Tag Archive: Retail sales

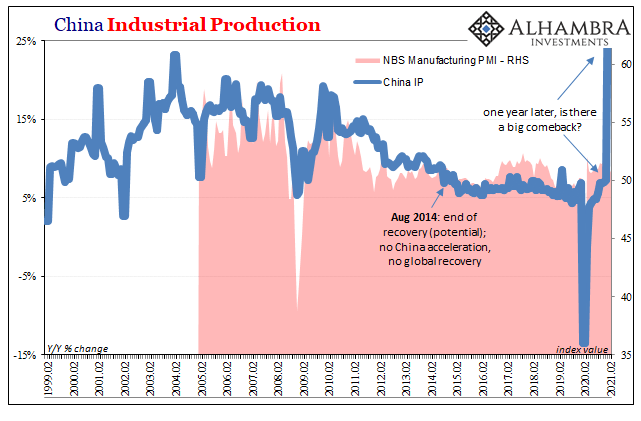

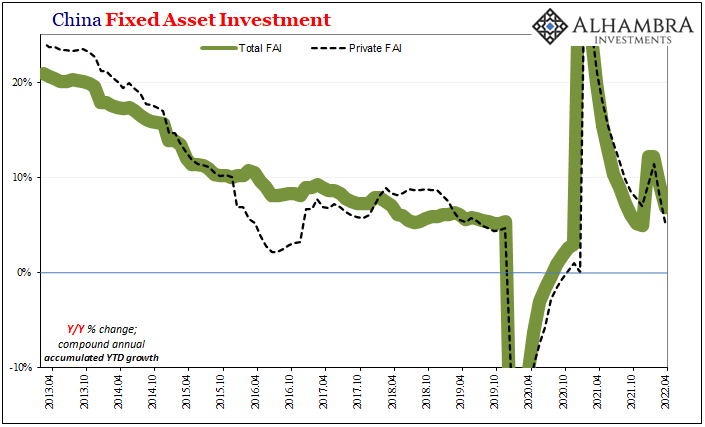

Looking Past Gigantic Base Effects To China’s (Really) Struggling Economy

The Chinese were first to go down because they had been first to shut down, therefore one year further on they’ll be the first to skew all their economic results when being compared to it. These obvious base effects will, without further scrutiny, make analysis slightly more difficult.

Read More »

Read More »

