Tag Archive: T-Bills

If Dollar Is Fixed By Jay’s Flood, Why So Many TIC-ked At Corporates in July?

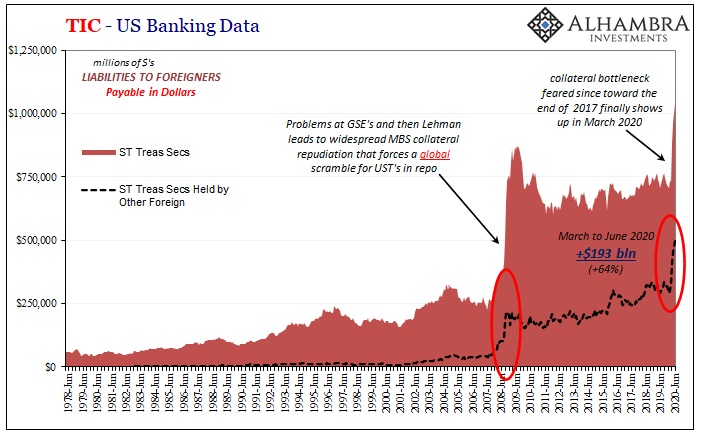

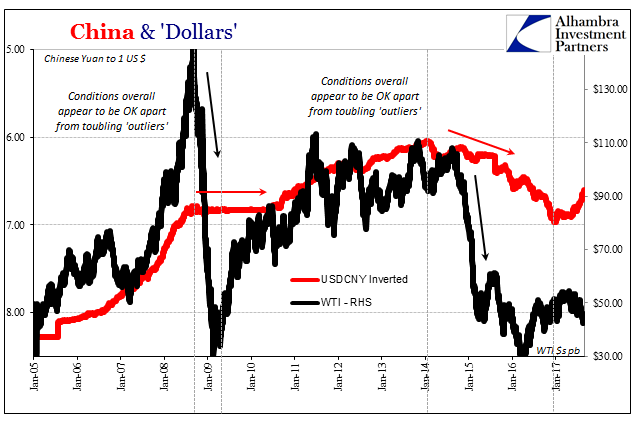

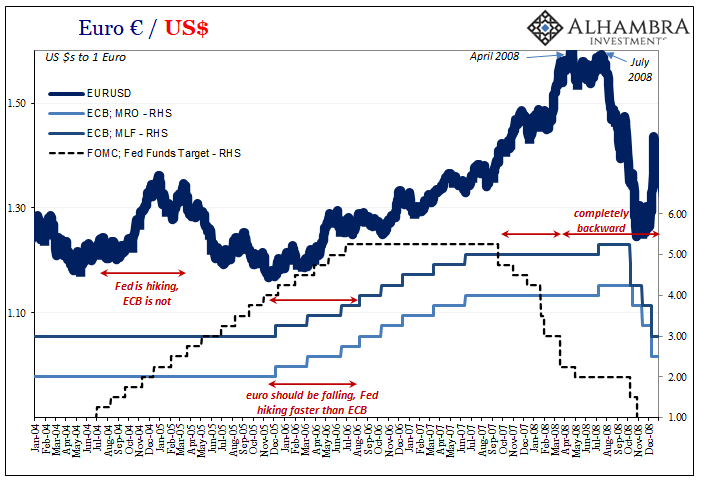

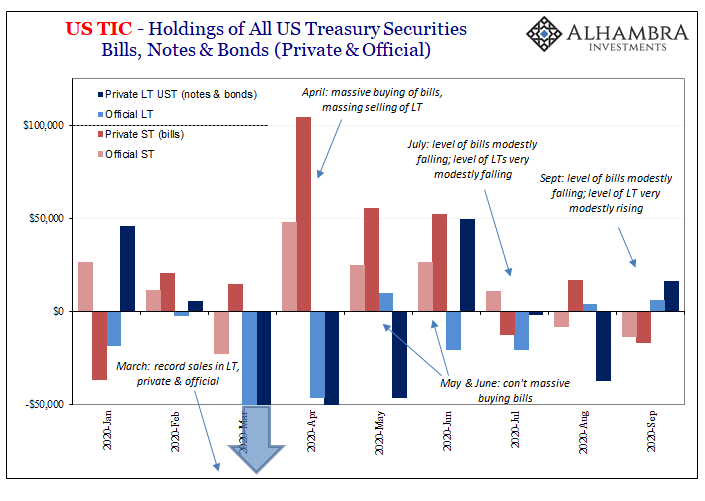

When the eurodollar system worked, or at least appeared to, not only did the overflow of real effective (if virtual and confusing) currency “weaken” the US dollar’s exchange value, its enormous excess showed up as more and more foreign holdings of US$ assets.

