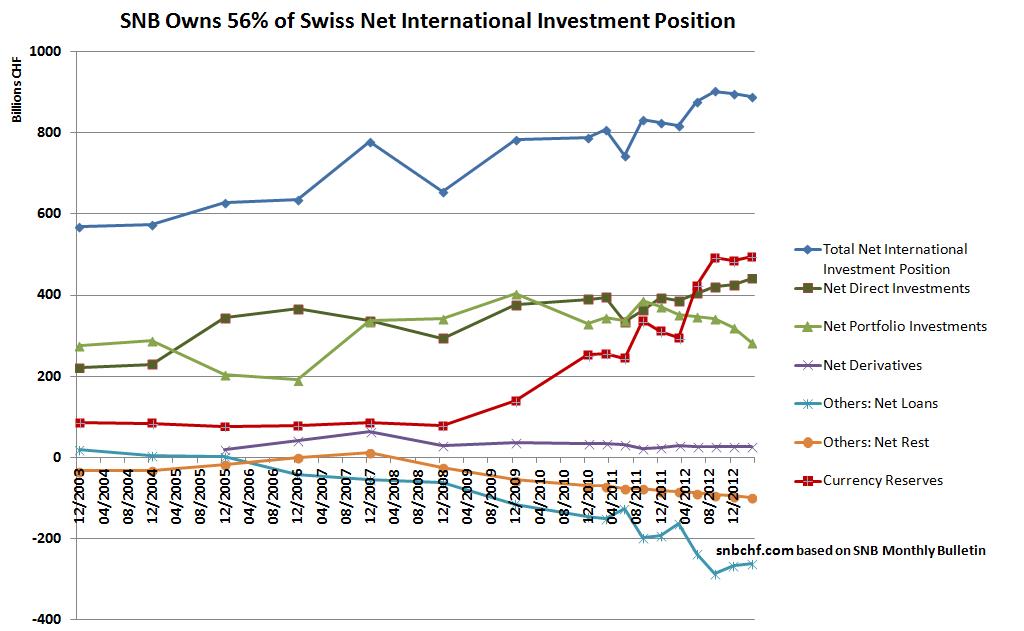

We compare aspects of the Net International Investment Positions for Italy and Switzerland

Read More »

Tag Archive: Switzerland

(2.3) Differences in global CPI baskets

Typically poorer countries have a basket with a higher weight for food and other consumption goods, but richer states give them a smaller weight. Here the full details over different countries

Read More »

Read More »

