Tag Archive: U.S. Existing Home Sales

Existing Home Sales measures the change in the annualized number of existing residential buildings that were sold during the previous month. This report helps to gauge the strength of the U.S. housing market and is a key indicator of overall economic strength.

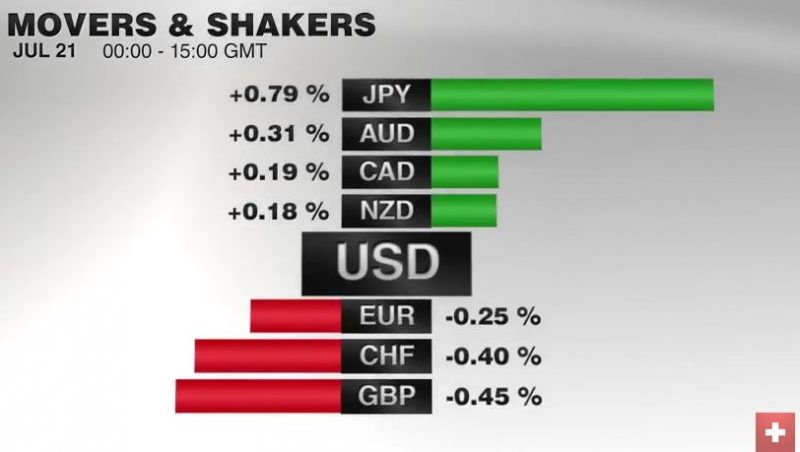

FX Daily, July 23: Dollar Consolidates Trump-Inspired Losses, BOJ Resolve Tested

US Treasury Secretary Mnuchin told G20 finance ministers and central bankers that President Trump was not trying to interfere in the foreign exchange market or encroach upon the Federal Reserve's independence. Trump's comments and tweets last Thursday and Friday effectively capped the dollar as it was looking to break out to the upside.

Read More »

Read More »

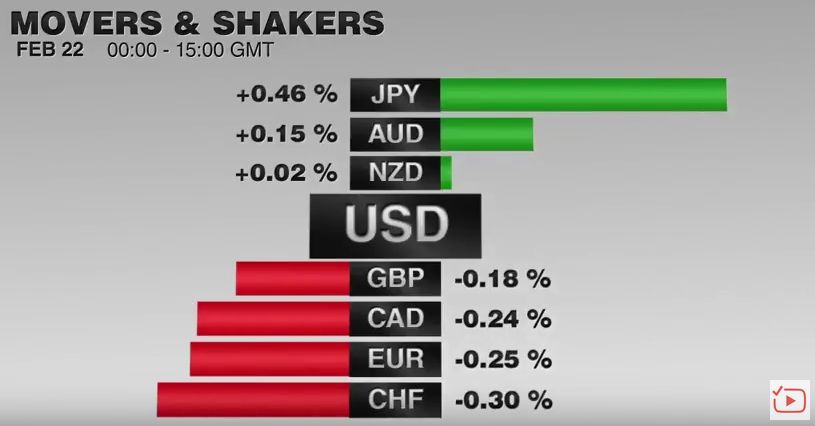

FX Daily, February 21: Markets Mark Time

The economic data stream is picking up, but there is an uneasy calm in the markets. It is almost as if the dramatic drop in stocks has left many with a sense of incompleteness, like waiting for another shoe to drop. The price action has not clarified the situation very much. The equity markets are stalling in front of important chart points as are yields and the dollar.

Read More »

Read More »

FX Daily, January 24: Dollar Takes Another Leg Lower

North American session sold into the dollar's upticks and Asia followed suit, taking the greenback to new multi-year lows against the euro and sterling while pushing it below the JPY110 level for the first time since last September. US trade action has become latest element of the narrative the seeks to explain the dollar's slide and the decoupling of the greenback from interest rates.

Read More »

Read More »

