Tag Archive: $TLT

New Month, New Trends?

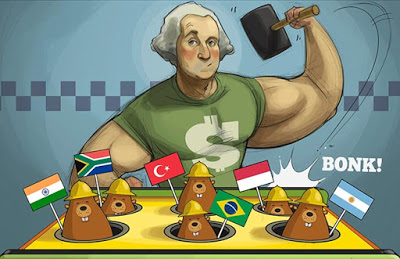

The dollar fell against all the major currencies and most of the emerging market currencies last week. The Dollar Index fell by 1.3%, the biggest loss since the last week of March, and posted its lowest close in nearly three weeks ahead of the weekend. There seemed to be a change in the market after key equity benchmarks, like the MSCI ACWI Index of both emerging and developed markets put in a recovery high in the middle of last week.

Read More »

Read More »

FX Daily, March 25: Monday Blues: Equities Pare Quarterly Gains

Overview: Global equities have soured after the US shares dropped the most since very early in the year before the weekend. Asia's sell-off was led by the 3% decline in Nikkei, while Malaysia fared among the best, surrendering 1%. Europe's Dow Jones Stoxx 600 is off for a fourth session. It lost 1.2% at the end of last week and gapped lower today but stabilizing after the better than expected German IFO survey.

Read More »

Read More »

FX Weekly Preview: Brexit Comes to a Head, and while Europe and US Data Rebound, the Equity Rally Falters

Brexit comes to a head. By nearly all reckoning, the Withdrawal Bill will be resoundingly defeated in the House of Commons on March 12. The margin of defeat may not match the first rejection, but it will be the death knell to the path that had been negotiated for a year and a half.

Read More »

Read More »

FX Daily, March 08: Equities Slump on Growth Concerns ahead of US Jobs

Overview: A weak economic assessment in the Beige Book and an ECB that slashed growth forecasts have been followed by news of a nearly 21% slump in China's exports have marked the end of the dramatic equity rally that was seen in the first part of 2019 after the sharp losses late last year.

Read More »

Read More »

FX Weekly Preview: The Week Ahead

After a dismal end of 2018, investors are faring better through the first two- thirds of the Q1 19. Equity markets have recouped a good part of the late-2018 decline. Bond yields, however, have not returned to where they previously were. The tightening of financial conditions, which was both cause and effect of heightened anxiety among investors, and spooked some central bank have eased considerably.

Read More »

Read More »

FX Daily, January 10: Equity Bounce Stalls while the Greenback Steadies at Lower Levels

Equities, bonds and the dollar are consolidating the moves seen earlier this week. This means equities are trading heavy and bonds firmer. The euro is paring gains that carried it to its best level (~$1.1570) since mid-October. After stalling near JPY109 in the last two sessions, the greenback slumped to almost JPY107.75 before finding a better bid.

Read More »

Read More »

Technical Musings about the Euro and Dollar Anchored by Macro

The $1.1475-$1.1550 is an important area for the euro. Many bulls see a rounded bottom being carved and a break above it would be embraced as a confirmation. The lower-end corresponds to the 100-day moving average. Such a bottom pattern, if confirmed, would project toward $1.1800 the high in H2 18. On the downside, the low from H2 18 was near $1.1200. This is just above a key (61.8%) retracement of the January 2017-February 2018 rally.

Read More »

Read More »

FX Daily, December 20: Stocks Slump and the Dollar Slides as Market Concludes Fed is Mistaken

Overview: Once again the US equity market failed to hold on to even minimal upticks. The sharply lower close spurred follow-through selling in global equities. Few have been spared the wrath of investors who apparently were disappointed with the Fed and its reluctance to consider stopping the balance sheet unwind.

Read More »

Read More »

FX Daily, December 06: New Spanner in US-China Relations Weighs on Risk Appetites

Overview: The global capital markets were fragile amid trade uncertainty and economic slowdown fears. News that Canada arrested the CFO of Huawei on behalf of the US, ostensibly for violating the embargo against Iran triggered an almost immediate risk-off wave that has extended the equity markets losses, sending core bond yields lower, with the US 10-year slipping below 2.9%, and underpinning the dollar against most currencies, with the notable...

Read More »

Read More »

FX Daily, December 04: Stock Rally Arrested, but Bond and Oil Advance Continues, leaving Dollar in a Lurch

Overview: Equity markets are unable to build on yesterday's advance, but bonds and oil are extending gains. The dollar remains on the defensive and is off again all the major currencies. The lack of a joint statement over the weekend by the US and China and seemingly different interpretations of what was agreed leaves investors in a lurch.