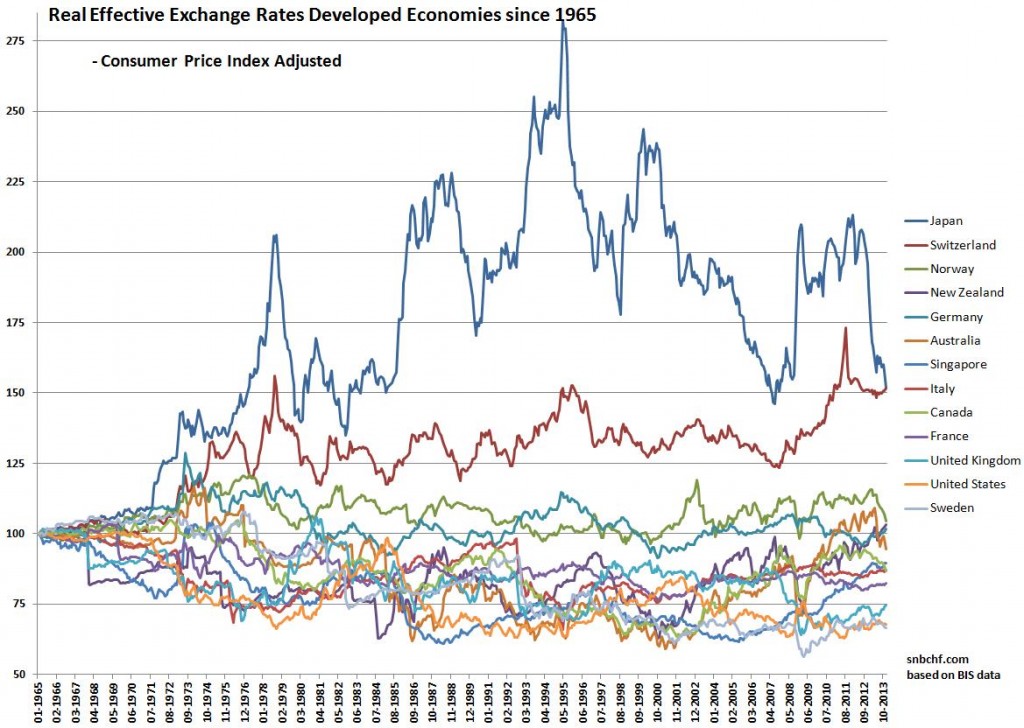

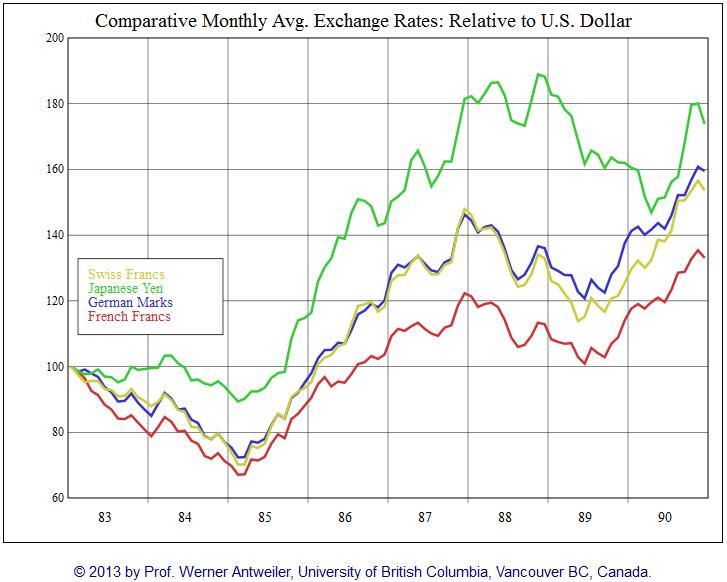

(2.6) CPI-based Real Effective Exchange Rate Since 1965: Yen Still Most Overvalued Currency

If we calculate Real Effective Exchange rates on the base year 1965, the Japanese yen remains the most overvalued currency.

This analysis is based on the real effective exchange rate (REER) provided by the Bank of International Settlement (BIS) and a consumer price-index adjusted exchange rate.

The real value of the yen is around 50% higher than 1965, the same applies to the Swiss franc.

Read More »

Read More »

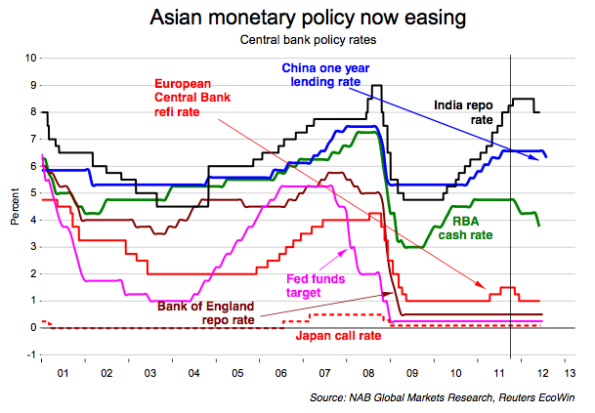

(3) Inflation, Central Banks and Interest Rates

In this chapter we connect three related concepts: inflation, central banks and interest rates.

Read More »

Read More »

(6) FX Theory: Carry Trade and Reverse Carry Trade

This page discusses two closely related concepts: the carry trade and the reverse carry trade.