Read More »

Read More »

Not This Again: Too Many Treasuries?

Tomorrow, the Treasury Department is going to announce the results of its latest bond auction. A truly massive one, $47 billion are being offered of CAH4’s notes dated August 31, 2020, maturing out in August 31, 2027. In other words, the belly of the belly, the 7s.We’ve already seen them drop for two note auctions this week, both equally sizable.

Read More »

Read More »

Fragile, Not Fortified

On Sunday, Argentina’s government announced it was postponing payment on any domestically-issued debt instruments denominated in foreign currencies. That means dollars, just not Eurobonds. At least not yet. In response, ratings agencies such as Fitch declared the maneuver a distressed debt exchange.In other words, technically a default.

Read More »

Read More »

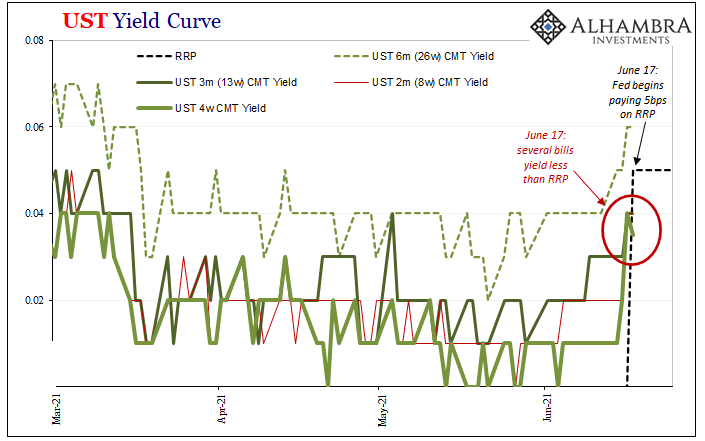

Banks Or (euro)Dollars? That Is The (only) Question

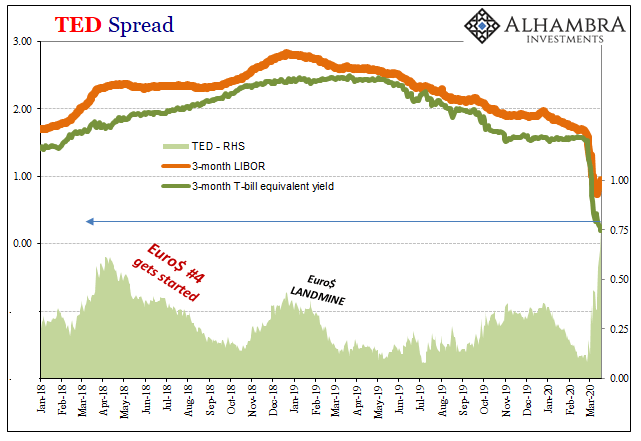

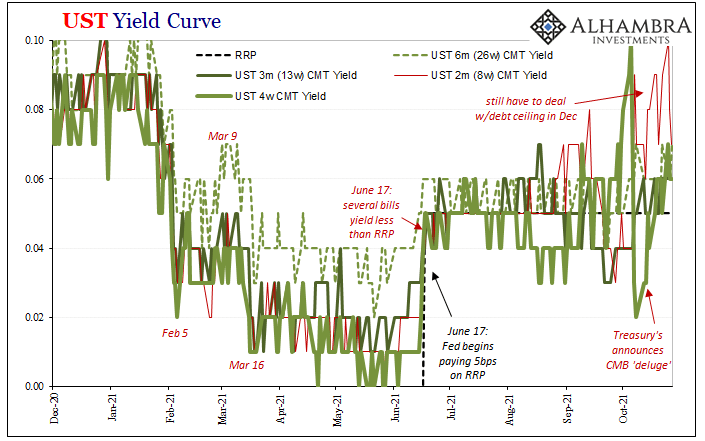

It used to be that at each quarter’s end the repo rate would rise often quite far. You may recall the end of 2018, following a wave of global liquidations and curve collapsing when the GC rate (UST) skyrocketed to 5.149%, nearly 300 bps above the RRP “floor.” Chalked up to nothing more than 2a7 or “too many” Treasuries, it was to be ignored as the Fed at that point was still forecasting inflation and rate hikes.

