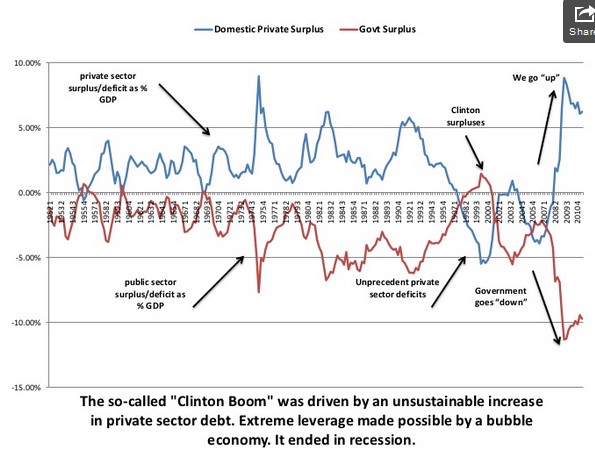

To find further explanations as to why the gold price was weak in the late 1990s we analyze sector balances. Effectively private spending and private debt went in two different directions: a heavy increase in private spending and debt in the US against less growth in private spending and less debt in the rest of world. This combination fostered GDP growth in the US and weakened it in other countries. Real interest rates were positive. Markets...

Read More »

Tag Archive: sector balances

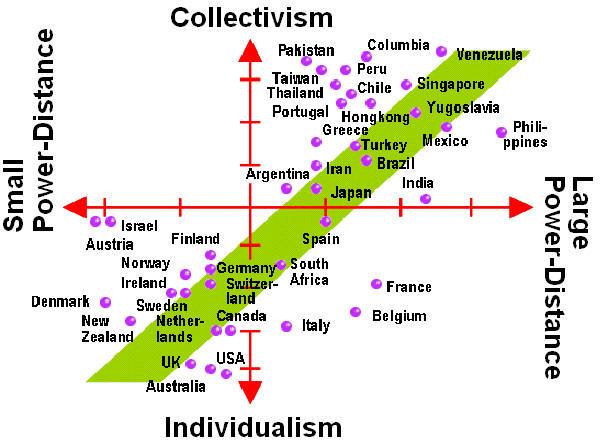

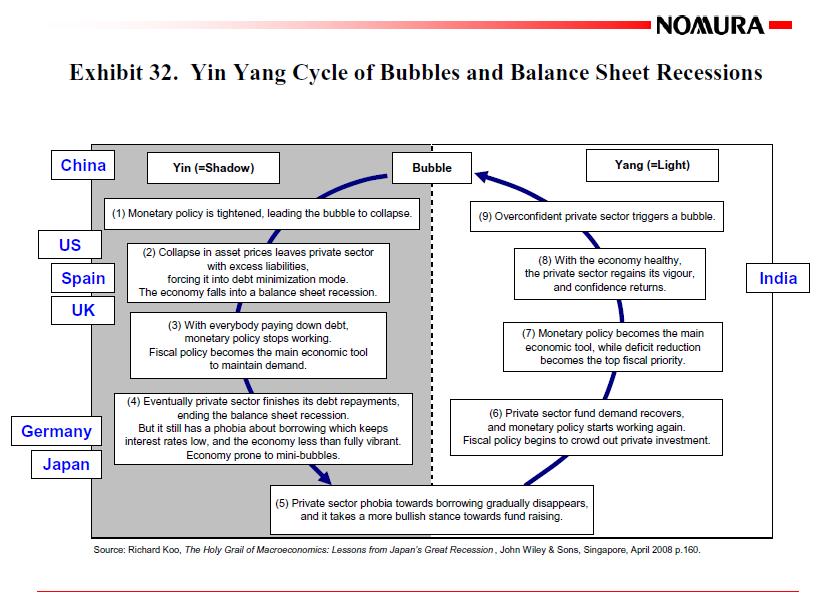

Cultural Reasons for Japan’s Deflation: Can the U.S. Go into a Balance Sheet Recession?

