanted to address. One topic, in particular, is the bond market and the ongoing concerns of a “bond bubble” due to historically low interest rates in the U.S. and, by direct consequence, historically high bond prices.

Read More »

Read More »

The Dying Middle Class

As expected, Ms. Yellen smiled last week, announcing no change to the Fed’s extraordinary policies. For the last eight years, she has been aiding and abetting the largest theft in history. Thanks to ZIRP (zero-interest-rate policy) and QE (quantitative easing), every year, about $300 billion is transferred from largely middle-class savers to largely better-off speculators, financial asset owners, and the biggest borrowers during that period –...

Read More »

Read More »

Labour Productivity, Taxes and Okun’s Law

The great “science” of economics once discovered an empirical relationship between GDP and unemployment that has been dubbed Okun’s Law. It simply states that the unemployment rate rises as GDP contracts, or vice versa, as production shrinks less peo...

Read More »

Read More »

Loose Monetary Policy and Social Inequality

It has been almost eight years since former U.S. President George W. Bush warned the world that “without immediate action by Congress, America could slip into a financial panic and a distressing scenario would unfold.” The government’s response to the crisis was a USD700 billion rescue package that was supposed to prevent U.S. banks from collapsing and encourage them to resume lending, which was soon to be followed by a series of Quantitative...

Read More »

Read More »

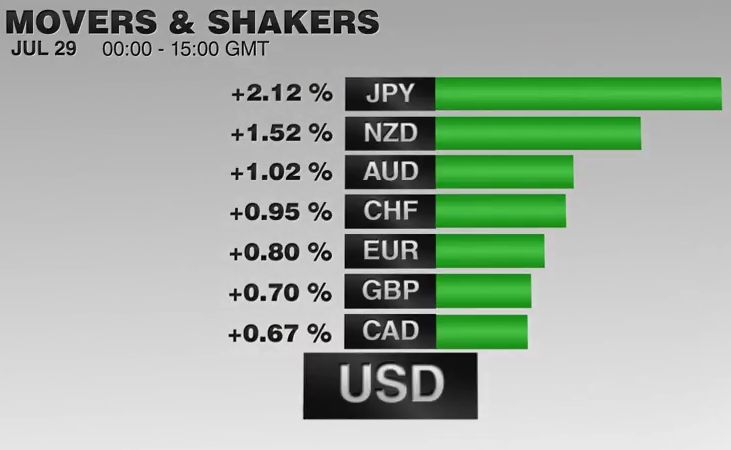

FX Daily, June 28: Markets Stabilize on Turn Around Tuesday

The global capital markets are stabilizing for the first time since the UK referendum. It is not uncommon for markets to move in the direction of underlying trends on Friday's; see follow-through gains on Monday, and a reversal on Tuesday. That is what is happening today.

Read More »

Read More »

Will the U.S. Stock Market give birth to its own Black Swan?

At 2099.06 points the S&P 500 is now in a confirmed uptrend and on the cusp of attacking the 19 April high of 2100.80. But uncertainty of the “we will - we won’t” vacillation of the Federal Reserve, remains.

Read More »

Read More »

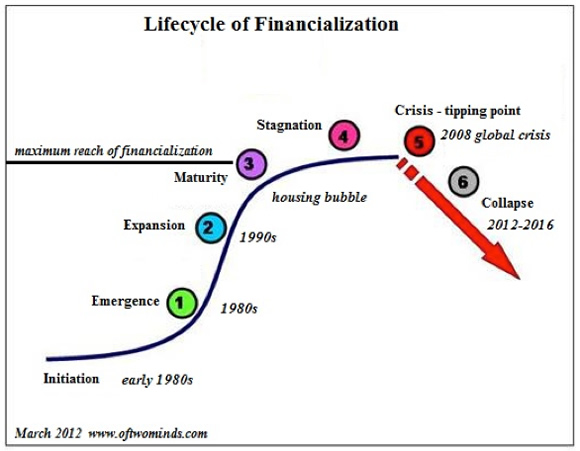

Financialization and Crony Capitalism Have Gutted the Middle Class

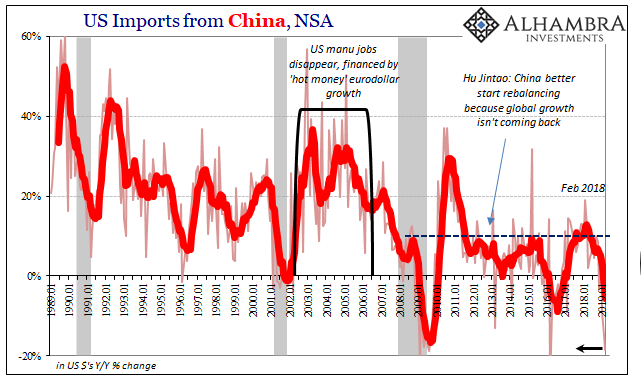

The neofeudal colonization of the "home market" has transformed the middle class into debt serfs. According to the conventional account, the Great American Middle Class has been eroded by rising energy costs, globalization, and the declining purchasing power of the U.S. dollar in the four decades since 1973.

Read More »

Read More »