Tag Archive: Switzerland Consumer Price Index

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

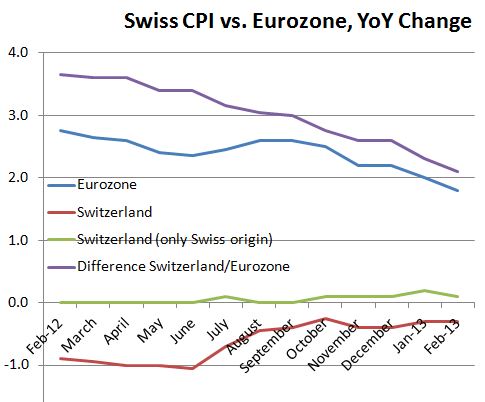

Swiss Inflation Unchanged, HICP Difference Euro Area to Switzerland Down to 1.6 percent

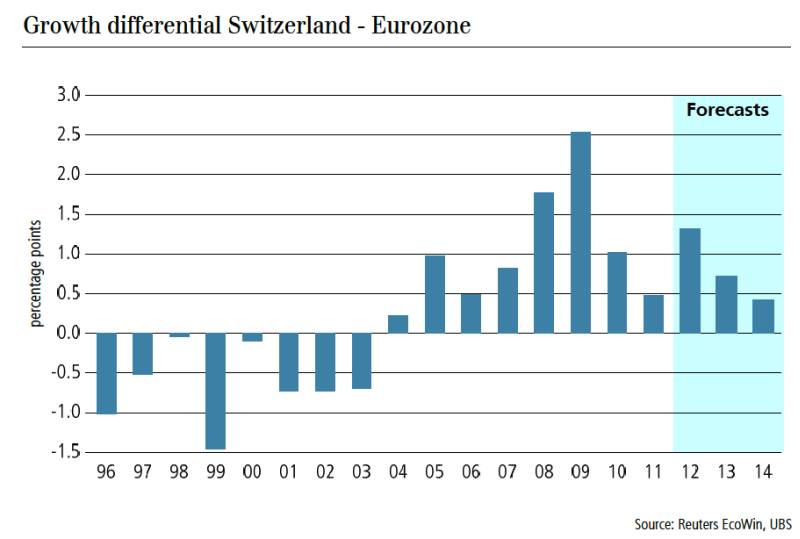

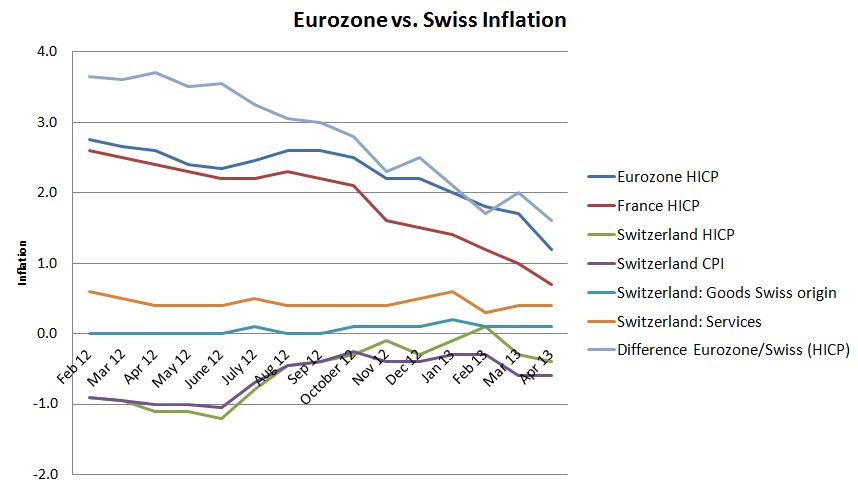

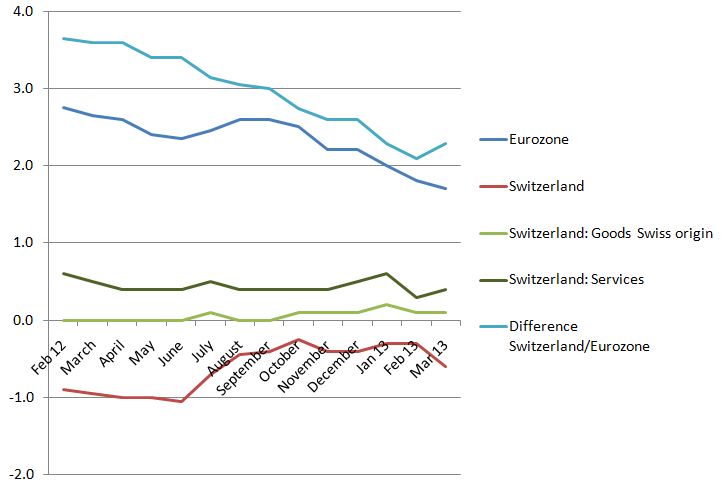

Swiss inflation unchanged in April against March. The inflation difference between the Euro area and Switzerland on a new low. While in early 2012 it was near 4%, if has shrunk now to 1.6%. Details