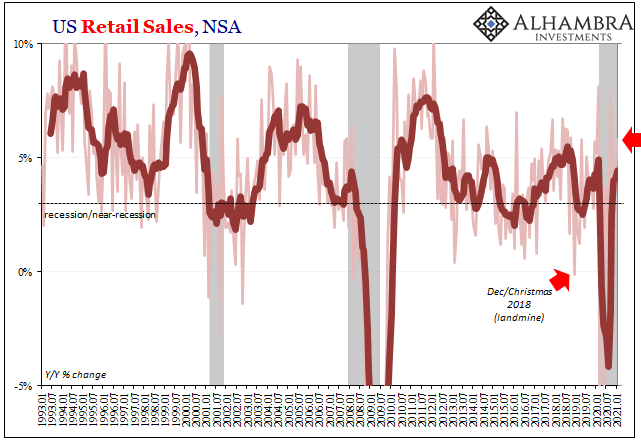

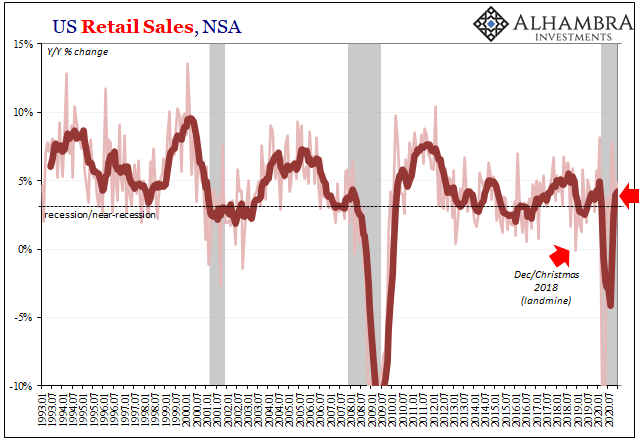

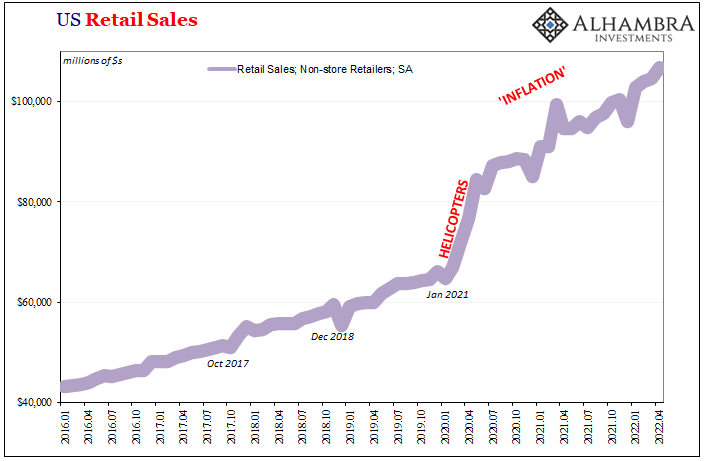

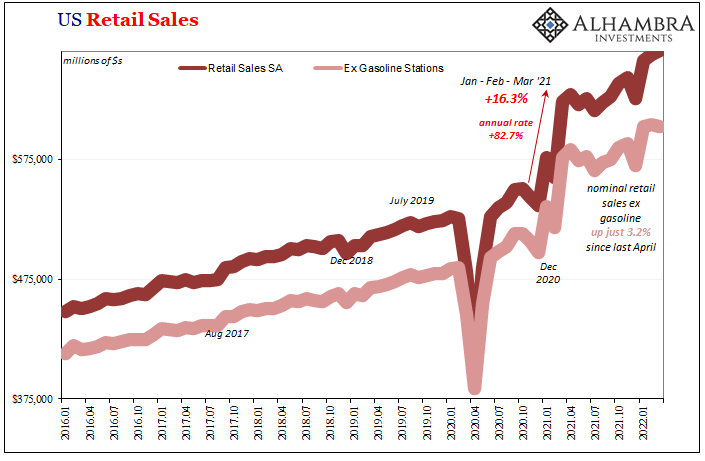

Uncle Sam Was Back Having Consumers’ Backs

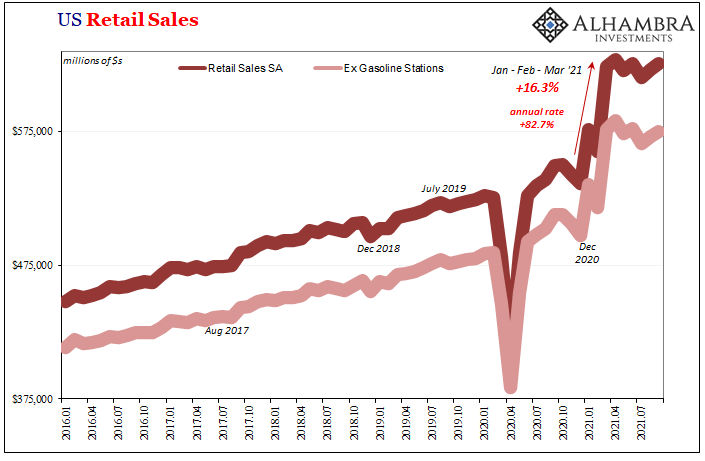

American consumers were back in action in January 2021. The “unemployment cliff” along with the slowdown and contraction in the labor market during the last quarter of 2020 had left retail sales falling backward with employment. Seasonally-adjusted, total retail spending had declined for three straight months to end last year.

