Tag Archive: Quantitative Easing

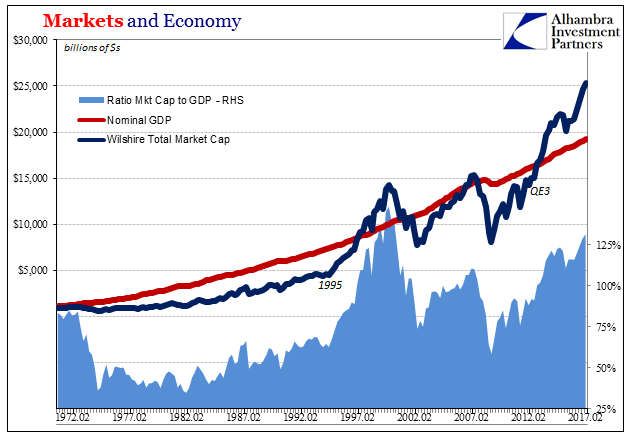

Central Banks Buying Stocks Have Rigged US Stock Market Beyond Recovery

Central banks buying stocks are effectively nationalizing US corporations just to maintain the illusion that their “recovery” plan is working because they have become the banks that are too big to fail. At first, their novel entry into the stock market was only intended to rescue imperiled corporations, such as General Motors during the first plunge into the Great Recession, but recently their efforts have shifted to propping up the entire stock...

Read More »

Read More »

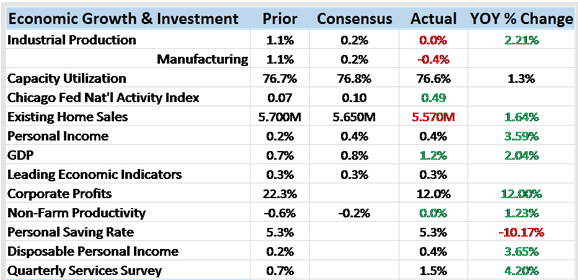

Bi-Weekly Economic Review: Has The Fed Heard Of Amazon?

