Tag Archive: Spain Consumer Price Index

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

FX Daily, May 30: Italian Reprieve, Euro Bounces, Trade Tensions Rise

After what could be described as a 15-sigma event yesterday in the Italian bond market, a reprieve today has seen the euro recover a cent from yesterday's lows. While the political situation in Italy is worrisome, many observers suspect that the new banking rules exacerbated the illiquidity that explains outsized moves.

Read More »

Read More »

FX Daily, March 27: Global Equities Follow US Lead, Dollar Steadies

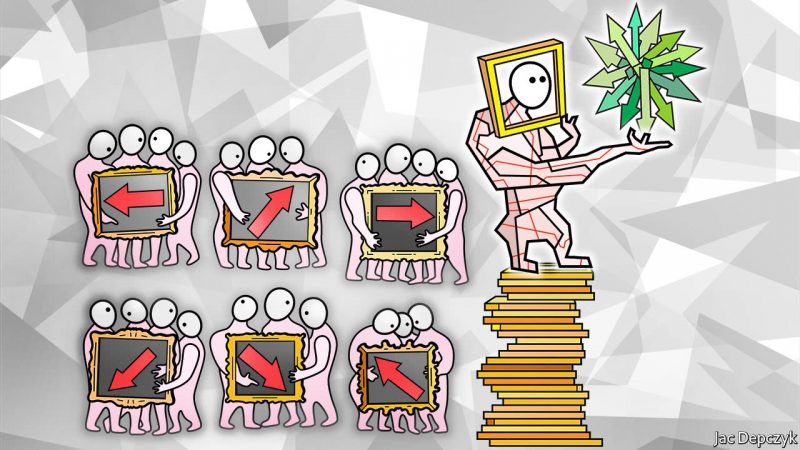

We argued that the talk of trade war was exaggerated. The confrontation, strong demands and a climb down is the Art of the Deal, and is part of the way the Trump Administration negotiates. We see striking parallels between the policymakers and tactics with the Reagan Administration's attempt to pry open Japanese markets.

Read More »

Read More »

FX Daily, March 13: Non-Economic Developments Dominate Ahead of US CPI

Many see the eruption of the scandal that threatens senior government officials as yen positive because it weakens those that ostensibly want to depreciate the yen through monetary policy. The scandal involves falsifying documents to conceal a sweetheart deal. The government sold of state-owned land to a school-operator, reportedly with connections to Prime Minister Abe's wife at an incredibly low price.

Read More »

Read More »

FX Daily, February 27: Markets Tread Water; Powell is Awaited

The capital markets seem unusually subdued. The US dollar is mostly slightly firmer, except against the euro and Swiss franc among the majors. The MSCI Asia Pacific Index managed to eke out a small gain (0.2%), for a third advancing session, without the help of China, Taiwan, Korea or India. It was really a Japanese story. The Nikkei rallied 1.1%, while excluding Japan the MSCI benchmark was off 0.25%.

Read More »

Read More »

FX Daily, February 15: Stocks Jump, Bonds Dump, and the Dollar Slumps

The significant development this week has been the recovery of equities after last week's neck-breaking drop, while yields have continued to rise. The dollar has taken is cues from the risk-on impulse from the equity market and the sales of US bonds more than the resulting higher yields. Asia followed US equities higher.

Read More »

Read More »

FX Daily, January 12: Euro Jumps Higher

There is one main story today and it is the euro's surge. The euro began the week consolidating it recent gains a heavier bias, but the record of last month's ECB meeting surprised the market with its seeming willingness to change the forward guidance early this year in a more hawkish direction. This spurred a 0.7% gain in the euro back above $1.20. The euro stayed bid in Asia, but took another leg up (~0.75%) in response to reports that a...

Read More »

Read More »

FX Daily, December 14: US Rates Bounce Back, but Dollar, Hardly

US interest rates have recovered the drop seen after the FOMC yesterday, but the dollar at best has been able to consolidate its losses and at worst, seen its losses extended. The Fed boosted its growth forecasts and lower unemployment forecasts. Yet its interest rate trajectory and inflation forecasts were largely unchanged. Yellen, as her recent predecessors have done, played down the implications of the flattening of the yield curve.

Read More »

Read More »

FX Daily, November 29: Sterling Charges Ahead on Brexit Hopes

Prospects of a deal with the EU has sent sterling to its best level in two months against the dollar. It reached $1.3430 in early European turnover. It had sunk to nearly $1.3220 yesterday as European markets were closing, which was a four-day low. It is the strongest of the major currencies today, gaining about 0.4%. With today's gains has met our retracement target near $1.3415. The momentum appears to give it potential toward $1.3500 in the...