Read More »

Read More »

Consumers, Producers, and the Unsettled End of 2020

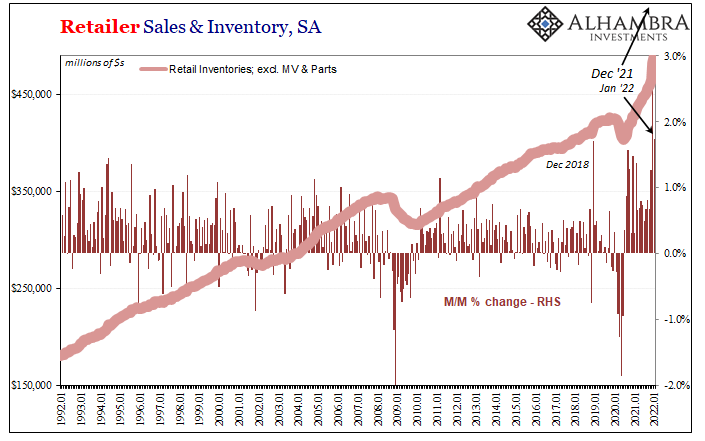

The months of November and December aren’t always easily comparable year to year when it comes to American shopping habits. For a retailer, these are the big ones. The Christmas shopping season and the amount of spending which takes place during it makes or breaks the typical year (though last year, there was that whole thing in March and April which has had a say in each’s final annual condition).

Read More »

Read More »

Consumers, Too; (Un)Confident To Re-engage

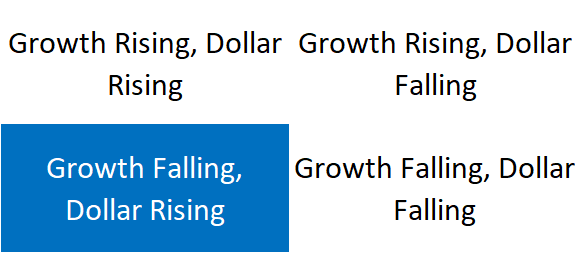

There is a lot of evidence which shows some basis for expectations-based monetary policy. Much of what becomes a recession or worse is due to the psychological impacts upon businesses (who invest and hire) as well as workers being consumers (who earn and then spend).

Read More »

Read More »

