Tag Archive: U.K. Construction PMI

The Chartered Institute of Purchasing and Supply (CIPS) Construction Purchasing Manager's Index (PMI) measures the activity level of purchasing managers in the construction industry. A reading above 50 indicates expansion in the construction industry; a reading below indicates contraction. It gives an indication about the health of the construction section in the UK. Traders watch these surveys closely as purchasing managers usually have early access to data about their company’s performance, which can be a leading indicator of overall economic performance.

FX Daily, December 3: US Brandishes Tariff Weapon and Weakens Animal Spirits

Asia Pacific equities mostly declined in sympathy with yesterday's large sell-off in the US and Europe. China and Taiwan were the notable exceptions, while Australia's 2.2% decline, following the central bank meeting that resulted in what many are seeing as a hawkish hold, led the move lower. Europe's Dow Jones Stoxx 600 fell 1.6% yesterday, the largest loss in two months, and is extending the losses for a third session today.

Read More »

Read More »

FX Daily, July 2: Post-G20 Euphoria Fades, Stuck with Same Reality

Overview: The euphoria that greeted the resumption of US-China and US-North Korea talks has subsided. Global equities have turned mixed after yesterday's surge. Hong Kong played catch-up, and despite ongoing demonstrations, the Hang Seng rallied over one percent, and the Hong Kong Dollar strengthened beyond its band midpoint for the first time in nine months.

Read More »

Read More »

FX Daily, July 03: Markets Trying to Stabilize

The global capital markets are trying to stabilize. US equities recovered from early losses yesterday but this was not enough to stop Asian equities from extending recent losses. The MSCI Asia Pacific Index slipped 0.2% for the sixth decline in the past seven sessions, However, several local markets, including China, Australia, and Korea advanced.

Read More »

Read More »

FX Daily, May 02: Confident Fed Key to New Found Respect for the Dollar

There is a brief respite in the powerful short squeeze that has fueled the dollar's dramatic recovery. The greenback which was nearly friendless a month ago now has many suitors. It is higher on the year against all the major currencies but the yen (~2.6%), the Norwegian krone (~1.6%) and sterling ~0.9%). It is virtually flat against the euro.

Read More »

Read More »

FX Daily, April 04: Trade Specificities Rattle Markets

Late yesterday, the US announced that specific tariffs and goods that would be targeted for intellectual property violations. China had warned of a commensurate response and earlier today made its announcement. This sent reverberations through the capital markets, driving down equities, corn and soybean prices (subject to Chinese tariffs). The US dollar was sold, especially against the yen, euro, and sterling.

Read More »

Read More »

FX Daily, March 02: Markets Unanchored?

The announcement of the US intention to impose tariffs on imported steel and aluminum on national security grounds has sent ripples through the capital markets. Yet there is certainly more going on here than that. The tariffs, justification, and magnitude have indicated and expected. After reversing lower on Tuesday and selling off on Wednesday, equity investors hardly needed a fresh reason to sell on Thursday.

Read More »

Read More »

FX Daily, February 02: A Note Ahead of US Jobs Report

The US dollar is sporting a firmer profile against all the major currencies after weakening yesterday. Frequently, it seems the Australian dollar leads the other currencies, and we note that it is making a new low for the week today. Briefly, in Europe, it slipped below its 20-day moving (~$0.7985) average for the first time since December 13.

Read More »

Read More »

FX Daily, January 03: Dollar Stabilizes, but Sees Little Recovery

The US dollar is stabilizing but the tone remains fragile. The euro, which has advanced for five consecutive sessions coming into today is slightly lower. The euro had stalled yesterday as it approached last year's high set in September near $1.2090. Yesterday was also the third consecutive close above the upper Bollinger Band, which is found today near $1.2060.

Read More »

Read More »

FX Daily, December 04: US Dollar Marked Higher After Senate Passes Tax Reform

The US dollar opened higher in Asia and retained those gains through the European morning. The greenback has recouped most of the pre-weekend losses recorded in the wake of the indictment of a fourth former Trump Administration official by the special investigation into Russia's involvement in last year's election. However, two weekend developments seemed to blunt the impact of the guilty plea and admission of cooperation.

