Tag Archive: Swiss National Bank

How Derivatives Markets Responded to the De-Pegging of the Swiss Franc

In a Bank of England Financial Stability Paper, Olga Cielinska, Andreas Joseph, Ujwal Shreyas, John Tanner and Michalis Vasios analyze transactions on the Swiss Franc foreign exchange over-the-counter derivatives market around January 15, 2015, the day when the Swiss National Bank de-pegged the Swiss Franc. From the abstract.

Read More »

Read More »

SNB announces 24 bn CHF profit for 2016 thanks to rising stock markets.

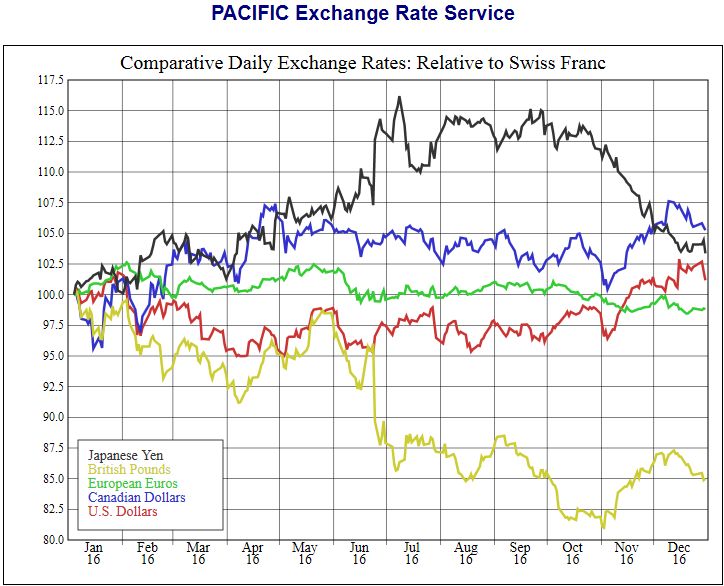

The Swiss National Bank has announced 24 bn profits from 2016. Profits came from the dollar, yen and Canadian dollar, while the pound retreated by 15%. The EUR/CHF is only slightly weaker, mostly because the SNB actively supported the euro.

Read More »

Read More »

Risk Reward Analysis for Financial Markets

We focus this video regarding the potential upside for stocks versus the considerable downside risk for investors. All Technical Analysis is flawed and backward looking, it is a Critical Thinking flaw to extrapolate the future from the most recent past. I want to know the next market move, and not still be stuck on the most recent market move. And the most important fact of all is valuations, stocks are in a bubble right now due to Central Banks...

Read More »

Read More »

A Biased 2017 Forecast, Part 1

A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after reading Liar’s Poker, Boomerang, The Big Short, Flash Boys, and Moneyball, I was interested to hear about his new project.

Read More »

Read More »

We Know How This Ends – Part 2

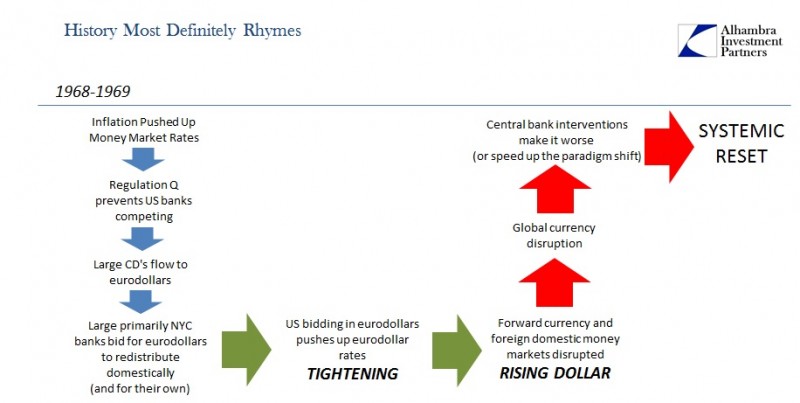

In March 1969, while Buba was busy in the quicksand of its swaps and forward dollar interventions, Netherlands Bank (the Dutch central bank) had instructed commercial banks in Holland to pull back funds from the eurodollar market in order to bring up their liquidity positions which had dwindled dangerously during this increasing currency chaos.

Read More »

Read More »

Kosten eines Vollgeld-Systems sind hoch (Costly Sovereign Money)

Eine Umsetzung der Vollgeld-Initiative würde grossen Schaden anrichten und dürfte im Ergebnis selbst die Initianten enttäuschen. Verbesserungen verspricht dagegen eine «sanfte» Reform: die Einführung von elektronischem SNB-Geld für alle.