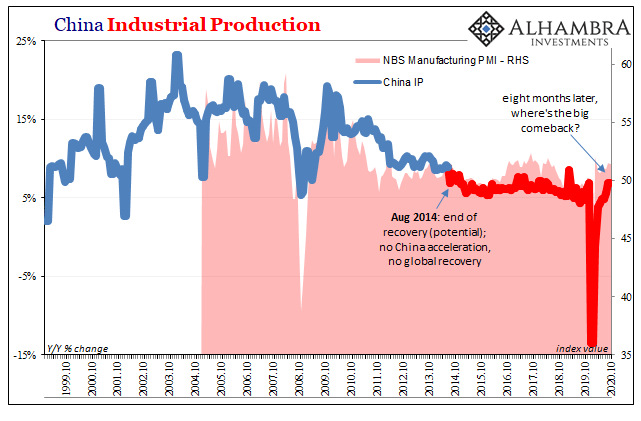

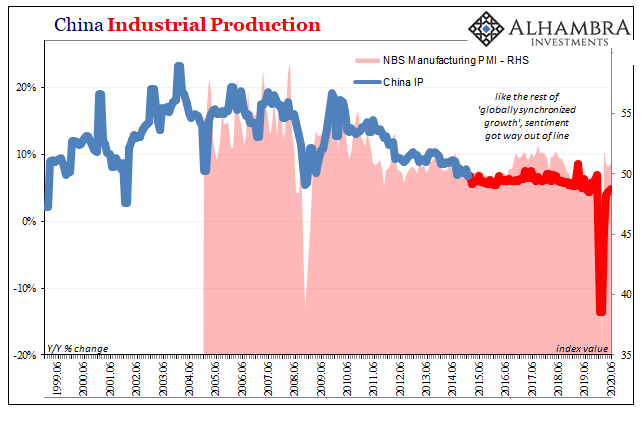

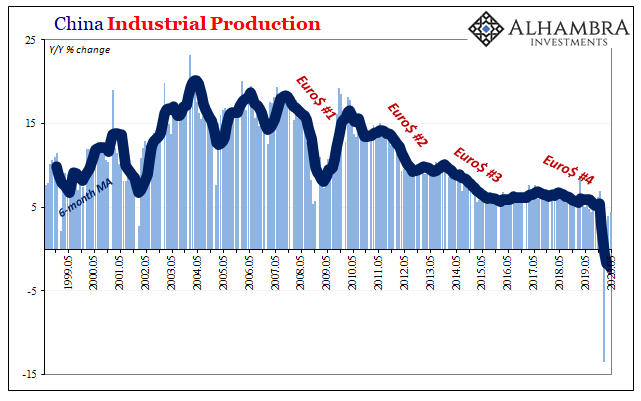

This Global Growth Stuff, China Still Wants A Word

Before there could be “globally synchronized growth”, it had been plain old “global growth.” The former from 2017 appended the term “synchronized” to its latter 2014 forerunner in order to jazz it up. And it needed the additional rhetorical flourish due to the simple fact that in 2015 for all the stated promise of “global growth” it ended up meaning next to nothing in reality.Oddly the same for 2017’s update heading into 2018 and...

Read More »

Read More »

Extending the Summer Slowdown

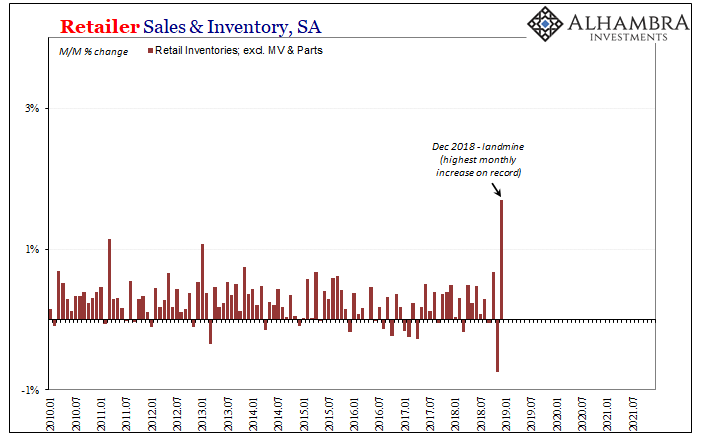

A big splurge in September, and then not much more in October. While it would be consistent for many to focus on the former, instead there is much about the latter which, for once, is feeding growing concerns. Retail sales, American consumer spending on goods, has been the one (outside of economically insignificant housing) bright spot since summer

Read More »

Read More »