Read More »

Read More »

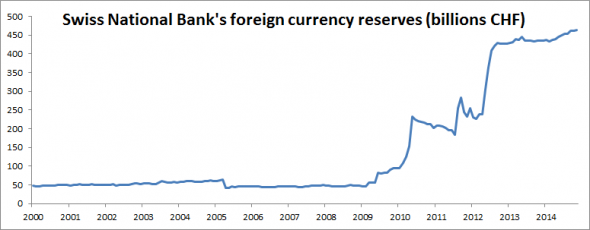

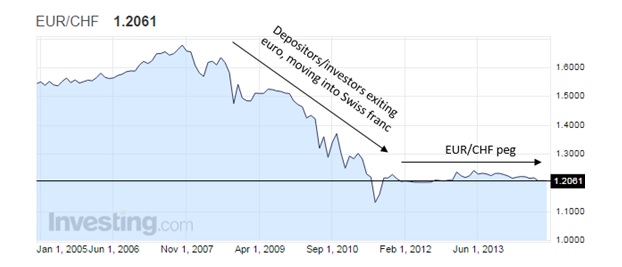

Why did the Swiss franc spike? Lack of Capital Outflows

There is a straightforward answer to the question in the headline: more money has been trying to get into Switzerland than get out, which didn’t affect the exchange rate as long as the Swiss National Bank bought foreign currency. As soon as they stop...

Read More »

Read More »

Death of an FX punter

terriegym: Ive came back to my computer and Alpari have closed all my trades, loosing over $1000 off of my current balance, anyone got any idea what may have happened!!! they arent answering the phone!!

Read More »

Read More »

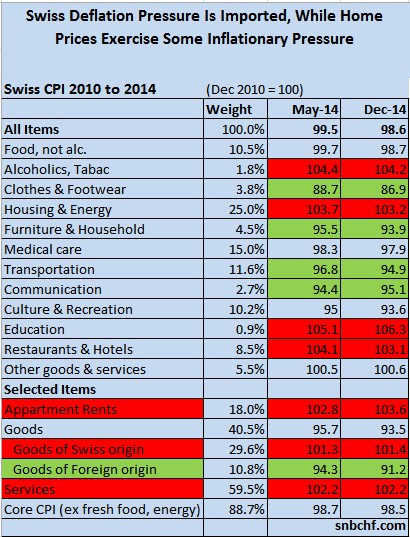

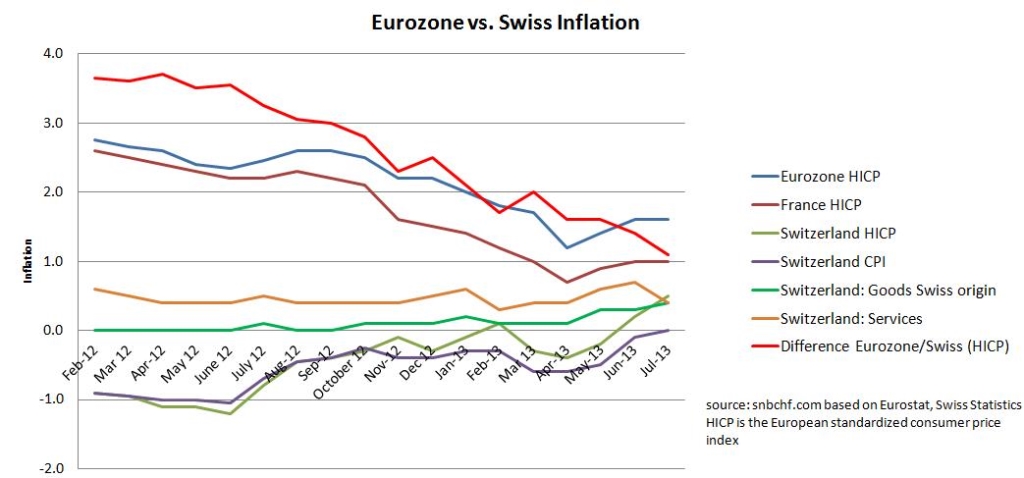

Downwards and Upwards Drivers of Swiss Inflation

In the following we present the drivers of Swiss price inflation. We first present the components of the consumer price index. Then we explain which are upwards-drivers of inflation and which ones cause downwards adjustments.