The power distance between employer and employee enforces the importance of the leader, the entrepreneur. Moreover, the collectivite Asian society does not want unemployment, employees prefer to renounce to salary hikes in favor of the collective. These cultural reasons can qualify as drivers of the Japanese balance sheet recession.

Read More »

Read More »

Why it Makes Sense to Exit the Euro Zone in Times of Balance Sheet Recessions

Italy will follow Japan for decade(s) of balance sheet recession. There is one mean to avoid it. The periphery should use current positive market sentiments and low inflation to exit the euro zone.

Read More »

Read More »

Ways to the Northern Euro

Two ways for building the Northern euro, exit of Southern members or slow creation of Northern euro with currency interventions of central banks.

Read More »

Read More »

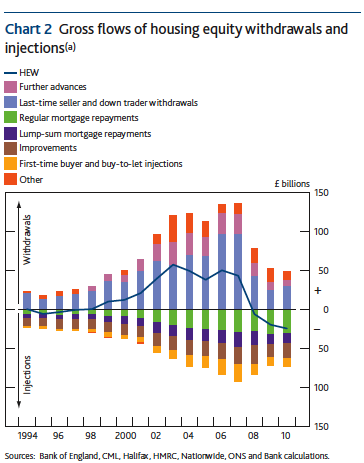

The Balance Sheet Recession: UK Q2 Housing Equity Injection Largest Since Q2 2011

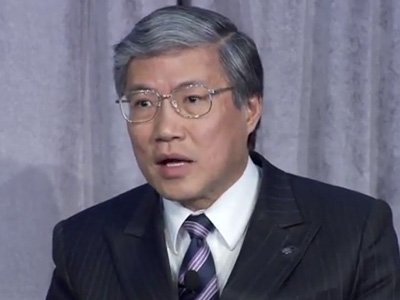

The American-Taiwanese economist Richard Koo, is the chief-economist of the Nomura Research Institute. In his theory of the Balance Sheet Recession he distinguishes between the “Yang” phase of the economy and the “Yin” phase (the so-called “balance sheet recession”). In “Yang” times companies want to increase profit and people consume a big part of their pay …

Read More »

Read More »

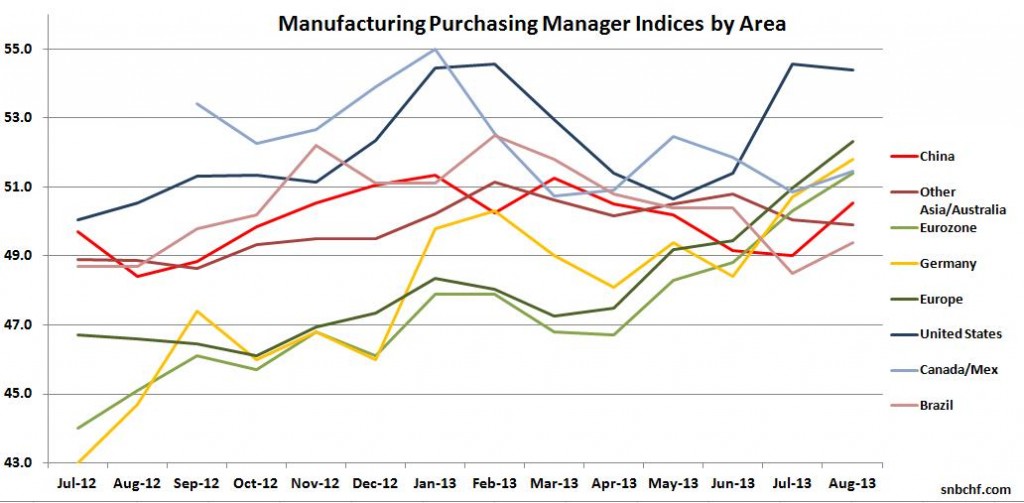

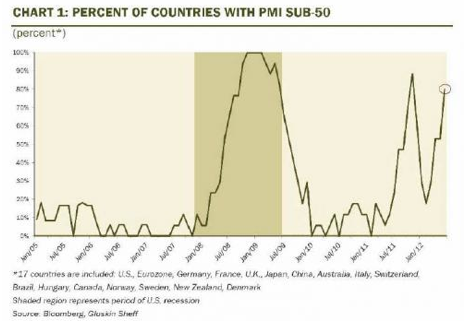

Global Macro with all Global PMIs July 4th

updated July 4,2012 This page inside our macro data menu contains global PMIs compared with the main risk indicators S&P500, Copper, Brent and AUD/USD as of the day after most PMIs came out. JP Morgan’s Global PMI: Click for details inside the table, History of composite PMI

