Tag Archive: U.K. House Price Index

The Office for National Statistics House Price Index measures the change in the selling price of homes. This data tends to have a relatively mild impact because there are several earlier indicators related to house prices.

FX Daily, September 18: FOMC Meets Amid Money Market Pressures

Overview: News that Saudi Arabia was able to restore 40%-50% of the oil capacity lost by the weekend strike coupled with the Fed's efforts to offset the squeeze in the money markets are allowing the global capital markets to trade quietly ahead of the conclusion of the FOMC meeting. Equities are little changed with a lower bias that has been seen in the first few sessions this week.

Read More »

Read More »

FX Daily, July 17: Back to the Well Again

Overview: After slapping punitive tariffs on structural from China and Mexico last week, US President Trump threatened to end the tariff truce with China because it is not stepped up its purchases of US agriculture products. Trump said the tariff freeze was in exchange for ag purchases, but at the time it seemed as if granting licenses to US companies to sell to Huawei was the quid pro quo.

Read More »

Read More »

FX Daily, June 19: Still Patient?

Overview: Risk-taking was bolstered by the dramatic shift in Draghi's rhetoric less than two weeks after the ECB meeting and a Trump's tweet announcing that there was going to be an "extended" meeting between him and Xi at the G20 meeting and that the respective staff would begin coordinating. It was later confirmed by the Chinese media.

Read More »

Read More »

London House Prices Fall 1.9 percent In Quarter – Bubble Bursting?

London house prices down 1.9 per cent in Q2 (yoy). London house prices still 50% above 2007 bubble peak (see chart). Brexit and weak consumer confidence to blame say experts. Little sign that U.K. property “weakness” is likely to change. London property bubble appears to be bursting.

Read More »

Read More »

Gold Looks A Better Bet Than UK Property

Dominic Frisby of Money Week looks at the historical relationship between UK house prices and gold (including some great charts), and concludes that your money is better off in the yellow metal than bricks and mortar.

Read More »

Read More »

FX Daily, February 13: Tuesday’s Two Developments

There are two important developments today. First, the recovery in the global equity markets is being challenged. Second, the yen has strengthened across the board, and is now at its best levels against the dollar since last September's low. The MSCI Asia Pacific Index extended Monday's recovery with another 0.5% gain. However, looking closer, the momentum faltered.

Read More »

Read More »

FX Daily, November 14: Euro Rides High After German GDP

Sterling is trading in the lower end of yesterday's range and has been confined to about a quarter a cent on either side of $1.31. On the other hand, the euro has pushed a bit through GBP0.8950 to reach its best level since October 26. Sweden also reported softer than expected October inflation.

Read More »

Read More »

Central Bank Chiefs and Currencies

Market opinion on the next Fed chief is very fluid. BOE Governor Carney sticks to view, but short-sterling curve flattens. New Bank of Italy Governor sought. A second term for Kuroda may be more likely after this weekend election.

Read More »

Read More »

FX Daily, September 12: Dollar Sports Heavier Tone as Yesterday’s Bounce Runs out of Steam

The sporadic updates continue while I am on a two-week business trip. Now in Barcelona, participating in TradeTech FX Europe. The euro advanced yesterday from NOK9.30 to NOK9.40. It is consolidating in a tight range today. The election results may have been a bit closer than expected, but the weight on the krone yesterday seemed to stem more from the unexpectedly soft inflation report.

Read More »

Read More »

FX Daily, August 15: Greenback Firms, Encouraged by Dudley and Ebbing of Tensions

NY Fed President Dudley appears to have stolen any potential thunder in the July FOMC minutes that will be released tomorrow. While we put more emphasis on today's US retail sales data and the August Fed surveys, many others argued that the minutes were the key report this week.

Read More »

Read More »

Bank Of England Warns “Bigger Systemic Risk” Now Than 2008

Bank of England warn that “bigger systemic risk” now than in 2008. BOE, Prudential Regulation Authority (PRA) concerns re financial system. Banks accused of “balance sheet trickery” -undermining spirit of post-08 rules. EU & UK corporate bond markets may be bigger source of instability than ’08. Credit card debt and car loan surge could cause another financial crisis. PRA warn banks returning to similar practices to those that sparked 08 crisis....

Read More »

Read More »

FX Daily, June 13: Dollar Softens Ahead of Start of FOMC Meeting

The US dollar is trading with a heavier bias against all the major currencies save the Japanese yen. The Scandis and Canadian dollar are leading the move. Sweden reported a 0.1% rise in the headline and underlying inflation while the median expected a decline of the same magnitude. The year-over-year pace slowed but not as much as expected.

Read More »

Read More »

FX Daily, May 16: Greenback and Dollar Bloc Lose Ground to Europe and Yen

Dollar selling pressure emerged at the end of last week, partly in response to disappointing US economic data. This selling pressure carried over into yesterday's activity. It appeared to have been trying to stabilize yesterday in the North American session.

Read More »

Read More »

London Property Market Vulnerable To Crash

London property market vulnerable to crash. House prices in London are falling. London property up 84% in 10 years (see chart). House prices have risen over 450% in 20 years. Brexit tensions as seen over weekend and outlook for U.K. economy to impact property. Global property bubble fragile – Risks to global economy. Gold bullion a great hedge for property investors.