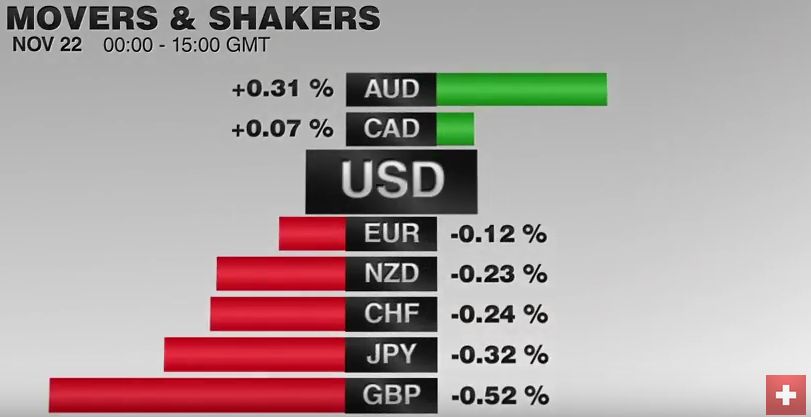

FX Daily, November 21: Dollar Marks Time

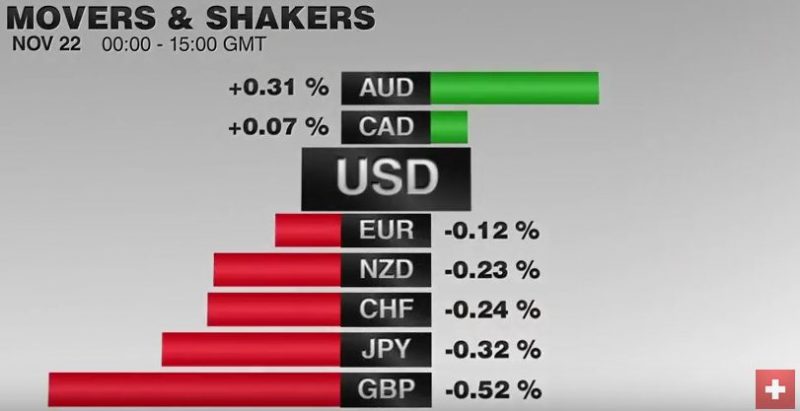

The US dollar has largely been confined to yesterday's trading ranges against the major currencies amid light news. The North American session does not hold much hope for fresh impetus. The US reports October existing home sales, which are not typically market moving in the best of times. Yellen does not speak until after the markets close, and even then is unlikely to sway expectations, which have priced in a rate hike next month.

Read More »

Read More »

Housing Isn’t Just About Real Estate

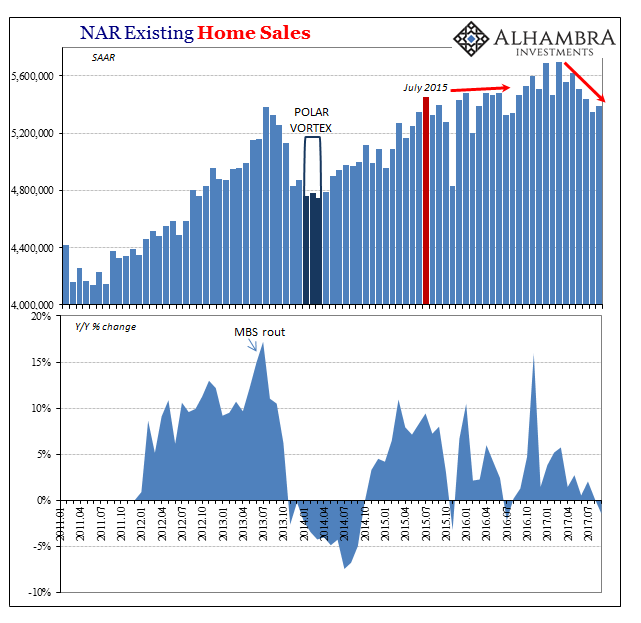

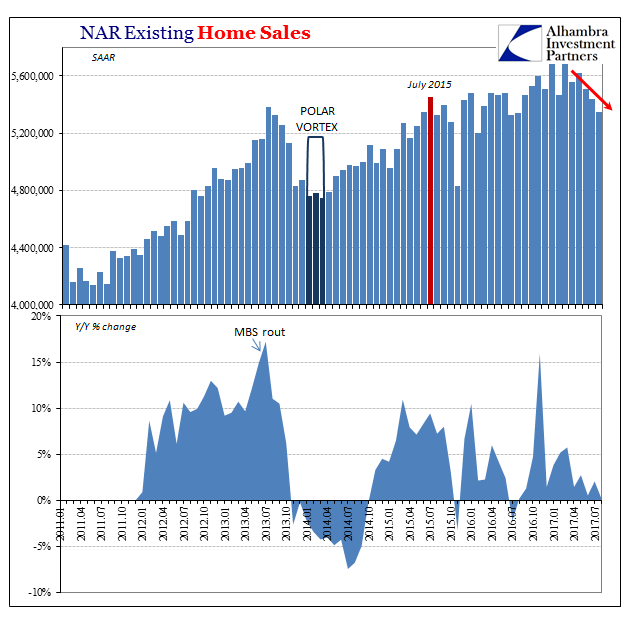

The National Association of Realtors (NAR) reported today that sales of existing homes (resales) were up slightly in September 2017 on a monthly basis. At a seasonally-adjusted annual rate of 5.39 million last month, that was practically unchanged from the 5.35 million estimate for August that was the lowest in a year.

