Tag Archive: Swiss National Bank

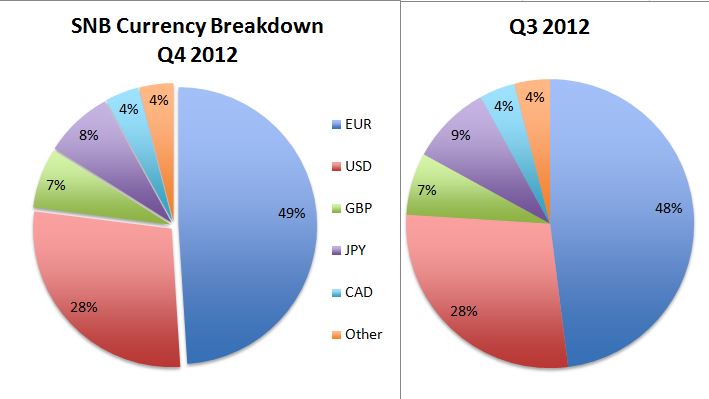

SNB Reserves Rise by 8 bln. CHF Thanks to Stronger USD, GBP, CAD and some FX Purchases

In March 2013, the foreign currency reserves of the Swiss National Bank (SNB) rose by 8 bln. CHF from 437 bln. to 445 bln. mostly thanks to valuation gains on US dollar, sterling and Canadian dollar. full details

Read More »

Read More »

SNB Sight Deposits: Only Slight Increase of 370 Million Francs despite Cyprus

The SNB published the weekly monetary data for the week of the "Cyprus crisis": SNB sight deposits are slightly up 400 million francs, mostly due to local banks. Details

Read More »

Read More »

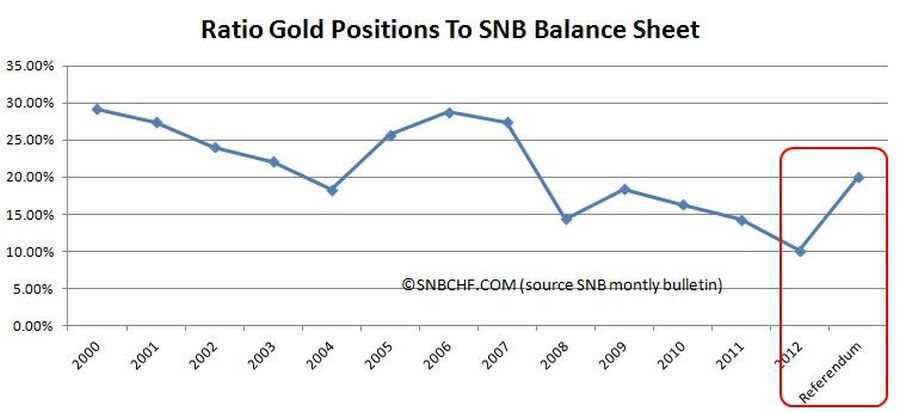

“SNB Concerned”: Does a Yes to the Swiss Gold Referendum Imply an End of the CHF Cap?

If the upcoming referendum "Save our Swiss gold" wins, the SNB must increase gold holdings from 10% to 20% of its balance sheet. Gold purchases and/or sales of fiat money implies an end of CHF cap.

Read More »

Read More »

IMF (2013): Sees Considerable Risks on SNB Balance Sheet

The International Monetary Fund (IMF) judges "that the SNB’s net revenue is subject to large fluctuations, and sizeable losses could occur if an appreciation of the Swiss franc was to take place before foreign exchange interventions were unwound."

Read More »

Read More »

In Week Before Cyprus SNB Sight Deposits Rise Slightly by 250 Million Francs

The SNB published the weekly monetary data for the week before the Cyprus event: SNB sight deposits are slightly up 250 million francs, mostly due to other sight deposits (companies, the Swiss confederation, foreign banks) while local banks reduced their deposits slightly. Details

Read More »

Read More »

SNB Monetary Assessment March 2013

In its monetary assessment the SNB maintains the EUR/CHF floor and warned against further risks in the euro zone. The SNB has downgraded the inflation path to -0.2% (previously-0.1%) in 2013 and +0.2% (+0.4%) in 2014.We do not completely agree.

Read More »

Read More »

When Will Hedge Funds and FX Traders Close their Short Yen Positions?