Read More »

Read More »

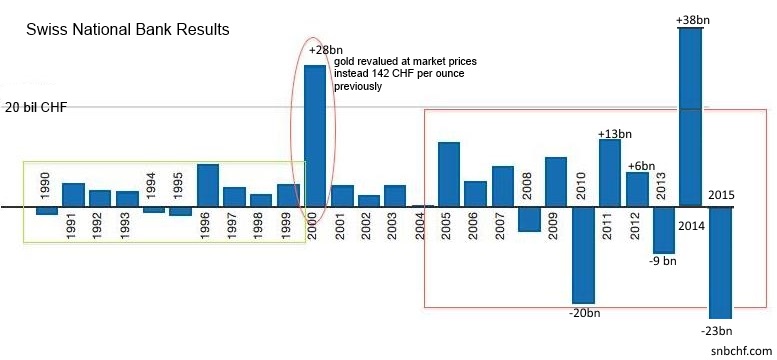

Swiss National Bank further strengthens provisions for currency reserves

The Swiss National Bank uses a strange formula on the basis of economic growth for the provisions for FX losses. It would be much easier to connect this number to the size of the balance sheet, e.g. 10% of the balance sheet.

Read More »

Read More »

Wie die SNB durch Kapitalsteuern die Schweizer Wirtschaft belastet

Vor dem Hintergrund eines angeblich „schwachen Wirtschaftswachstums“ rechtfertigte SNB-Chef Thomas Jordan neulich in einem Interview in der Tagespresse die SNB-Negativzinsen und bezeichnete diese als „expansiv“. Nur: Sind Negativzinsen wirklich „expansiv“? Sind diese nicht viel eher „restriktiv“ und bremsen unsere Wirtschaft – bewirken also genau das Gegenteil von dem, was die SNB behauptet?

Read More »

Read More »

Swiss banks taking more risks to compensate for record-low interest rates

Swiss banks focused on property lending are taking more risks to compensate for the impact of record-low interest rates, increasing the threat of a real-estate bubble, Swiss National Bank Vice President Fritz Zurbruegg said.

Read More »

Read More »

Former CEO Of UBS And Credit Suisse: “Central Banks Are Past The Point Of No Return, It Will All End In A Crash”

Remember when bashing central banks and predicting financial collapse as a result of monetary manipulation and intervention was considered "fake news" within the "serious" financial community, disseminated by fringe blogs? In an interview with Swiss Sonntags Blick titled appropriately enough "A Recession Is Sometimes Necessary", the former CEO of UBS and Credit Suisse, Oswald Grübel, lashed out by criticizing the growing strength of central banks...

Read More »

Read More »

SNB sollte Bund bis 60 Milliarden ausschütten – nur so ist der Steuerzahler sicher

Letzte Woche gab die Schweizerische Nationalbank (SNB) bekannt, dass sie für dieses Geschäftsjahr eine Milliarde Franken an Bund und Kantone ausschütten wird. Von der Presse wird dies unterschiedlich interpretiert. Einerseits nimmt man mit Genugtuung zur Kenntnis, dass die SNB überhaupt eine Milliarde ausschütten kann. Andererseits wird mit Blick auf drohendes negatives Eigenkapital der SNB gewarnt, diese müsse dringend Reserven bilden.

Read More »

Read More »

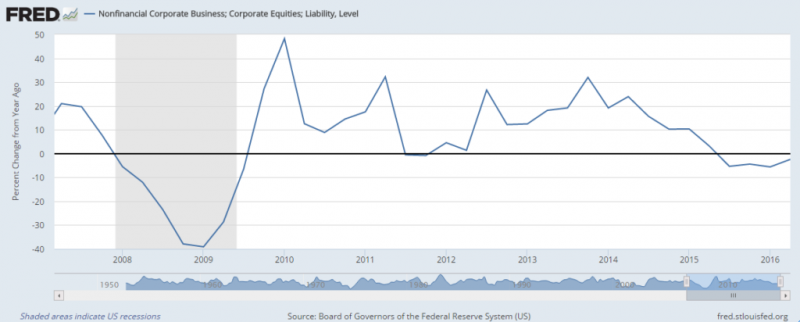

Did President-Elect Trump Just Inadvertently Kill The Golden Goose?

President-Elect Trump may have just unwittingly sowed the seed of an equity market draw-down which will send even more protesters into the streets of America. Donald Trump’s stated economic policies are clearly pro-growth and if he manages to implement his pro-business, anti-regulation agenda, in the longer term they have the potential to surpass the bold and successful initiatives of Ronald Reagan.

Read More »

Read More »

European Central Bank gold reserves held across 5 locations. ECB will not disclose Gold Bar List.