Read More »

Read More »

The Real Estate View For A Second Lost Decade

The National Association of Realtor (NAR) reports today that sales of existing homes in the US were down 1.7% in August 2017 from July. At a seasonally-adjusted annual rate of 5.35 million, that’s the lowest pace for resales since July 2016. It is yet another data point reflecting the almost certain end of “reflation” in the economic sense.

Read More »

Read More »

FX Daily, September 20: Shrinkage and Beyond

After much anticipation, the FOMC decision day is here. Much of the focus is on the likely decision that the Fed will allow its balance sheet to shrink gradually. No other country who employed quantitative easing has is in a position to begin unwinding the emergency expansion of its balance sheet. The Fed's experience in QE, communication, and now unwinding, will be part of the information set other central banks can draw upon.

Read More »

Read More »

FX Daily, August 24: Greenback Firmer in Becalmed Markets

The US dollar is enjoying a firmer tone in quiet. Sterling is stabilizing after grinding down to its lowest level since late June. The Mexican peso, which had dropped in thin trading in Asia and Europe yesterday following Trump's threat to exit NAFTA and force Congress to fund the Wall or face a government shutdown recovered fully and is now slightly higher on the week.

Read More »

Read More »

FX Daily, July 24: Euro Recovers from Softer Flash PMI

The euro made a marginal new high in early Asia, but participants rightly drew cautious ahead of the flash eurozone PMI. The flash PMI was softer than expected, and although the composite fell to six monthly lows, it is more a reflection of how steady it has been at elevated levels.

Read More »

Read More »

FX Daily, June 21: Heavy Oil Weighs on Yields and Lifts Yen

The US dollar is narrowly mixed against the major currencies. The drop in oil prices (3.3% this week) is seen as one of the factors that may be underpinning the appetite for fixed income, and this, in turn, is lifting the yen. The greenback had approached JPY112 yesterday, but with the drop in oil prices and yields has seen it retreat toward JPY111.00.

Read More »

Read More »

FX Daily, May 24: Dollar Consolidates, While Market Shrugs Off China Downgrade

After staging a modest recovery in North America yesterday afternoon, the greenback is consolidating in narrow ranges. Momentum traders, who appeared to dominate activity recently, paused. To be sure, the greenbacks upticks have been modest, and little technical damage has been inflicting on the major foreign currencies.

Read More »

Read More »

FX Daily, April 21: Markets Enter Consolidative Mode Ahead of Weekend

Neither the terrorist attack in Paris nor the strong eurozone flash PMI has managed to shake investors. Judging from the social media, many suspect that the terrorist attack plays into Le Pen's hands, but investors do not seem particularly concerned. The French interest rate premium over Germany has narrowed, and gold is flat. UK retail sales fell sharply, yet sterling is holding on to the bulk of this week's gains, which are the most here in 2017.

Read More »

Read More »

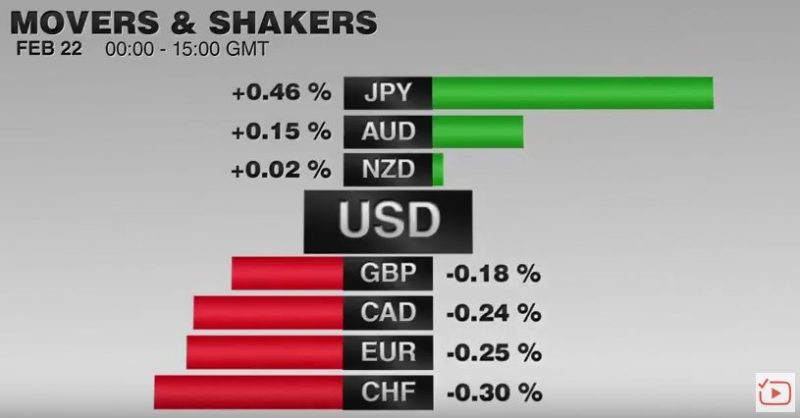

FX Daily, February 22: Euro Meltdown Continues

February has been cruel to the euro. Of the sixteen sessions this month, counting today, the euro has risen in four, and two of those were last week. Its new four-day slide pushed it below $1.05 for the first time in six weeks as European markets were opening. The $1.0560 area that was broken yesterday, and provided a cap today is 61.8% retracement objective of last month's rally.