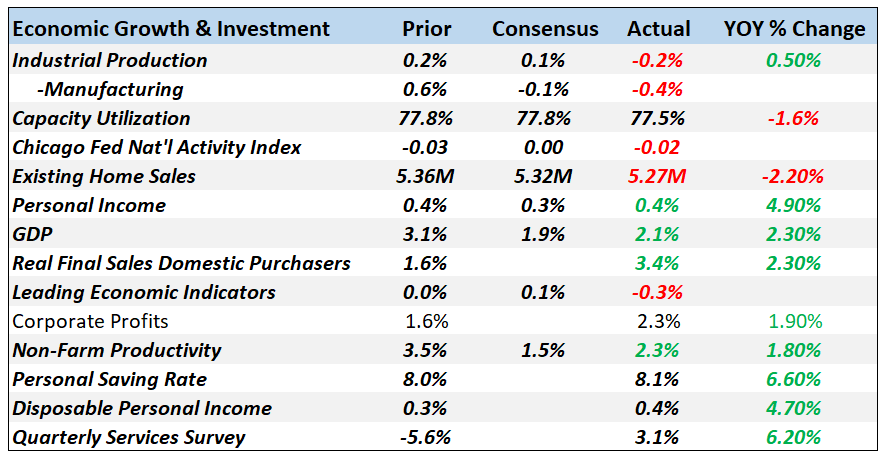

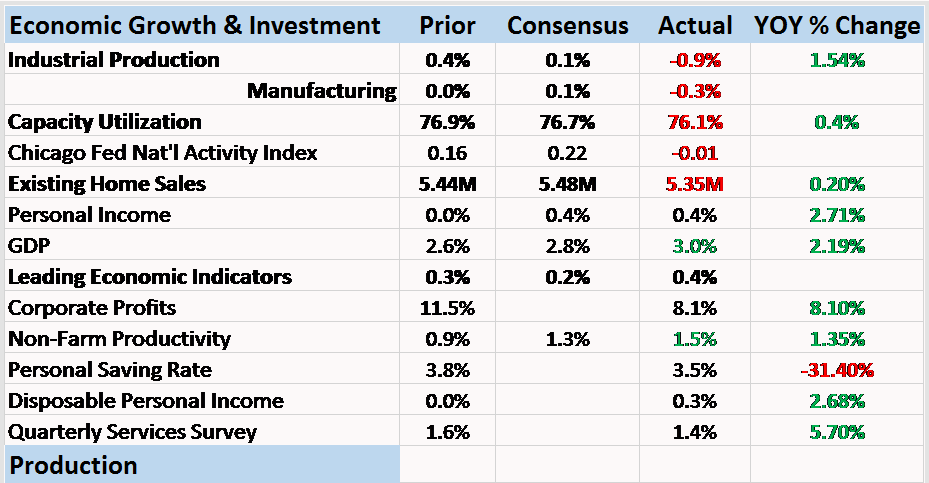

The economic surprises keep piling up on the negative side of the ledger as the Fed persists in tightening policy or at least pretending that they are. If a rate changes in the wilderness can the market hear it? Outside of the stock market one would be hard pressed to find evidence of the effectiveness of all the Fed’s extraordinary policies of the last decade.

Read More »

Read More »

Is the Central Bank’s Rigged Stock Market Ready to Crash on Schedule?

We just saw a major rift open in the US stock market that we haven’t seen since the dot-com bust in 1999. While the Dow rose by almost half a percent to a new all-time high, the NASDAQ, because it is heavier tech stocks, plunged almost 2%.

Read More »

Read More »

Nomi Prins’ Political-Financial Road Map For 2017

As tumultuous as last year was from a global political perspective on the back of a rocky start market-wise, 2017 will be much more so. The central bank subsidization of the financial system (especially in the US and Europe) that began with the Fed invoking zero interest rate policy in 2008, gave way to international distrust of the enabling status quo that unfolded in different ways across the planet.

Read More »

Read More »

Money, Markets, & Mayhem – What To Expect In The Year Ahead

If you thought 2016 was full of market maelstroms and geopolitical gotchas, 2017's 'known unknowns' suggest a year of more mayhem awaits... Here's a selection of key events in the year ahead (and links to Bloomberg's quick-takes on each).

Read More »

Read More »

Former Treasury Secretary Summers Calls For End Of Fed Independence

At an event in Davos, Switzerland earlier today, Former U.S. Treasury Secretary, Larry Summers, argued that Central Bank independence from national governments should be scrapped in favor of a coordinated effort between politicians, central bankers and treasury to engineer inflation. Seems reasonable, right?...what could possibly go wrong?

Read More »

Read More »

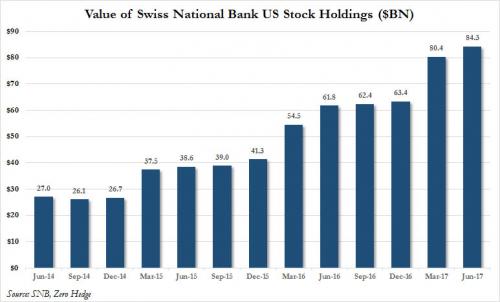

Jim Grant Puzzled by the actions of the SNB

James Grant, Wall Street expert and editor of the investment newsletter «Grant’s Interest Rate Observer», warns of a crash in sovereign debt, is puzzled over the actions of the Swiss National Bank and bets on gold.

Read More »

Read More »

Cashless Society – Is The War On Cash Set To Benefit Gold?

Cash is the new “barbarous relic” according to many central banks, regulators, and some economists and there is a strong, concerted push for the ‘cashless society’. Developments in recent days and weeks have highlighted the risks posed by the war on cash and the cashless society.

Read More »

Read More »

Rogoff Warns “Cash Is Not Forever, It’s A Curse”

Kenneth Rogoff, Professor of Public Policy at Harvard University, postulates to get rid of cash. In his opinion, killing big bills would hamper organized crime and make negative interest more effective. Kenneth Rogoff makes a provocative proposal. One of the most influential economists on the planet, he wants to phase out cash.

Read More »

Read More »

Richard Koo: If Helicopter Money Succeeds, It Will Lead To 1,500 percent Inflation

After today's uneventful Fed announcement, all eyes turn to the BOJ where many anticipate some form of "helicopter money" is about to be unveiled in Japan by the world's most experimental central bank. However, as Nomura's Richard Koo warns, central banks may get much more than they bargained for, because helicopter money "probably marks the end of the road for believers in the omnipotence of monetary policy who have continued to press for further...