Read More »

Read More »

FX Daily, November 02: Dollar Pulls Back in Asia

We suggested the market was at crossroads. It is still not clear if the dollar's breakout, supported by higher yields is real or simply the fraying of ranges. Asia has pushed the dollar broadly lower. While the greenback finished the North American session above JPY114.00 for the first time since July, the fact that the US 10-year yield could not push back above the 2.40% level, does not help confidence.

Read More »

Read More »

FX Daily, October 03: Dollar Retains Firm Tone, Spanish Markets Stabilize

Firm US interest rates and a strong manufacturing ISM yesterday help support the greenback, while disappointing construction PMI in the UK weighs on sterling. The euro briefly slipped below $1.17 in Asia for the first time in six weeks. It has recovered toward the highs seen in North America yesterday (~$1.1760). There are several euro option strikes that may be in play today. In the euro, between $1.1750 and $1.1775, there are nearly 2.9 bln euros...

Read More »

Read More »

FX Daily, August 02: Euro Climbs Relentlessly, While Greenback is Mixed

The euro's strength is surely partly a reflection of US dollar weakness, but it is also a reflection of the improved sentiment among investors. The initial dollar losses at the start of the year was largely a correction that is common after a Fed hike. This is more or less what happened at the start of 2016 as well, following the Fed hike in December 2015.

Read More »

Read More »

FX Daily, June 02: Dollar Marks Time Ahead of US Jobs Report

The foreign exchange market is becalmed, leaving the US dollar narrowly mixed. The euro has been confined to less than a 20-pip range through the Asian session and most of the European morning. The news stream is light. The US withdrawal from the Paris Accord may have garnered the headlines, but as a market force, it is difficult to detect the immediate impact.

Read More »

Read More »

FX Daily, May 03: Marking Time

The global capital markets are relatively calm. Japan, South Korea, and Hong Kong markets are closed for national holidays. Investors await the FOMC statement, though expectations could not be much lower. The disappointing US auto sales, and poor Apple sales figures reported yesterday have had little impact on the broader investment climate.

Read More »

Read More »

FX Daily, March 02: Dollar Remains Bid

The US dollar is bid against the major currencies as the combination the increased expectation of a Fed rate hike and the President's commitment to fiscal stimulus buoys sentiment. The dollar-bloc, where speculators in the futures market, have grown a net long position, are leading the move.

Read More »

Read More »

FX Daily, January 04: Consolidation in Capital Markets

GBP/CHF rates have jumped during the first official day of trading in 2017, with the pair hitting 1.2657 at today’s high. The Pound gained support this morning following positive UK Manufacturing data, which came in well above market expectation. This increased market confidence in the UK economy and the Pound has ultimately benefited as a result, gaining a cent on the CHF.

Read More »

Read More »

FX Daily, December 02: Is it About US Jobs Today?

The capital markets are finishing the week amid speculation that the driving forces of the past three weeks are ebbing. Global equities and the dollar may be snapping three-week advances. The issue is whether it is a consolidation or trend change. The former is a more prudent assumption until proven otherwise. As a rough and ready signal, the 100.60 level in the Dollar Index, which corresponds to the lows November 22 and November 28 is reasonable.

Read More »

Read More »

FX Daily, November 02: Standpat FOMC Trumped by US Political Jitters

The single biggest driver in the capital markets is the continued narrowing of the US election polls. The prospect of a Trump presidency and the dramatic changes that could entail is rattling investors and spurring position squaring.The dollar is broadly lower as are stocks. The surge in global yields has been arrested.