Read More »

Read More »

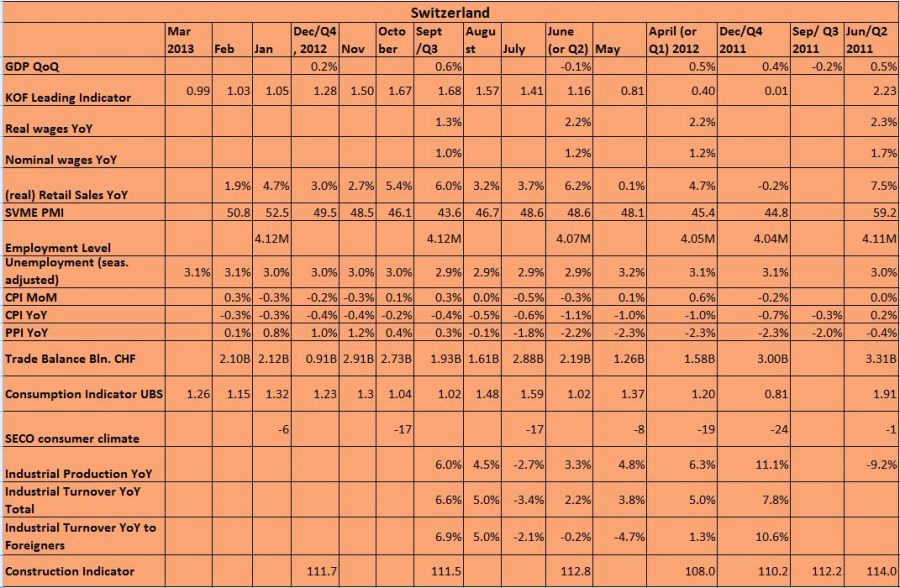

March Swiss Inflation Up 0.2 percent MoM, Down -0.6 percent YoY

Swiss inflation edged up 0.2% MoM when seasonal effects on clothes and footware were corrected. On a year basis, the CPI fell by 0.6%. Major reason were the falling energy prices, details

Read More »

Read More »

Difference between Eurozone and Swiss Inflation Rates Continues to Shrink

The gap has fallen from 3.7% in February 2012 to 2.1%. Swiss CPI is rising on monthly basis, but still negative with 0.3% YoY.

Read More »

Read More »

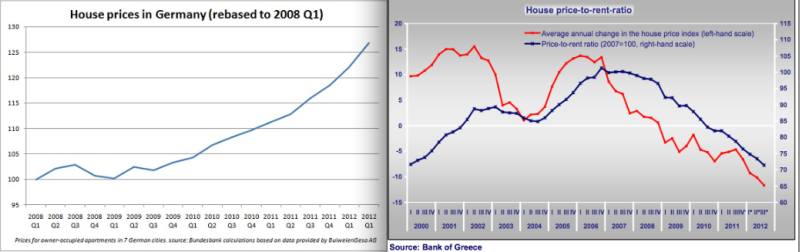

What Ernst Baltensperger Got Wrong: Why SNB FX Losses Might Not Be Recovered By Income on Reserves

Opposed to Ernst Baltensperger, we think that the risk of losses on the SNB balance sheet and of an asset price bubble might be more important than the dangers of upcoming Swiss inflation.

Read More »

Read More »

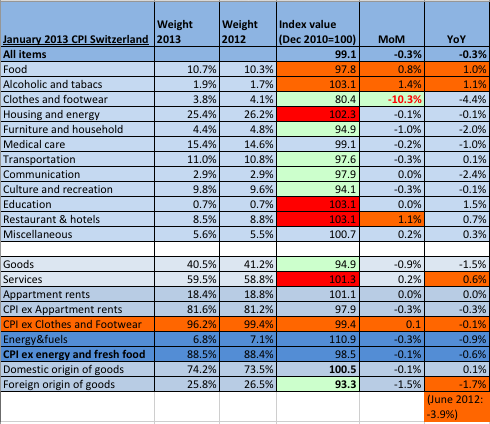

Switzerland’s Slow Way to Inflation

UPDATE February 2013 inflation data: The inflation figures for February showed the upwards movement we expected. On monthly basis inflation rose by 0.3%. The Swiss CPI is getting closer and closer to the one of the euro zone. We explain the January 2013 data on Swiss inflation and indicate which components drive the consumer …

Read More »

Read More »

Deflationary Risks? Comparing Swiss, Swedish and Norwegian Inflation and Exchange Rates