Hedge Funds have lost their power. This year has shown that their only remaining possibility to gain easy money is a concerted action with some of their friends manipulating currency markets, calling it “currency wars” and creating an unholy alliance with the dovish prime minister Abe. Some of the biggest U.S. hedge-fund investors have made …

Read More »

Read More »

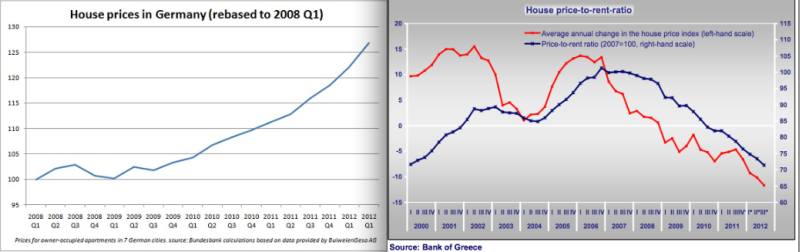

What Ernst Baltensperger Got Wrong: Why SNB FX Losses Might Not Be Recovered By Income on Reserves

Opposed to Ernst Baltensperger, we think that the risk of losses on the SNB balance sheet and of an asset price bubble might be more important than the dangers of upcoming Swiss inflation.

Read More »

Read More »

SNB Liabilities (deposits & bank notes) at New Record High

SNB sight deposits are rising again, by 700 million CHF in one week. But the amount of cash in form of bank notes and coins has risen by 10% since September. It seems that the central bank is now not only virtually printing (via sight deposits) but also physically. SNB liabilities reached a new record high. Details

Read More »

Read More »

SNB Remains the Only Central Bank Currency Warrior: The Japanese do not Fight, they Talk

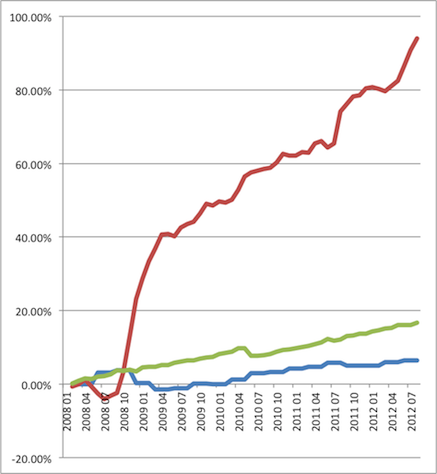

Central Bank data show that the Swiss National Bank (SNB) remains the only central bank that strongly participated in currency wars with FX intervention, while the Japan was just verbal intervention.

Read More »

Read More »

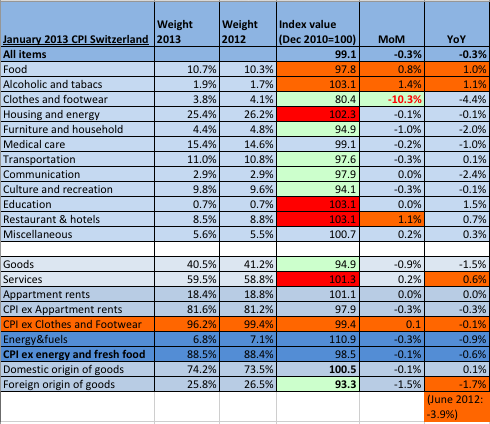

Switzerland’s Slow Way to Inflation

UPDATE February 2013 inflation data: The inflation figures for February showed the upwards movement we expected. On monthly basis inflation rose by 0.3%. The Swiss CPI is getting closer and closer to the one of the euro zone. We explain the January 2013 data on Swiss inflation and indicate which components drive the consumer …

Read More »

Read More »

SNB Sight Deposits Fall by 1.2 Billion CHF, Weeks ending February 1 and 8

The latest improvement in U.S. unemployment and good PMIs, finally let the sight deposits (money supply) at the SNB fall by 800 million francs in week ending on February 1 and 400 million for the one of Feb 8 . See the recent history of sight deposits.

Read More »

Read More »

