Tag Archive: Switzerland Consumer Price Index

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

What Caused The Swiss Financial Tsunami? Three Reasons, One Trigger, One Chain Reaction

In this post we give our (Swiss) view for the financial tsunami on January 15.

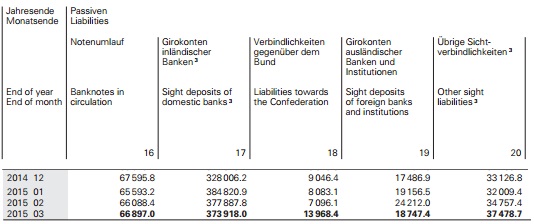

The SNB has preferred its secondary mandate, namely financial stability, and the elimination of risks on its own balance sheet caused by ECB QE.

It will not obey its primary target, price inflation, for the next three to five years. While in the mid-term (5 -10 years) inflation should move up.

Differing perceptions between Switzerland and the Anglophone world about...

Read More »

Read More »

Currencies: Going cuckoo for the Swiss

CURRENCIES don't normally move that far on a daily basis—2 to 3% is a big shift. The exception is when a country on a fixed exchange rate suffers a devaluation; then a 20-30% fall is a possibility. But a 20-30% plus upward move is almost unprecedented. That, however, is what happened to the Swiss franc on January 15th, as Switzerland's central bank abandoned its policy (instituted back in 2011) of capping the currency at Sfr1.20 to the euro.

Read More »

Read More »

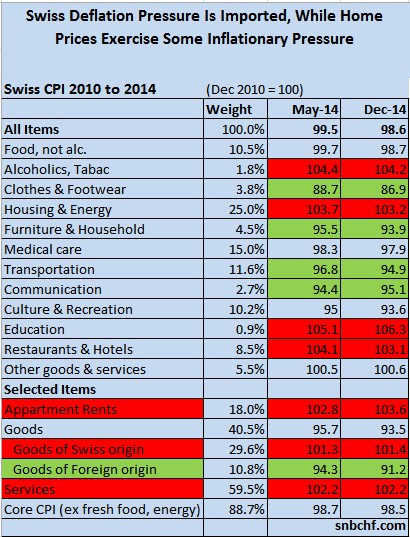

Downwards and Upwards Drivers of Swiss Inflation

In the following we present the drivers of Swiss price inflation. We first present the components of the consumer price index. Then we explain which are upwards-drivers of inflation and which ones cause downwards adjustments.

Read More »

Read More »

Peter Schiff’s Message to Switzerland: Preserve Your Wealth, Gold is Better than Pegging to the Euro

Peter Schiff, an Austrian economist who predicted the financial crisis urges the Swiss to preserve their wealth. Therefore, they should vote yes in the gold referendum. He thinks that buying gold is better than pegging to the euro. The Swiss will be better off if they possess a strong currency. Pegging to the euro implies that the Swiss Franc will become a new Italian Lira, Peseta or French Franc.

Read More »

Read More »

Swiss Gold Referendum and SNB’s Opinion: An Exchange of Arguments

Already in 2013, the Swiss National Bank (SNB) spoke out against the gold initiative and revealed that the Swiss gold is stored mostly in Switzerland and 20% in the UK and 10% in Canada. There is no Swiss gold in the United States according to SNB chairman Jordan. In this post we provide an exchange of Jordan's arguments against the ones of the gold initiative. We also state our view that is not as strict as the one of the referendum proponents.

Read More »

Read More »

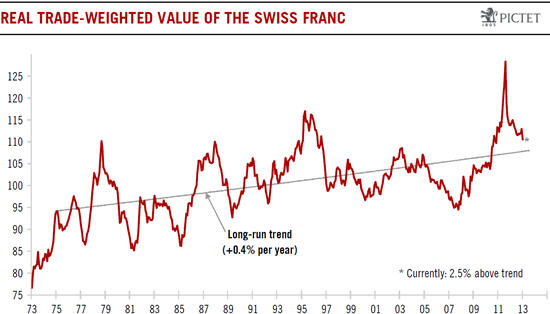

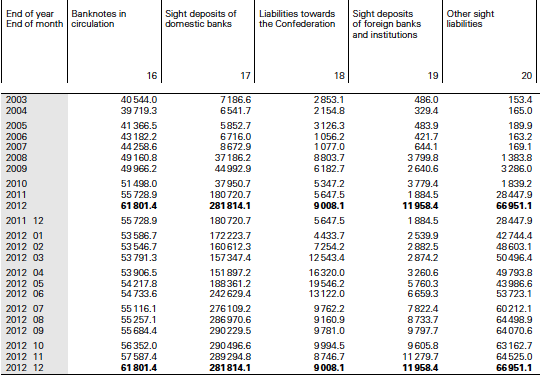

Swiss Franc and Swiss Economy: The Overview Questions

Before the upcoming SNB monetary policy assessment meeting on June 19th, rumors started the SNB could follow the ECB and set negative rates on banks' excess reserves. We would like to deliver the whole background, starting with the question why Swiss inflation has been so low in the past and why CHF always appreciated.