Read More »

Read More »

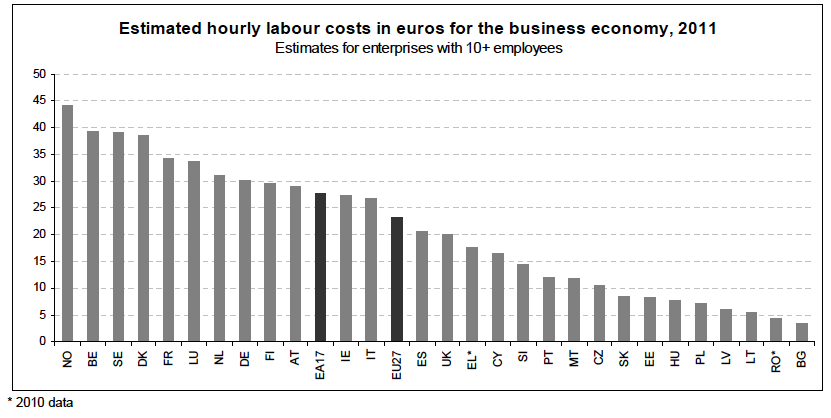

The German supply-side reforms or will German companies take over the PIIGS ?

Words heart on German street in 2010 during the first Greek bailouts were that Germany should obtain the Greek islands as collateral if Greece is not able to pay back the debt to Germany. But even today German n-tv is reporting about many Greek real estate brokers that are currently delling islands. If it is not that type … Continue...

Read More »

Read More »

Why the Euro Crisis may last another 15 years

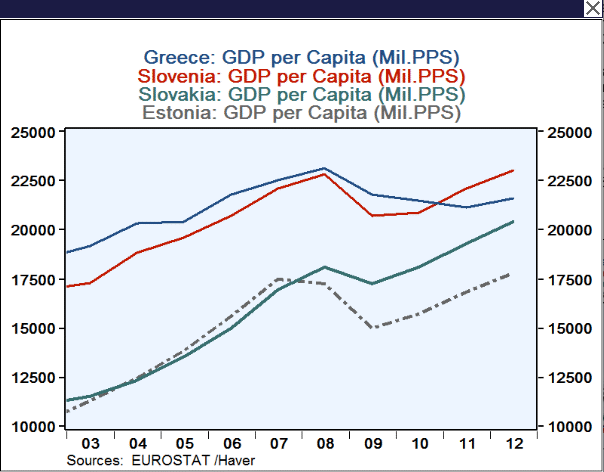

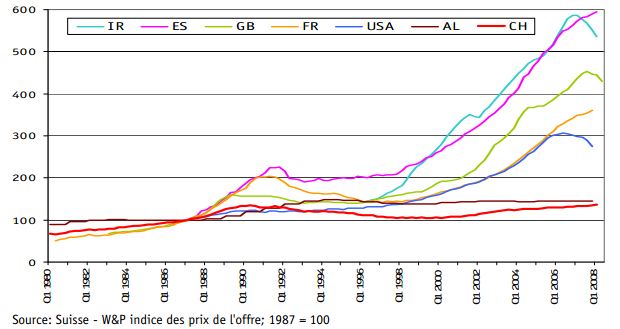

Abstract In the following article we will explain which types of crisis occur in the euro area and will argue that this crisis will last at least another fifteen years. (1) Competitiveness crisis: Before the euro introduction peripheral countries regularly saw their currency depreciate against the German Mark and helped them to increase their competitiveness. …

Read More »

Read More »