Read More »

Read More »

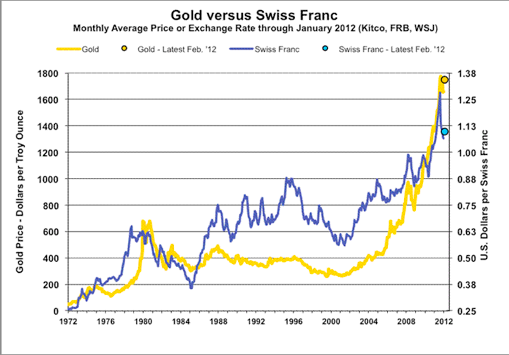

Quantitative Easing, its Indicators and the Swiss Franc

The main drivers of demand for Swiss francs are the euro crisis and, even more, the behavior of American investors, who go out of the dollar in the fear of bad US economic data and/or Quantitative Easing (QE). Risk-friendly investors move into risky assets like stocks or currencies of emerging markets, while risk-averse investors fear inflation and buy inflation-resistant assets like Swiss francs.

Read More »

Read More »

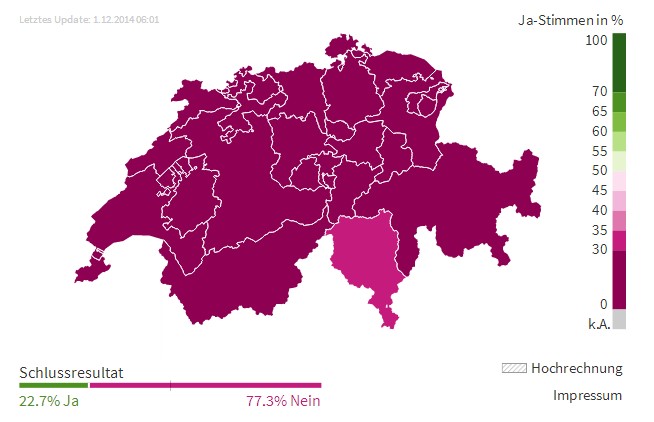

Swiss Gold Referendum: Results and Analysis

In a referendum, the Swiss had to decide about:

1) Ecopop, an ecological-political movement that wants to limit immigration to 0.2% of the population.

2) Abolishment of tax advantages for rich foreigners.

3) A gold initiative.

All three initiatives were rejected, the gold initiative by 78%.

George Dorgan summarizes the outcome. He explains what it means for gold, CHF and the SNB. He argues that the next economic cycle will be driven by...

Read More »

Read More »

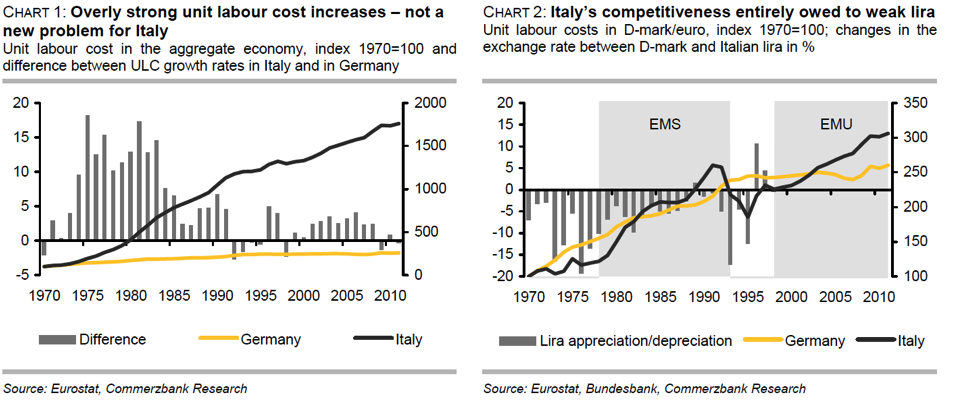

Financial Cycles History, 1990-1996: Breakdown of Communism, German Reunification, Housing Busts in Europe and Japan

A history of financial cycles: 1990-1996 the breakdown of communism leads to a boom in Germany and - due to high interest rates and inflation - to a breakdown of the European monetary system.

