Tag Archive: U.S. Gross Domestic Product

Gross Domestic Product (GDP) measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health. A stronger than expected number should be taken as positive for the EUR and a lower than expected number as negative to the EUR.

Tensions Run High Ahead of ECB Meeting and US Q3 GDP as JPY150 Breached

Overview: The market is on edge. Anxiety is running higher. It is

partly geopolitics, and it is partly market stresses. The dollar is holding

above JPY150 but so far, no reports or signs of intervention. Bank shares are

under pressure. An index of Japanese banks has fallen for five of the past six

sessions and are off about 8% from the year's high set last month. An index of

European bank shares has fallen in six of the past seven sessions and...

Read More »

Read More »

FX Daily, June 25: Contagion Growth and Calendar-Effect Saps Investor Enthusiasm

Given the huge run-up in risk assets this quarter, and the technical indicators warning of corrective forces, concerns over the new infections is pushing on an open door. The S&P 500 gapped lower yesterday and fell 2.6%, led by energy and airlines. The NASDAQ snapped an eight-day rally. Follow-through selling in the Asia Pacific region saw most markets fall at least 1%, with Korea and Australia seeing losses in excess of 2%.

Read More »

Read More »

FX Daily, May 28: Escalating Tensions, Calm Markets

Overview: The US Secretary of State's announcement that the autonomy of Hong Kong could no longer be affirmed did not derail the rally in US equities. However, the threat of an executive order against social media companies may be discouraging follow-through buying, leaving US equities little changed ahead of the open. In contrast, Asia Pacific and European equities are mostly higher.

Read More »

Read More »

FX Daily, April 29: Heavy Dollar amid Month-End Pressure

Overview: The dollar is lower across the board as dealers attribute the selling to month-end pressures ahead of the FOMC today and ECB tomorrow and long-holiday weekend for many. Japan's Golden Week holiday has already begun. Despite the loss in US equities yesterday, despite the higher opening, it has not spilled over, as Alphabet earnings helped lift sentiment.

Read More »

Read More »

FX Daily, March 26: Rumor Bought, Fact Sold

Overview: Speculation that the US Senate would pass the large stimulus bill worth around 10% of US GDP is thought to have fueled a bounce in equities in recent days. The bill was approved and will now go to the House, where a vote is expected tomorrow. If the rumor was bought, the fact has been sold. The first to crack was the Asia Pacific region.

Read More »

Read More »

FX Daily, February 27: The Rot Continues but Somewhat Less Dollar Friendly

A new phase of the Covid-19 is at hand. Yesterday was the first time that the number of new cases in the world surpassed the number of new cases China acknowledged. This confirms what we have known, namely that the battle for containing it in China has been lost.

Read More »

Read More »

FX Daily, January 30: Contagion Impact not Peaked, Weighs on Risk Appetites

Overview: The ongoing concerns about the geometric progression of the new coronavirus continues to swamp other considerations for investors. Risk continues to be unwound, as the World Health Organization meets to decide if this is indeed a global health emergency. Several large equity markets in Asia were hit particularly hard.

Read More »

Read More »

FX Daily, December 20: Sterling Trades Higher after Test on $1.30

Overview: The holiday mood has tightened its grip on the capital markets, and global investors have nearly completely ignored the impeachment of the US President as it has little economic or policy significance. US equities reached new record highs yesterday with the S&P 500 moving above 3200.

Read More »

Read More »

FX Daily, October 30: All About Perspective

Overview: The global capital markets are mostly treading water ahead of the Federal Reserve meeting. Asia Pacific and European equities drifted lower. The MSCI Asia Pacific Index appears to have snapped a four-day advance, while the Dow Jones Stoxx 600 was trading slightly lower for the second consecutive session following a six-day rally.