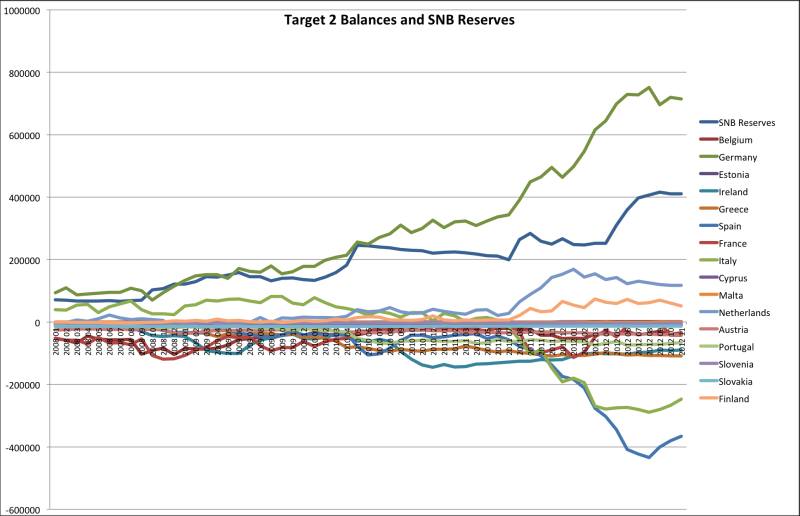

Target2 Balances and SNB Currency Reserves: Same Concept, Update February 2013

We show that Target2 imbalances and the SNB currency reserves represent the same issues, namely current account surpluses/deficits and capital flight. Therefore it makes sense to compare them, in total and by inhabitant.

Read More »

Read More »

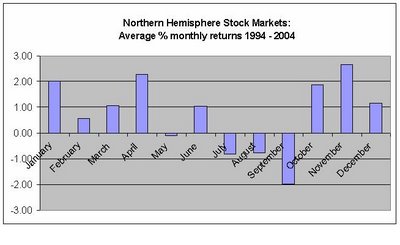

The “Get Stress in May and Relax in October Effect” for the SNB

The U.S. economy regularly improves between October and March. The SNB should use the moment to sell some currency reserves. From May on, the typical seasonal effects will push the SNB into a defense.

Read More »

Read More »

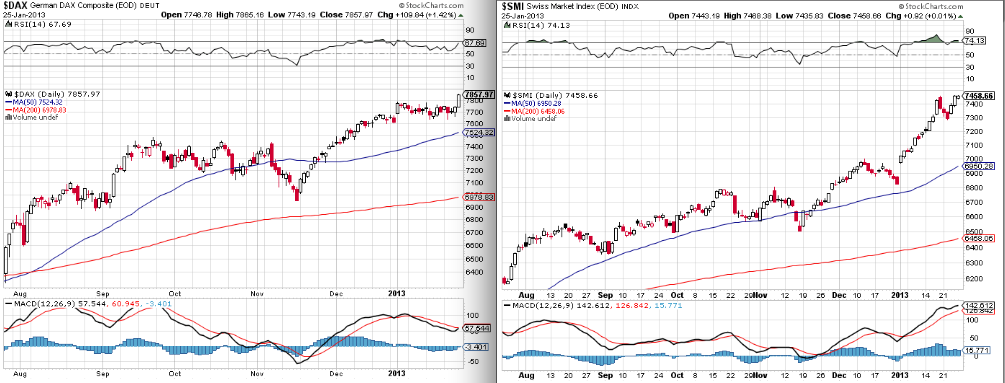

SNB Sight Deposits Rise by 100 Million CHF, Week January28

While FX traders and some hedge funds are long EUR/CHF and some short covering happened, sight deposits show a different picture. They rise again, this time with 100 million francs (see details) in one week. Risk-off investors are not convinced yet that the euro crisis is finished, while other investors keep profit of the rising SMI...

Read More »

Read More »

Deflationary Risks? Comparing Swiss, Swedish and Norwegian Inflation and Exchange Rates

When the Swiss National Bank introduced the 1.20 lower limit, it wanted to eliminate the deflationary risks for Switzerland. For a certain period, namely when a global recession was looming in Autumn 2011, and the Swiss franc was hovering around 1.10, this risk was really present. In this post we would like to know if …

Read More »

Read More »

Target2 Balances and SNB Currency Reserves. They are Both the Same Concept

We show that Target2 imbalances and the SNB currency reserves represent the same issues, namely current account surpluses/deficits and capital flight. Therefore it makes sense to compare them, in total and by inhabitant.

Read More »

Read More »

SNB Sight Deposits Rise by 2 Bln. Francs, M3 by 10 Bln., Week January 21

While FX traders and some hedge funds go long the EUR/CHF, sight deposits at the SNB rise by 2 bln. francs (see details) in one week, M3 by nearly 10 bln. (nearly 2%) francs in one single month (see

Read More »

Read More »

Helicopter Money against Animal Spirits and our Critique

The newest paper by McCulley and Poszar "Helicopter Money: or how I stopped worrying and love fiscal-monetary cooperation" presents fiscal policy and monetary policy along these two criteria

Read More »

Read More »