Read More »

Read More »

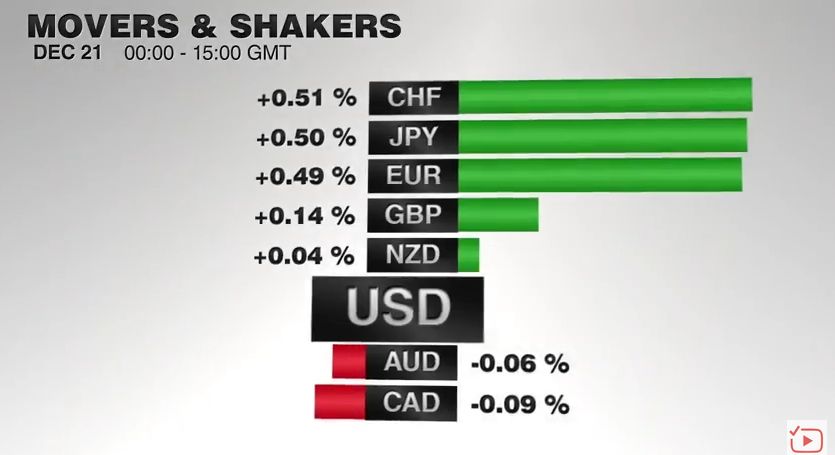

FX Daily, December 21: Dollar Mixed in Thinning Activity, Dow 20,000 Watch Continues

The US dollar is narrowly mixed as the holiday markets make for light turnover. Global equity markets are not finding much encouragement from the new record highs by the Dow Jones Industrials. There have been a few developments to note.

Read More »

Read More »

FX Daily, November 22: Bonds and Stocks Rally, Leaving Greenback to Meander

The US dollar entered a consolidative phase yesterday, and this carried into today's activity.While the foreign exchange market is sidelined as the two-week trend slows, the stocks and bonds are posting strong gains today. Equities are being led by energy and materials, as oil and industrial metals continue to advance. Bond are recovering from their recent slide.

Read More »

Read More »

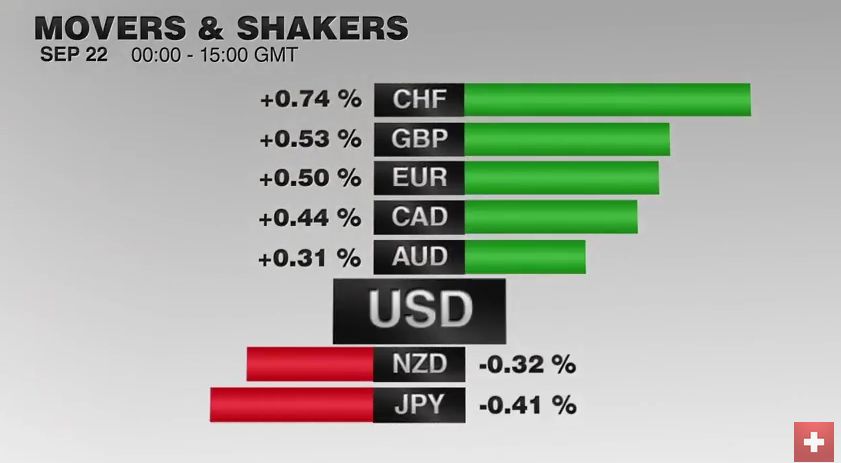

FX Daily, September 22: Swiss Franc Strongest Currency Again

Once again the Swiss Franc was the strongest. The EUR/CHF depreciated to 1.0875. As said yesterday, the reasons: the Fed and the strong Swiss trade balance.

Read More »

Read More »

FX Weekly Preview: BOJ and FOMC Meetings Featured in the Last Week of July

A recent Reuters poll found about half of the 100 economists surveyed expect a hike in Q4, which really means December since the November meeting is too close to the national election. The other half is split between a Q3 rate hike (September) and some time in 2017. That said, two primary dealers anticipate no hike until the end of 2017.

Read More »

Read More »

FX Daily, July 21: Monetary Policy Expectations are Driving Foreign Exchange

Monetary policy is said to have lost its impact on the foreign exchange market, as investors scratch their heads at the resilience of currencies with negative interest rates. Yet the price action in the action cannot be understood without recognizing the ongoing importance of monetary policy expectations.

Read More »

Read More »

FX Daily, June 22: Markets Consolidate as Table is Set for Referendum

There is a nervous calm in the capital markets today. The focus is squarely on tomorrow’s UK referendum. Brexit According to a BBC focus group, the leeave camp won the debate 39%-34%. The last polls show a contest that it too close to calls in that the results are within the margin of error. The … Continue...

Read More »

Read More »

FX Daily April 20: Bulls’ Charge Stalls, while Greenback Consolidates Losses

The US dollar has been largely confined to yesterday’s ranges against the major currencies. China’s yuan slipped lower for the first time in four sessions, while the Shanghai Composite fell 2.3%, the most since the end of February. While a few equity markets in Asia managed to follow suit after US equity market gains carried …

Read More »

Read More »