Read More »

Read More »

FX Daily, November 14: Euro Rides High After German GDP

Sterling is trading in the lower end of yesterday's range and has been confined to about a quarter a cent on either side of $1.31. On the other hand, the euro has pushed a bit through GBP0.8950 to reach its best level since October 26. Sweden also reported softer than expected October inflation.

Read More »

Read More »

FX Daily, October 30: Dollar Slips in Consolidative Activity

The markets are mixed, mostly responding to idiosyncratic developments, as the week's large events loom ahead. These BOJ, BOE, and FOMC meetings, eurozone flash CPI and US jobs reports. In addition, US President Trump is expected to announce his nomination of the next Fed chair, and the initial House tax bill will be unveiled.

Read More »

Read More »

FX Daily, October 11: Markets Looking for a New Focus

The US dollar is consolidating after retreating since reversing lower following the US jobs data at the end of last week. While the greenback has largely been confined to yesterday's ranges against the major currencies, the euro has made a marginal new high, briefly trading through the $1.1830 area noted yesterday.

Read More »

Read More »

FX Daily, August 30: US Dollar Recovery Extended

The US dollar recovery that began in North American yesterday continued to in Asia and Europe. The geopolitical anxiety sparked by North Korea's missile over Japan subsided. The US response was seen as measured and tempered.

Read More »

Read More »

FX Daily, August 11: Geopolitical Tensions Remain Elevated into the Weekend

There has been no apparent attempt by either North Korea or the United States to ease the rhetorical flourishes that have made global investors nervous. Risk assets were liquidated, and the funding currencies, particularly the Japanese yen and Swiss franc were bought back. The yen gained nearly 1.6% this week, ahead of the US session, while the Swiss franc gained 1.3%.

Read More »

Read More »

FX Daily, July 28: Dollar and Equities Closing Week on Heavy Note

The US dollar is mostly lower, though one of the features of recent days has been the dramatic slide of the Swiss franc, and that is continuing today. The franc is off another 0.5% today, to bring its weekly loss to a sharp 2.5%. The euro finished last week near CHF1.1030 and is now near CHF1.1370; its highest level since the cap was lifted in mid-January 2015.

Read More »

Read More »

FX Daily, July 13: Sterling and Antipodeans Trade Higher

The US dollar is mostly consolidating yesterday's move. Sterling is pushing back through $1.29 as the hawks on the MPC may not have been dissuaded by disappointing PMI readings and the softer earnings growth. The table is being set for another 5-3 vote at next month's MPC meeting.

Read More »

Read More »

FX Daily, June 29: Run on Dollar and Yen Continues

The main driver of the foreign exchange market is the continued reassessment of the trajectory of monetary policy in the UK, EMU, and Canada. The OIS market does not show that higher rates are discounted for the next policy meeting (August, September, and July respectively), but rather there is greater confidence that, outside of Japan, peak monetary stimulus is behind us.

Read More »

Read More »

FX Daily, June 13: Dollar Softens Ahead of Start of FOMC Meeting

The US dollar is trading with a heavier bias against all the major currencies save the Japanese yen. The Scandis and Canadian dollar are leading the move. Sweden reported a 0.1% rise in the headline and underlying inflation while the median expected a decline of the same magnitude. The year-over-year pace slowed but not as much as expected.

Read More »

Read More »

FX Daily, May 30: Mixed Dollar as Market Awaits Preliminary EMU CPI and US Jobs

With the backdrop of US interest rates unable to get much traction, despite the strong probability of another Fed rate hike in a couple of weeks, the third since last November election, the US dollar mixed today. The chief story today, though, is not the greenback but the euro. The euro is trading heavily for the fourth session.

Read More »

Read More »

FX Daily, April 27: Several Developments ahead of the ECB meeting

The ECB meeting and the press conference that follows it is the main event. However, it has had to compete with the Bank of Japan and Riksbank meetings, as well as the further reflection of the tax reform proposals by the Trump Administration yesterday.

Read More »

Read More »

FX Daily, April 12: Investors Catch Breath, Markets Stabilize

Markets are calmer today. The significant movers yesterday have stabilized. The dollar has been unable to resurface above JPY110, but after plumbing to new lows near JPY109.35 in Asia, the dollar has recovered back levels since in North America late yesterday. The decline in the US 10-year yield was also initially extended in Asia before stabilizing and returning to levels seen in the US afternoon.

Read More »

Read More »