Read More »

Read More »

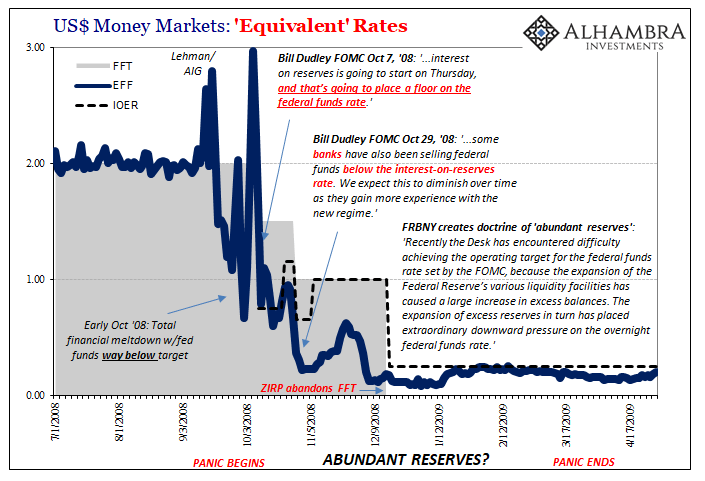

No Further Comment Necessary At This Point

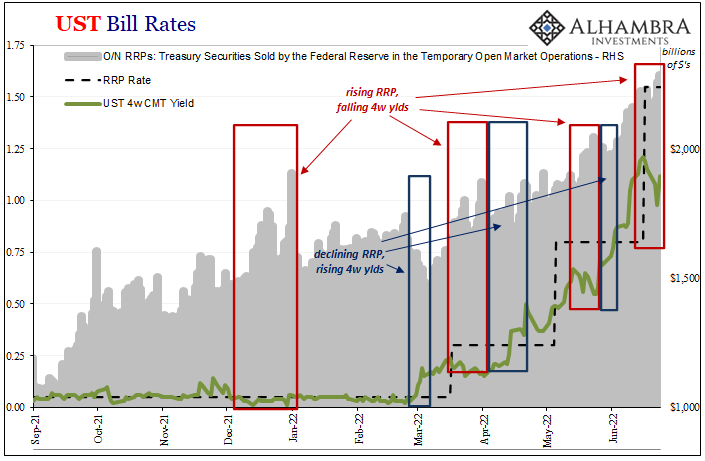

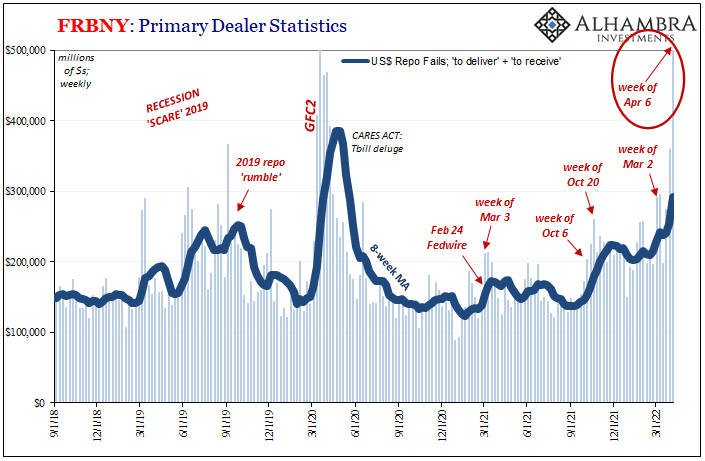

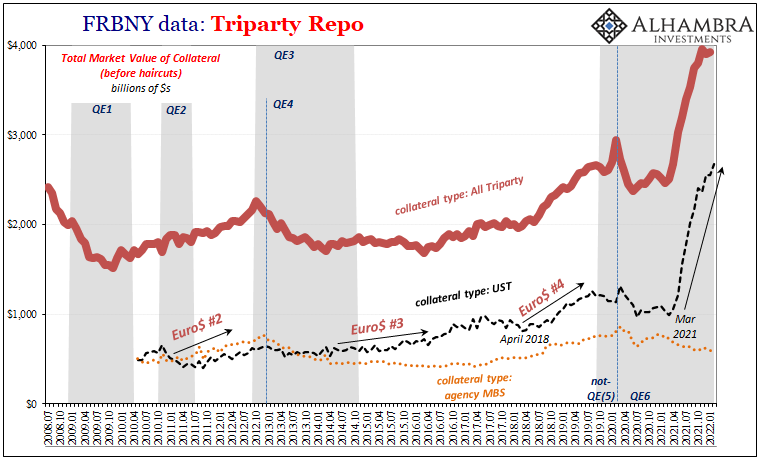

I would write something snarky about bank reserves, but why bother at this point? It’s already been said. If Jay Powell doesn’t mention collateral, no one else does even though it’s the whole ballgame right now. Note: FRBNY’s updated figures shown below are for last week.