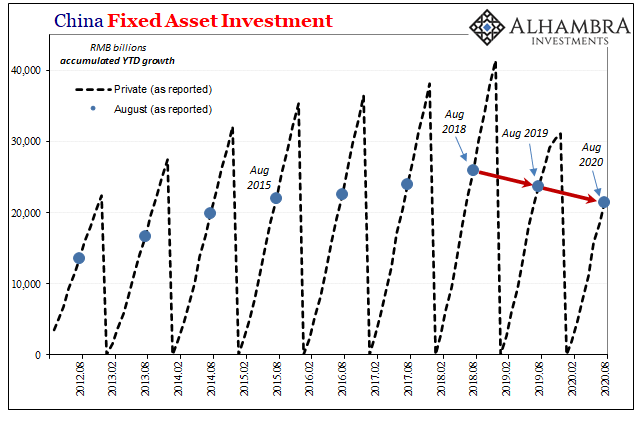

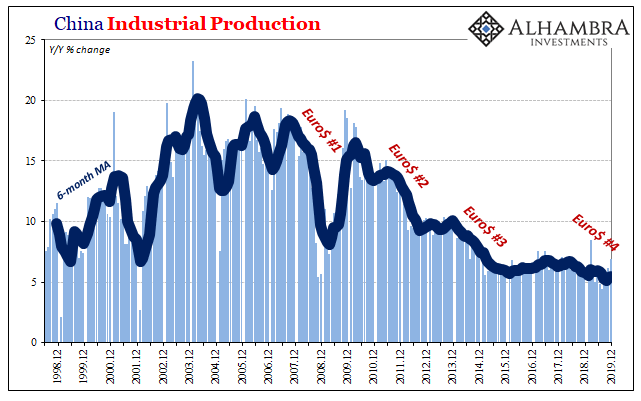

Six Point Nine Times Two Equals What It Had In Twenty Fourteen

It was a shock, total disbelief given how everyone, and I mean everyone, had penciled China in as the world’s go-to growth engine. If the global economy was ever going to get off the ground again following GFC1 more than a half a decade before, the Chinese had to get back to their precrisis “normal.”

Read More »

Read More »

The Prices And Costs Of What Xi Believes He’s Got To Do

It does seem, at first, a huge contradiction. On the one hand, what we know so far of China’s 14th 5-year plan apparently will lean heavily on new technologies not-yet invented to rescue the country’s economy from the pit of de-globalization the eurodollar system had thrown it into years ago.

Read More »

Read More »

China’s Hole Puzzle

One day short of one year ago, on September 16, 2019, China’s National Bureau of Statistics (NBS) reported its updated monthly estimates for the Big 3 accounts. Industrial Production (IP) is a closely-watched indicator as it is relatively decent proxy for the entire goods economy around the world. Retail Sales in the post-Euro$ #2 context give us a sense of the Chinese economy’s persistent struggle to try to “rebalance” without the pre-2008 boost...

Read More »

Read More »

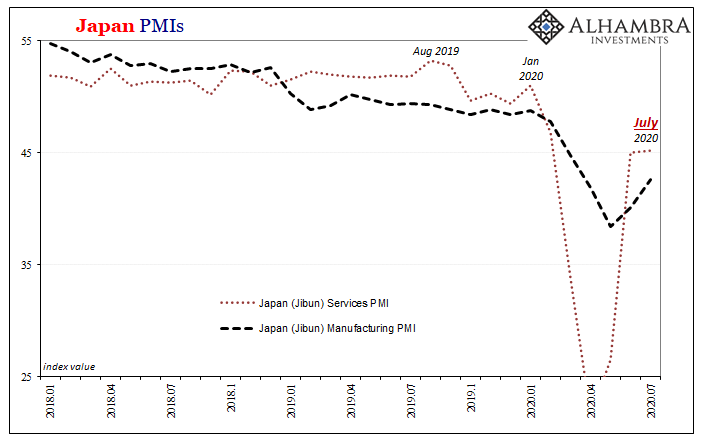

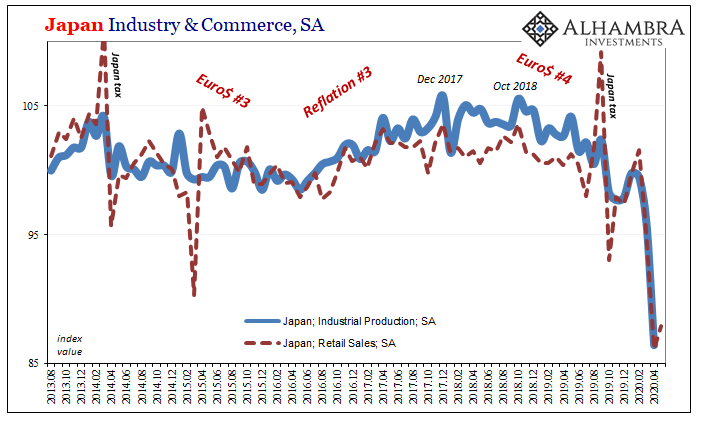

A Japanese Stall?

In sharp contrast to the sentimental deference towards central bank stimulus exhibited by Germany’s ZEW, for example, similar Japanese surveys are starting to describe potential trouble developing. Like Germany, Japan is a bellwether country and a pretty reliable indicator of global economy performance.