Read More »

Read More »

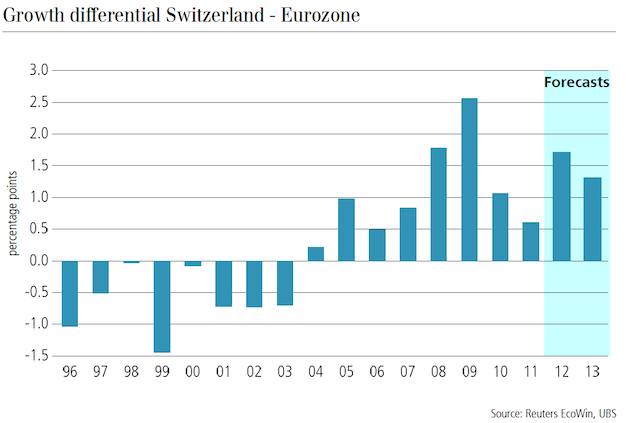

Swiss Franc History, from 2004 to 2009: The undervalued franc

A Critical History of the Swiss Franc: During the "global carry trade" period between 2004 and 2007, the euro strongly appreciated against the Swiss franc. Most astonishingly this happened, despite the fact that the Swiss GDP growth was on average 0.5% higher

Read More »

Read More »

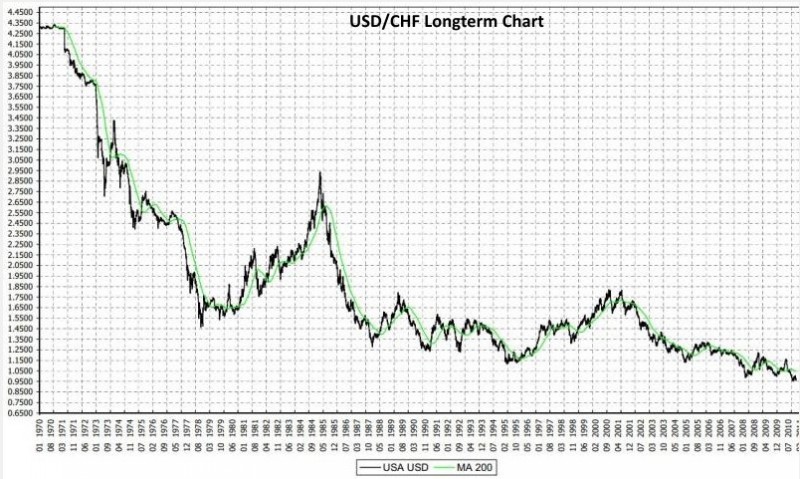

Swiss Franc History: The long-term view and the comparison with gold

We establish a long-term view and history of the Swiss franc. We compare the franc with gold.

Read More »

Read More »