Read More »

Read More »

Is GFC2 Over?

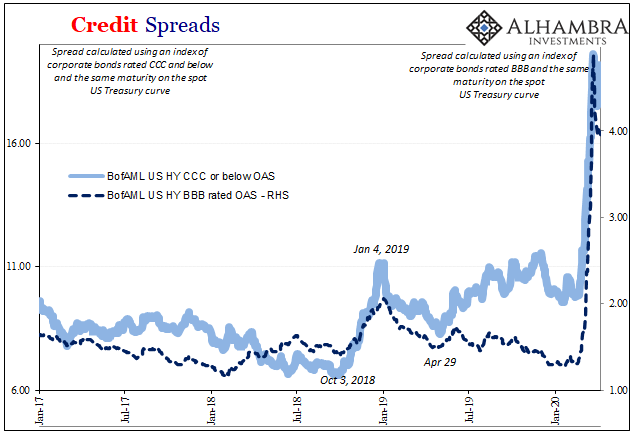

Is it over? That’s the question everyone is asking about both major crises, the answer is more obvious for only the one. As it pertains to the pandemic, no, it is not. Still the early stages. The other crisis, the global dollar run? Not looking like it, either.

Read More »

Read More »

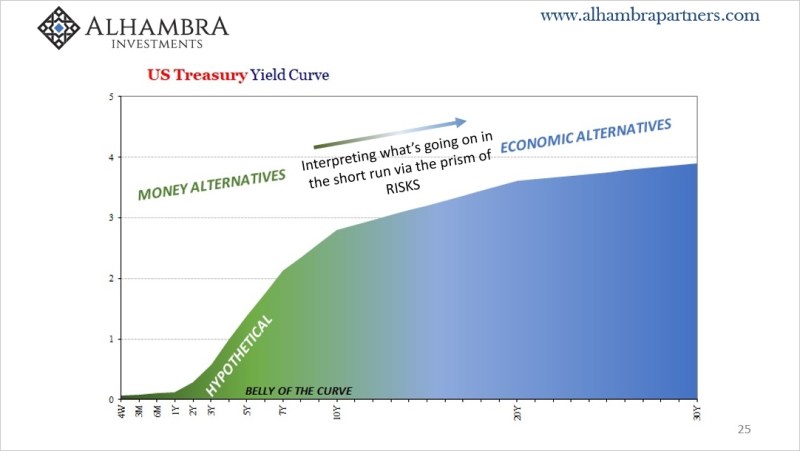

Never Attribute To Malice What Is Easily Explained By Those Attributing Anything To Term Premiums