Read More »

Read More »

FX Daily, March 21: Euro Recovery Continues, Posts New Six Week High Other Currencies Mixed

Growing confidence that Le Pen will not be the next president of France following the televised debate for which two polls showed Macron doing best has lifted the euro and reduced the French interest rate premium over Germany. The euro pushed through $1.0800 after initially dipping below yesterday's lows.

Read More »

Read More »

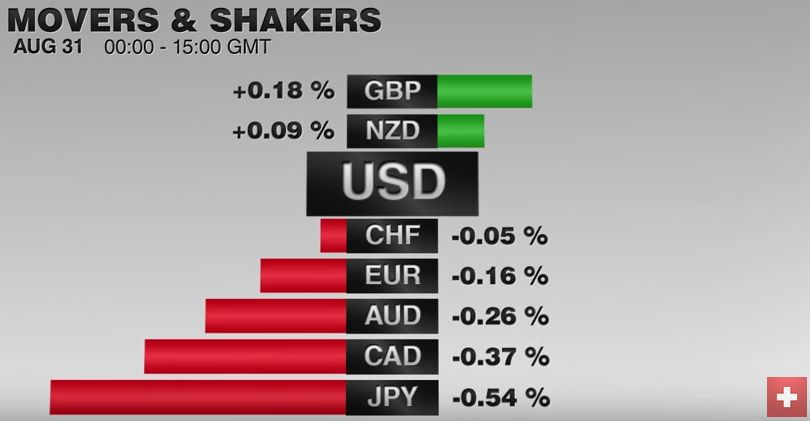

FX Daily, August 31: Dollar Bides Times, Month-End at Hand, Jobs Data Ahead

The US dollar is a little softer against most of the major and emerging market currencies. The exception is the Japanese yen, where the greenback has moved above JPY103 for the first time in a month. The tone is consolidative as the market awaits assurances that the jobs growth this month has been sufficiently strong as to keep the prospects of a September meeting still alive.

Read More »

Read More »

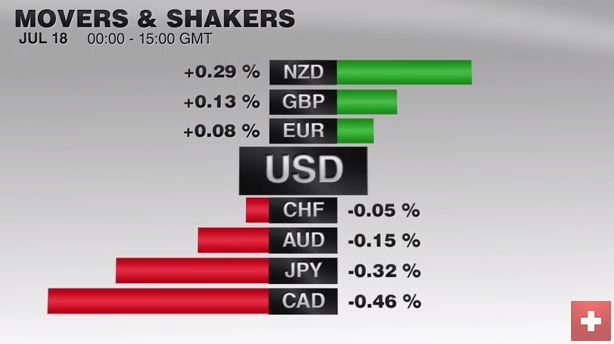

FX Daily, July 18: Coup in Turkey Repulsed, Risk-Appetites Return

The US dollar and the yen are trading heavy, while risk assets, including emerging markets, and the Turkish lira, have jumped. Sterling is the strongest of the majors. It is up about 0.5% (~$1.6365), helped by the opportunity of GBP23.4 bln foreign direct investment and comments from a hawkish member of the MPC suggesting not everyone is onboard necessarily for a rate cut next month.

Read More »

Read More »

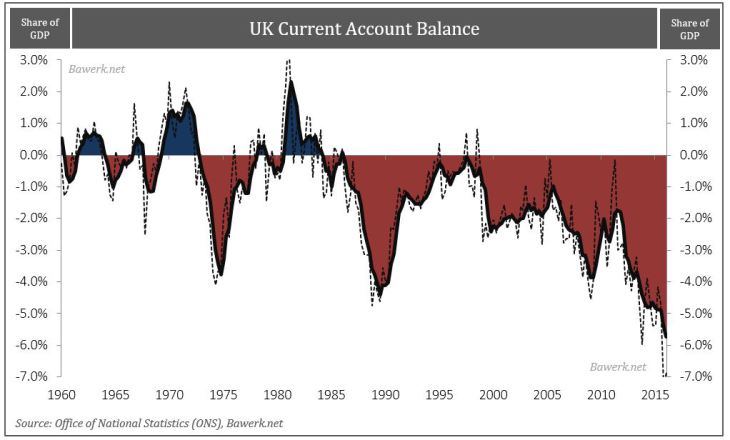

Brexit or not, the pound will crash

Status quo, as our generation know it, established in 1945 has plodded along ever since. It is true that it have had near death experiences several times, especially in August 1971 when the world almost lost faith in the global reserve currency and in 2008 when the fractional reserve Ponzi nearly consumed itself. While the recent Brexit vote seem to be just another near death experience.

Read More »

Read More »

FX Daily, July 07: Sterling Bounces Two Cents, but Does not Appear Sustainable

Amid a better if not strong risk appetite, sterling has rallied two cents from yesterday's lows near $1.28 to poke through the $1.30 level in the European morning. It was helped by an industrial production report that was better than expected. Industrial and manufacturing output fell 0.5% in May. This was around half of the expected decline after a strong April advance (2.1% and 2.4% respectively).

Read More »

Read More »

Dollar Mixed, Equities Head South, Oil Stabilizing

The US dollar is firm against the dollar-bloc currencies, and sterling, but is heavier against the euro and yen.

The 13th consecutive year-over-year decline in China's imports helped keep the pressure on the commodity producers. Despite New ...

Read More »

Read More »