When the Swiss National Bank introduced the 1.20 lower limit, it wanted to eliminate the deflationary risks for Switzerland. For a certain period, namely when a global recession was looming in Autumn 2011, and the Swiss franc was hovering around 1.10, this risk was really present. In this post we would like to know if …

Read More »

Read More »

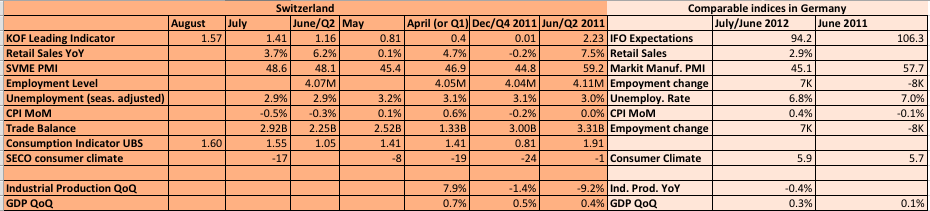

SNB only major central bank missing at Jackson Hole, are important SNB decisions looming ?

The Jackson Hole Symposium is traditionally a meeting of global central bankers, here the 2010 attendance list. This year it takes place between August 30 and September 1. Central bankers assemble The annual economic symposium for central bankers staged by the Federal Reserve Bank of Kansas City begins in Jackson Hole, Colorado (until September 1). …

Read More »

Read More »

Written in February 2012: Will the EUR/CHF never rise over 1.22 or 1.23 again?

Our analysis from February 2012 shows astonishing accurateness: It predicted that the euro would not rise against CHF and that the commodity currencies were overvalued and subject to correction.

Basic foreign exchange theory, the SNB price stability mandate and strong fundamentals for Switzerland and bad ones for the peripheral countries of the euro zone speak for the thesis that the EUR/CHF exchange rate might never go over the level of around...

Read More »

Read More »

EUR/CHF, A History, Market Betting on Floor Hike: February 2012

EUR/CHF Busy Doing Jack; Jordan Gobbing Off Later EUR/CHF sits at 1.2048, some 7 pips easier from when I started out. Barrier option interest sits at 1.2025 and ofcourse 1.2000. SNB interim head honcho Jordan speaks later this evening (18:30 GMT) in Zurich. Might be giving instructions on how to make his favourite alpine muesli … Continue reading...

Read More »

Read More »

EUR/CHF, Market betting on Floor Hike, December 2011

Four Trades For 2012: #2 Sell The Swiss Franc I bought EUR/CHF shortly after the 1.20 peg was introduced and have held it ever since. My only regret has not been trading the range more aggressively. At this point everyone has an opinion of the SNB so I won’t try to convince the bears. Personally, … Continue reading »

Read More »

Read More »

EUR/CHF, a Year of Free Market (07/2010-07/2011): July 2010

EUR/CHF Hit Again EUR/CHF has been hit again, down at 1.3535 from early 1.3580. Recently there has been talk of the Swiss National Bank selling the cross, something I for one certainly can’t substantiate. Also yesterday there were rumours of a September rate hike in Switzerland. All very murky. The EUR/CHF cross selling has helped pressure EUR/USD, which is … Continue reading »

Read More »

Read More »

Recent History of the Swiss Franc: April 2009

A history of the EUR/CHF from the website ForexLive April 2009 Selling EUR/CHF Seems Akin To Poking Billy Goat Gruff With A Sharp Stick It seems to me selling the EUR/CHF cross down here is akin to poking the elder billy goat gruff with a sharp stick. You get it, Alpine meadows, goat herds….(Ok I know … Continue reading »

Read More »

Read More »

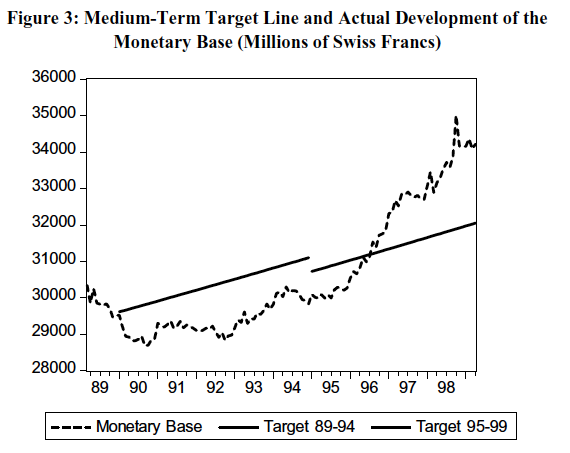

Swiss Inflation, GDP, Monetary Base between 1974 and 2000

Some background statistics on the Swiss monetary policy in the 1970s from Swiss Monetary Targeting 1974-1996: The role of internal policy analysis. More details and monthly data on inflation here.

Read More »

Read More »