The European Central Bank (ECB), creator of the Euro, currently claims to hold 504.8 tonnes of gold reserves. These gold holdings are reflected on the ECB balance sheet and arose from transfers made to the ECB by Euro member national central banks, mainly in January 1999 at the birth of the Euro. As of the end of December 2015, these ECB gold reserves were valued on the ECB balance sheet at market prices and amounted to €15.79 billion.

Read More »

Read More »

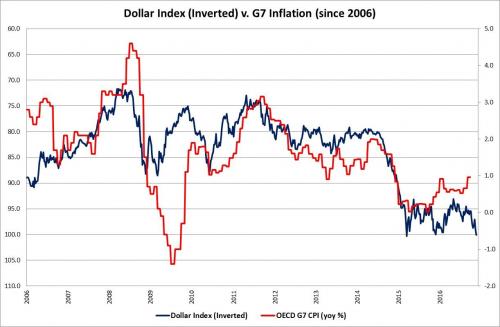

Dollar Illiquidity Getting Critical: A $10 Trillion Short Which The Fed Does Not Understand

In the latest report from ADM ISI’s strategy team, “Dollar Liquidity Threat is Getting Critical and Fed is M.I.A.”, Paul Mylchreest argues that mainstream economic luminaries (like Carmen Reinhart) are finally acknowledging the evolving crisis due to the dollar shortage outside the US, a topic which even the head researcher at the BIS shone a spotlight on yesterday suggesting that the strength of the dollar, not the VIX is the new "fear...

Read More »

Read More »

Federal Department of Finance and SNB enter new distribution agreement

The Federal Department of Finance (FDF) and the Swiss National Bank (SNB) have signed a new agreement regarding the SNB’s profit distribution for 2016 to 2020. Subject to a positive distribution reserve, the SNB will in future pay CHF 1 billion p.a. to the Confederation and cantons, as was previously the case. In future, however, omitted distributions will be compensated for in subsequent years if the distribution reserve allows this.

Read More »

Read More »

We’re All Hedge Funds Now – Central Banks Become World’s Biggest Stock Speculators

At first, the idea of central banks intervening in the equity markets was probably seen even by its fans as a temporary measure. But that’s not how government power grabs work. Control once acquired is hard for politicians and their bureaucrats to give up. Which means recent events are completely predictable.

Read More »

Read More »

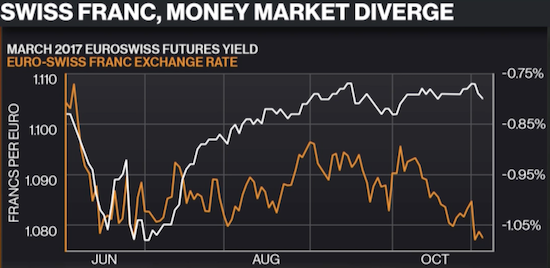

THIS Time A Swiss Franc Hedge Makes More Sense

Money markets and the Swiss franc have diverged despite a presumed increase in event risk from the U.S. Presidential election. Moreover, shorts against the Swiss franc have risen. This surprising divergence opens up a presumed opportunity use the franc as a hedge against a surprise outcome from the election. This time I agree with the strategy even as I suspect that, once again, any subsequent incremental strength in the Swiss franc will be...

Read More »

Read More »

Der SNB-Milliardengewinn täuscht Stärke vor. Tatsächlich ist die SNB so schwach wie nie.

Voller Stolz präsentiert die SNB ihr Zwischenergebnis für die ersten 9 Monate dieses Jahres: 28.7 Milliarden Franken Gewinn. Und die Medien kolportieren diese Zahlen unbedarft. Die Devisenreserven der SNB seien erneut gestiegen wird da behauptet; und zwar allein in diesen neun Monaten um 73 Milliarden auf sage und schreibe 666 Milliarden Franken. Solche Schlagzeilen sind oberflächlich und lenken von der grossen Gefahr ab, in welcher sich die SNB...

Read More »

Read More »

Swiss National Bank Results Q3 / 2016: Volatility of Results is Increasing

Interim results of the Swiss National Bank as at 30 September 2016 The Swiss National Bank (SNB) reports a profit of CHF 28.7 billion for the first three quarters of 2016. But the volatility is rising: The SNB may lose 50 billion in one year and win 60 billion in the next year or the opposite.

Read More »

Read More »

Und nun kommt der Nobelpreisträger daher und will uns weismachen, wir müssten den Mindestkurs wieder einführen

„Es kostet fast nichts, Franken im richtigen Umfang zu drucken.“ Das sagte der Wirtschaftsnobelpreisträger Joseph Stiglitz am World Economic Forum (WEF) in Davos anlässlich eines Interviews mit dem Tages-Anzeiger.

Read More »

Read More »