Read More »

Read More »

Of Incomplete Plans and Recoveries

At the monthly press conference China’s National Bureau of Statistics (NBS) now regularly gives whenever the Big Three economic accounts are updated (this time along with quarterly GDP), spokesman Liu Aihua was asked by a reporter from Reuters to comment on how the global economic recession might impact the Communist government’s long range goal of reaching its assigned GDP target.

Read More »

Read More »

Looking Ahead Through Japan

After the Diamond Princess cruise ship docked in Tokyo with tales seemingly spun from some sci-fi disaster movie, all eyes turned to Japan. Cruisers had boarded the vacation vessel in Yokohama on January 20 already knowing that there was something bad going on in China’s Wuhan. The big ship would head out anyway for a fourteen-day tour of Vietnam, Taiwan, and, yes, China.

Read More »

Read More »

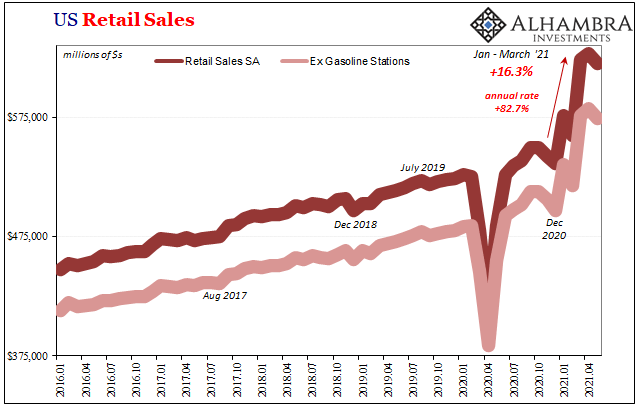

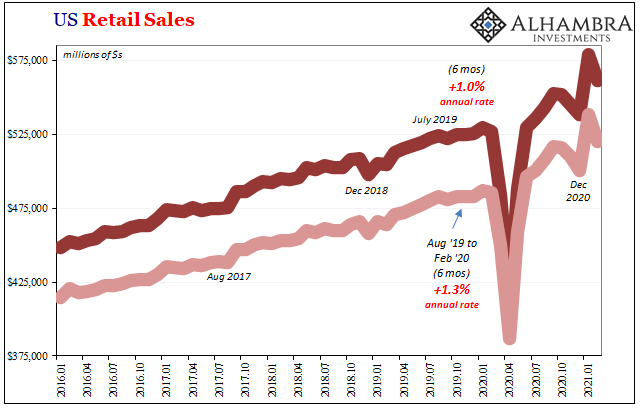

The Smallness of the Most Gigantic

These numbers do seem epic, don’t they? It’s hard to ignore when you have the greatest percentage increase in the history of a major economic account. Just writing that sentence it’s difficult to deny the power of those words. Which is precisely the point: we already know ahead of time how the biggest economic holes in history are going to produce the biggest positives coming out of them.

Read More »

Read More »

A Chinese Outbreak (of Li v. Xi, Round 2)

Here they are again, seemingly at odds over how to proceed. Reminiscent of prior battles over whether to revive the economy or just let it go where it will, it appears as if China is in for Xi vs. Li Round 2. Or is it all just clever politics? Li Keqiang may be nominally the Chinese Premier but he’s a very distant second on every list of power players. Xi Jinping holds all the top spots, including a 2017-18 consolidation of power that left Xi...

Read More »

Read More »

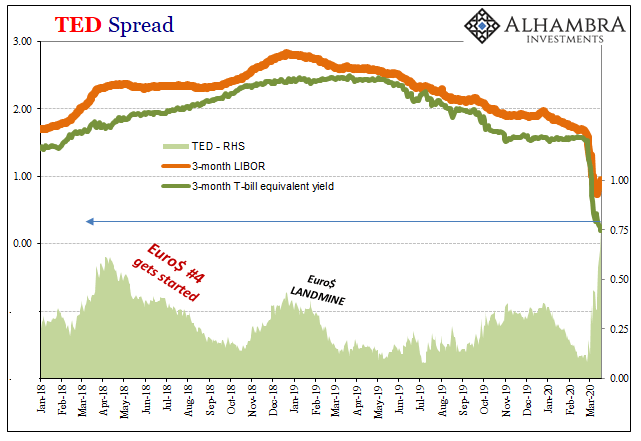

Is GFC2 Over?