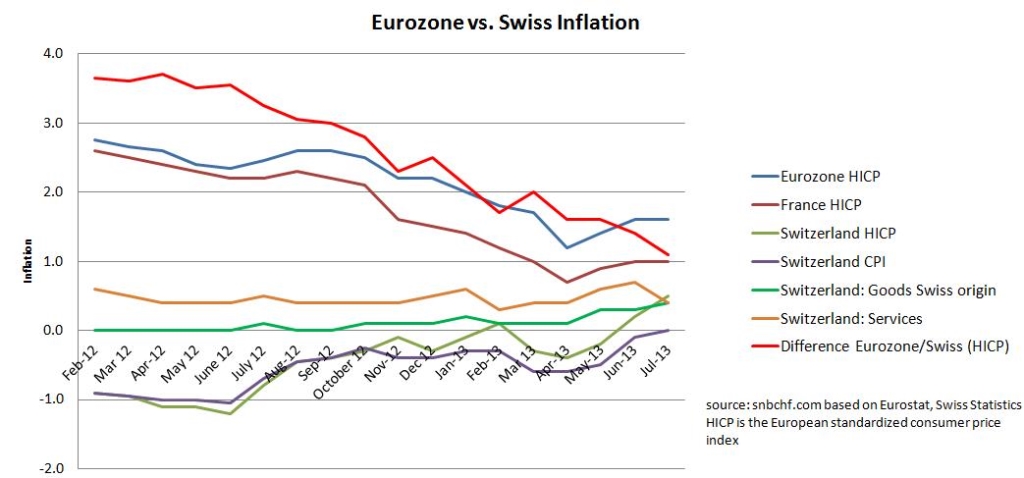

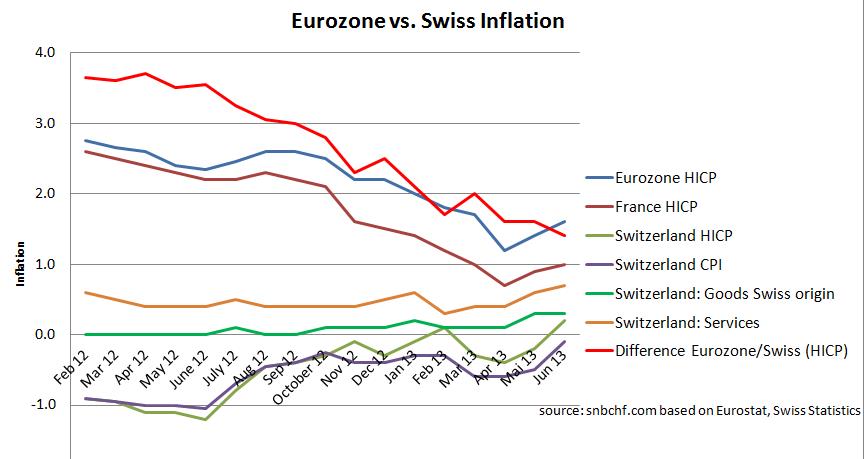

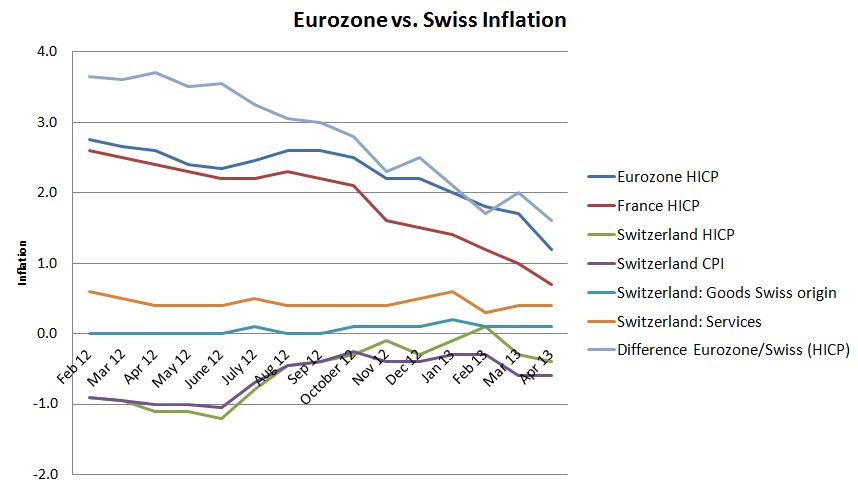

Inflation Difference between Eurozone and Switzerland Narrows to 0.3 percent

According to Swiss Statistics the inflation rate has risen to 0.2% y/y – as for both the Swiss CPI standard and the European HICP standard.

Read More »

Read More »

The IMF Assessment for Switzerland 2014 and our critique

In the 2014 assessment for Switzerland by the International Monetary Fund, several sentences sparked in our eyes; we will contrast them with our recent critique.

Read More »

Read More »

Inflation Difference between Eurozone and Switzerland Narrows to 0.5 percent

Another five months till Swiss inflation is higher? When the European economy starts to expand again, who will hike rates first, the SNB or the ECB? December Update According to Swiss Statistics the inflation rate remained stable at 0.1% y/y, while the inflation measured by the European HICP standard was +0.3% y/y, slightly higher than … Continue reading »

Read More »

Read More »

SNB’s Jordan Responds to the Critique from the Peterson Institute: What They Forgot to Ask Him …

SNB's Jordan Responds to the Critique from the Peterson Institute: What They Forgot to Ask...

Read More »

Read More »

Inflation Difference (HICP) between Eurozone and Switzerland Narrows from 1.4 percent to 1.1 percent

According to Swiss statistics, the yearly change in the Swiss consumer price index has risen from -0.1% to 0%. The headline MoM figure fell by 0.4% due to the yearly sell-off in the retail sector. The difference between euro zone and Switzerland in terms of the European Harmonized Index of Consumer Prices HICP has … Continue reading »

Read More »

Read More »

The End of Swiss Deflation

The yearly change of the Swiss consumer price index has risen from -0.5% to -0.1%, the end of deflation is near. Swiss inflation measured with the European standard HICP has even improved to +0.2% y/y. Details

Read More »

Read More »

Danthine’s Latest Statements Imply that SNB Might Remove Cap in 2014

SNB Vice Chairman Jean-Pierre Danthine is undoubtedly the most hawkish member of the governing board, an opposite personality to the rather interventionist and Keynesian hedge fund manager Philip Hildebrand. Danthine has perfectly understood that times for the SNB might get hard again in 2014. Jean-Pierre Danthine has made some comments recently: – Swiss franc stays …

Read More »

Read More »

Swiss Inflation Rises, Services Up 0.6 percent YoY, Goods Swiss Origin +0.3 percent, Energy Tames

Cheaper energy prices and long-lasting contracts help against inflation. Swiss inflation increased by 0.1% against April. According to Swiss Statistics, on a year basis, the CPI fell by 0.5%. Major reasons for lower figures were the 6.3% YoY decrease in energy prices, 4.5% YoY lower clothes and footwear price and technological improvements in communication that caused … Continue reading »

Read More »

Read More »