Read More »

Read More »

Big Players (Read: Governments) Make Markets Unsafe

Authored by Steve H. Hanke of the Johns Hopkins University. Follow him on Twitter @Steve_Hanke.

Reportage in The Wall Street Journal on April 4th states that “A fund owned by China’s foreign-exchange regulator has been taking stakes in some of the co...

Read More »

Read More »

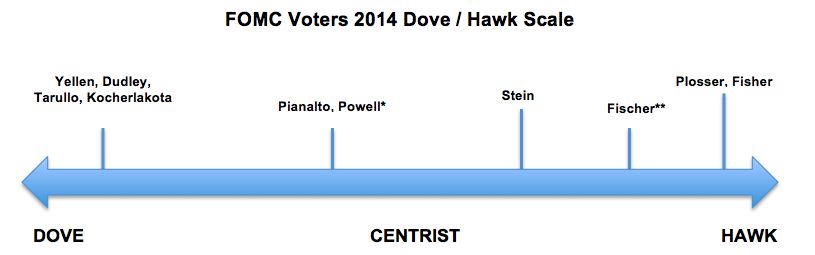

Fed FOMC: Who is Hawk, Who is Dove? 2015 Update

Composition of the Fed's Federal Open Market Committee (FOMC composition), needed to know if the Fed is opting for quantitative easing or not.

Read More »

Read More »