Is it over? That’s the question everyone is asking about both major crises, the answer is more obvious for only the one. As it pertains to the pandemic, no, it is not. Still the early stages. The other crisis, the global dollar run? Not looking like it, either.

Read More »

Read More »

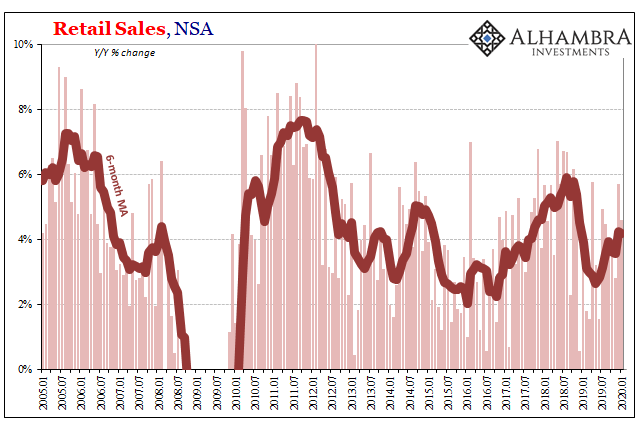

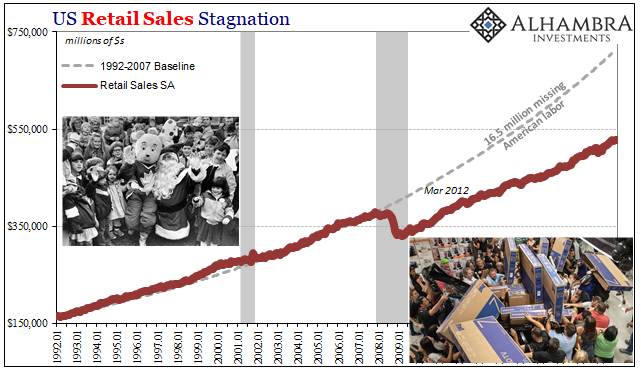

US Sales and Production Remain Virus-Free, But Still Aren’t Headwind-Free

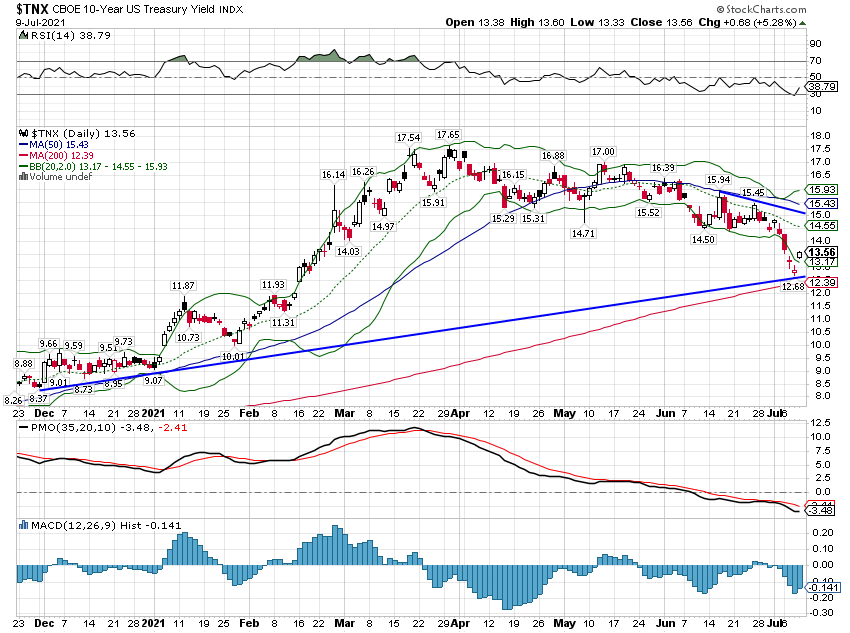

The lull in US consumer spending on goods has reached a fifth month. The annual comparisons aren’t good, yet they somewhat mask the more recent problems appearing in the figures. According to the Census Bureau, total retail sales in January rose 4.58% year-over-year (unadjusted). Not a good number, but better, seemingly, than early on in 2019 when the series was putting out 3s and 2s.