Read More »

Read More »

FX Daily, November 27: Market Shrugs Off Latest US Tariff Provocation

The global capital markets have taken the US latest tariff threats in stride. Most of the Asian equity markets advanced, including Japan, Korea, Taiwan, India, and Australia. China and Hong Kong were exceptions with marginal losses. European markets are trying to extend their recovery for a third session, but the industry performance is mixed with energy and materials lower, and utilities, consumer staples, and information technology/communication...

Read More »

Read More »

FX Daily, October 23: Stock Slump Pushes Yields Lower and Buoys Yen

There is one main story today, and that is the resumption of the slide in equities. It is having a ripple effect through the capital markets. Bond yields are tumbling. Gold is firm. The dollar is narrowly mixed, though the yen stands out with almost a 0.5% gain. Most of the large equity markets in Asia, including Japan, China, Hong Kong, Korea, and Taiwan were off mostly 2%-3%.

Read More »

Read More »

FX Daily, October 18: China’s Angst Stays Local

Asian equities were lower, led by a nearly 3% drop in Shanghai, while European shares shrugged it off and the Dow Jones Stoxx 600 is up about 0.4% in late morning turnover. The S&P 500 is off by about 0.25%. Global bond yields were dragged higher by US Treasuries where the 10-year yield is straddling 3.20% after rising four basis points yesterday.

Read More »

Read More »

FX Daily, October 10: US Dollar Pullback may Continue in North America

The euro bottomed yesterday near $1.1430 and reached $1.1515 in Asia. Support is seen near $1.1480 and should hold if the euro's upside correction is to continue. There are options struck $1.1500-$1.1510 for nearly 1.4 bln euros that expire today. For the third consecutive session, the dollar found bids a little below JPY113.00. There is a $1 bln JPY113 option that will be cut today.

Read More »

Read More »

FX Daily, October 09: A (Short) Reprieve For China while the Dollar Stays Firm

The small gains in China's Shanghai Composite and the yuan is helping sentiment today. News that Italy's budget watchdog may reject the government's fiscal plans has helped stabilize Italian assets initially, but renewed pressure quickly materialized. Most Asian equities retreated while Europe's Dow Jones Stoxx 600 is struggling to snap a three-day slide. US shares are trading heavily in Europe.

Read More »

Read More »

FX Daily, October 08: China and European Woes Weigh on Equities but Buoy the Dollar

Overview: The markets are having a rough adjustment to the return of the Chinese markets are the week-long holiday. The cut in the required reserves failed to lift investor sentiment. The Shanghai and Shenzhen Composites fell almost 4%, and the yuan slid nearly 0.8%. It is an unusually large decline for the closely managed currency. The offshore yuan fell by a little more than 0.5%.

Read More »

Read More »

FX Daily, October 04: Dollar Consolidates Gains while Yields Continue to Rise

The US dollar is consolidating yesterday's gains against most of the major currencies, though the dollar bloc is underperforming. Bond yields are moving higher, and equities are lower. With a light data and events stream, the price action itself is the news.

Read More »

Read More »

FX Daily, October 01: NAFTA Deal Struck, Softer EMU Mfg PMI, and Firm Greenback Starts Week

The Canadian dollar and Mexican peso are extending its pre-weekend gains on news that a new NAFTA deal (US-Mexico-Canada Agreement USMCA) has been struck. Against most of the other major and emerging market currencies, the US dollar is firm. China's mainland and Hong Kong markets are closed for a national holiday.

Read More »

Read More »

FX Daily, September 25: Greenback Remains at the Fulcrum

The major currencies are mixed in quiet turnover. Most of the European currencies are firmer, while the dollar-bloc currencies, yen and Swiss franc are softer. Emerging market currencies are steady to higher, though there are a few exceptions in Asia, where the Indonesian rupiah and the Chinese yuan are off about 0.3%, while the Indian rupee and Malaysian ringgit are around 0.2% lower.

Read More »

Read More »

Portfolio Re-Balancing and the Dollar

Boosted by tax reform, deregulation, and strong earnings growth, US equities have motored ahead, leaving other benchmarks far behind. As the Great Graphic here shows, most of the other benchmarks are lower on the year. The S&P 500 (yellow line) is up 8.8% for the year before the new record highs seeing seen now, while the Dow Jones Stoxx 600 from Europe (purple line) is still off 1.7%.

Read More »

Read More »