Read More »

Read More »

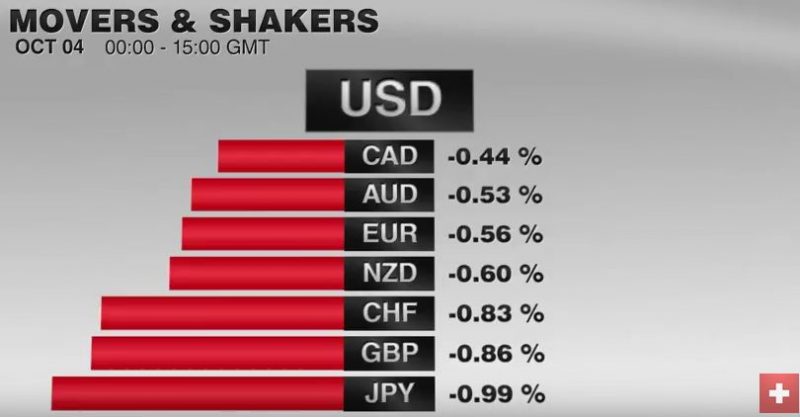

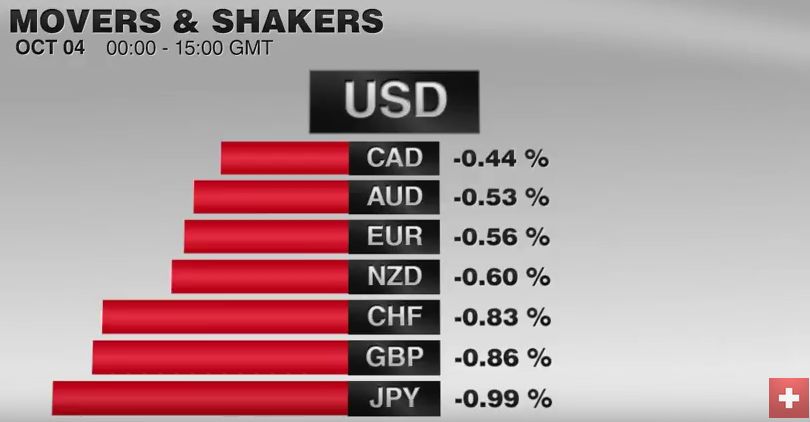

FX Daily, October 04: Sterling’s Slide Continues, EUR/CHF Soars Again

UK Prime Minister May's comments at the Tory Party Conference over the weekend played up the risk of what has been dubbed a hard Brexit and triggered a slide in sterling saw it fall to new 30-year+ low against the dollar just below $1.2760. The EUR/CHF has soared again. Later during the day, it has even achieved 1.0970.

Read More »

Read More »

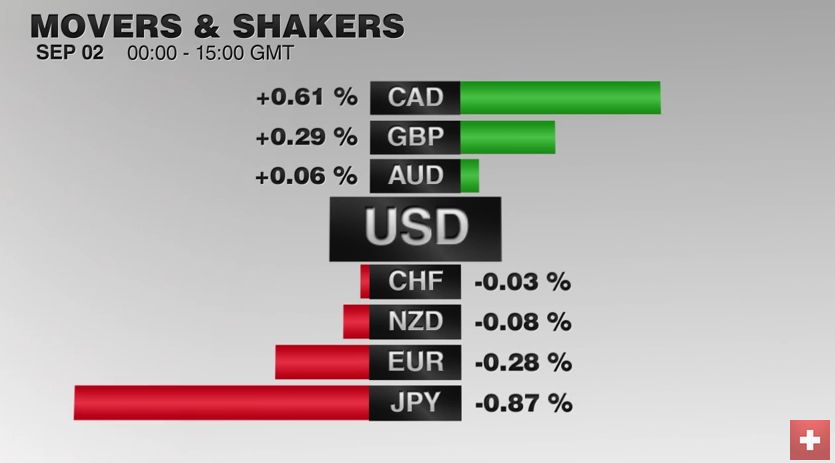

FX Daily, September 2: US Jobs Data–Higher Anxiety, Thank You Mr. Fischer

The US dollar is little changed ahead of the job report. Our near-term bias is for a lower dollar. Sterling is flat and is holding on to about a 1% gain this week. The Japanese yen is about a 0.3% lower and is off 1.7% this week. The euro was coming into today for the week.

Read More »

Read More »