Read More »

Read More »

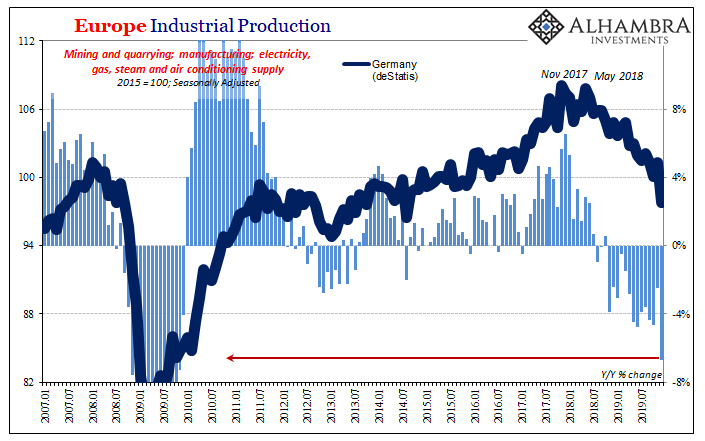

Two Years And Now It’s Getting Serious

We knew German Industrial Production for December 2019 was going to be ugly given what deStatis had reported for factory orders yesterday. In all likelihood, Germany’s industrial economy ended last year sinking and maybe too quickly. What was actually reported, however, exceeded every pessimistic guess and expectation – by a lot.

Read More »

Read More »

China Enters 2020 Still (Intent On) Managing Its Decline

Chinese Industrial Production accelerated further in December 2019, rising 6.9% year-over-year according to today’s estimates from China’s National Bureau of Statistics (NBS). That was a full percentage point above consensus. IP had bottomed out right in August at a record low 4.4%, and then, just as this wave of renewed optimism swept the world, it has rebounded alongside it.

Read More »

Read More »

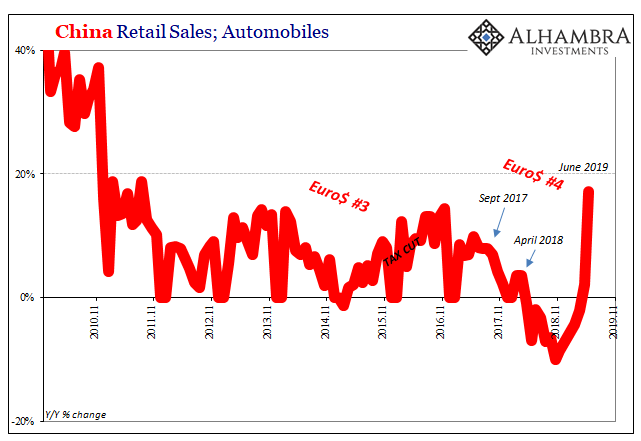

China Data: Something New, or Just The Latest Scheduled Acceleration?

The Chinese government was serious about imposing pollution controls on its vast stock of automobiles. The largest market in the world for cars and trucks, the net result of China’s “miracle” years of eurodollar-financed modernization, for the Chinese people living in its huge cities the non-economic costs are, unlike the air, immediately clear each and every day.

Read More »

Read More »

If The Best Case For Consumer Christmas Is That It Started Off In The Wrong Month…

Gone are the days when Black Friday dominated the retail calendar. While it used to be a somewhat fun way to kick off the holiday shopping season, it had morphed into something else entirely in later years. Scenes of angry shoppers smashing each other over the few big deals stores would truly offer, internet clips of crying children watching in horror as their parents transformed their local Walmart into Thunderdome.

Read More »

Read More »