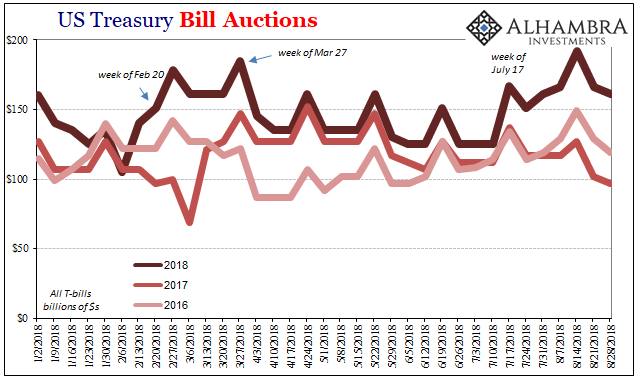

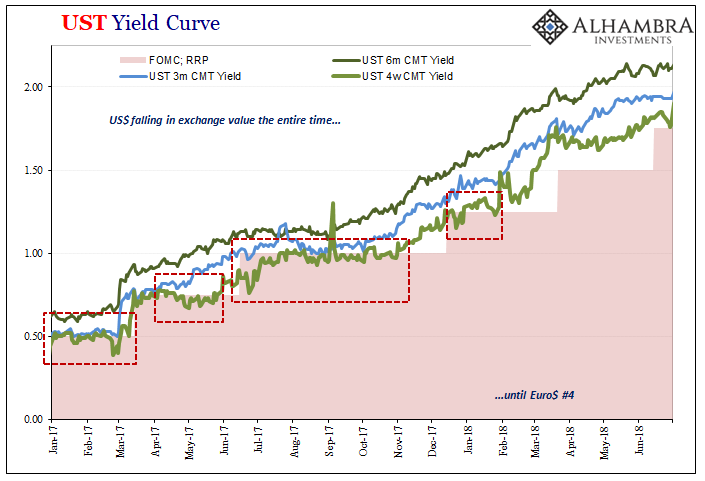

There will be more opportunities ahead to talk about the not-QE, non-LSAP which as of today still doesn’t have a catchy title. In other words, don’t call it a QE because a QE is an LSAP not an SSAP. The former is a large scale asset purchase plan intended on stimulating the financial system therefore economy. That’s what it intends to do, leaving the issue of what it actually does an open question.

Read More »

Read More »

Anticipating How Welcome This Second Deluge Will Be

Effective federal funds (EFF) was 1.92% again yesterday. That’s now eight in a row just 3 bps underneath the “technically adjusted” IOER. If indeed the FOMC has to make another one to this tortured tool we know already who will be blamed for it.

Read More »

Read More »

It Was Collateral, Not That We Needed Any More Proof

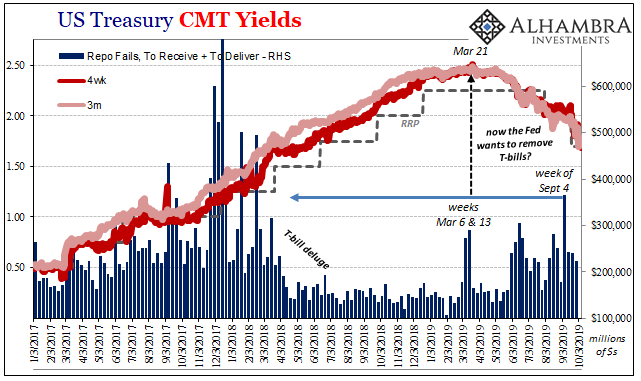

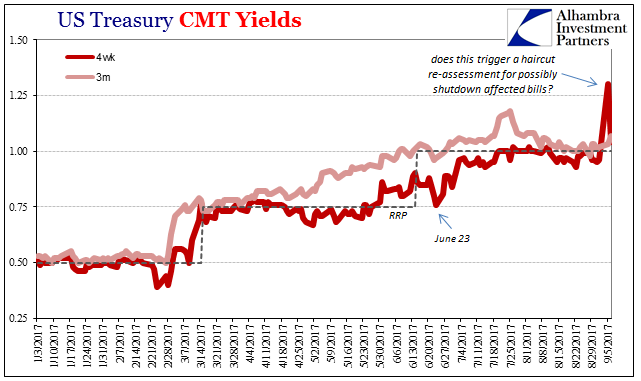

Eleven days ago, we asked a question about Treasury bills and haircuts. Specifically, we wanted to know if the spike in the 4-week bill’s equivalent yield was enough to trigger haircut adjustments, and therefore disrupt the collateral chain downstream. Within two days of that move in bills, the GC market for UST 10s had gone insane.To be honest, it was a rhetorical exercise.

Read More »

Read More »

Moscow Rules (for ‘dollars’)

In Ian Fleming’s 1959 spy novel Goldfinger, he makes mention of the Moscow Rules. These were rules-of-thumb for clandestine agents working during the Cold War in the Soviet capital, a notoriously difficult assignment. Among the quips included in the catalog were, “everyone is potentially under opposition control” and “do not harass the opposition.” Fleming’s book added another, “Once is an accident. Twice is coincidence. Three times is an enemy...

Read More »

Read More »

From One Crisis to Another: One Month T-Bill Yields Go Negative Again

[unable to retrieve full-text content]The one-month T-bill yields zero again, as God intended, and even briefly turned negative this morning, as investors scramble for the safest, most-liquid assets they can find.

Read More »

Read More »