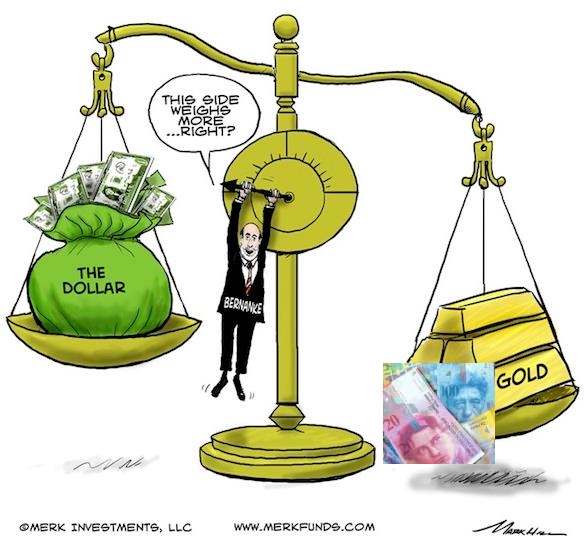

Quantitative Easing, its Indicators and the Swiss Franc

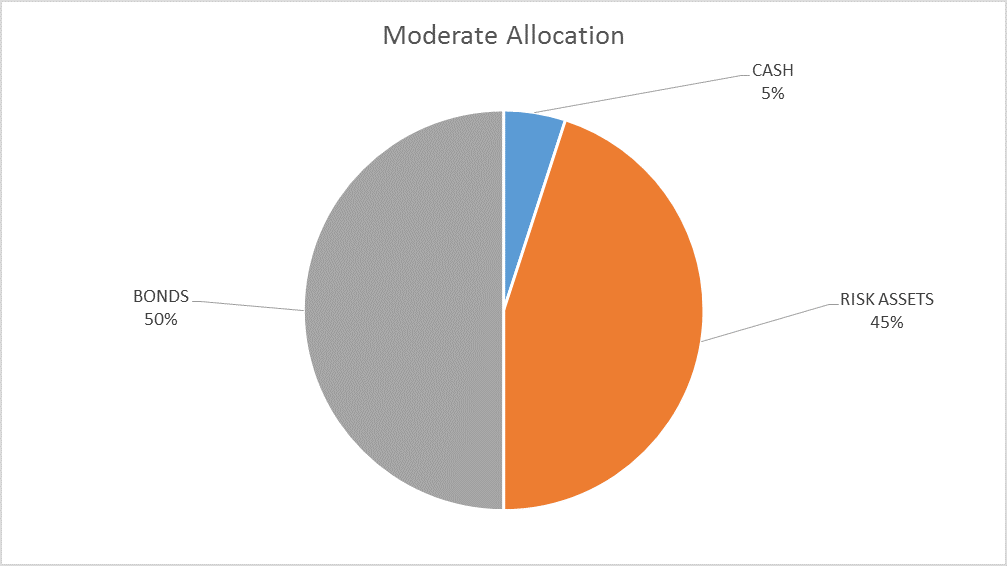

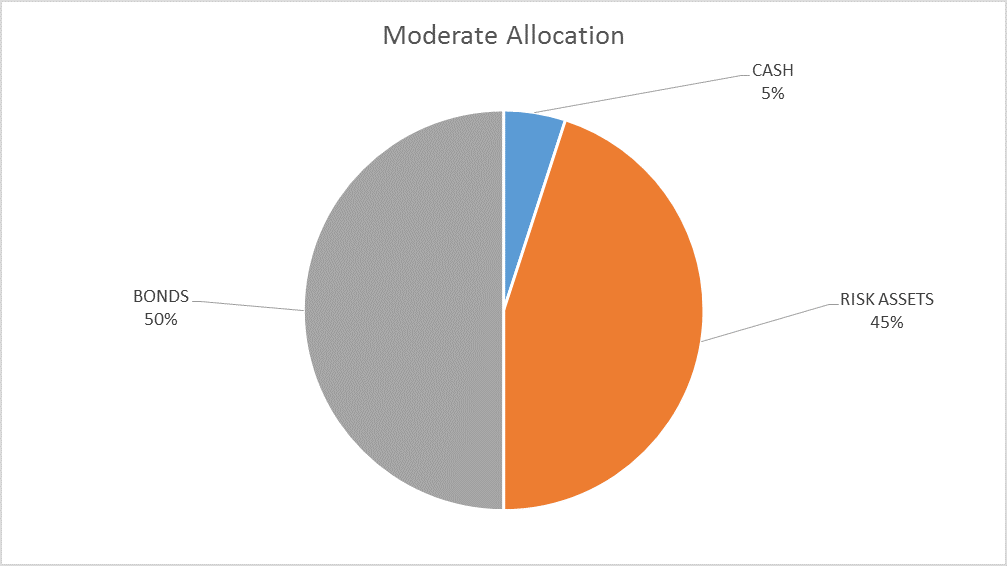

The main drivers of demand for Swiss francs are the euro crisis and, even more, the behavior of American investors, who go out of the dollar in the fear of bad US economic data and/or Quantitative Easing (QE). Risk-friendly investors move into risky assets like stocks or currencies of emerging markets, while risk-averse investors fear inflation and buy inflation-resistant assets like Swiss francs.

Read More »

Read More »

QE, QEE, the Money Multiplier and the Secular Stagnation Confusion

In some countries, the money multiplier is falling, in some others it is increasing, mostly due to central bank tightening. Does this justify to speak of secular stagnation?

Read More »

Read More »

Japanese Investors Will Determine Fate of USD/JPY not U.S. Hedge Funds

By Stephen Jen (via Itau Global Connections). Bottom line Now that the Bank of Japan will be led by a team of super-doves, the mechanism through which a more aggressive BOJ could influence the yen is through capital flows. We have used the analogy of a two-stage rocket to describe how USDJPY could be propelled. … Continue reading »

Read More »

Read More »

BoJ: Despite Quantitative and Qualitative Easing No Sign of FX Purchases

The Bank of Japan has introduced the expected “massive” quantitative and qualitative easing programme. “Quantitative” means increase of quantities of JGBs bought, “qualitative” the purchase of more ETFs, REIT and the loan support program.

Read More »

Read More »

The “Sell in May, Come Back in October” Effect and the 19 Fortune-Tellers of the FOMC

The U.S. economy regularly improves between October and April, this year additionally fueled by "unlimited" quantitative easing, weaker gas prices and higher competitiveness thanks to a stronger Chinese yuan and weaker Asian economies. Update 2013: The Case-Shiller index continued to climb in April 2013; it became clear that this year the "Sell in May" …

Read More »

Read More »

Why the Yen Is Now Fairly Valued, USD back as Preferred Funding Currency

Producer prices and “real mean reversion” for currencies show that the yen is currently fairly valued. Many momentum factors could, however, speak for some further weakening, while seasonality favours an appreciation. For us, the US dollar is back as the preferred funding currency. The real mean reversion for currencies Some economists, like Goldman’s O’Neill, in the case …

Read More »

Read More »