Read More »

Read More »

Swiss Franc History 1986-1996: Swiss real estate Boom and Bust

A critical Swiss franc history: This chapter describes the most controversial episode in the Swiss monetary history: How the Swiss National Bank helped to wreck the Swiss real estate market in the 1990s.

Read More »

Read More »

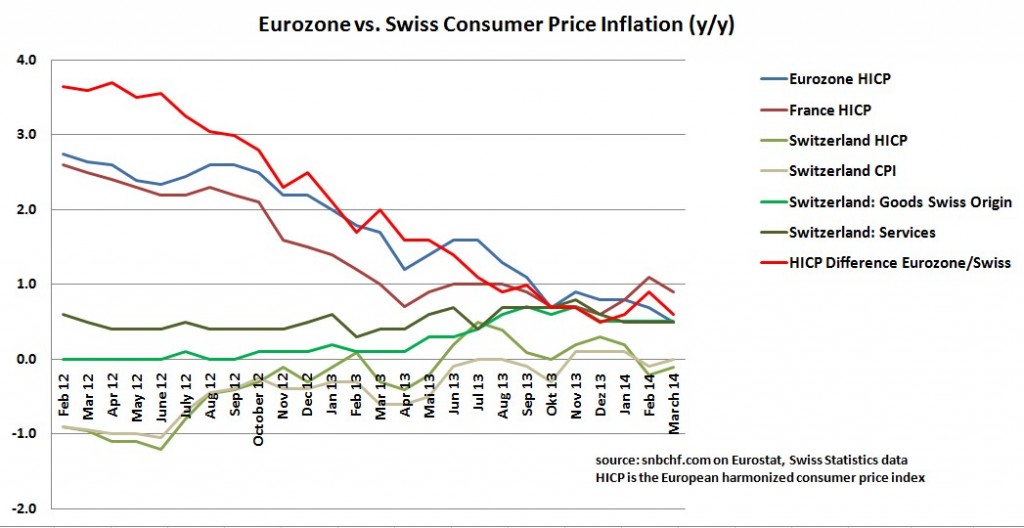

Inflation Difference between Eurozone and Switzerland Narrows to 0.3 percent

According to Swiss Statistics the inflation rate has risen to 0.2% y/y – as for both the Swiss CPI standard and the European HICP standard.

Read More »

Read More »

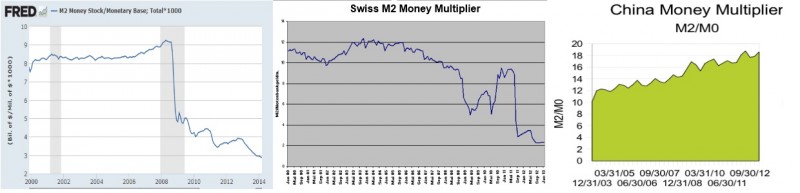

QE, QEE, the Money Multiplier and the Secular Stagnation Confusion

In some countries, the money multiplier is falling, in some others it is increasing, mostly due to central bank tightening. Does this justify to speak of secular stagnation?

Read More »

Read More »

Swiss Yearly Inflation Rate Overtakes First Eurozone Countries

According to Swiss Statistics the yearly inflation rate is at 0.0%, and the monthly rate is +0.4%. The Spanish CPI is already under zero at -0.2%, and the Italian one is at +0.3%, not to speak about severe Cyprus or Greek deflation . Still in February 2012, the difference between the Swiss and Euro …

Read More »

Read More »