Read More »

Read More »

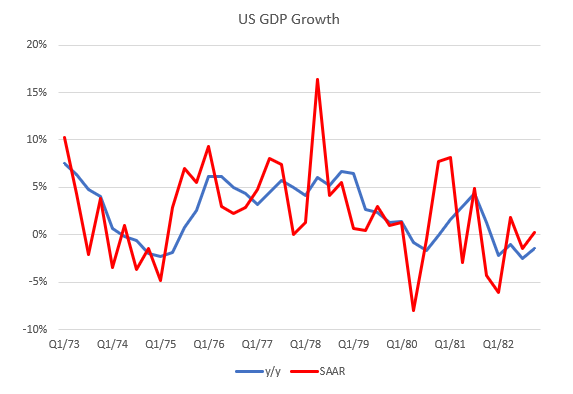

Some Thoughts on the Fed and Oil Shocks

Oil prices have spiked after the weekend attack on Saudi oil facilities. Will it impact the Fed tomorrow? No. We compare the current (but still unfolding) situation to past oil shocks from the 1970s and discuss the policy responses taken.

Read More »

Read More »

United States: The ISM Conundrum

Bond yields have tumbled this morning, bringing the 10-year US Treasury rate within sight of its record low level. The catalyst appears to have been the ISM’s Manufacturing PMI. Falling below 50, this widely followed economic indicator continues its rapid unwinding.

Read More »

Read More »

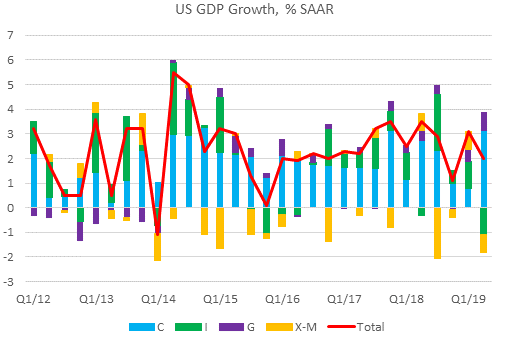

Latest Thoughts on the US Economic Outlook

The US economy is starting to show cracks from the ongoing trade war. While we do not want to make too much from one data point, we acknowledge that headwinds are building whilst US recession risks are rising.

Read More »

Read More »

FX Daily, August 29: Johnson Faces Legal Challenges and Conte may be Given an Extension

The capital markets are calm today, though there does seem to be some optimism creeping back into the market. The Chinese yuan strengthened, snapping a ten-day slide and Italian bank shares index has risen by more than 1% for the fourth consecutive session.

Read More »

Read More »

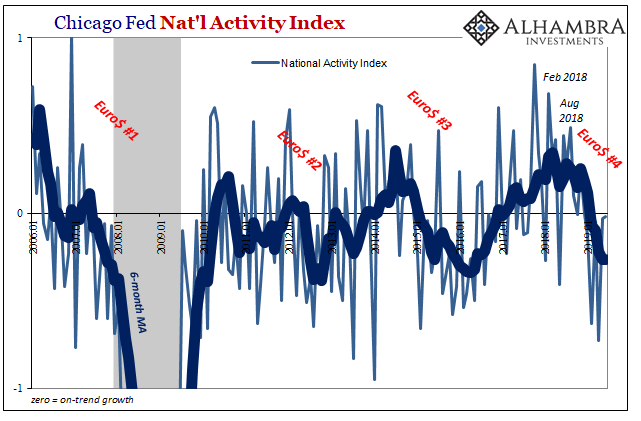

US Economic Crosscurrents Reach the 50 Mark

In the official narrative, the economy is robust and resilient. The fundamentals, particularly the labor market, are solid. It’s just that there has arisen an undercurrent or crosscurrent of some other stuff. Central bankers initially pointed the finger at trade wars and the negative “sentiment” it creates across the world but they’ve changed their view somewhat.

Read More »

Read More »

FX Daily, July 26: Markets Consolidate as the Dollar Index Extends its Advance for the Sixth Consecutive Session

Investors are happy for the weekend. Between the ECB, Brexit, and next week's FOMC, BOJ, and BOE meetings, the markets are mostly in a consolidative mode ahead of the weekend. The first look at Q2 US GDP is the last important data point of the week, though it is unlikely to impact next week's Fed decision.

Read More »

Read More »

FX Daily, June 27: Ready. Set. Wait.

Overview: The approaching month/quarter-end and the G20 meeting dominate considerations. Although the S&P 500 closed on its lows for the third consecutive session yesterday, Asia Pacific equities liked the apparent increase in the prospect of a tariff freeze between the US and China and the pullback in the Japanese yen.

Read More »

Read More »

FX Daily, May 30: Kill Bull: Intermission

Overview: After significant moves in equities and interest rates, investors are taking a collective breath, waiting for fresh developments. A nervous calm has settled over the capital market. China, Japan, and Australian equities leaked lower, but other bourses in the region, including Korea and Taiwan posted modest gains, while Indonesian equities are still responding positively to the recent election.

Read More »

Read More »

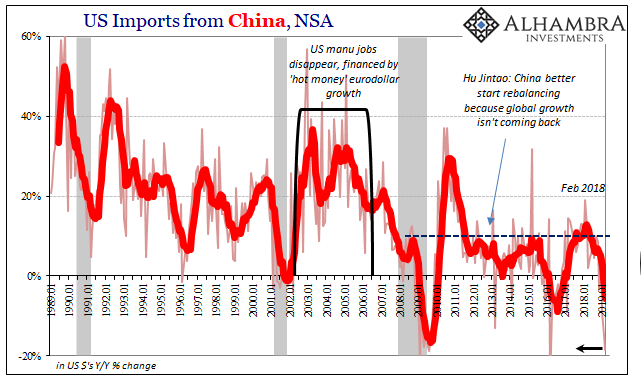

Trade Wars Have Arrived, But It’s Trade Winter That Hurts

There is truth to the trade war. That’s a big problem because it’s not the only problem. It isn’t even the main one. Given that, it’s easy to look at tariffs and see all our current ills in them. The Census Bureau reports today that the trade wars have definitely arrived. In March 2019, US imports from China plummeted by nearly 19% year-over-year.

Read More »

Read More »

Brexit, EU, Germany, China and Yellow Vests In 2019 – Something Wicked This Way Comes

“Something wicked this way comes” warns John Mauldin. Shaky China: Chinese landing could be harder than expected. Brexit and EU Breakage: “I have long thought the EU will eventually fall apart”. Helpless Europe: If Germany sneezes, their banks & the rest of continent catches cold. We may see “yellow vests” spread globally: Economics is about to get interesting …

Read More »

Read More »

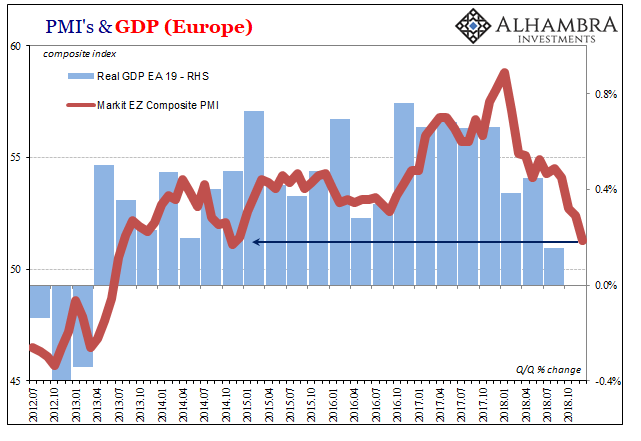

Just In Time For The Circus

Just in time to follow closely upon yesterday’s European circus, IHS Markit piles on with more of the same forward-looking indications looking forward the wrong way. Mario Draghi says the ECB is ending QE, good for him. The central bank will do this despite balanced risks rebalancing in a different place. The more bad news and numbers stack up the more “they” say it’s nothing just transitory roughness.

Read More »

Read More »